I’ve spilled endless digital ink on these digital pages warning of an artificial intelligence bubble. See here, here, or here for my skepticism of a highly valued market led by AI stocks that were driven by hype, not fundamentals.

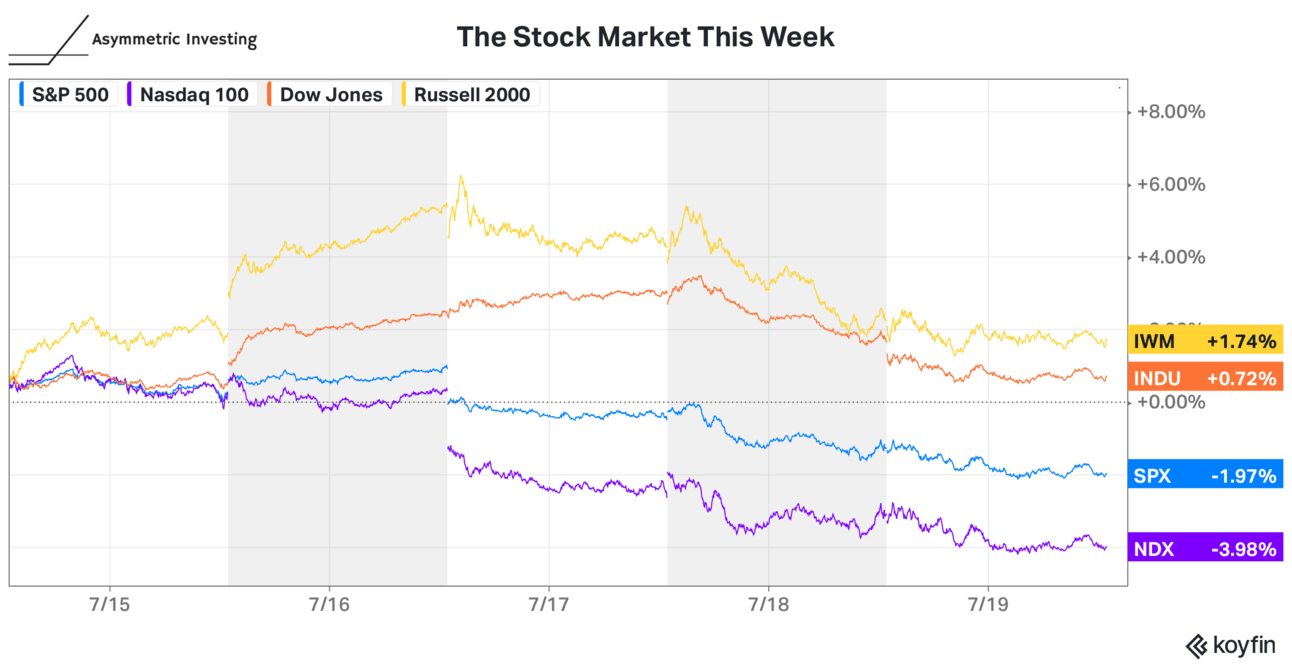

Last week, some of that bubble started to unwind as NVIDIA fell 9.8%, Microsoft fell 3.6%, and Meta Platforms fell 4.4%. Weaker-than-expected guidance from equipment supplier ASML was the cause and that will put even more focus on earnings. The last two years haven’t seen anything but a surge in AI demand and that pushed stocks higher, but the stakes are higher than ever as the industry matures and any weakness will be punished.

The Asymmetric Portfolio finally benefitted a bit from not being over-exposed to AI. But the next few weeks will determine if my value on fundamentals over hype will pay off.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads like this one. Sign up for premium here to get 2x the content, access the Asymmetric Portfolio, and avoid ads.

Track Company Earnings Like a Pro

Earnings Hub is designed for investors to give you everything you want to know about company earnings, including:

An Earnings Calendar

Expectations & Actuals

Listen to Earnings Calls Live (or replay)

Earnings Call Transcripts & AI Summaries

Realtime News on your favorite stocks

Alerts delivered via Text or Email

Most of the features are FREE! Premium features are 50% off right now at just $49 for an entire year.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Bundle Economics: Bundles can be a driver of economic value and internet bundles supercharge that with zero marginal cost.

Earnings Preview #3: I previewed four of the consumer stocks in the Asymmetric Portfolio.

Earnings Preview #4: Fintech stocks were in focus in this preview.

Verizon’s Value: It has a low P/E and Verizon has been a surprise winner for investors over the past year.

AI Reality

The next few weeks will tell us a lot about the future of AI investment. But I wanted to note a few startup “exits” that should be cause for concern because it’s startups that provide the asymmetric upside for investors and employees.

Microsoft has invested over $10 billion in OpenAI and is now diversifying to run other models, Meta’s Llama model, and is investing in other AI startups.

Inflection AI was “acquired” by Microsoft in a convoluted deal that involved hiring the company’s staff and licensing the technology developed at the startup. The price paid was enough to make investors whole, but not provide a return on the $1.525 billion invested in the company.

Amazon made a similar “non-acquisition acquisition” of Adept AI the involved staff moving to Amazon and getting access to the company’s technology.

Usually venture capital deals aren’t something I would focus on, but the dollars and details are important. Microsoft, Google, and Amazon have used their cloud — and access to NVIDIA chips — to fund startups through credits, or use of the cloud to train models and perform inference.

It was a non-cash investment structure that gave big tech access to startups and startups much-needed access to chips.

But the biggest names in AI startups are being acquired for what appears to be breakeven deals to appease investors. Put bluntly, the businesses they built appear to be worthless.

And so begins the questions about AI business models.

I can’t find a record of any of the AI startups being profitable or many/any public companies (outside of NVIDIA) making a profit from AI. Yet, earnings multiples have exploded in the hope that there will be some future profit at the end of the AI rainbow.

If early earnings are any sign, the AI bubble is starting to lose its luster.

Goldman Sachs questioned the investment made in AI and Sequoia asked the $600 Billion Question.

If AI isn’t all it’s cracked up to be, the market will be in for a rough few months. Are you prepared if the AI bubble pops?

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.