Today’s deep dive is on MGM Resorts. The company’s roots go back to the 1960s but a number of mergers and divestitures in subsequent decades leave little resemblance to the original company.

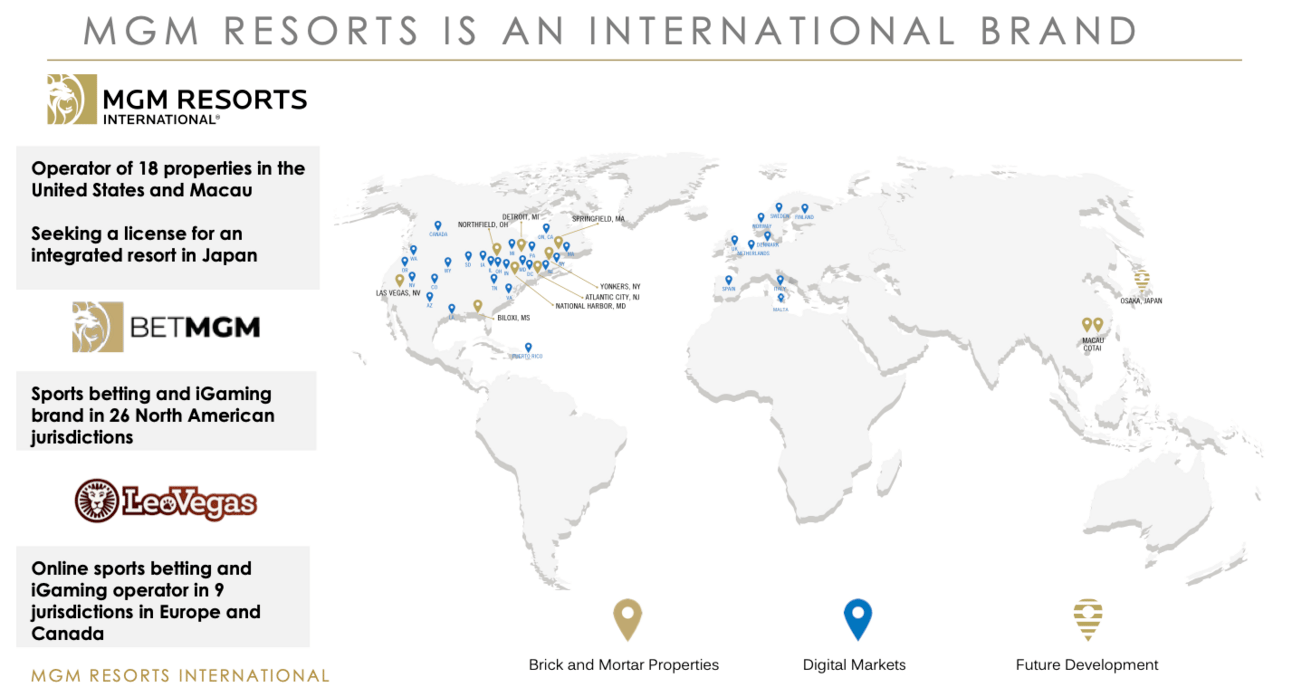

MGM Resorts is now one of the biggest casino companies in the world with a massive presence on the Las Vegas Strip and an opportunity to grow as Macau recovers and a casino in Japan opens near the end of this decade.

Why MGM Resorts? In ~ 100 Words

Through the long arc of time, we are spending a smaller percentage of income and time on basic needs, leaving more time and money for entertainment. Combine that with more friendships and businesses that are far-flung around the world and we’re seeing increased value in centralized locations to meet, eat, drink, and be entertained.

Resorts and casinos are a natural meeting point and MGM Resorts is one of the world’s biggest players with casinos in Las Vegas, Macau, and soon Japan.

From a financial perspective, the biggest investment phase of building these multi-billion dollar casinos is largely behind us and competition from new resorts is limited because of regulation. This gives MGM a competitive moat that should drive greater profitability long-term.

In short, MGM Resorts has become an underappreciated cash flow machine.

Key Stats

MGM Resorts by the numbers:

Company: MGM Resorts

Ticker: MGM

Market Cap: $15.5 billion

Revenue (ttm): $14.8 billion

Gross Margin: 48.4%

Net Income (ttm): $375 million

Shares Outstanding and Y/Y Growth: 350.9 million down 8.6% Y/Y

FCF (ttm): $1.2 billion

MGM Resorts’ Leadership:

Founder: Kirk Kerkorian, a legend in Las Vegas. Kerkorian bought and sold MGM Resorts multiple times and owned MGM Studios for a period of time, which is where MGM Resorts gets its name.

CEO: William Hornbuckle, who has a long history with MGM including holding the President role at MGM Resorts since 2012 and COO role since 2019. He took over as CEO in 2020.

The Strategy

At its core, MGM Resorts is an entertainment company. It builds massive resorts and then generates revenue through gambling, hotel rooms, restaurants, entertainment, and shopping. It may be known as a casino company, but well over half of the company’s revenue in Las Vegas comes off the casino floor.

Profits in this business can exceed businesses like hotels or restaurants because the supply of resorts in MGM’s market is limited because of gambling regulations. For example, in Macau, MGM Resorts is one of only six concession holders and the number of casinos and even tables is strictly limited. In Japan, MGM is the only company approved to build a casino, although one or two more are expected in the next decade.

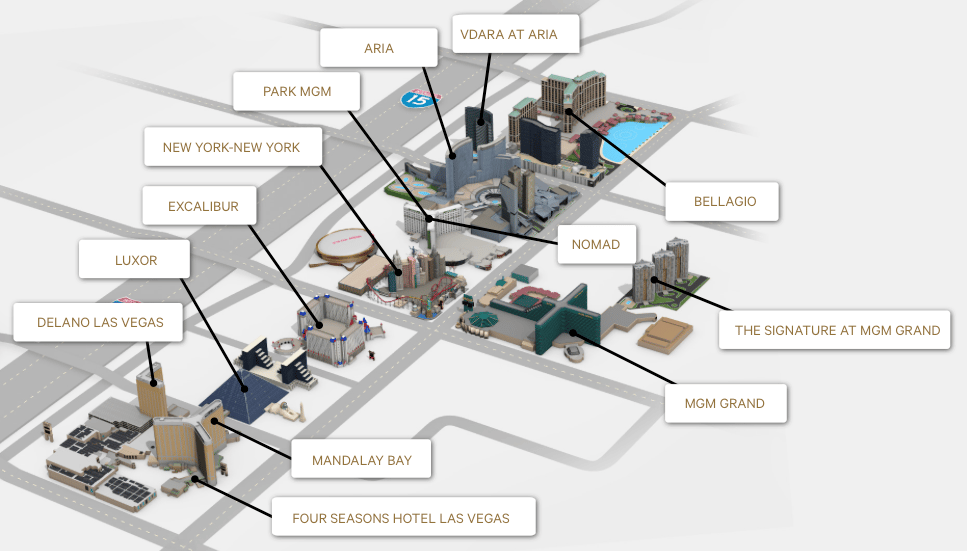

Las Vegas, MGM’s biggest market, is more lax as far as allowing supply, but the Las Vegas Strip is the central hub of the industry and MGM controls about half of the supply on The Strip.

Not only is supply constrained on a local basis, it’s limited on a global basis. Most countries simply don’t want gambling.

Japan is opening up and Dubai may allow gambling as well, but this pales in comparison to the gambling boom in the U.S., Macau, and Europe between the 1960s and late 2000s. We have entered a cash extraction phase for the casino industry.

The central piece of MGM’s strategy that I find appealing is being an entertainment hub at a time when consumers and businesses need central places to meet, mingle, and work. What better place for a convention or company get-together than Las Vegas or Macau?

With that overview laid out, let’s dig into where MGM Resorts operates and how much money it makes.

Las Vegas

Look at Las Vegas as the biggest cash machine for MGM Resorts. The company controls most of the south end of the Las Vegas Strip (shown below) and can ride the wave of growth in the region with very little capital investment.