Today’s deep dive is into audio streaming company Spotify (NYSE: SPOT).

Founded in 2006 in Stockholm, Sweden, Spotify offers audio streaming services globally, including music, podcasts, and audiobooks. The company makes money by selling premium subscriptions and through growing advertising business.

The audio business is particularly attractive because it’s a passive medium that’s not currently controlled by one of the major technology giants. It’s largely overlooked in comparison to streaming video or search advertising. This has given Spotify the opportunity to build a unique business focused entirely on audio while potential competitors are distracted with other businesses. It’s been so successful in this strategy that it’s taken market share from Apple in both music and podcasts in recent years. Not many companies can say that.

In this deep dive, I’ll get into the strategy, financials, and opportunity for Spotify, but let’s start with some facts about the company.

Spotify by the numbers:

Company: Spotify

Ticker: SPOT

Revenue (ttm): $12.7 billion

Gross Margin: 25.0%

Operating Margin: (5.6%)

Net Income: ($466 million)

Shares Outstanding and Y/Y Growth: 195.8 million (+1.0%)

FCF (ttm): $21 million

Founder(s): Daniel Ek and Martin Lorentzon

Date Founded: April 23, 2006

Spotify’s leadership:

Daniel Ek is a founder and the CEO of Spotify.

Ek doesn’t often get the credit he deserves for building a business that successfully monetized streaming music following the rise of Napster, Limewire, and other p2p file sharing services.

Operationally, Spotify has been free cash flow positive for years, but can’t be considered an industry leading operator…yet.

Ek currently owns 31,931,376 shares, or 16.5% of the voting power in Spotify’s ordinary shares.

Ek also holds 140,278,420 beneficiary certificates that hold voting power but no economic benefit, giving him 31.7% of the total voting power in Spotify.

Martin Lorentzon is a co-founder and continues to serve on Spotify’s board of directors.

Lorentzon currently controls 21,469,762 shares, or 11.1% of the voting power in Spotify’s ordinary shares.

Lorentzon also holds 209,597,620 beneficiary certificates that hold voting power but no economic benefit, giving him 42.6% of the total voting power in Spotify.

The board of directors includes:

Netflix co-CEO Ted Sarandos.

Peloton CEO Barry McCarthy

Coda co-founder Shishir Mehrotra

Why Spotify? In < 100 Words

Spotify aims to “own your ears” by connecting creators, listeners, and advertisers on a single platform.

Boasting a market share lead in music and podcasts with an emerging business in audiobooks and video, Spotify monetizes the business through monthly subscriptions and advertising.

Growth relies on user expansion, improved advertising economics, and building the go-to platform for creators to reach and monetize their audience.

Spotify has a market cap of $25.3 billion, and generated $12.5 billion in revenue and $23 million in free cash flow in 2022. For this company to be a 10x investment it needs to continue growing the top line through premium subscriptions and (more importantly) advertising revenue, but it also needs to start displaying the operating leverage that’s possible in a technology business.

Big picture

The internet has reshaped how we interact with text (Google/blogs disrupting newspapers) and video (Netflix disrupts cable), allowing new companies to be built with completely new cost structures on the assumption that the internet exists. But innovation has largely skipped over disrupting the audio business. The same record labels that dominated the 1990s still dominate today and radio is…still around. But that’s starting to change.

Spotify’s ability to create a viable subscription business in music actually grew the pie for labels and artists and is creating new opportunities for other audio content. The first area of growth is podcasts, which aren’t new, but have been a niche business for more than a decade. Spotify’s platform allows users to find creators and as advertising revenue grows, it will help creators monetize their work. Think of it like YouTube, but for the ears.

It won’t be an easy battle to win over creators and listeners, but Spotify is uniquely focused on audio and creators.

They key to Spotify’s success comes down to building a thriving user generated content ecosystem, much like what YouTube did in video. If podcasters, authors, and even some video producers know there’s an audience and money to be made on Spotify, they’ll go there.

The Strategy

How does Spotify “own your ears”? It starts with music and then extends to other forms of audio and potentially video and other forms of content.

The music business

Spotify was built on business, but it doesn’t actually own or create any content. It needs to sign deals with record labels to distribute the music they control. Despite attempts to break the record label oligopoly, Spotify hasn’t been successful and we should expect the status quo to be the best-case scenario in music.

Monetization will continue to come through subscriptions and ads, but there are growth opportunities in discovery and helping creators monetize, which I’ll cover in the financial section below.

The podcast business

The growth story for Spotify comes from extending the streaming and advertising technology built for music to podcasts. Unlike music, podcasts are user-generated content, so creators don’t need a big business behind them and choose to put content on a platform like Spotify. That’s the perfect position for a content aggregator like Spotify to both be the discovery tool for listeners and a monetization tool for creators.

Podcasts are still an emerging market and monetization at a large scale is a relatively new phenomenon. So, this is where I will focus a lot of attention below because I think there are a lot of levers Spotify can pull to increase content, ad revenue, and make the podcast part of the platform extremely sticky for creators and listeners.

An app people love

Users need an app they will actually…use. So, part of Spotify’s strategy is building a delightful app.

Cnet calls Spotify “the best music streaming service”, TechRadar said “the best streaming service keeps getting better, and Spotify has a 4.8-star rating in 25.7 million reviews on the Apple App Store. People love Spotify!

In the content business, a great app is table stakes, so I’m not going to focus on this component too much because creators are more important to Spotify’s future. But it looks like people are choosing Spotify over competitors.

Tools for creators

Like YouTube, Spotify is in a “build it and they will come” position with creators. It’s extremely difficult to monetize a podcast via Apple Podcasts or with direct advertising partners unless you have a massive audience, so serving streaming ads inserted dynamically into a podcast is an ideal strategy. Spotify just had to build the tools to create content, find listeners, and monetize.

On the creation side, Spotify acquired Anchor in 2019 and now calls these tools “Spotify for Podcasters”. The creation tools make it simple to record, edit, and post audio and video content to Spotify.

On the discovery side, Spotify is really leaning into building tools that allow creators to find their audience. This means audio or video clips that can be posted on social media or in a newsletter. My friends Jason and Jeff did exactly that in the clip below, pulling content from their audio podcast that was then distributed on Twitter and pointed back to (you guessed it) Spotify!

When it comes to monetization, it’s not Joe Rogan that needs help, it’s the long tail of creators that needs the most attention. And that technology and advertising stack is what Spotify has been spending the last 4-5 years building out.

I have heard from friends with podcasts that it’s as easy to monetize as Spotify says.

Just tell us where to place your ad, or set a monthly subscription price, and we'll do the rest.

Spotify also announced recently that it’s creating merchandise and ticketing landing pages for artists, deepening the relationship between creators and listeners ON SPOTIFY.

So, Spotify will help you create content, find an audience, and make money! That’s a platform creators can invest their future in.

How Spotify makes money on discovery

These discovery tools are great, but they aren’t free. And they’re the reason investors could see a significant upside in Spotify’s margins over the next 5-10 years.

Many of the discovery tools Spotify uses are actually paid features. It’s advertising.

Source: Spotify.

I will cover this more below, but these discovery features are why music margins are up in the last few years and they’re a big reason why margins for podcasts, audiobooks, and video could be even better than music long-term.

Rinse and repeat

All of the tools and strategies I highlighted above may be built for music or podcasts, but they’re usable in audiobooks, video, and any other content Spotify moves into. Ten years from now, Spotify may be even more than an audio company and that’s the kind of optionality I want in an asymmetric stock.

Financials

Spotify’s business is monetized through premium subscriptions and an ad-supported tier, which is how the company breaks out its financial results. But in reality, the music business and podcast businesses are very distinct. I think of the business this way with the potential to add columns for audiobooks and videos over time.

Since management only reports revenue and margins for premium and ads and doesn’t break out what comes from music or podcasts, it limits how we can analyze these four components.

Premium

The premium business is pretty straightforward. Spotify charges a monthly fee to subscribers and shares a percentage of that fee with record labels (who then pay artists). Unfortunately for Spotify, there are only three major record labels, and losing any label would be devastating to Spotify’s business. So, the company has little negotiating leverage and shares about 70% of its revenue with labels.

To increase margins, Spotify expanded its discover features highlighted above, charging creators to get distribution (advertising) to new potential fans, which it called “marketplace”. This is similar to dynamic Facebook or YouTube ads and mirrors how radio stations have long been paid directly or indirectly to play certain songs for decades.

You can see below that growth in “marketplace” had a direct impact on premium gross margins, which are now approaching 30%.

Long-term, management thinks music gross margins will reach 30% to 35% and discovery and marketplace will play a big role in getting to that level.

Ad-supported

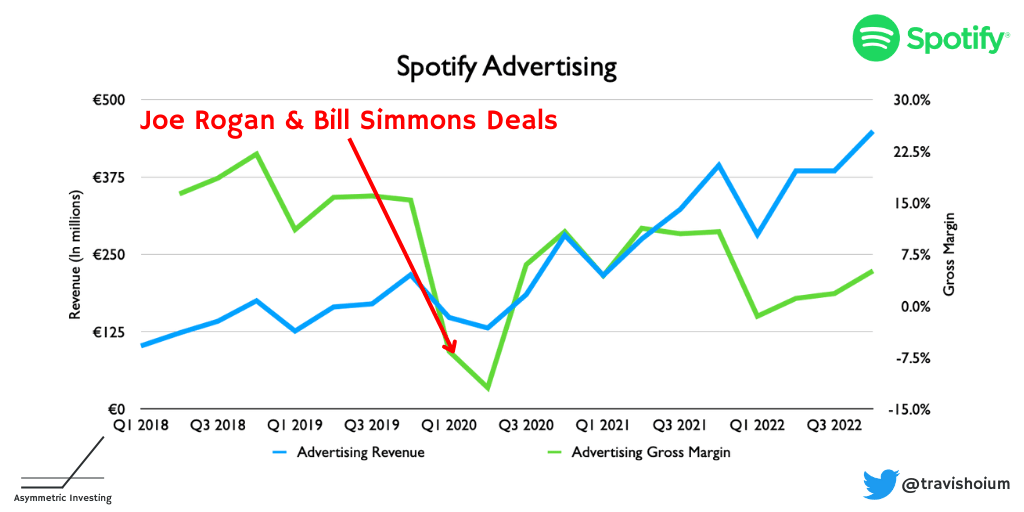

The advertising business supports all of Spotify, but it’s critical to point out that the company reports all podcast-related costs under the ad tier. So, when Spotify signs an exclusive deal with “The Joe Rogan Experience” for a reported $50+ million per year, those costs are included in the ad segment. And the costs are adding up.

Bill Simmons really started the podcast flurry, selling The Ringer to Spotify for up to $200 million in early 2020.

Joe Rogan signed a multi-year deal with Spotify in 2020 reportedly worth over $200 million.

Barack and Michelle Obama signed a deal in 2019 for a reported $25 million but left Spotify in 2022.

Alex Cooper’s “Call Her Daddy” went exclusive on Spotify in 2021 in a $60 million, three-year deal.

Emma Chamberlain was signed late in 2022 and will be exclusive to Spotify in 2023.

Dax Shepard’s “Armchair Expert” inked a deal reported to be worth over $50 million in 2021.

You can see below that before the exclusive podcast strategy began in earnest in early 2020, Spotify’s advertising gross margins were in the high teens even on a low revenue base. But the cost of podcasts — which could be over $200 million per year based on the deals above — crushed those margins, masking a potentially very high-margin ad business in the process.

Spotify has recently said it will pull back on exclusives and focus more on user-generated content, leaning into the tools for creators I highlighted above and its aggregator status in audio.

In theory, this should be the best monetization strategy for Spotify in podcasts and is transferrable to other verticals like audiobooks and video. But it’s yet to be proven that the ad business can scale profitably, so this is the biggest risk facing Spotify.

On the upside, there’s a cap on premium segment margins because of the power record labels have that will cap premium margins, but ads face no such limitation. If competitors like YouTube, Facebook, and Google are any indication, the advertising business can be a 50% to 70% gross margin business even after paying creators a cut.

While there have been ups and downs, management has indicated it will focus more on margins and reduce exclusive content spend, so this could be a big contributor to the bottom line in the future. And between Q1 2018 and Q4 2022, advertising revenue jumped 340%, so growth anywhere near that pace over the next decade would make Spotify an advertising juggernaut.

How to 10x From Here

Spotify’s long-term success depends largely on the company’s ability to build an effective advertising business. If it can do that, it’ll create another revenue stream for creators, who will choose Spotify over competing streaming platforms for their distribution and start a flywheel effect with content.

The growth levers to watch are:

# of monthly active users

Engagement time

$$$ per premium subscription

A la carte revenue like merchandise and concert tickets

$ per ad

Available ad space (listening time * ad density)

Not all of these levers are reported, but they are what will drive the business.

Back-of-the-envelope math

To 10x in a decade, Spotify would need to be a $253 billion business in 2033. That’s reasonable given a few assumptions:

At a $253 billion value, Spotify trades for 25× 2032 earnings

Implies $10.1 billion in 2032 net income

15% net margin by 2032 ($GOOG 21.2%)

Given an implied net income of $10.1 billion, Spotify would need $67.5 billion in revenue in 2032

This would be an 18.4% CAGR from 2023 to 2033 (2017 to 2022 CAGR was 23.5%)

I don’t think the revenue growth rate is unattainable for Spotify, but the key will be on the margin and cost side. Spotify needs to expand advertising margins to 50%+ while growing the ad business rapidly. If it can’t, it’s unlikely anything near a 15% net margin is attainable.

How to 0x From Here

While Spotify has a lot of upside potential, it also has major risks. Spotify is dependent on record labels and content creators putting their content on its platform. Without that, it doesn’t have a business.

In music, if Spotify were to lose its relationship with major music labels it could lose a significant amount of revenue. Spotify has not been successful in building a direct-to-the-artist model in music, so labels will continue to be gatekeepers.

In podcasts, audiobooks, and video, Spotify faces significant competition and creators can upload content to multiple platforms to hedge their own bets.

Competition

Spotify faces competition from Apple Music, Amazon Music, Tencent Music, YouTube Music, and others in the music space.

In podcasts, there is competition from Apple Podcast, Google Podcast, Pandora, YouTube, Audible, Stitcher (owned by Sirius XM), and others.

Competition is only a click away, so Spotify faces constant competitive pressure in all of its business segments.

What To Watch

As Spotify announces financial results, these are the metrics I will be watching.

Monthly Active Users: Premium and ad-supported

Advertising Revenue Growth

Gross Margin: Premium gross margin goal of 30%+ and ad gross margin increasing to 50%+ within 5 years.

Operating Costs: Spotify needs to reduce operating expense growth in order to get operating leverage in the business.

Why Spotify is in the Asymmetric Investing Universe

The audio business has been there for the taking for a decade if Apple, Google, Amazon, or any number of other companies wanted to take it. None have done so and Spotify has been the one company to remain focused on building an audio business that’s available on any device anywhere in the world.

I think we are just starting to see a boom in podcast and video content moving to Spotify and the focus on discovery and monetization will draw even more creators to make it their home. This could create a powerful flywheel between users and creators with Spotify at the center.

With a visionary leader at the helm and innovators like Bill Simmons growing in provenance, Spotify has a very bright future.

Disclaimer: Asymmetric Investing provides analysis and DOES NOT provide individual financial advice. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.