One of the frameworks of Asymmetric Investing is consistently buying stocks every month.

I think we’re in a bubble — or parts of the market are in a bubble — but I’m still buying.

Why?

Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.

Time in the market beats timing the market.

I don’t know when the market is going to be at its top. And I won’t know when there’s a bottom. I’ve found the best strategy is to ignore market timing entirely and simply try to make the best decision possible each month. I’ll get to more of my thoughts on the potential bubble below.

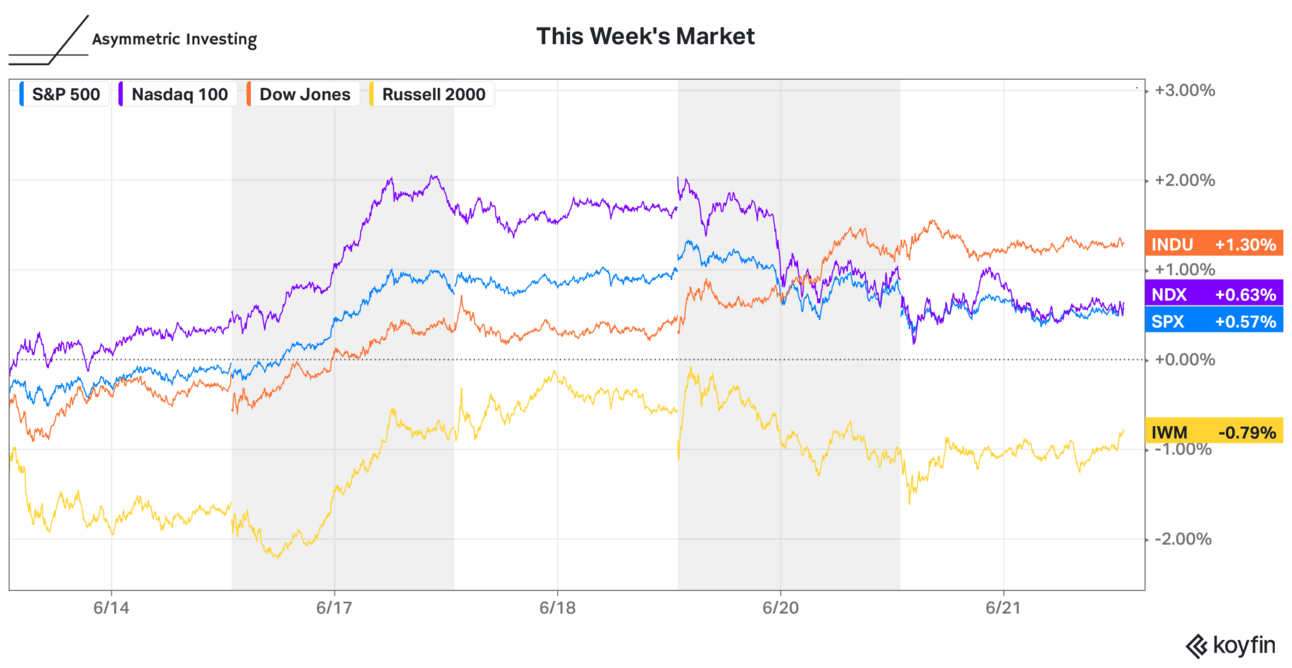

Here is what the market did this week.

The Asymmetric Portfolio continues to outperform the market but the gap is closing. Earnings season, which starts in a few weeks, will likely determine the course of the market for the next few months.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

The 1 Reason Insiders Buy Stocks: Two Asymmetric Portfolio stocks had insider buys recently and there’s only one reason that makes sense.

Google and Uncertainty in Artificial Intelligence: There’s more uncertainty in AI than most investors realize and Google is well-positioned no matter what happens.

Lessons From the EV Stock Collapse: Fisker filed for bankruptcy this week and every EV stock is struggling. I looked at why.

Why NVIDIA Stock Will Fall Over 50%: This is a provocative headline, but it’s backed up with lots of history, including from NVIDIA itself.

We Are In a Bubble (Probably)

Bubbles are strange because they’re difficult to see at the moment and obvious in hindsight.

From where I sit, something feels off in the stock market.

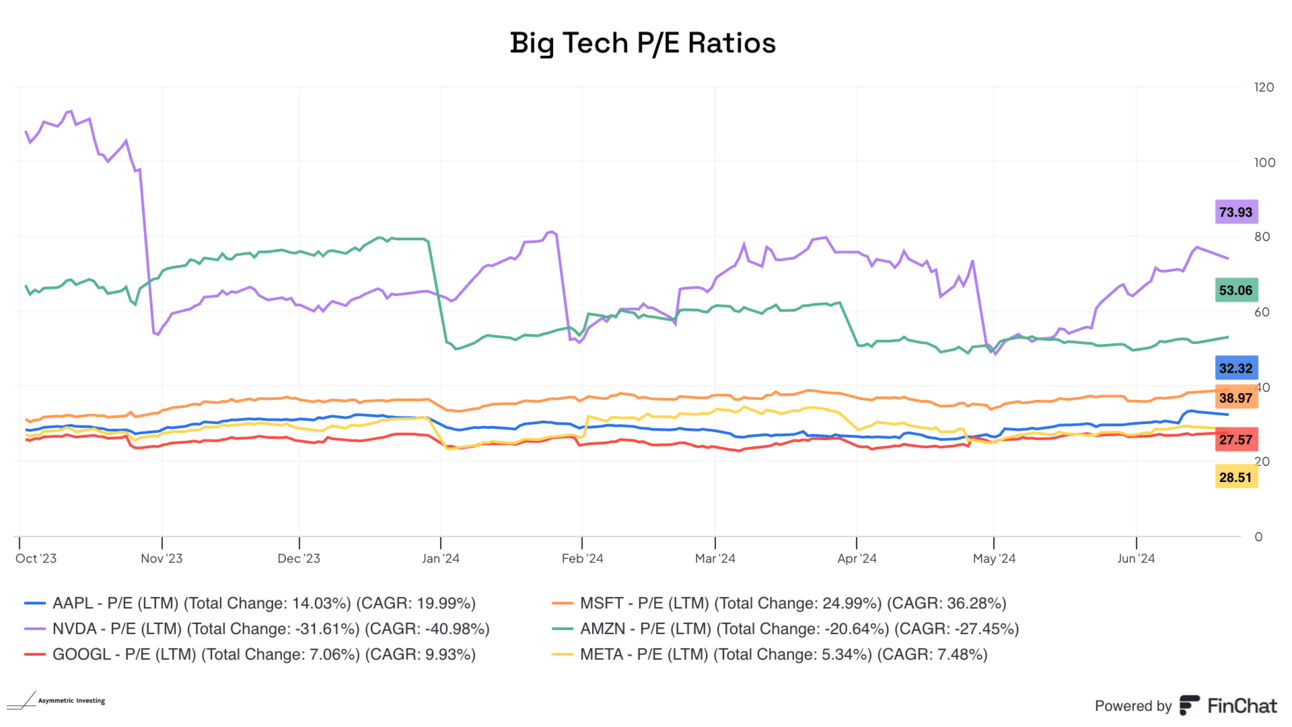

A handful of stocks are driving the entire market higher on a technology that has yet to prove economic value (AI). Multiples have gotten stretched to historic highs, despite higher interest rates. Exhuberance is running the show and it doesn’t seem justified.

Evidence is pointing to the market being in bubble territory.

The S&P 500 trades for a price-to-earnings multiple of 28.4, according to Multpl.

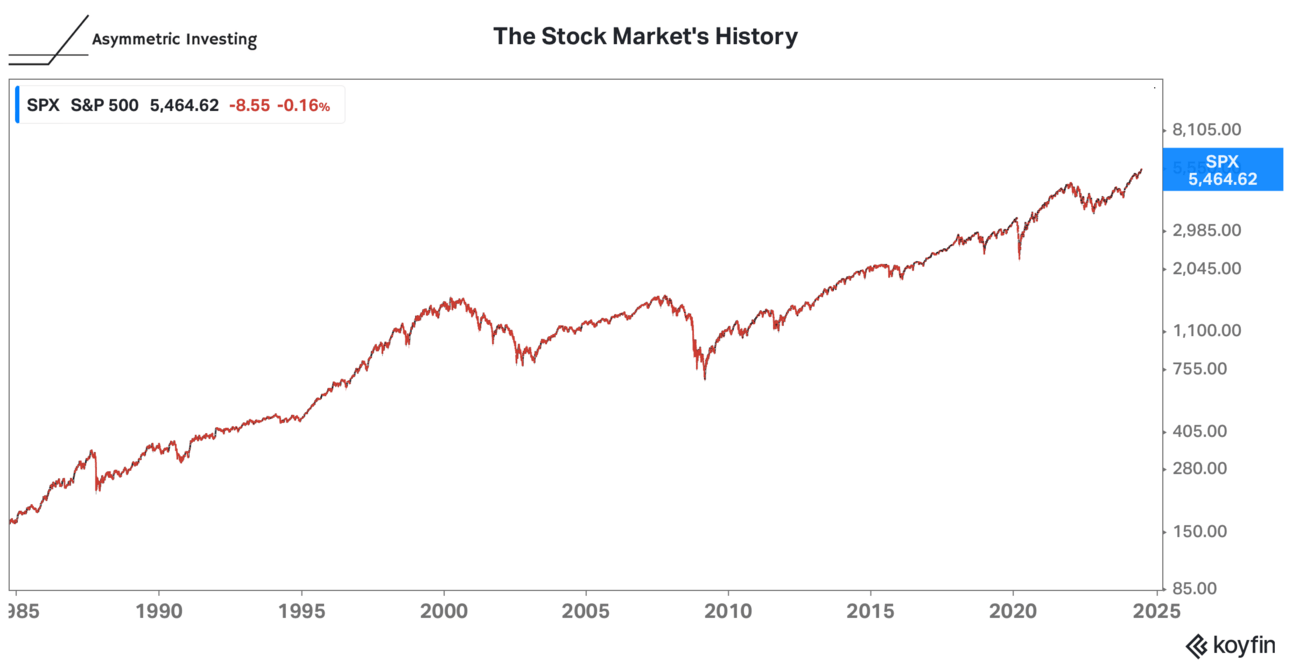

Before March 1998, the S&P 500 had never traded for more than 27x earnings and the multiple was as low as 6.8x in 1980 and 5.3x in 1917. The S&P 500 has only exceeded a 27x multiple during three periods of time since 1998.

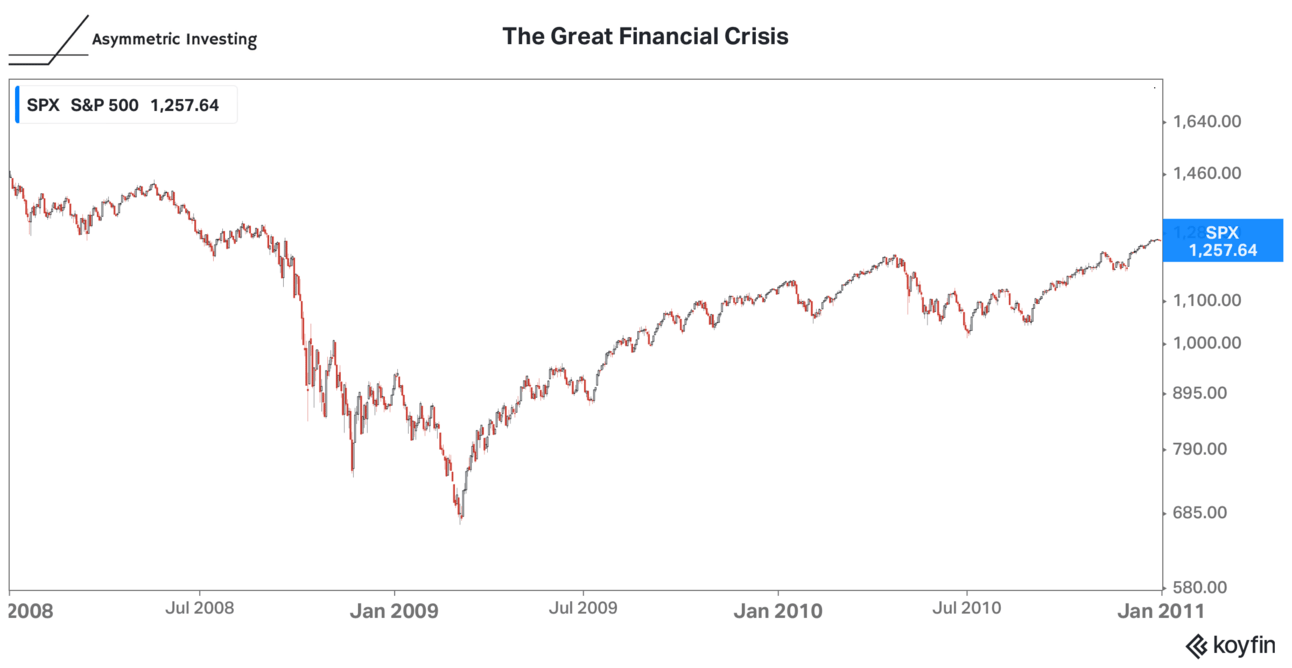

The first time the S&P 500 was this expensive was in 1998 in the middle of the Dot Com Bubble. It wasn’t the top, but the market also didn’t go anywhere for 12 years after March 1998.

The second time was the Great Financial Crisis, which was arguably worse than the Dot Com Bubble for the broader market.

The third time was during 2020 when COVID hit and the “E” in P/E dropped like a rock temporarily as the world shut down.

When P/E multiples get this high they tend to revert to the historical mean of 16.1x. So, why am I still buying stocks today?

I’m Still Buying

Two things can be true at once.

The market itself can be overvalued.

There can be attractive stocks available.

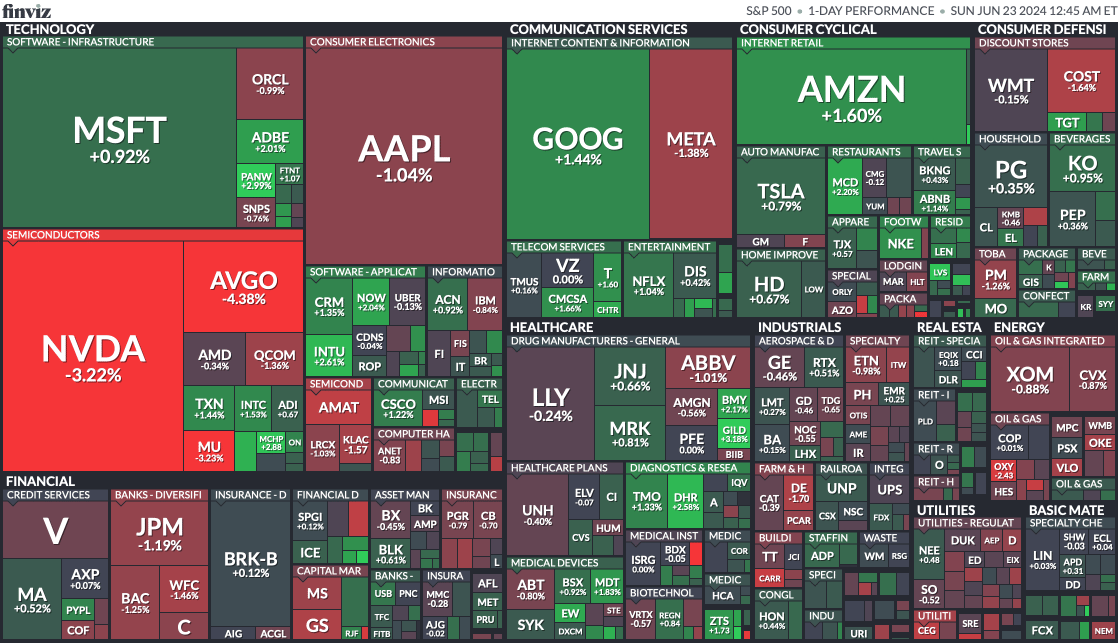

As we’ve seen big tech take up a bigger and bigger percentage of the market cap-weighted S&P 500 Index, it’s overweighted the index’s P/E multiple to a few companies. You can see the weight of big tech visualized in the heat map below.

The six Big Tech stocks aren’t just heavily weighted, they all have above-average P/E multiples, which means the other 494 stocks in the index have a P/E multiple significantly lower than the big six.

As the market has gotten more expensive, I’ve focused on companies trading for a value with strong balance sheets.

5 of the stocks in the Asymmetric Portfolio have a P/E ratio under 20.

The lowest is 5.8x.

14 of 20 stocks have positive operating cash flow.

13 of 20 have a net cash position (ie. no debt)

I’m focusing on stocks with growth potential that trade for a reasonable price. Not every stock is the same, but broadly I’m being more conservative because of the bubble-like territory it looks like we’re in.

I’m still investing because I don’t know if we’re in 1998 with two years left in the bubble or 2008 when the global economy is about to collapse (I’m not predicting that!).

Historically, the correct answer is to keep buying stocks because the market will go up long-term. The trick is avoiding the most bubblicious stocks at the top and being aggressive at the bottom.

As a wise investor once said:

Stocks always go down faster than they go up, but they always go up more than they go down.

And I’ll keep buying month after month, no matter if/when the bubble pops.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.