Today’s deep dive is on Figs. Started in 2013, Figs is a direct-to-consumer healthcare apparel company specializing in scrubs and other apparel for healthcare workers.

Why Figs? In ~100 Words

Figs is the leading specialized retail company in healthcare, starting with scrubs and beginning to extend to all parts of the healthcare industry.

Figs’ potential isn’t as large as bigger retailers like Amazon or Shopify and the company is almost all direct to consumer today (a few retail outlets opening) so this is a specialized company. Still, I think Figs can grow the business 10x into a profitable niche, and the risk/reward of today’s price gives investors 10x potential with low downside risk.

Figs has a $1.16 billion market cap offset by $268 million in cash (no debt) with a profitable, cash-flowing business.

Key Stats

Figs by the numbers:

Company: Figs, Inc.

Ticker: FIGS

Market Cap: $1.16 billion

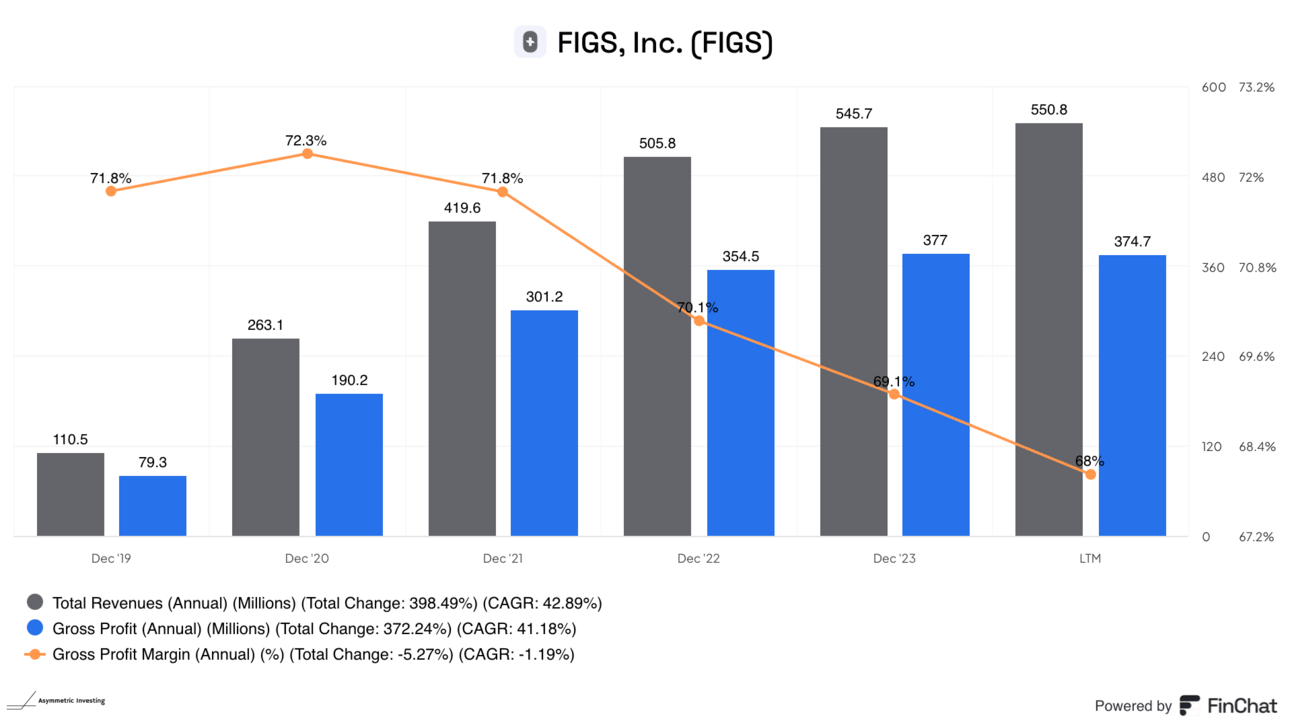

Revenue (ttm): $550.8 million

Gross Margin: 68%

Operating Margin: 4.8%

Net Income: $18.7 million

Shares Outstanding and Y/Y Growth: 179.7 million, down 2%

Earnings per share: $0.01

FCF (ttm): $78.3 million

Date Founded: 2013

Founder: Heather Hasson and Trina Spear

Figs’ Leadership:

CEO: Trina Spear became CEO after Heather Hasson stepped into the executive chair role. Spear has a finance background and formerly worked at Blackstone.

Heather Hasson is a co-founder and Executive Chair, but seems to have one foot out the door. She stepped down as co-CEO in 2022 and has sold nearly half of her shares in Figs this year, leaving her with just 1.8% of the company. Trina Spear owns 3.8% of the company and has been acquiring shares (primarily through stock-based compensation).

Thomas Tull is the largest shareholder, with a 16.3% stake in the company, and was a large investor pre-IPO.

The Strategy

Figs strategy is pretty simple. The company wants to be the biggest brand in healthcare worker apparel. If the company can do that, it’ll be a great value at today’s price.

Land With Scrubs

The start of Figs is scrubs, and it will expand in healthcare from there.

The best way to think about the company’s strategy is with the Smiling Curve, but instead of being in the top right — like Asymmetric Universe stocks Google, Spotify, Peloton (fitness), and Disney (streaming) — we are looking at a company that’s in the top left in retail.

If we look at this in a retail market, Figs wants to dominate a niche.

It’s that niche position that we need to examine for Figs. Today, Figs has about a 5% market share in the U.S. and only 1% internationally. If it can grow within that niche, it’ll be an amazing business, but it will never be Amazon. And that’s the point.

We have about a 5% market share within the U.S. We have less than 1% internationally. And so we’re very early days on a long road -- have a long road ahead of us. There’s about 140 million health care professionals around the world. We have 2.6 million active customers. And so our goal is to continue to bring more health care professionals into the FIGS family, engage them with our incredible products and have them come back. We have a really replenishment-driven model. About 70% of our revenue is from repeat customers, which is a great dynamic. Obviously, you don’t pay for people to come back. And so that’s where we’re focused.

When you look at Figs’ scrubs, what’s most impressive is the selection. You can see below that it has a lineup with 26 different colors. There are a variety of fits, and the next step is to expand sizes to fit all body types.

The number of SKUs Figs carries is high, but it has the scale in this niche to make it profitable. Niche scale is the moat, and this is where Figs’ gross margin of 68% is so impressive. That puts brands like Lululemon (59%) and On Holding (60%) to shame. Management has said margins are only below 70% because of a mix shift to lower margin, lower volume new products.

Expand Beyond Scrubs

The core is great, but Figs needs to grow into its niche to be a great investment. The strategy is to grow in 3 ways:

Increase scrubs market share (5%)

Grow international market share (1%)

Expand the product lineup beyond scrubs