One of the common themes of asymmetric investments is their ability to create and leverage a moat around their business. Companies like Facebook have a natural network effect, Costco can charge lower prices because of membership economics, and bundle economics have been an important value driver for tech, media, and telecom for decades.

Done well, bundle economics can lead to highly stable and profitable businesses and I want to highlight why it’s central to two of the Asymmetric Portfolio stocks.

Building a Bundle

Bundles aren’t just about putting different products together for one price. They’re about putting products that appeal to different consumers together to create value for a wider range of users.

Cable TV was a classic bundle, appealing to sports fans, prestige TV viewers, kids, and everyone in between. Different people in different houses may watch different channels, but they all subscribed to the same product…Cable TV.

This is an instructive example of how to build a successful bundle today.

Let’s use Disney as an example of a modern media bundle. The company owns Disney+, Hulu, and ESPN, which appeal to different customers.

Disney+: Kids, Star Wars, and Marvel content.

Hulu: Adult series.

ESPN: Sports.

There may not be much crossover between these groups and THAT’S THE POINT!

If you’re building a bundle, you want “must-have” content for each demographic. This will get them into the bundle (subscriber net adds) and the breadth of content keeps them in the bundle (lower churn).

Each subscriber doesn’t need to value everything in the bundle as long as SOMEONEputs high value on each key product.

Let’s use Disney’s key demographics of kids, nerds (Marvel and Star Wars fans), adults, and sports fans as our target groups for an example. Each may put a different value on Disney’s services, but they all value something in the bundle very highly.

Monthly Service Value | Kids | Nerds | Adults | Sports Fans |

|---|---|---|---|---|

Disney+ | $20 | $30 | $2 | $1 |

Hulu | $1 | $10 | $15 | $5 |

ESPN | $2 | $1 | $5 | $40 |

Bundle Value | $23 | $41 | $22 | $46 |

Based on these numbers, Disney could maximize its subscriber base by charging $22 per month. More than that and you start to lose kids and adults.

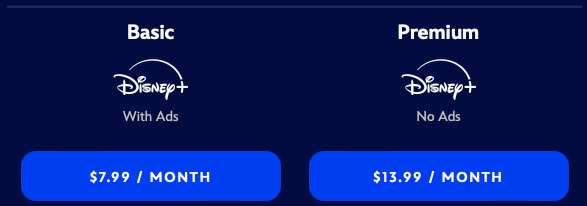

And that’s about what Disney has done. You can see the pricing option for the three bundles below and it’s only an additional $2 per month to add Hulu (with ads) to Disney+ and ESPN+ is another $5 per month. Why not just take the whole bundle while we’re at it?

The current pricing isn’t the end of the bundle economics strategy.

Once the bundle scales and competitors fall to the wayside (Peacock and Paramount+), prices AND value ratchet up, just like they did with cable.

With more scale and revenue, Disney can add more/better content to the bundle, making it more valuable to sports fans (see the NBA deal) or create more movies for kids. Content costs don’t scale as the business does, but revenue will scale.

In Disney’s case, the bundle becomes a reinforcing loop, if executed well.

And that’s the long-term bull case for the stock.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Take a demo, get a Blackstone Griddle

Automate expense reports so you can focus on strategy

Uncapped virtual corporate cards

Access scalable credit lines from $500 to $15M

Disney’s Bundles Beyond Disney

Not only is Disney creating a bundle itself, but it’s also bundling with others who need bundles to help their businesses.

Warner Bros. Discovery “bent the knee” earlier this year when it agreed to be bundled with Disney+ and Hulu, subordinating itself to the Disney bundle for most consumers.

Verizon is offering a $10 price point to bundle with Disney, Netflix and Max, Apple, or Walmart+. It just wants to bundle with someone…

Cable TV operators like Charter have also resided to bundling Disney streaming with subscriptions for Disney’s TV channels in cable TV packages.

Wider distribution is the goal and Disney should accomplish that with all of these deals, despite being convoluted.

Watch for Disney’s subscriber numbers to move sharply higher in 2024, churn to come down, and profitability will improve all because of bundles.

Spotify’s Solo Bundle

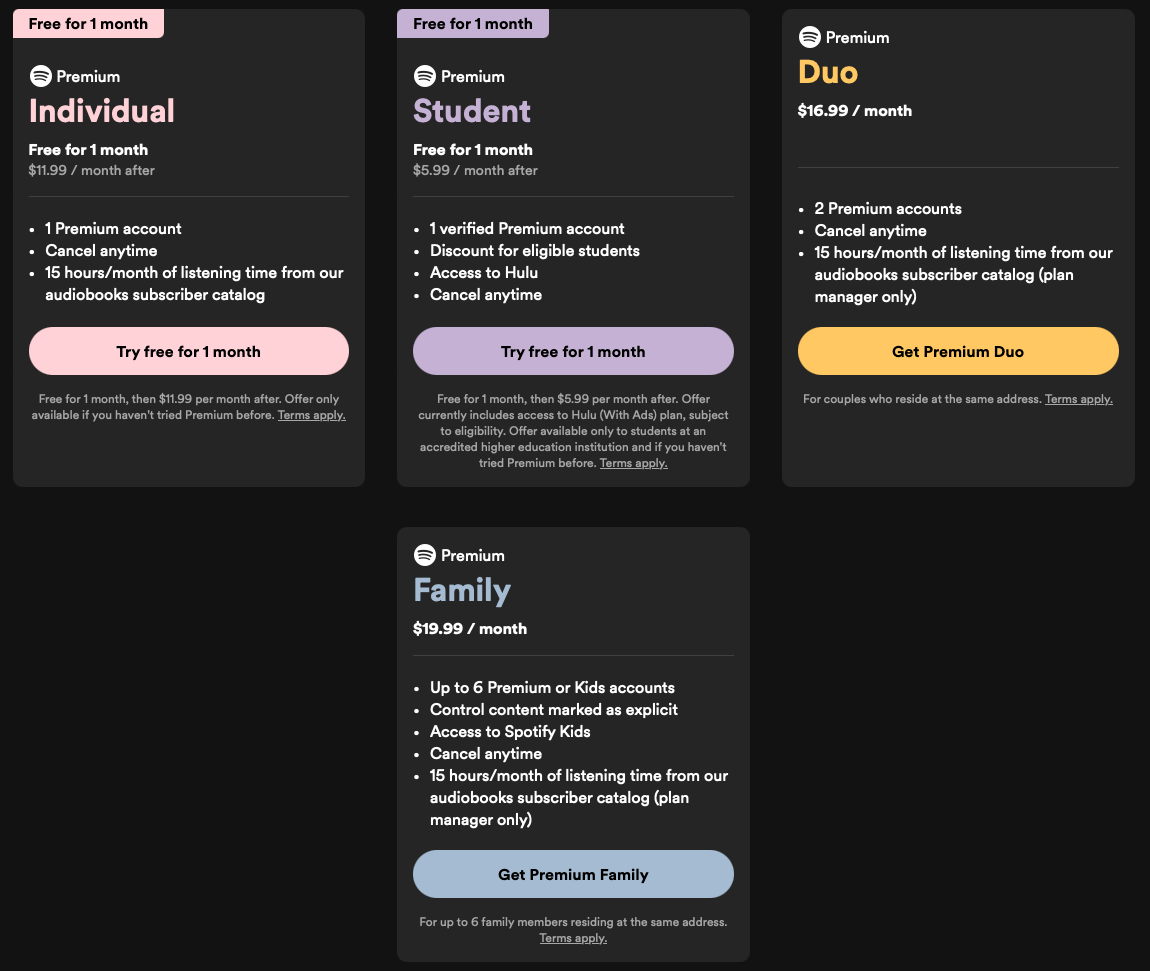

Spotify is trying to use a solo bundle strategy. It’s won the music market, but that’s not a very lucrative market given the hold record labels have on content.

To add value and increase margins, Spotify is including audiobooks as part of bundles. Note: There’s a basic plan that doesn’t include audiobooks, but it’s buried in Spotify’s website.

This won’t be the end of bundles for Spotify. Podcasts are still not monetized well and would make sense as a premium add-on for subscribers who want to get premium access or avoid ads. Don’t discount Spotify’s increased use of video as well.

It’ll be harder to build a bundle on its own, but if Spotify is as successful in audio bundles as it has been in music streaming against much larger rivals, this could be a huge value driver long-term.

Big Tech Bundles

Google and Amazon have long been big bundlers, showing how big these products can get.

If you pay for Google Workspace you get email, cloud storage, virtual meetings, forms, and even premium Gemini access depending on your tier.

Amazon Prime is known for 2-day shipping, but it also includes video, music, gaming, a Twitch account, and lots more you may never use. This is maybe the best example of a bundle of seemingly unrelated products that combine to make a valuable bundle.

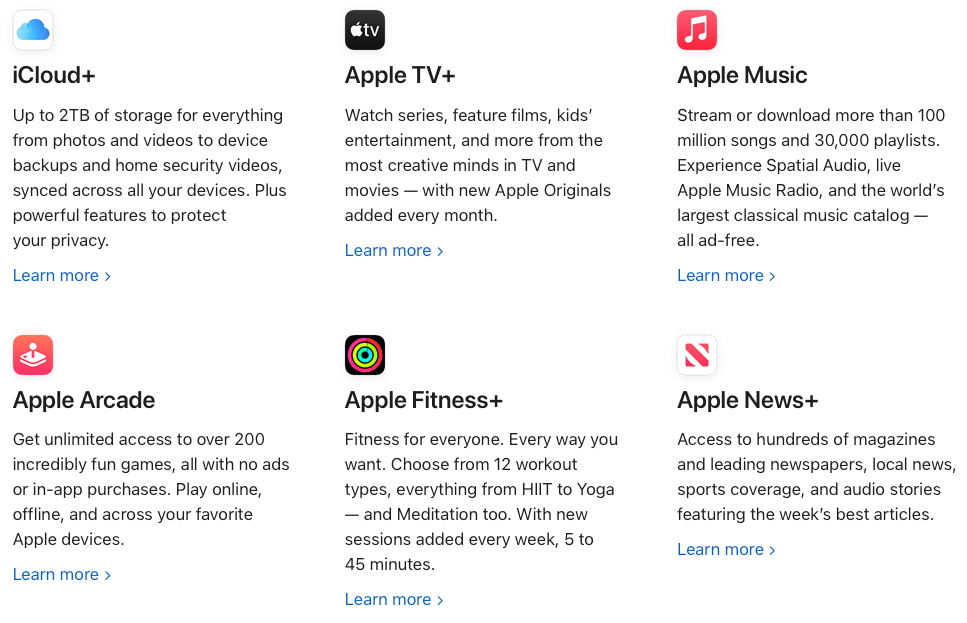

Apple One is the company’s attempt to build a bundle.

Microsoft is the king of bundles with Microsoft 365 including Word, Excel, Teams, and much more for one fee.

These are examples of successful bundles that have generated asymmetric returns over the past decade. I think Disney and Spotify are two companies with next-generation bundles that have asymmetric potential over the next decade.

Internet Bundles Are Asymmetric Opportunities

Bundles are especially important on the internet because of the zero cost of distribution. aka. Internet Economics

Disney+ Core could go from 117.6 million subscribers today to 200 million subscribers and the cost to create a movie or show for streaming wouldn’t change.

There’s tremendous operating leverage in Internet businesses that can attract customers that have a high lifetime value and low churn.

Bundle economics combined with internet economics are major reasons Disney and Spotify are two of the biggest holdings in the Asymmetric Portfolio. And I think they have a decade or more of user and price growth ahead that will disproportionately flow to the bottom line.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.