It’s hard to argue with the fact that Facebook (I refuse to call it Meta Platforms because the name is so ridiculous) dominates the social media landscape right now and that’s been reinforced by the company’s performance in the last 12 months. But if I can be honest for a second — I’ve never owned the stock!

Everything I know about internet economics, network effect, and the smiling curve points to Facebook being an absolute no-brainer. Yet, the only social media stock I own to this day is Snap.

What was I thinking?

The good news is, we learn more from our mistakes than from our success. So, today I’m going to highlight why I got Facebook wrong and why it’s unlikely a competitor will knock it off the top of the social media heap.

The Smiling Curve and Social Media

Social media combines a lot of the themes I talk about here on Asymmetric Investing. Social networks have effectively zero marginal distribution costs — which I covered in internet economics — and that played a huge role in the disruption Facebook caused to media and the success of its advertising business. On top of that, there are network effects from users attracting more users to the platform. It’s a tech product so operating leverage can drive outsized profits once scale is reached. And there’s winner take all dynamic ultimately leads to the domination we see today.

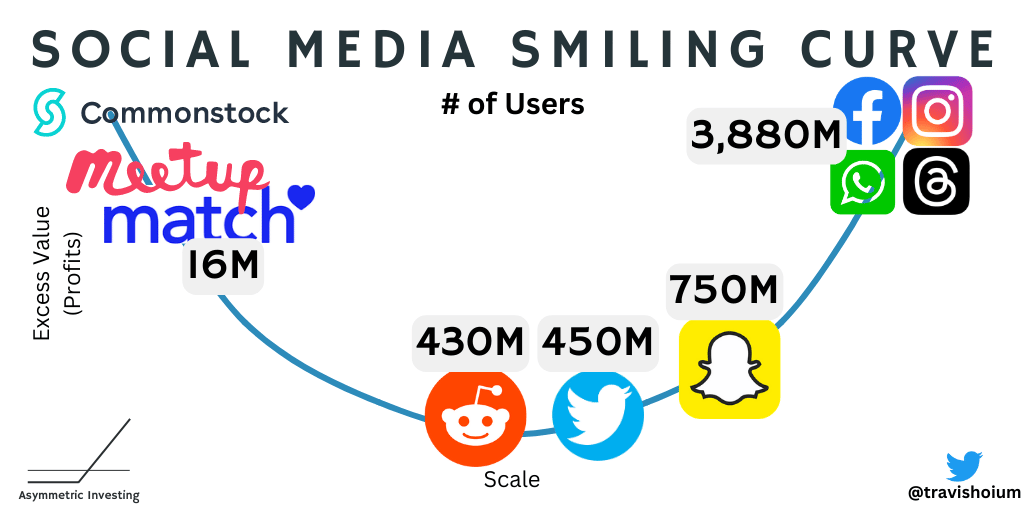

All of these concepts combine in the smiling curve, which I think illustrates why there’s value in some social networks and not others. Before we get to the numbers, here’s how I see some of the leading social networks fitting in the smiling curve today. On the right is Facebook with its multi-billion user scale and on the left are niche players. Everyone else is stuck in the middle.

A good proxy for scale on the x-axis is the number of monthly active users. You can see below that Facebook’s Family of Apps now has 3.88 billion monthly active users (combined), which dwarfs rivals like Snap, Twitter, and Reddit. On the other end is niche social networks like Match Group (16 million paying users), which is very profitable, unlike Reddit, Twitter, or Snap.

We see the same value generation curve in annual revenue per user. Power flows to a company with scale or a company that offers a niche product that people are willing to pay a premium for, like a dating site.

The smiling curve shows what we see in the financial and operational performance of social media companies today. Facebook has the scale and revenue per user to be extremely profitable, which allows it to offer better products and services, which drives better revenue and profitability long-term. Competitors like Twitter and Snap are left trying to climb the smiling curve without the resources to make it possible. Elon Musk is finding that out the hard way at Twitter/X.

What I overlooked in my analysis of Snap (beyond Evan Spiegel being one of the worst CEOs in tech) is that I thought Snap could climb this curve by growing the number of users and increasing revenue per user. The last three years have shown that’s a nearly impossible task for Snap or anyone else.

How Facebook Falls…Someday

I’ve also stayed away from Facebook because social media companies tend to rise and fall (or did prior to Facebook’s IPO). So, how does Facebook’s domination end?

It would take a wild misstep by management (like wasting billions of dollars and a decade of goodwill on the “metaverse”) or a rival that can compete on a vector that Facebook can’t easily respond to.

TikTok took off with younger users and grew in large part because it had an engagement-based algorithm rather than a social graph that Facebook’s model is built on. This threat took some time to respond to but Facebook did just that with Reels on Instagram and appears to have stopped the bleeding. In hindsight, TikTok looks like it’s following the same rapid rise and then flatline path that Snap did a decade earlier.

It’s possible that a new social network can users to switch, but we have seen that network effects are hard to break and for millions of users like me, switching is just a pain in the ass. For the foreseeable future, it’s Facebook’s world and we’re all just living in it.

If you want to know how I’m applying these strategic lessons to stocks today, join Asymmetric Investing Premium. You’ll get stock deep dives and updates on the entire Asymmetric Investing Universe of stocks.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.