Memberships are suddenly everywhere.

Retailers, restaurants, and even finance are moving to a membership model. And for good reason.

The company that broke the mold for memberships is Costco and understanding how it allowed it to operate differently is key to understanding the new membership theme.

But first, here’s an advertisement for Betterment. For the ad-free tier, subscribe to a premium plan.

Rise and grind, dollar bills!

Put your money to work in a high-yield cash account with up to $2M in FDIC† insurance through program banks.

Get started today, with as little as $10.

Membership Economics

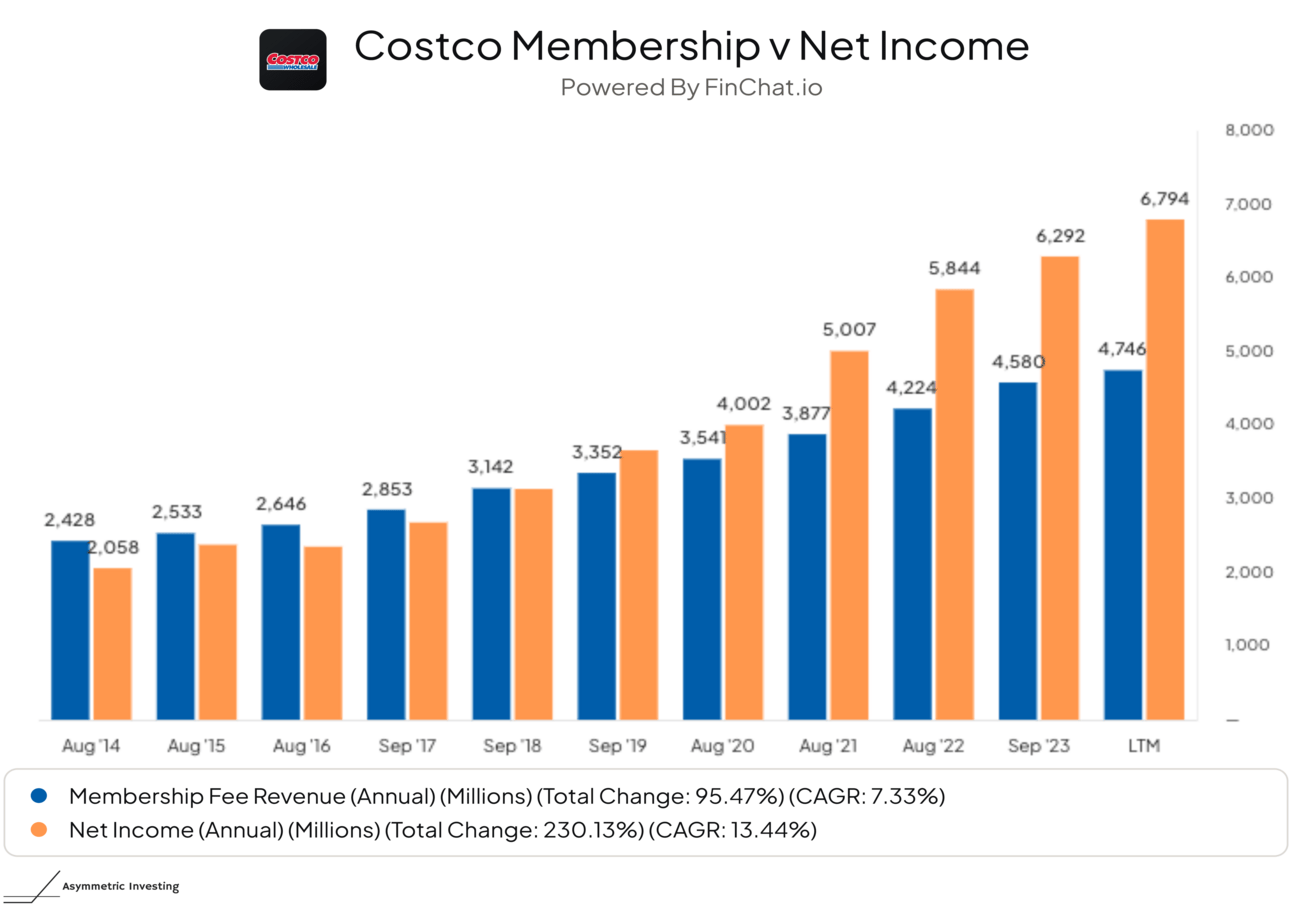

Costco is the best example of a successful membership business and I dug into the model in detail here. At a high level, the company makes all of its profit on memberships and operates stores at breakeven. That’s right, Costco doesn’t make money on most of the products it sells.

The model creates all kinds of interesting incentives and ultimately that’s how you get the chart below.

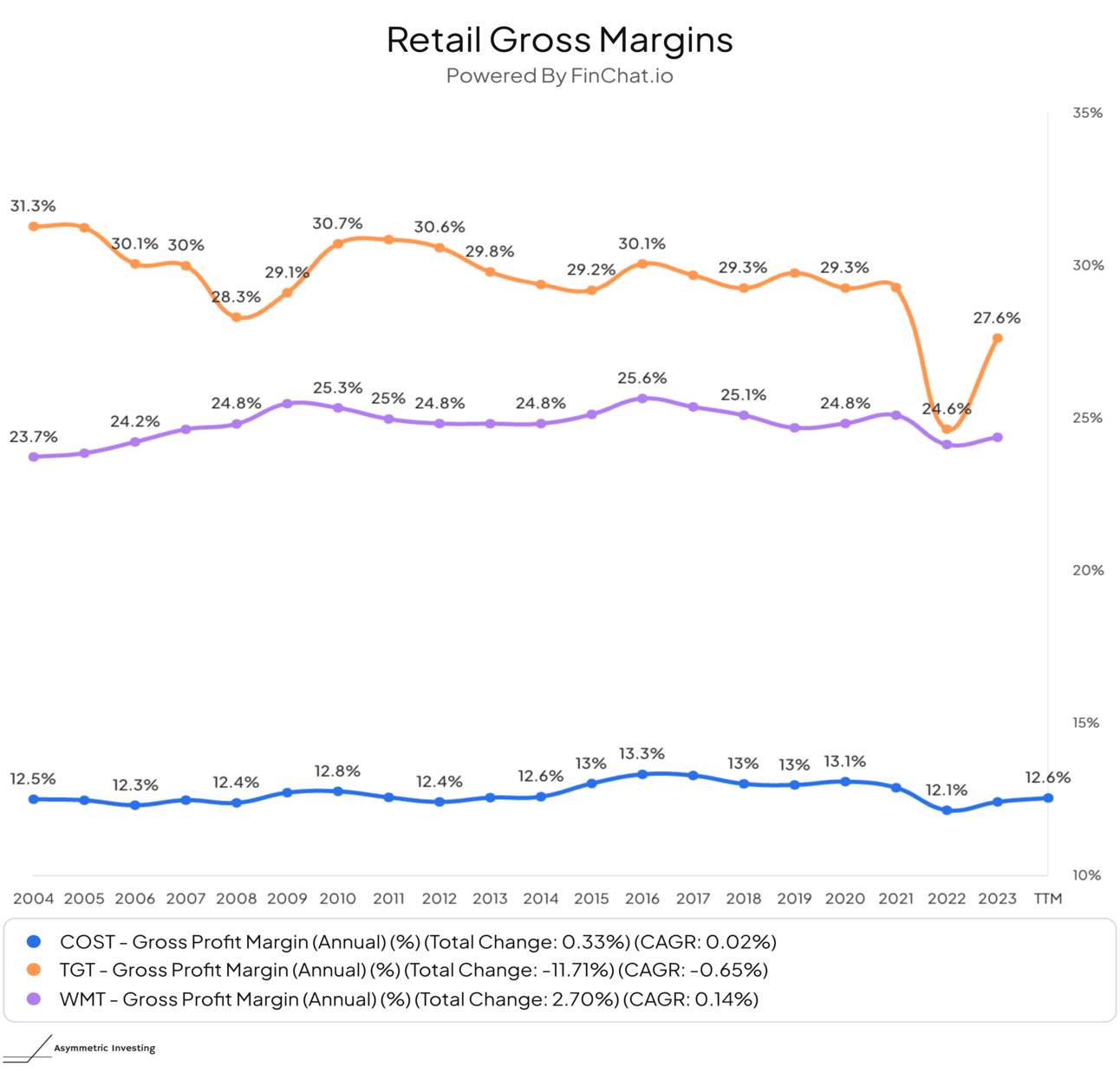

How do you compete with that if you’re a traditional retailer? The membership wins!

Customer Cohort Example

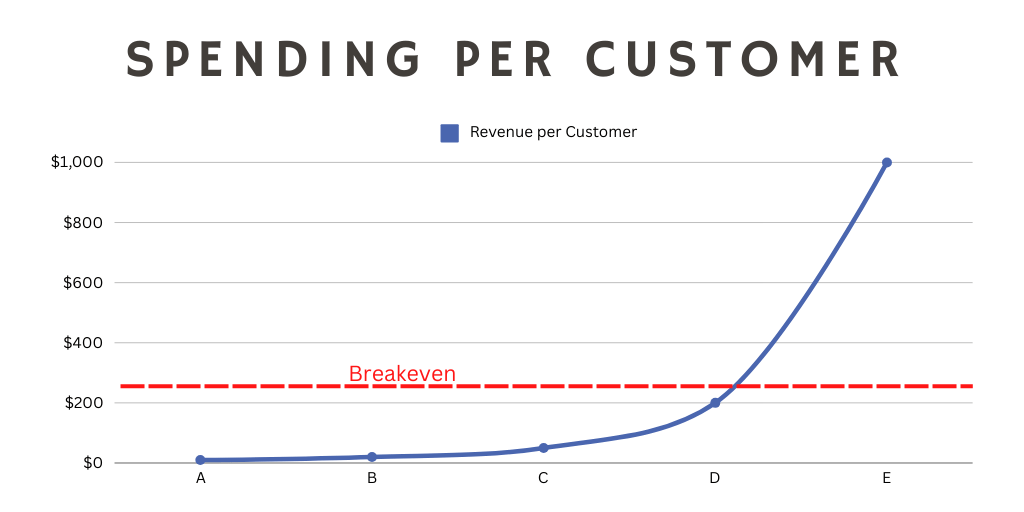

Here’s a very simplistic example of how a retailer or service provider can analyze customers. Let’s say there are five customers with $1,000 to spend and they spend the following amounts at the fictitious company Asymmetric Retail.

Customer A: $10

Customer B: $20

Customer C: $50

Customer D: $200

Customer E: $1,000

Let’s also assume the customer acquisition cost is $50 and our operating margin is 20%. This means customers need to spend $250 at Asymmetric Retail to be profitable.

Only Customer E is a profitable customer in this scenario. So, we want to:

Move at least Customer D above the $250 breakeven line.

Cut ties with unprofitable Customers A, B, and C.

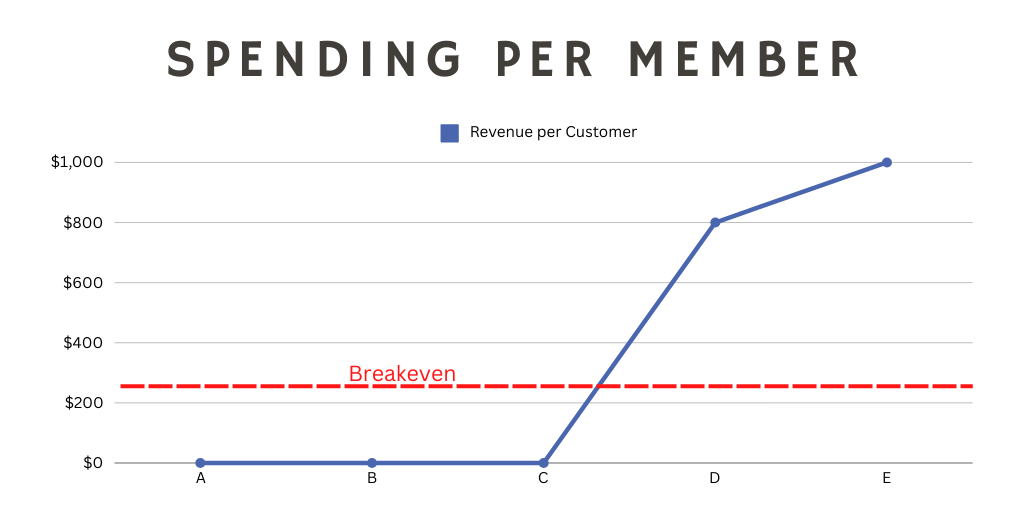

A membership can accomplish all three and may look like this.

Subscriptions act as a filter to keep unprofitable customers out and incentivize existing customers to spend more. The benefit for customers is better incentives because the company can focus on the needs of members and not attract marginal customers.

It’s a win-win-win.

Membership Incentives

The goal of memberships is simple.

Increase the number of customer visits/interactions

Increase $$$ per visit

As the business grows, the company can then lower prices/increase incentives to lock customers into the value of the membership.

These three factors drive a feedback loop for the membership company. Customers who are more loyal return more, which increases volume in the system, which allows the company to lower prices, making the membership more attractive to incremental customers.

The incentive for the membership company is now to make the membership as valuable as possible. NOT to make more money on each incremental transaction.

When deployed successfully, memberships break the traditional rules of business, which is what we see with Costco. And others are trying their hand in the market.

Memberships Keep Winning

I want to give two mini-breakdowns of membership that could be successful, one of which recently entered the Asymmetric Portfolio.

Target’s Circle 360 Experiment

Target is trying to get into the membership game with a $50 membership with the following benefits:

5% savings on all purchases

2-day free shipping

Free same-day delivery for orders over $35

30-day extension on returns

This doesn’t wall off Target access like Costco has done with memberships, but is trying to increase customer spend by offering compelling benefits.

As I highlighted above, Target looks like it’s giving up margin on each purchase by covering shipping or delivery costs, choosing the benefit of membership fees, and increasing loyalty.

Robinhood’s Gold Subscription

Robinhood has the $6.99 per month Gold plan that includes some incredible benefits for investors.

Gold Members | Non-Gold | |

|---|---|---|

Interest Rate | 5% | 1.5% |

Gold Card Cash Back | 3% | n/a |

IRA Match | 3% | none |

Margin Rate | 8% | 12% |

Deposit Match | 1% | none |

On their own, the IRA and deposit match and 3% cash back on the credit card are money-losing products. But as long as brokerage, credit card, banking, and other products break even, the Gold subscription is a win.

These benefits may be the best customer acquisition tool in finance and memberships make them possible.

Memberships Win For a Reason

If a company can reach scale with a membership program it can create both a moat and a reinforcing cycle to grow the business.

Memberships provide a baseline of profitability and allow other products to have much lower margins, attracting marginal customers to the membership program. Costco has used this with great success and so has Amazon.

Target and Robinhood are following in their own way and I wouldn’t be surprised if memberships become the theme of the next decade in investing.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.