This article is sponsored by The Motley Fool.

Costco’s retail formula isn’t complicated.

Customers are charged an upfront fee to become “members” of the Costco club and then the warehouse itself is run at breakeven.

That’s right, Costco doesn’t make money when you buy a pumpkin pie or a 27-pound bucket of mac and cheese (a real item at Costco), it’s just trying to cover the operating cost to run the store.

Running stores at breakeven is Costco’s weapon against competitors. If you don’t have to make money selling goods, you can price products lower than anyone else. And it’s been a magical strategy for Costco long-term.

Turning Retail Economics Upside Down

Think about Costco as running a retail business backward. It can start with the profits it generates from membership fees and then back into how to price products in the store.

This creates a feedback loop of lower prices and ultimately more members (profits).

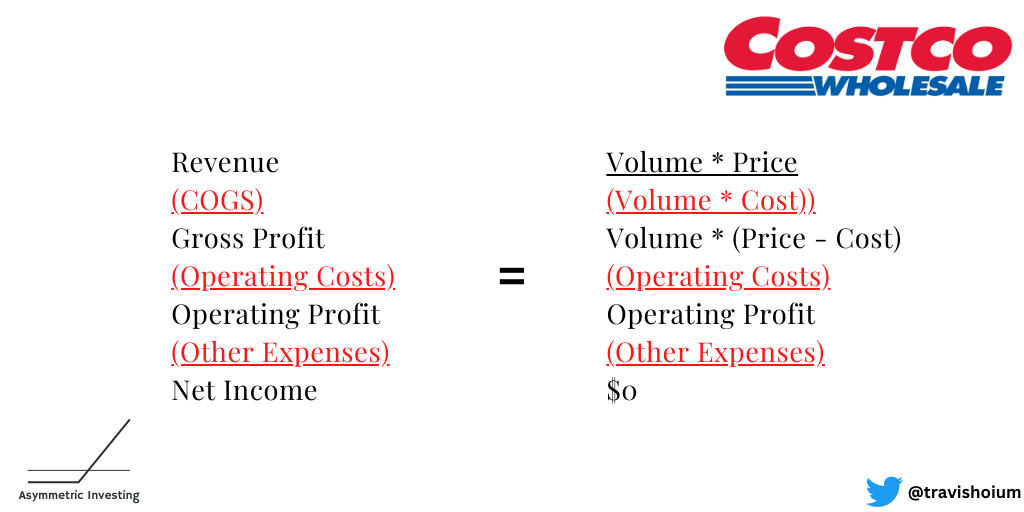

In the image below, the left side is a straightforward income statement. Traditional retailers must generate enough gross profit from stores to cover operating costs and leave a little net income. Excluding membership fees (on the right), Costco’s gross profit only needs to cover fixed expenses to run the business.

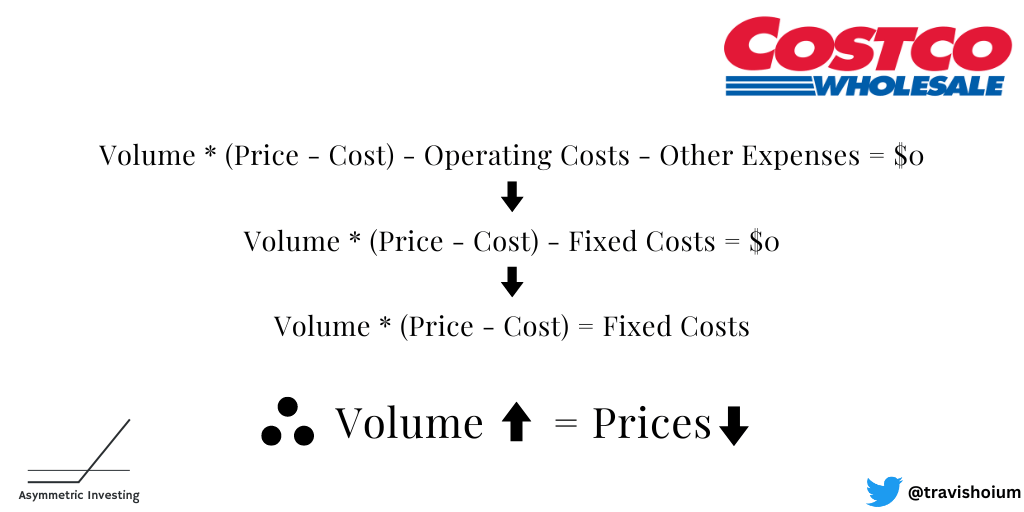

Turn this into a formula and it shows how Costco prices its products so aggressively.

Take this formula to its logical conclusion. Costco has low prices, which attracts more customers, which increases volume, which allows Costco to lower prices, which attracts more customers, which increases volume, and so on.

The only limit to lowering prices toward the cost of goods sold is the physical volume Costco can get through the store.

This video of $5.99 pumpkin pies being picked by customers is the business model in action.

Competition Is Left In The Dust

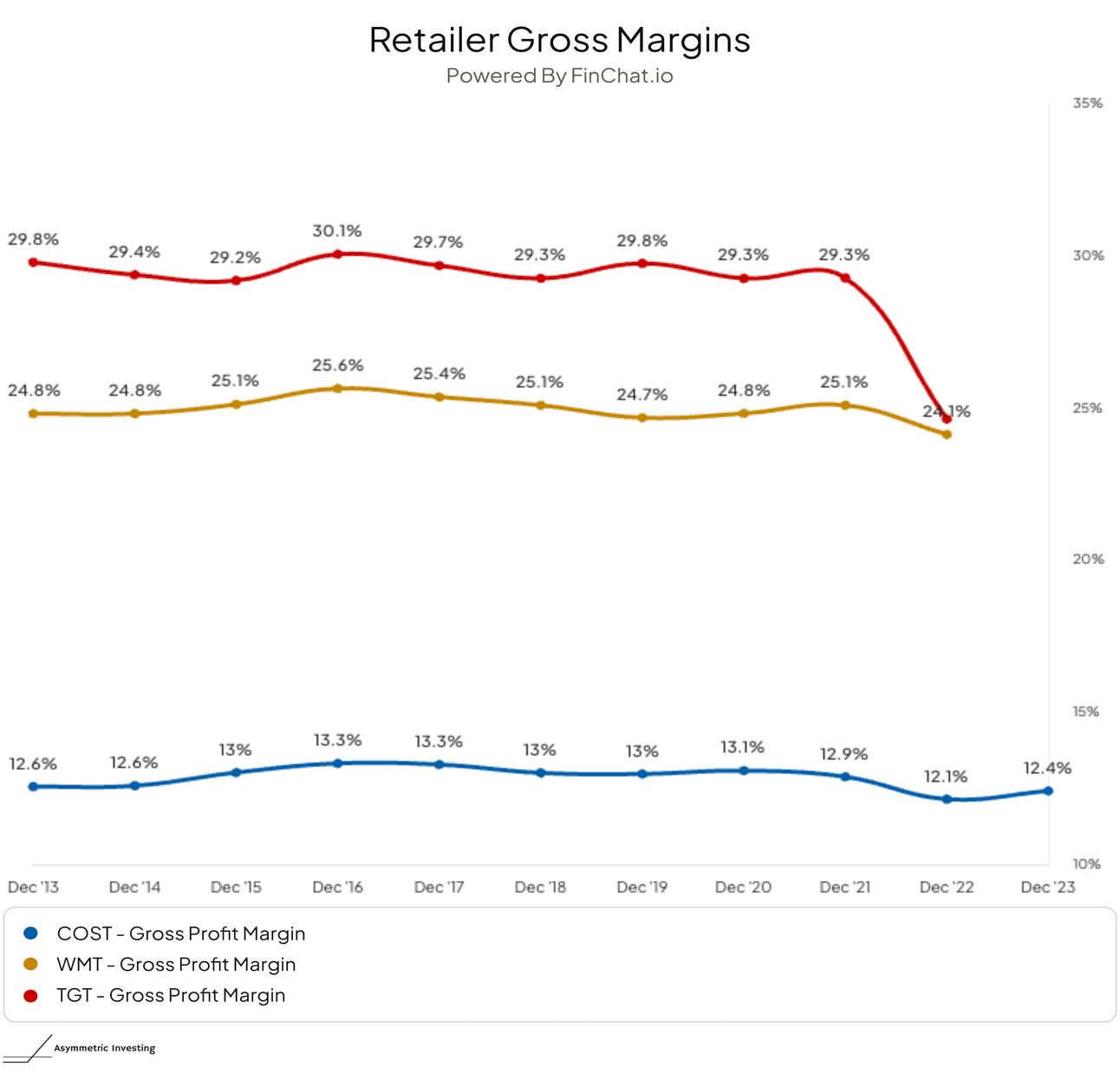

This is the most incredible chart about Costco that I’ve seen. You can see below that even the best big-box retailers can’t compete with Costco’s pricing structure.

The fight isn’t fair.

Costco and Earnings Growth

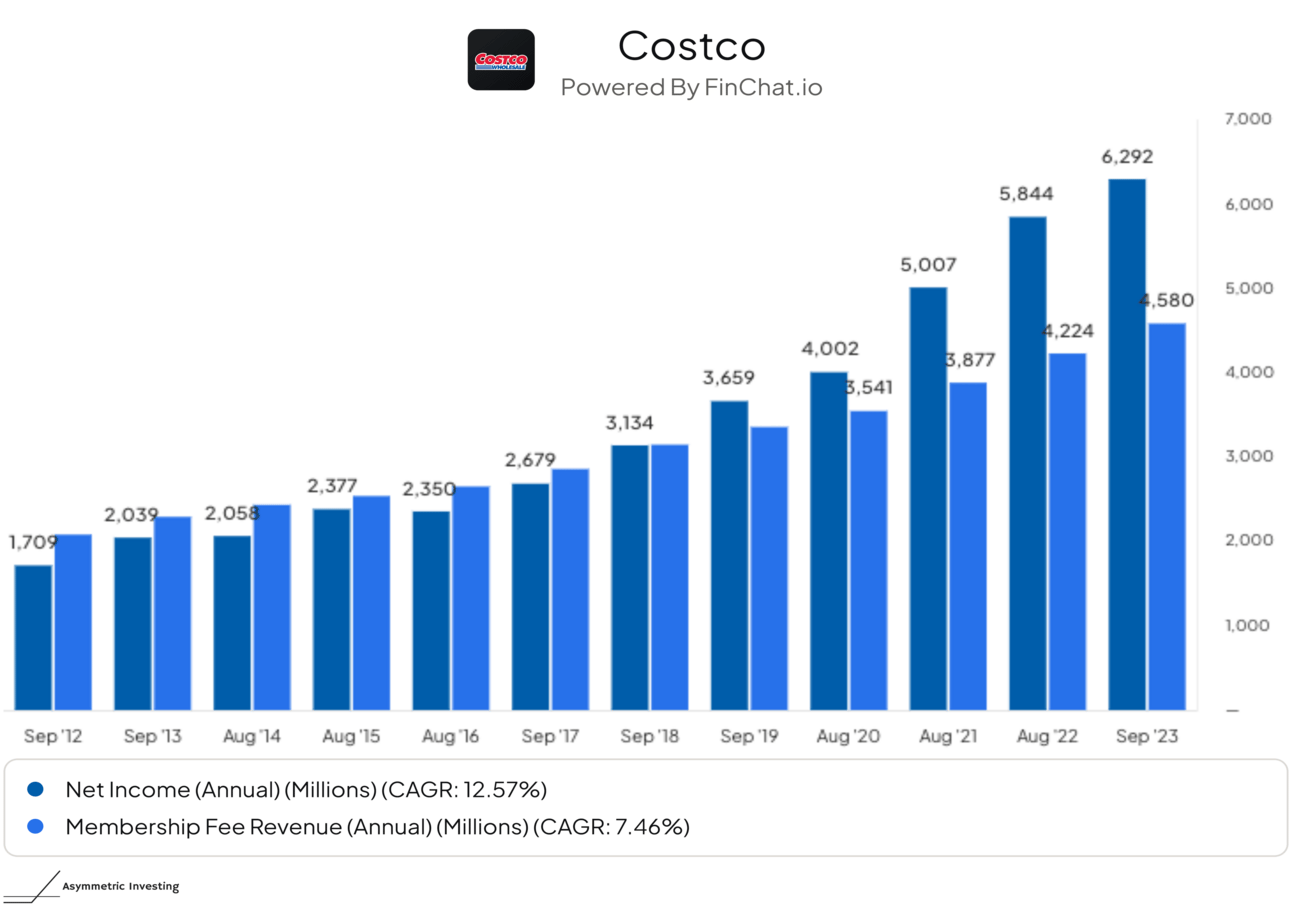

You can see in the first chart that Costco’s net income was below membership revenue as recently as 2017. Now, the company is making a small amount of excess profit from each store, but the growth driver is still the # of members and the membership fee Costco charges.

We can debate whether or not this profit formula makes Costco worth 35 times its trailing earnings, which is a story for another day. For today, I’ll marvel at Costco’s business model and how impossible it is for other retailers to compete.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.