Today’s deep dive is on Alphabet. Not all asymmetric investing opportunities come from small, fast-growing companies; in this case, I see a big, powerful company with outsized growth opportunities in a few important markets.

Why Alphabet? In < 100 Words

Buying Alphabet is a combination of buying one of the best business models in the world and the brightest technical minds.

Search is the financial powerhouse that’s arguably the best business model ever invented and it lays the foundation for future growth opportunities in artificial intelligence, streaming, and autonomous driving.

Like Apple a decade ago, a combination of steady revenue growth, steady cash flow, and share buybacks could drive a 10x return for one of the biggest companies in the world.

Key Stats

Alphabet by the numbers:

Company: Alphabet (formerly Google)

Ticker: GOOG (no voting rights) and GOOGL (voting rights)

Market Cap: $1.65 billion

Revenue (ttm): $289.5 billion

Gross Margin: 55.4%

Operating Margin: 25.8%

Net Income: $61.0 billion

Shares Outstanding and Y/Y Growth: 12.63 billion down 3.2%

Earnings per share: $4.72

FCF (ttm): $71.1 billion

Date Founded: 1998

Founders: Larry Page and Sergey Brin

Alphabet’s Leadership:

CEO: Sundar Pichai, who began his career as a materials engineer and ran Google (the subsidiary of Alphabet) before taking the CEO role.

Page and Brin remain controlling shareholders and members of the Board of Directors, but no longer have day-to-day roles at the company.

The Strategy

Alphabet as a whole is a collection of companies that have anywhere from very clear to very loose connections. In this breakdown, I’m going to focus on search, YouTube, AI, and Waymo, which I think are the most important parts of the business long-term.

Search and Beyond

Google’s core business is search. The “10 Blue Links” and goofy word that became an internet verb is one of the best businesses ever created because it connects users with intent to the information they want and advertisements that make Google money.

From there, the company has wiggled its way into collecting data everywhere from mail to cloud storage, which makes the ad network more efficient. It’s all a reinforcing loop around search and at this point Google’s tentacles are everywhere.

Below, I’ve laid out how I visualize Google’s “Scorched Earth” strategy, which essentially entails giving away any complimentary products to fend off competition. You can see below that everything on the graphic is free for users (at least initially). How do you compete in maps or mail when a competitor like Google can give it away for free?

But Google’s version of scorching the earth is more than that. Google gets a feedback loop of data that helps make search (and advertisements) better.

The strategy has led to a reinforcing loop in search and the logical conclusion of the smiling curve. There’s ONE winner who extracts ALL of the value in the industry. You’re forgiven if you’ve never heard of Yandex, Baidu, or Duck Duck Go, which are real “competitors” to Google.

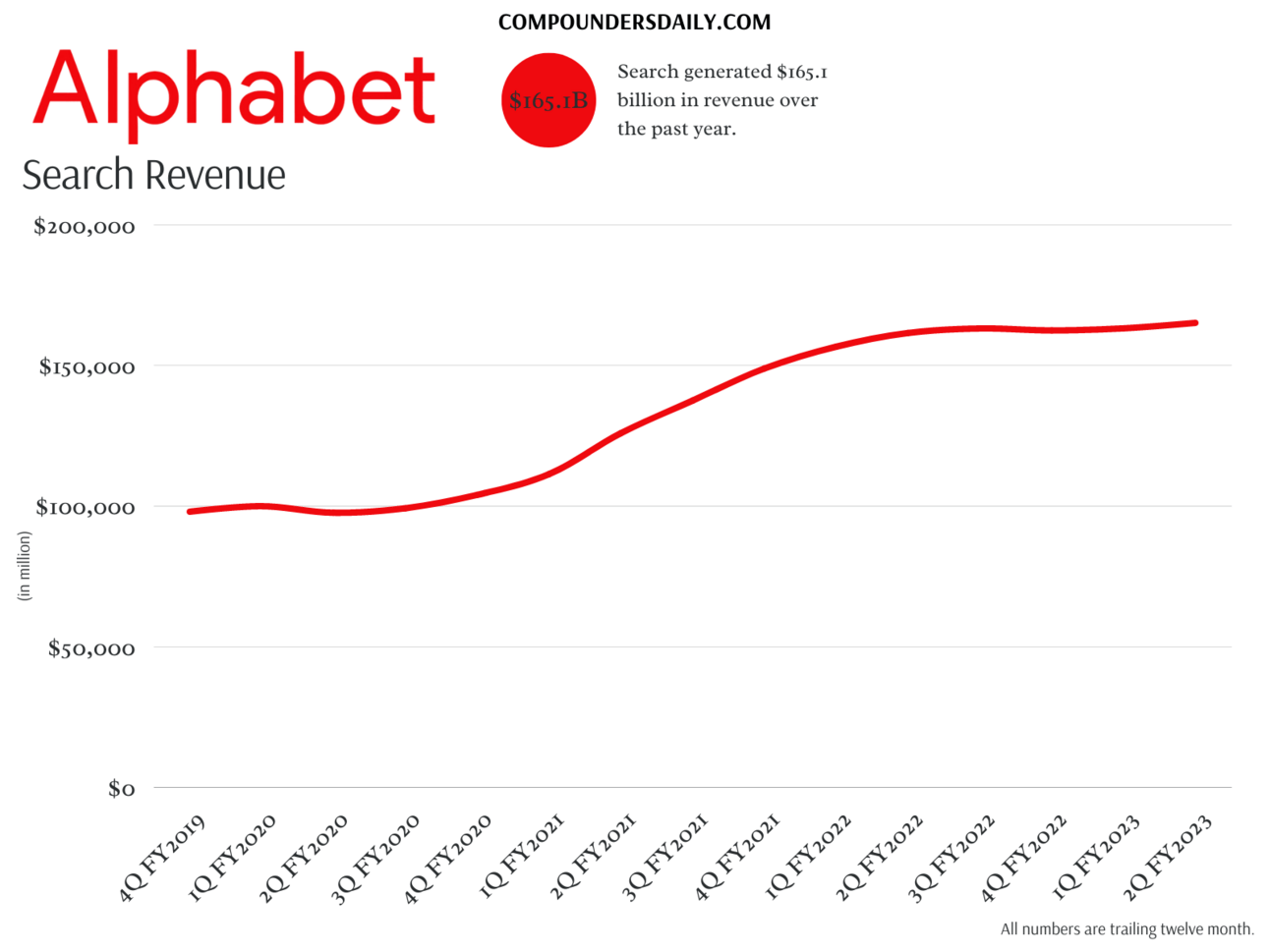

The 90%+ market share Google has in search drives the entire business. And search is a VERY big business.

You can see that growth has slowed in search, but that’s natural in a maturing market. What investors need to know and appreciate is that search spits off nearly $100 billion per year in operating profit. That alone could justify Alphabet’s $1.56 billion enterprise value.

YouTube’s Video Dominance

An underappreciated part of Alphabet’s business is YouTube. It’s THE platform for user-generated content and it’s moving into traditional television, consuming more and more hours of our day.

Here’s a fun fact, YouTube generated $29.4 billion in revenue over the past year, not far from Disney’s linear AND streaming revenue run rate of $48.9 billion.