Today’s deep dive is on Disney. Started in 1923, Disney is an icon of media and entertainment. But the company has fallen on hard times, to say the least. Linear TV is declining, ESPN is looking for partners, studios seem lost, and streaming TV is a money loser thus far.

Read most market commentary and Disney seems like a lost cause. But when you start to understand Disney’s history, you see why now is the time to buy because Disney is a company defined by eras. The next era could be its most dominant yet.

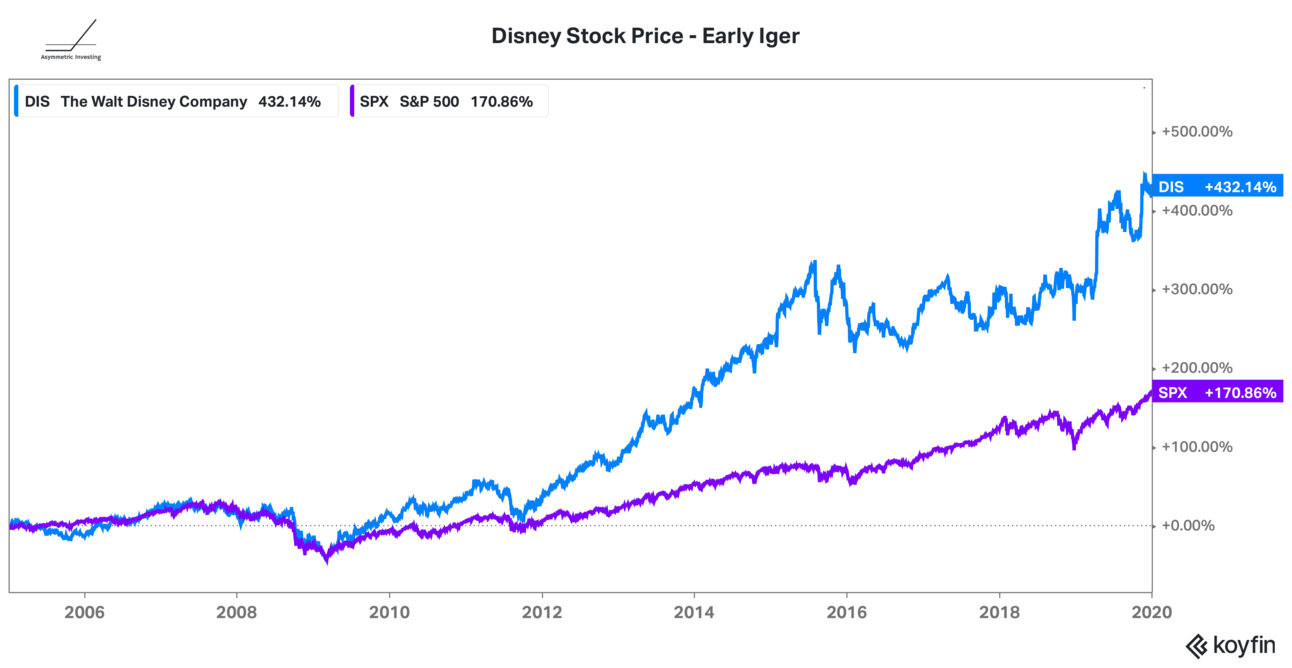

I’m going to start this spotlight with a look back at Disney’s historical performance (and asymmetric returns) to show why we may be at a low point for the company

Walt Disney Era (1923-1966)

Disney Brothers Studio was founded on October 16, 1923, by Walt and Roy 0. Disney as an animation studio. Ultimately, the company would be renamed The Walt Disney Company (Disney) that we know today.

Originally, the company produced animations for larger studios, but Disney began making its own films in 1928 with Mickey Mouse as the main character.

Mickey Mouse in Steamboat Willie.

A series of hits eventually followed:

1937: Snow White and the Seven Dwarfs

1940: Pinocchio

1941: Dumbo

1942: Bambi

1950: Cinderella

1951: Alice in Wonderland

1953: Peter Pan

Pre and post World War II, it is hard to argue with Disney’s animation track record and these films put the company on the map. This would also be the precursor to Disneyland, which opened in 1955.

But even Walt Disney had a string of failures. After Peter Pan, the company put out 62 movies before Walt’s death in 1966 and the only notable films were:

1954: 20,000 Leagues Under the Sea

1955: Lady and the Tramp

1959: Sleeping Beauty

1964: Mary Poppins

The ebbs and flows of Disney had begun but this opening era was one of the most successful ever for a media company.

Era Theme: This is the birth of Disney and the company survived multiple major gambles by Walt. First, Disneyland, which opened in 1955 and nearly bankrupted the company. Next was Walt Disney World, which was Walt’s concept but didn’t open until 1971, five years after he died. Walt’s era was defined by innovative ideas and big swings, which ultimately paid off.

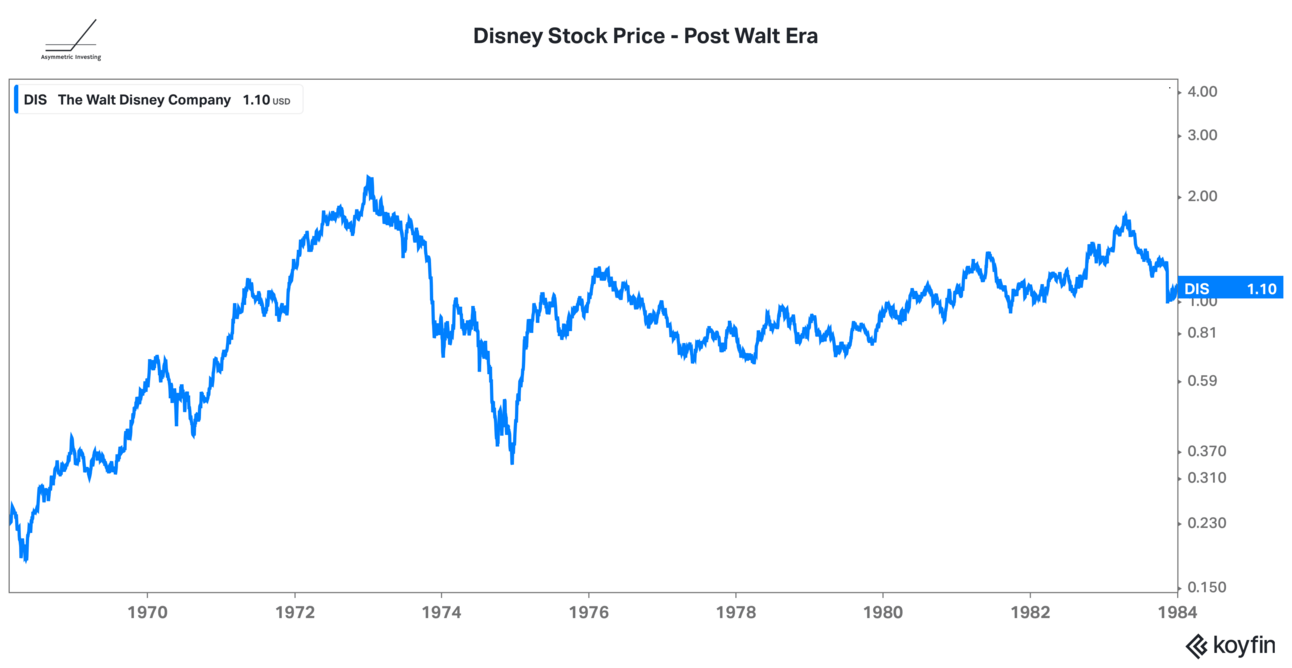

Post-Walt Era (1966-1984)

After Walt Disney died in 1966, his brother Roy O. Disney would come out of retirement to complete the Walt Disney World dream and the theme park opened in 1971.

On the studio side, the business was in a rut with the only notable movies being:

1967: Jungle Book

1973: Robin Hood

Chart by Koyfin. Get 10% off a Koyfin subscription here.

You can see that the stock didn’t do well either. For more than a decade, it went nowhere.

Era Theme: Lost without Walt.

Eisner Era (1984-2005)

The Eisner era can be split into two sections.

Early Eisner Era (1984-1998)

Eisner brought back some of the creative juices to Disney and revitalized its theme parks. Notable films early in his tenure were:

1988: Who Framed Roger Rabbit

1989: The Little Mermaid

1991: Beauty and the Beast

1992: Aladdin

1994: Lion King

1995: Toy Story (co-production with Pixar)

1998: A Bug’s Life (co-production with Pixar)

And the market loved what it saw.

Chart by Koyfin. Get 10% off a Koyfin subscription here.

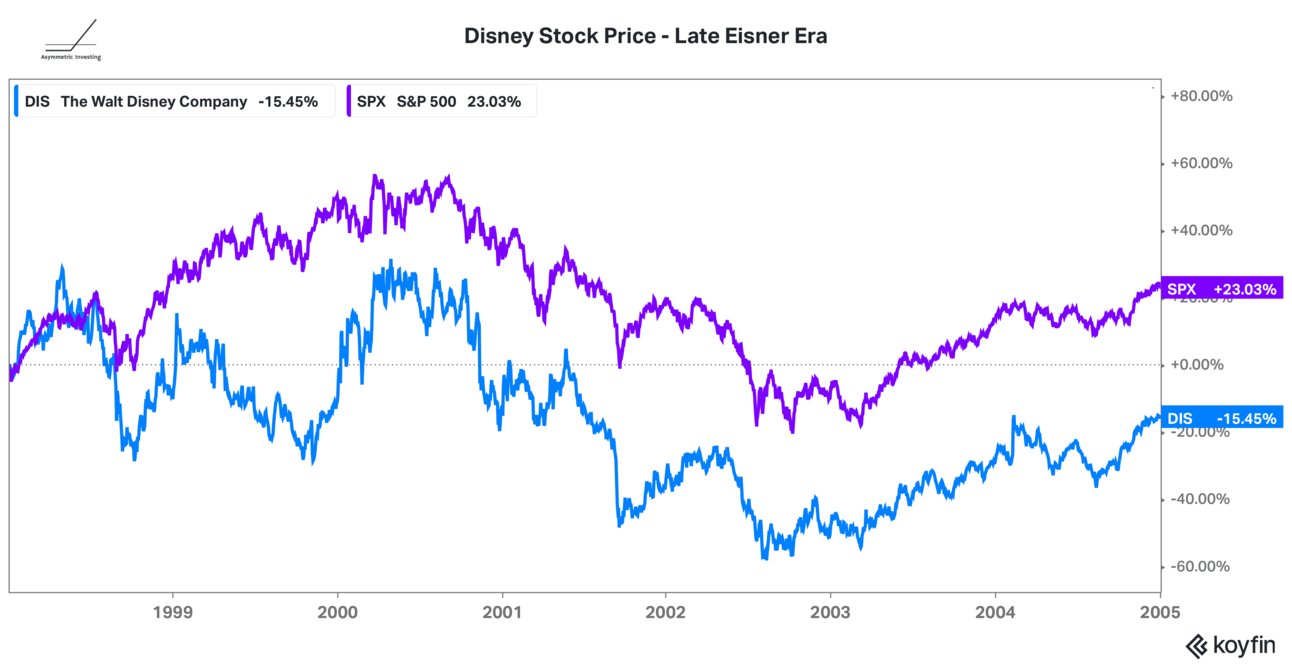

Late Eisner Era

The final decade of Eisner’s reign at Disney was marked by ego and empire-building.

Jeffrey Katzenberg left in 1995 after Eisner wouldn’t make him President, starting the wildly successful studio DreamWorks SKG.

Capital Cities/ABC was acquired in 1995 for $19 billion.

25% of the California Angels were acquired in 1996 with a complete buyout in 1998.

Disney became a conglomerate in this era, for better or worse.

Some of these assets (ESPN) would ultimately pay off for Disney, but in the final years of Eisner’s tenure the magic faded and the stock price underperformed the market by a wide margin.

Chart by Koyfin. Get 10% off a Koyfin subscription here.

Era Theme: Disney’s comeback and complacency.

Early Iger Era (2005-2020)

Iger’s early years as CEO were defined by revitalizing Disney’s content machine. But he did that primarily through acquisitions.

2006: Pixar

2009: Marvel

2012: Lucasfilm

This was also a time when the cable bundle was growing in both subscriptions and carriage fees going up every year, so revenue and profit grew like clockwork. He was riding a tailwind that would have been hard to screw up and he augmented that strength by buying great assets along the way.

Disney+ was also launched in late 2019 and grew like crazy, showing that Disney could pave a path in a post-cable world.

You can see that Iger had a great tenure from a stock perspective as well. Until the pandemic, Disney could do no wrong.

Theme: Blockbusters become the name of the game and Disney made the biggest blockbusters in Hollywood. Simultaneously, Disney’s linear networks benefit from the growth in cable and Disney’s pricing power driven by ESPN.

Chapek/2nd Iger Era (2020-2023)

Let’s be honest, Bob Iger bounced as soon as he saw COVID-19 coming. Disney’s Shanghai resort was the first to be hit and he saw an exit path and took it.

Chapek took the reigns just in time to watch the world shut down. Parks were shuttered, theaters closed, film and TV production stopped, and Disney was in survival mode. On the plus side, Disney+ was gaining subscribers faster than expected and Chapek decided to go all-in on streaming. After all, this was the plan Iger had laid out and the pandemic was a crisis he didn’t want to waste.

This created two problems.

The push into streaming hastened cord-cutting, damaging Disney’s cash cow.

Streaming was not yet profitable and going all-in made the problem worse to the tune of losses of over $1 billion per quarter.

When the economy emerged from the pandemic, Disney found that linear network profitability was falling, streaming was burning money, and studios were a mess (partly from pandemic production/creative realities and partly the ebb and flow in quality content that’s a theme here).

The studios were also in a transition period. Marvel’s Avengers: Endgame came out in 2019 and there was a natural soul-searching following the end of a decade-long content plan. But that soul-searching also made its way to Pixar and Lucasfilm at an inopportune time.

Chapek ultimately pushed Iger’s long-term streaming strategy too hard and clearly wasn’t a good operator. That’s why his tenure was so short.

Iger came back in late 2022 to clean up the mess that he had started making. But now the die is cast and Disney has to go all-in on streaming.

Era Theme: Pushing streaming too far, too fast.

As you can see, there’s a natural ebb and flow to Disney’s business. The animation studio hits a peak and then rests on its laurels for a decade before being reborn bigger and better than before.

As investors, the time to buy Disney stock is when the market counts the company out. In 1984 when it hadn’t had a hit in years, in 2005 when the animation studio was in shambles, and I think today.

Why Disney? In < 100 Words

Disney is one of the most iconic companies in the world and it’s currently going through a transition that could make it an even more powerful company in the future.

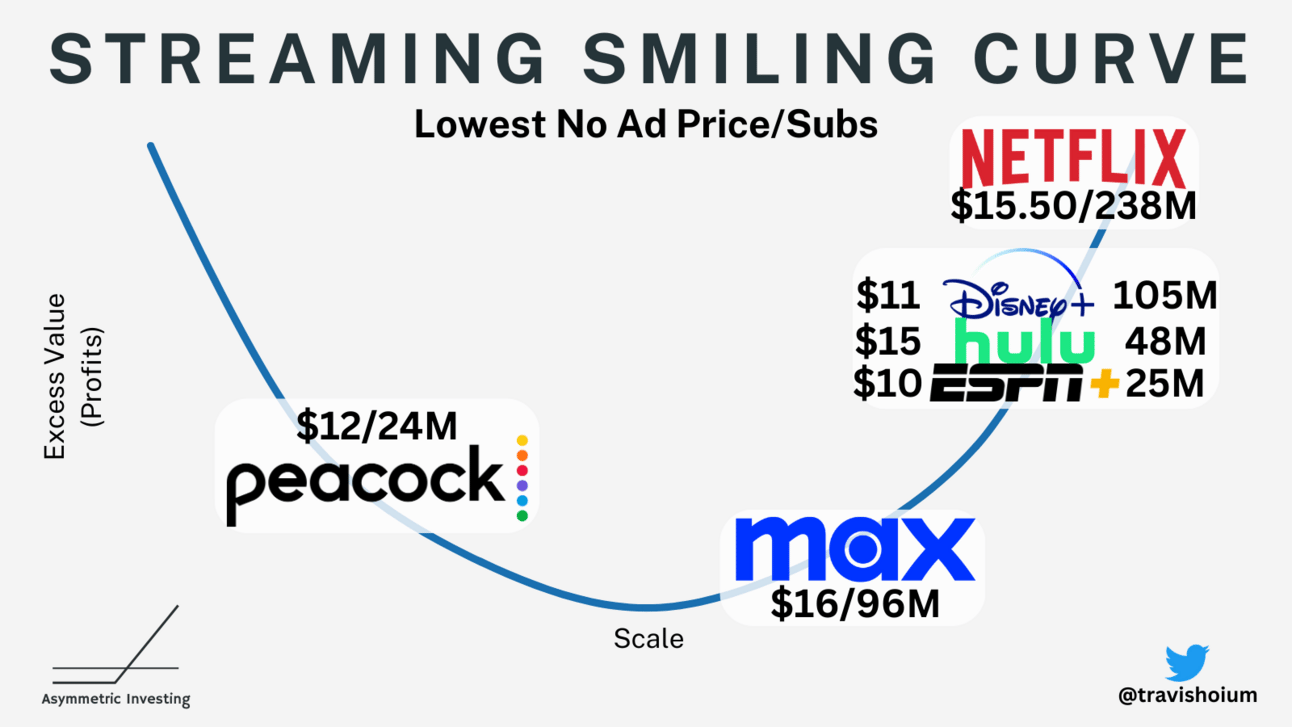

The long-term thesis is based on Disney leveraging its content to be a leader in streaming, which will likely only have one or two companies generating high profitability as the market matures. Netflix is the other rival, but Disney is the biggest company going after a sports streaming market that’s untapped thus far.

If it’s successful, Disney could increase significantly (10x will be a stretch) in value over the next decade.

Key Stats

Disney by the numbers:

Company: The Walt Disney Company

Ticker: DIS

Market Cap: $157.3 billion

Revenue (ttm): $87.8 billion

Gross Margin: 32.8%

Operating Margin: 8.5%

Net Income: $2.25 billion

Shares Outstanding and Y/Y Growth: 1.83 billion (up 0.1%)

Earnings per share: $1.23

FCF (ttm): $2.85 billion

Date Founded: October 16, 1923

Founders: Walt Disney and Roy Disney

Disney’s Leadership:

Bob Iger, CEO: Iger returned as CEO in late 2022 after a 15-year run that ended in 2020. Before becoming CEO, Iger was COO of Disney and an executive at ABC prior to Disney’s acquisition of Capital Cities/ABC in 1995.

The Strategy

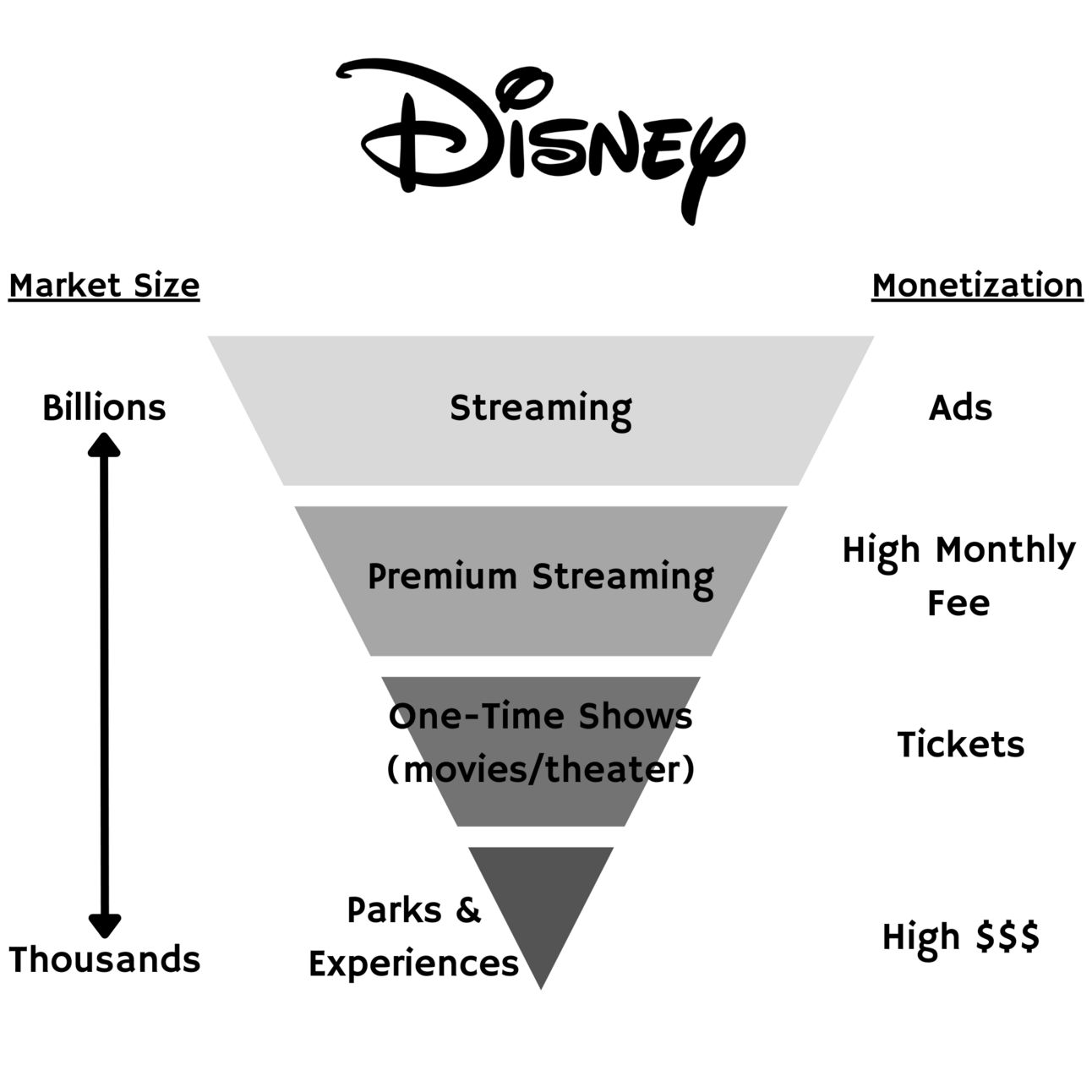

Disney’s business today can be thought of in four distinct segments: Parks and Entertainment, Content Studios, Linear TV, and Streaming.

The businesses are connected but operate independently. And this is ultimately the challenge for Disney’s current management.

Parks and Experiences

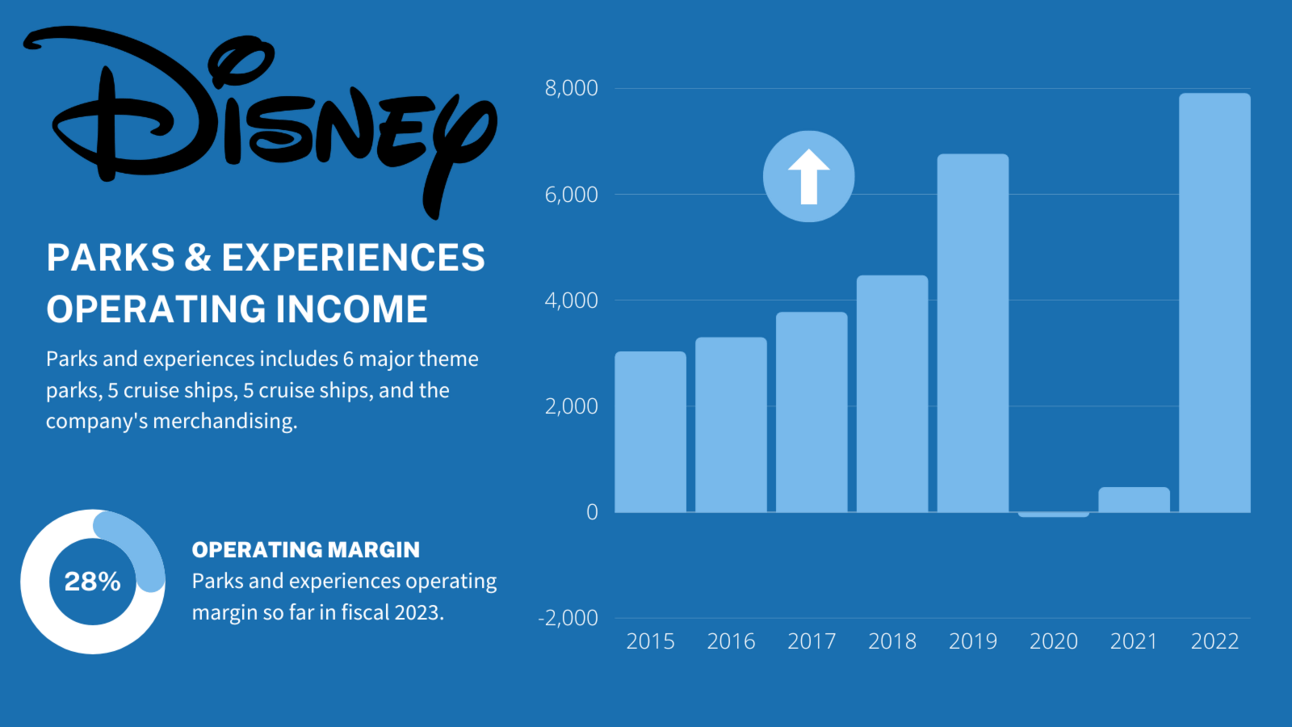

Disney’s current cash cow is the parks. In the first nine months of this fiscal year, Parks and Experiences have generated $7.64 billion in operating income, a path to about $10 billion in operating income this fiscal year.

I discuss scarcity and abundance a lot here and the driver of parks and experience profits is scarcity. It costs a fortune to go to Disney parks (always has) and that pricing power gives the company strong margins. What’s incredible is the consistent growth in operating profits year after year.

The common perception is that the studios fuel the parks, and that’s partly true. But the studios don’t need to make hits every year for the parks to be successful. The Lion King, Star Wars, and Avatar are iconic movies turned experiences, but Epcot and many of Magic Kingdom’s most iconic rides aren’t tied to movies at all. Internationally, the parks are fueled by decades-old content from Mickey Mouse and Dumbo as well as iconic Disney concepts like Frontierland, Tomorrowland, and Fantasyland. Some of the park maps are shown below.

Disneyland Paris

Disneyland Shanghai

Disneyland Hong Kong

The parks and experiences are tied to the studios, but I don’t think they are dependent on them anymore. That gives Disney more flexibility in how to think about content in the future.

Content Studios

I am going to split Disney’s content studios into movies and general entertainment, which is broadly what the company does.

Movie Studios

Disney owns some of the most iconic and successful movie studios in the world. Walt Disney Pictures includes the animation studio the company is known for while Marvel, Pixar, and Lucasfilm were the key acquisitions to Iger’s tenure.

Walt Disney Pictures

Marvel

Pixar

Lucasfilm

Twentieth Century Studios

Searchlight Pictures

The studio business is naturally very volatile, but even in a down period, Disney is putting out some big hits. Guardians of the Galaxy Vol 3 is #3 in the world this year with $845 million in box office revenue and Avatar: The Way of Water led 2022 with $2.32 billion in box office revenue.

As I mentioned above, the quality and revenue will ebb and flow over time, but the way to think about these studios strategically is tentpoles in Disney’s content strategy.

General Entertainment

In the world of linear TV, general entertainment is what you watch on a random Tuesday night. It’s sitcoms, dramas, and kids shows. Disney operates under these banners and plans to produce 270 original programs in fiscal 2023.

ABC Signature

20th Television

Disney Branded Television

FX Productions

National Geographic Studios

These general entertainment studios are in the most flux as people shift their viewing from linear TV to streaming. What is valuable? What will people watch? We don’t have perfect answers.

I think the way to think about general entertainment strategically is as a churn reduction vehicle. It’s the content you put on when you “just want to watch something”. Disney wants its platform (as Netflix is now) to be the go-to for those moments.

Disney’s Content Smiling Curve

Bob Iger seems to be coming to the realization that Disney needs to lean into the smiling curve of content. Either make blockbusters or make Suits.

Note: Netflix revealed that Suits was its most-watched show with 18 billion minutes of watch time in July.

Disney arguably has the best top-right corner of the smiling curve content in the world. Yes, quality will come and go, but what better tentpoles to build on that Marvel, Star Wars, Pixar, and Disney Animation?

The challenge for Disney is eliminating the middle of the curve and doubling down on the top left.

We don’t know exactly what the end state of the studios will look like, but I think the shifts in what studios make will be noticeable.

My take on Disney’s content business

Given the long history of ebbs and flows in the content business (shown above), I’m inclined to forgive Disney’s current weakness in the studio business today. I think Disney:

Doubled down on Marvel one too many times

Pixar went in the wrong creative direction

The pandemic negatively impacted both the production and creation of content

I want to double down on the creative point. I can’t imagine how hard it was trying to come up with movie or TV show ideas on Zoom.

On the plus side:

Disney’s legacy assets are second to none.

Disney still has a top reputation among parents and is now creating more (top left) content to fill their needs. Ex:

Spidey and His Amazing Friends

Alice’s Wonderland

Star Wars: Young Jedi Adventures

Remember that Disney+ only launched less than four years ago. It takes time for the production-to-consumption feedback loop to kick in.

Distribution

Distribution is where I think we will see the most change for Disney over the next decade. In general, linear TV will be out and streaming will be in for the company.

Linear TV

Linear TV — and the cable bundle specifically — has been Disney’s cash cow for more than a decade. The company could bundle channels together to get high carriage fees from cable operators and sell ad space to advertisers. Channels include:

ABC

ESPN

ESPN2

SEC Network

ACC Network

FX

National Geographic

A&E (50% owned)

History (50% owned)

Lifetime (50% owned)

In the fiscal year ending September 28, 2019, media networks generated $7.5 billion in operating income. In the current fiscal year operating income is on a $6.6 billion run rate, but is down 27% from a year ago. The writing is on the wall that the linear TV business is in decline.

The question Iger needs to answer is whether or not these assets belong under Disney as revenue falls.

Streaming

Disney played a role in the decline of linear TV by creating a big streaming business. Those key assets include:

Disney+

Hulu

67% owned by Disney

Comcast has the ability to “put” the remaining portion to Disney for $9.2 billion

ESPN+

Iger has said that ESPN will also “go over the top” soon, so ESPN+ may be the ESPN channel with more content. I did a longer writeup on Disney’s strategic positioning in streaming sports, but the general landscape is similar in all of streaming content. Disney is losing money, but over time I think it will leverage the second-largest streaming platform to become a leader in streaming.

The challenge will be building a bundle of content that answers people’s media viewing needs like cable did. The content adjustments to make this streaming move successful are already underway.

The Future Disney

As I think about the assets Disney has and how it makes sense to structure the company in the future, I think there are four key assets.

Tentpole Studios (top right of smiling curve)

Marvel, Star Wars, Pixar, and Disney

General Entertainment (top left of smiling curve)

Owned and acquired content

ESPN/Sports (top right of smiling curve)

Parks & Experiences

I think Disney will ultimately sell the linear TV networks (probably keeping ESPN) to an entity that will monetize them as standalone assets. As distribution tools, the linear TV assets just don’t make sense within Disney as the company builds a streaming future.

ESPN probably wouldn’t make sense under the Disney umbrella if it wasn’t already there, but now that it is the company will leverage it to build a compelling streaming bundle. We know that advertising on streaming is a growing monetization tool and Disney is widening the gap between ad-supported and ad-free tiers of their services.

Long-term, the logical conclusion is the have a fully ad-supported tier that maximizes the top of the Disney funnel. Higher price tiers can unlock more experiences, just like higher cable bundle tiers did.

The key to this streaming strategy will be keeping a large scale and building the advertising tech stack for streaming.

Advertising has become so lucrative — for both general streaming and sports — that I think Disney needs to lean into the ad structure to attract more users and squeeze out competition.

Streaming is zero distribution cost, so maximizing the number of viewers is key. And having scale is the first step in building an advertising model that makes the entire financial model work. In a simple sense, this is how to think of Disney’s content and monetization.

If part of Disney isn’t in service of growing the ad market, making a bundle more valuable, or enhancing the parks and experiences does it belong at Disney? Probably not.

I think ABC is likely to be sold and along with it most/all of the cable channels could go. That would leave the studios to create content for Disney’s streaming services or license that content to linear networks or other streamers.

I’m not going to speculate on what linear network sales would sell for, but even with its decline linear TV is a very profitable business. Don’t be surprised if the networks are worth multiple tens of billions of dollars.

Financials

Disney is still recovering from the pandemic in many ways, but it’s also facing some negative trends in linear TV, which I covered above. But the bigger challenge may be a balance sheet that has excess debt after acquiring Fox’s media assets in 2019.

Income Statement

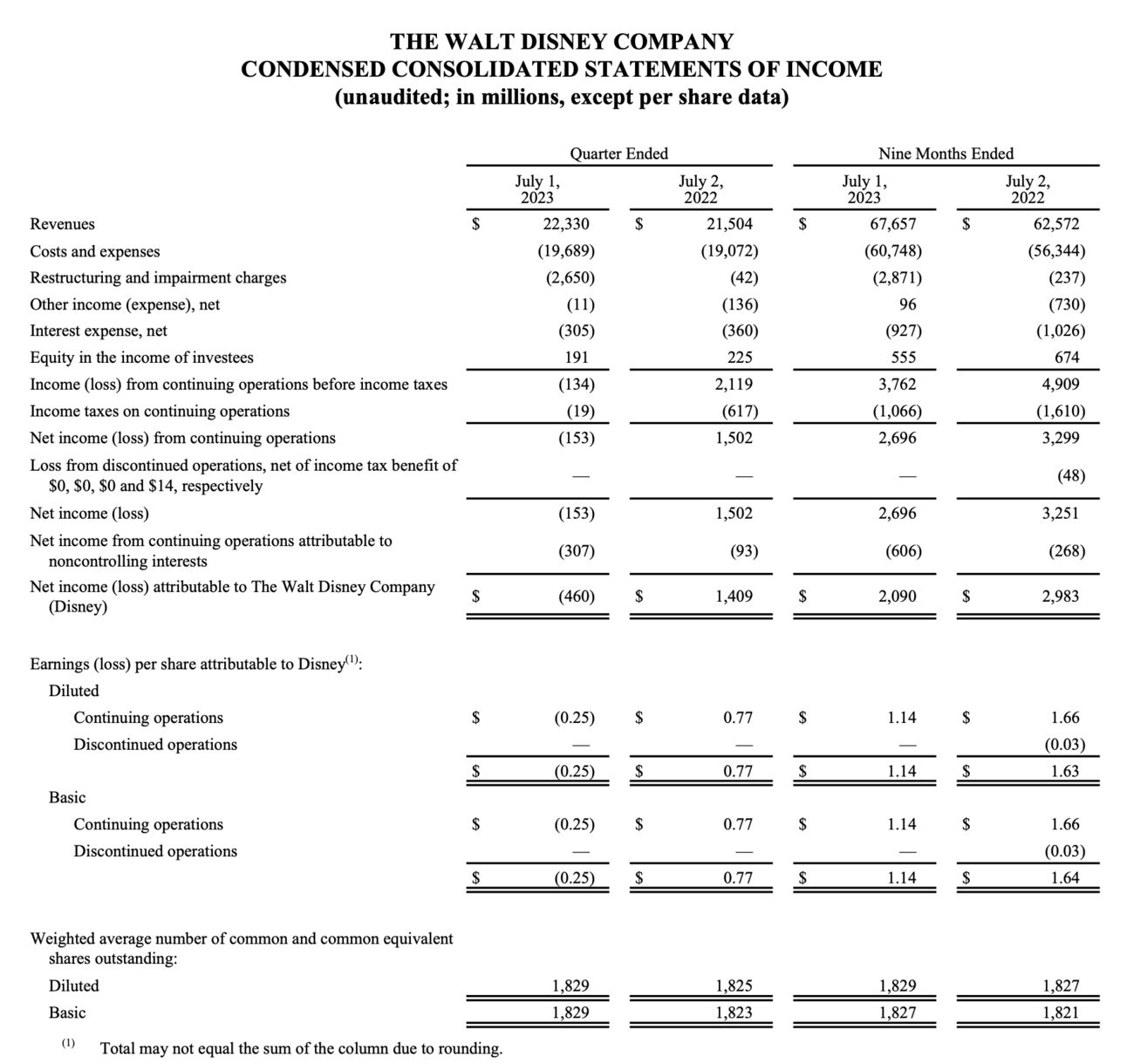

I am going to include two images below that show Disney’s operating income by segment and then the official income statement. Operating income shows how the direction of the business segments and margins, while the income statement includes items like $2.7 billion in restructuring and impairment charges in the most recent quarter.

Breaking down the media business even further, the components of Disney’s media and entertainment businesses are below. You can see that linear TV revenue is falling and operating income is dropping like a rock. Meanwhile, direct-to-consumer (streaming) is growing but isn’t yet profitable.

Streaming has become a big business but is going through some major transitions. You can see below that subscriptions for Disney+ Hotstar (India) are down sharply while domestic and international subs are relatively flat.

The lever Disney is pulling to increase revenue is pricing. You can see below that prices have gone up in the past six months but that will accelerate with the recently announced price increases for all of Disney’s streaming services.

There will also likely be a big increase in advertising revenue over the next year for Disney’s streaming services.

Bottom Line: Parks and experiences are doing great, linear TV is in decline, and streaming is growing but losing money.

Balance Sheet

Disney’s balance sheet isn’t too bad, but it’s not a point of strength. There’s $47.2 billion in debt and $9.2 billion will be needed to buy out the remainder of Hulu in 2024.

Cash Flow Statement

As much pressure as Disney has been under on the stock market, the company’s cash flow doesn’t look too bad. Operations have generated $5.1 billion of cash over the last nine months and free cash flow was $1.47 billion.

Parks continue to grow and streaming losses are shrinking, so the cash flow improvement (at least outside of linear TV) should be heading in the right direction.

How to 10x From Here

Disney 10 years from now won’t look the same as Disney today. I think we see Disney:

Sell Non-Core Assets: ABC and cable networks, a music studio, and other non-core assets could be sold.

“Win” Sports Streaming: I put longer thoughts here, but the idea would be for ESPN to become the go-to streaming service for sports, supported by ads. Streaming is likely a winner-take-all market and ESPN could be the winner in streaming sports.

Bundle Streaming: The Disney bundle with Disney+, Hulu, and ESPN content is the present and the future for Disney. A decade from now, The Disney bundle could be $50 per month before any advertising revenue.

So, how do these strategic changes lead to an asymmetric return? The high upside case centers around streaming being a winner-take-all market and Disney generating more revenue from more users than they do today. We saw this play out in social media and streaming TV could be next.

I don’t think it’s unreasonable to think Disney could have 200 million subscribers generating an average of $100 per month (subscriptions and advertising) a decade from now. That would be $240 billion in streaming revenue and would dwarf the current media business run rate of under $60 billion per year.

Growth at the parks could continue as well. New capacity isn’t being added, so the scarcity of parks and experiences will continue to drive great margins.

How to 0x From Here

I don’t think Disney goes to zero, but if sports leagues partner with another company or go it on their own in streaming we could see Disney’s sports value plummet. ESPN is still profitable, but may not be for long in a declining subscriber scenario.

Streaming may also not turn the corner to profitability and if Disney proves not to have pricing power it would put a lot of pressure on the business.

The upside is high if Disney can get its media business right, but the risks are high too. Not everyone will survive in streaming.

What to Watch

Strategically, here’s what I’m looking for:

Asset sales (ABC and linear networks)

ESPN’s over-the-top launch

Rights deals with the NBA and other leagues will be key

ESPN needs distribution partners to hit 50 million subs as quickly as possible

Can Disney grow streaming subs with a bundle and higher price point?

On the financial statements, these will be the markers to watch right now:

Streaming turning to operating profit

Stop the bleeding at linear networks

Steady FCF growth at parks and experiences

There will be a lot of moving parts as Iger reshuffles Disney for the future. But I think these are the keys to long-term success.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.