The common perception in the media is that the NBA is about to sign a massive rights deal starting after the 2024/2025 season. The current 9-year agreement was signed in 2014 and has ESPN and TNT paying $24 billion over that period for the right to broadcast games.

Current reports indicate that the NBA is looking for a $75 billion deal, or $7.5 billion per year in a new 10-year deal. But I can’t find anyone asking who would be willing to pay $75 billion for NBA media rights. And there’s no thought going into how they would make a profit on the rights.

No one is doing the work because the answers aren’t easy. It’s easier to criticize media companies than understand how they run.

I’m going to try to find some answers to sports media with the NBA as an example and I promise there’s an investment takeaway in the next spotlight article for premium subscribers.

There are no easy answers, but some of the factors I’m considering:

How does the NBA maximize short-term revenue?

How can media and the NBA reverse the decade-long decline in ratings, which are reportedly down 43% since the ESPN/TNT deal was signed?

Young viewers have more options than ever and a dwindling ability to watch NBA basketball because fewer homes have cable. How does the NBA answer this?

Ex. My 6-year-old son LOVES basketball but has NEVER watched an NBA game because…we don’t have cable. The NBA needs to balance short-term revenue with growing the top of the funnel of long-term fans.

The NBA (should) wants to have financially viable partners. The bankruptcy of Diamond Sports (formerly Fox Sports) should be a warning that signing a big $$$ deal is only good if the counterparty can actually pay their bills.

ESPN and Warner Brothers Discover have the initial negotiating rights until April 2024, but there will be at least a half dozen companies interested in NBA rights. The question is, who can possibly pay what the NBA thinks it’s worth?

NBA Commissioner Adam Silver to media executives.

The State of Media Today

We know that two things are true about the media environment today:

Cable is in decline.

Streaming is growing, but in most cases losing money.

The media pie has not only shifted but in many ways, it’s gotten smaller and definitely less profitable. Instead of ESPN, TNT, and regional sports networks all forking over hundreds of millions of dollars annually to the NBA and walking away with tidy profits themselves, the cash cow of cable that drove two decades of sports excess is falling apart before our eyes.

This puts the NBA and its media partners in a precarious position.

Does the NBA continue to split up rights, selling a portion to a national cable operator, some to regional networks, a portion to a streamer, and League Pass on top of that?

Does the NBA make a “one big check” deal like MLS did with its $2.5 billion Apple deal? This may sound great, but increases counterparty risk.

How much does the NBA value reach and availability of its content compared to maximizing dollars in this contract?

A Mindset Change

The NBA has long generated value on an assumption of scarcity. TNT has a batch of games, ESPN has other games, and the rest are reserved for local audiences (regional networks). In all instances, the NBA itself was the appointment viewing.

I think this mindset needs to be broken in the next rights deal. The NBA should lean into an abundance of content and make any game available to any person anywhere at any time.

The NBA has done that on YouTube with great success and now it’s time to open the top of the funnel for full games, not just clips.

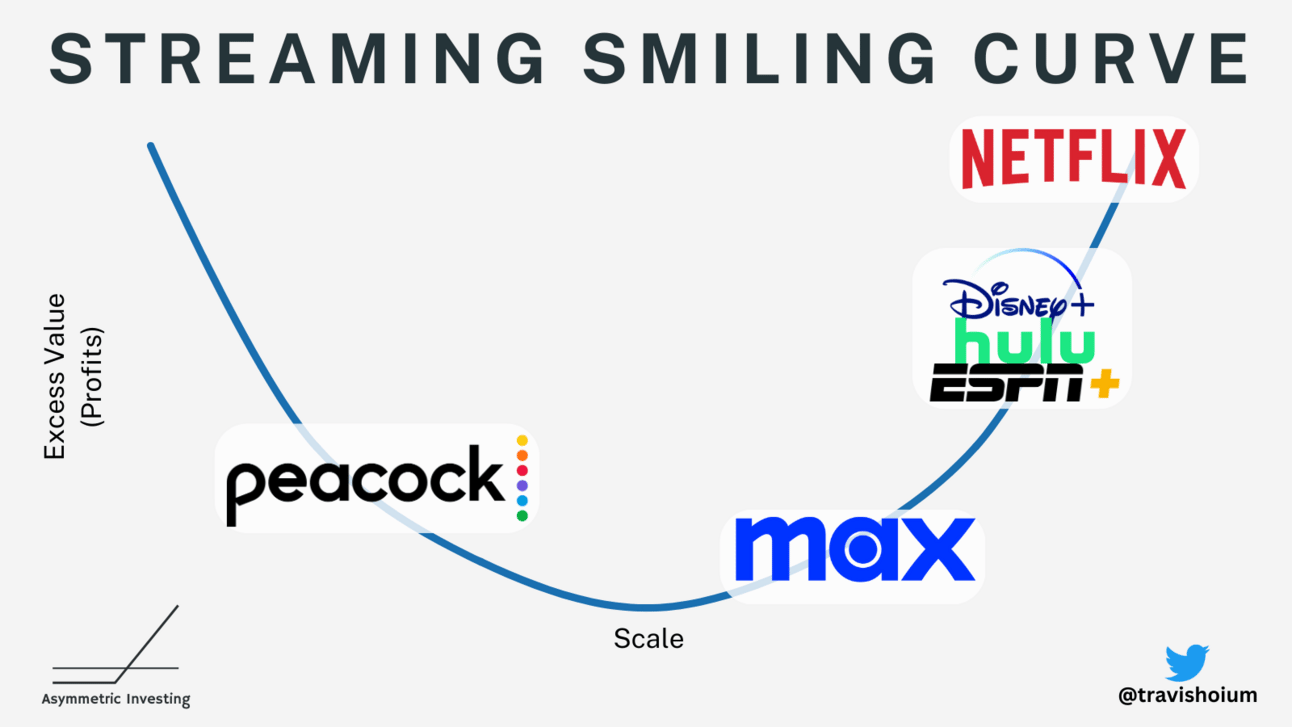

Long-time readers know that media is moving in the direction of all internet businesses, which favors the very big or the very small. My favorite visual of this is the Smiling Curve.

We can already see the Smiling Curve playing out in streaming and if the NBA is smart it will lean into streaming in its next deal. This framework makes it easier to see who the logical partners are and where $75 billion might (or might not) come from.

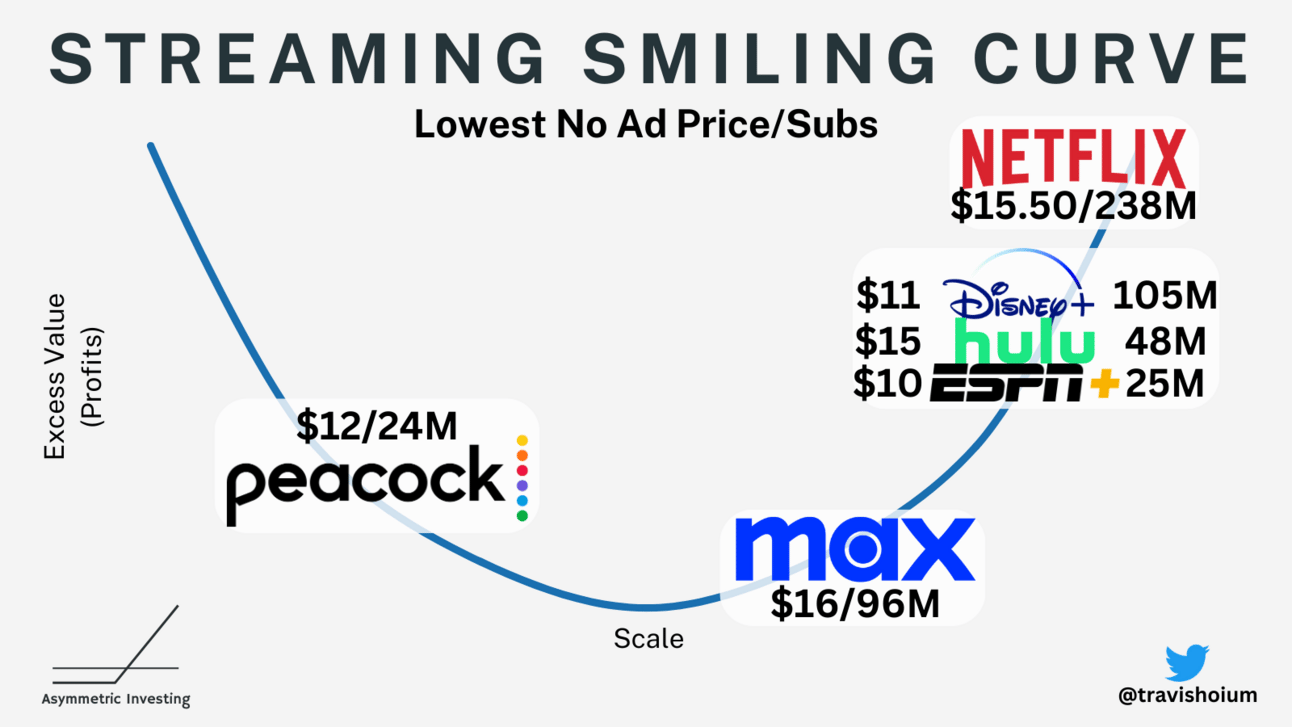

The reason I put these media companies where I did is because of their subscriber base and ability to generate revenue. Below is subscribers and price per month for each service, but note that Disney has announced another round of price increases and Netflix just raised prices. You can see that both subscribers and pricing power are accruing in the top right of the smiling curve, as we would expect.

Note: Subscribers are not equivalent across services. Ex. Disney bundles its services (triple counting subs) and Max includes Discovery+, HBO, HBO Max, and Max.

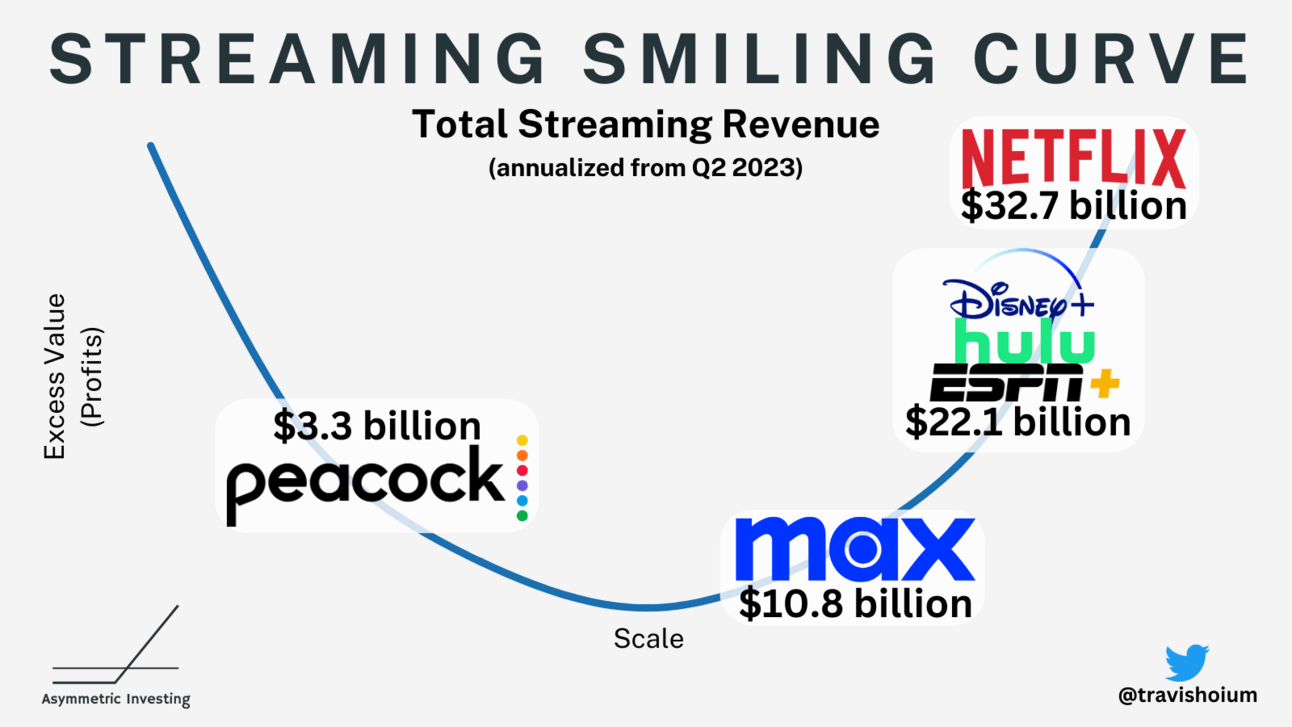

If we look at the total revenue for these streaming businesses — which levels out some of the bundling and discounting of services — you can see that Netflix and Disney separate themselves with Peacock falling well into the rearview.

We see again and again that companies either want to be in the top right of the Smiling Curve or the top left. Being in the middle is no man’s land because you don’t have enough money coming in to acquire the best content, stopping the growth flywheel in its tracks.

Don’t Forget About Cable

I have focused on streaming, but there is still a lot of money in network and cable TV as well. The problem for the industry is that cable is in steep decline.

Disney: Linear networks generated $6.7 billion in revenue (down 7%) and $1.9 billion in operating income (down 23%) in the most recent quarter.

Warner Bros Discovery: Networks accounted for $5.8 billion in revenue (down 5%) and $2.2 billion in adjusted EBITDA (down 7%) in the most recent quarter.

NBC Universal: Media (including Peacock) accounted for $6.2 billion in revenue (flat) and $1.2 billion in adjusted EBITDA (down 18%).

I would look at cable as a cash flow engine that can be a piece of a bigger sports rights package, but absolutely not the driver of value unless the NBA wants an even smaller deal than the current one or to go down the Diamond Sports path again.

The NBA’s Options

With this landscape in mind, I see five options for the NBA.

The NBC Gambit

The NBA makes a deal with NBC to show games on the NBC network, NBC Sports on cable, and the Peacock streaming platform.

The problem is, Peacock is the smallest major streaming platform and doesn’t have the audience or resources to monetize the NBA today. The Olympics didn’t give Peacock a foothold in streaming, so the NBA would be betting that it could.

NBC and NBC Sports are the network and cable assets that wouldn’t really change anything compared to the NBA staying with ESPN and TNT in a re-up of the current deal.

Some Napkin Math: Is Peacock the answer? Peacock has 24 million subscribers and is burning $2.8 billion per year at its current $5.99 price point. What kind of a draw would the NBA be to new subscribers and how much more would they pay? 10 million new subs and a $10/sub price bump would be $4.9 billion in incremental revenue. Maybe another $4.9 billion in advertising revenue and you’re looking at $9.8 billion in incremental revenue added to Peacock by the NBA before any operating costs, hardly enough to justify a $7.5 billion annual price tag and Peacock still wouldn’t be cash flow positive.

Partnering with NBC and Peacock could end the same way the regional sports networks did. A lose, lose for everyone.

Likelihood: Low

Netflix And Foregone Sports Domination

With 238 million subscribers around the globe, Netflix could be a big player in sports. But it has chosen not to be. I don’t understand why not, but that’s the reality.

Likelihood: Unless Netflix’s sports strategy changes dramatically in the next 6 months, I think Netflix is out.

Disney’s Optionality

The best-positioned company strategically is still Disney. The company owns 80% of ESPN so it has a cash flow engine coming from the linear TV business and it has the biggest streaming platform outside of Netflix.

Bob Iger has also committed to ESPN being a leader in sports, however vague that sounds. And with the new $1.5 billion check from Penn Entertainment as part of its war chest, I see 3 viable options for Disney as it relates to the NBA.

The Big Check Option: Disney/ESPN writes the biggest check they possibly can to the NBA and says they want the right to show games anywhere they want, linear TV, Hulu, ESPN over the top, wherever. This would give Disney/ESPN the ability to show more games to more people, increasing the value of streaming platforms AND the ads on those platforms. But for $75 billion, I think Disney would want EVERYTHING.

The Platform Option: ESPN positions itself as the “sports streaming platform” with TNT, Apple, NBC, etc having the option to sell content on the platform. The NBA signs up as an initial partner with a mix of fixed fees from linear TV/streaming and royalties from streaming upside and ads.

Ex. ESPN could create a high-end (~$80/month) all-inclusive all sports option with a goal of having all games and all sports on the platform. Or this could be a la carte with sub-channels under ESPN. Content partners could take ~70% of their direct fees or a percentage of the monthly fee (Spotify-style). With 178 million subscribers and a push toward bundles like Disney+ and Hulu, the NBA and other sports could fold into a future platform nicely if the economics are right.

Some Napkin Math: $7.5 billion per year is $3.51 per subscriber or $25 per month per existing ESPN+ subscriber. Disney would obviously need a markup over that, but Disney has the scale to get close to the numbers the NBA wants. I think a two tier pricing structure with $5/month for 5-10 games a week and $25 per month for ALL NBA games makes sense. To get to $15 billion in revenue (half going to the NBA) and assuming half of the revenue is ads, ESPN would need 42 million subs at the $5 price point and 17 million at the $25 price point. That seems possible and that’s without considering “subsidies” from linear TV.

The Skin in the Game Option: The NBA does a revenue-sharing deal with ESPN, similar to Spotify or YouTube. ESPN could offer multiple tiers from a few free ad-supported games per week to all 1,230 regular season games for a ~$200 per season fee.

I think it’s in the best interest of the NBA to get into as many homes around the world as possible and Disney/ESPN is the most likely partner to do that. Don’t forget that this is also a profitable company with a big balance sheet, which is the kind of stability the NBA should value.

Likelihood: High, but at what price and how much distribution can ESPN command?

PERSONAL ANECDOTE

If the NBA wants to reach a new generation of fans, Disney may be the best path. My 6-year-old loves playing basketball but has NEVER watched an NBA game at home because we don’t have cable. When my 3-year-old daughter wants to watch something she asks us to turn on “Disney” or “Netflix”.

Combining the brand and content identification that Disney has with young viewers with its reach in streaming and Disney helps solve the NBA’s top-of-the-funnel problem.

Warner Bros Discovery

TNT wants to keep the NBA. The question is, how?

Warner Bros Discovery’s studios and TV networks are arguably in better shape than Disney’s and Max has a big audience. But you can see above that streaming revenue is about half of Disney and that’s before Disney’s upcoming price hikes.

The game for Warner Bros Discovery would be using the NBA to catch up to Disney and Netflix subscribers.

Here’s the problem: Warner Bros Discovery doesn’t have a cash engine like Disney’s parks to fall back on as networks decline net debt of $45 billion is a weight around the company.

The same three scenarios I laid out for Disney are possible for Warner Bros Discovery, but:

Warner Bros Discovery doesn’t have as big a checkbook as Disney.

The streaming platform is smaller than Disney or Netflix.

TNT is an NBA powerhouse and has college basketball, wrestling, soccer, and NHL, but it’s second-tier content compared to ESPN’s SEC, MLB, NHL, and Monday Night Football deals.

Warner Bros Discovery is like Disney, but with less money, less cash flow, a worse balance sheet, and less appealing supporting content to bundle with.

Likelihood: Not at $75 billion, but TNT and Max playing a role in a bigger deal with Disney seems the most likely.

Big Tech Billions

The wild card is tech companies. Apple, Amazon, or Alphabet (YouTube) could fly in with a mega-offer for NBA rights.

Apple: A $75 billion deal with the NBA would get more scrutiny than the $2.5 billion MLS deal, but the idea is the same. In some ways, Apple brings more scale than its media rivals with over a billion users, but Apple TV+ is a side business, not the focus and Apple typically drives a “take it or leave it” bargain on its terms. I think an Apple/NBA deal is unlikely.

Amazon: 200 million people subscribe to Prime and that’s likely where the NBA would land with Amazon. But the price tag for the NBA would be $37.50 per year on average for Prime members, who may not be a great overlap with sports fans. The NFL on Prime drew fewer fans for Thursday games in 2022 than Fox/NFL Network drew in 2021. Again, the NBA would get a big check, but operate in service of a bigger more important business at Amazon.

YouTube: The most interesting big tech streamer would be YouTube. It has over 1 billion users, recently made a deal for NFL Sunday Ticket, and it’s already on almost every streaming device. The downside for YouTube is there’s no tie to a legacy network or cable channel and the NBA likely won’t want to leave all of its legacy viewers behind. Maybe this is the big-money partner a legacy media company needs.

Likelihood: YouTube, but probably needs a linear TV partner.

The NBA is in a tough spot trying to negotiate a 10-year rights deal as cable subscriptions decline and media companies try to stop the bleeding in their streaming units.

This could create an opening for a new partner like YouTube or it could be an opportunity for Bob Iger to build ESPN into a live sports platform. I think those are the two most likely scenarios based on the strategic position and financial wherewithal of the players involved.

However, I think the NBA may have a hard time getting to a guaranteed $75 billion without taking on some of the financial risk itself. The money in TV just isn’t as good as it used to be.

Become a premium subscriber to find out which stock I spotlight as a potentially massive winner in sports.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.