I am inclined to be an optimist about the stock market in general, but today’s market has me questioning what’s ultimately driving new market highs this year.

Artificial intelligence is clearly a winner on the market and big tech has benefitted the most (as you can see below), but other parts of the market are falling behind. Nike, Tesla, Lululemon, McDonald’s, and Etsy are just a few of the names that have struggled in 2024.

Why are markets hitting all-time highs as consumer data gets weaker and earnings warnings get stronger?

Why Stocks Go Up

In a very simple sense, stocks go up for 3 reasons:

Revenue growth

Margin expansion (earnings growing faster than revenue)

Multiple expansion

Revenue growth is simple enough to understand.

Margin expansion can take the form of higher gross margins or a reduction in operating expenses, but the bottom line is faster earnings and free cash flow growth than revenue growth. Therefore, there are limits to margin expansion to drive stock performance long-term.

The final factor is multiple expansion. In a single quarter, a stock price can double and the price-to-earnings multiple can expand from 15x to 30x. You can see below the P/E ratio of the S&P 500 is at historic highs for non-recessionary periods.

Why is the S&P 500 P/E ratio so high?

One reason is the market cap weighting of the index. As of this morning, six big-tech companies accounted for 32.1% of the S&P 500 index. They all have P/E ratios above the index, which means the other 494 stocks are trading for below-market multiples.

Stock | S&P 500 Weight | P/E Ratio (trailing) | Growth Rate (3-year) |

|---|---|---|---|

Microsoft | 7.32% | 40.4x | 13.9% |

Apple | 7.09% | 36.3x | 5.5% |

NVIDIA | 7.01% | 78.8x | 60.6% |

Alphabet | 4.36% | 29.3x | 17.4% |

Amazon | 3.87% | 56.1x | 12.1% |

Meta | 2.48% | 30.8x | 14.8% |

Notice that last column. Outside of NVIDIA — which is an entirely different story — growth rates at the big tech companies aren’t all that high. At Apple, revenue is currently falling, and yet the stock is climbing because of something, something AI.

As we head into earnings season and firms like Goldman Sachs and Sequoia write scathing critiques of the AI bubble, it’s worth looking at what’s going on beyond the market headlines to the fundamentals and consumers, who drive the economy long-term.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Get value stock insights free.

PayPal, Disney, and Nike recently dropped 50-80%. Are they undervalued? Can they recover? Read Value Investor Daily to find out. We read hundreds of value stock ideas daily and send you the best.

All Is Not Well

Nearly ¾ of stocks in the S&P 500 are down in 2024, despite the index climbing 17.8% so far this year. There’s a bifurcation going on between AI and non-AI and there are signs that all is not well with either.

Consumer Goods Crash

I’ll get to the health of consumers in a moment. What we see in the market is stocks related to consumer spending have had a tough time in 2024. In the Asymmetric Portfolio, Portillo’s, Celsius, and Disney have all struggled recently on the market. But they’re not the only ones.

Nike said it expects revenue to fall 10% in the first fiscal quarter (the current quarter).

Lululemon is down 43% from its high after saying growth would slow to single digits this quarter.

Target said comparable store sales fell 3.7% last quarter.

These are just a few examples but the market is littered with tepid numbers from consumer-facing companies.

Tesla’s Bounce on Falling Sales?

Tesla is another stock that smells fishy. Shares of Tesla are up 52% in the past month after reporting…falling vehicle deliveries?

You can see below that annual deliveries have now been on the decline for two straight quarters and margins are falling at the same time. Not only are sales down, but Tesla is losing market share to companies like (gasp) General Motors!

Yet, Tesla stock is going up because of multiple expansion and an AI story!

Consumers Are Getting Weaker

There’s more evidence that all is not well with the underlying economy. To be clear, I’m not arguing a recession is imminent, but rather that stocks trading for a historic premium makes no sense and investors shouldn’t go chasing high-priced stocks.

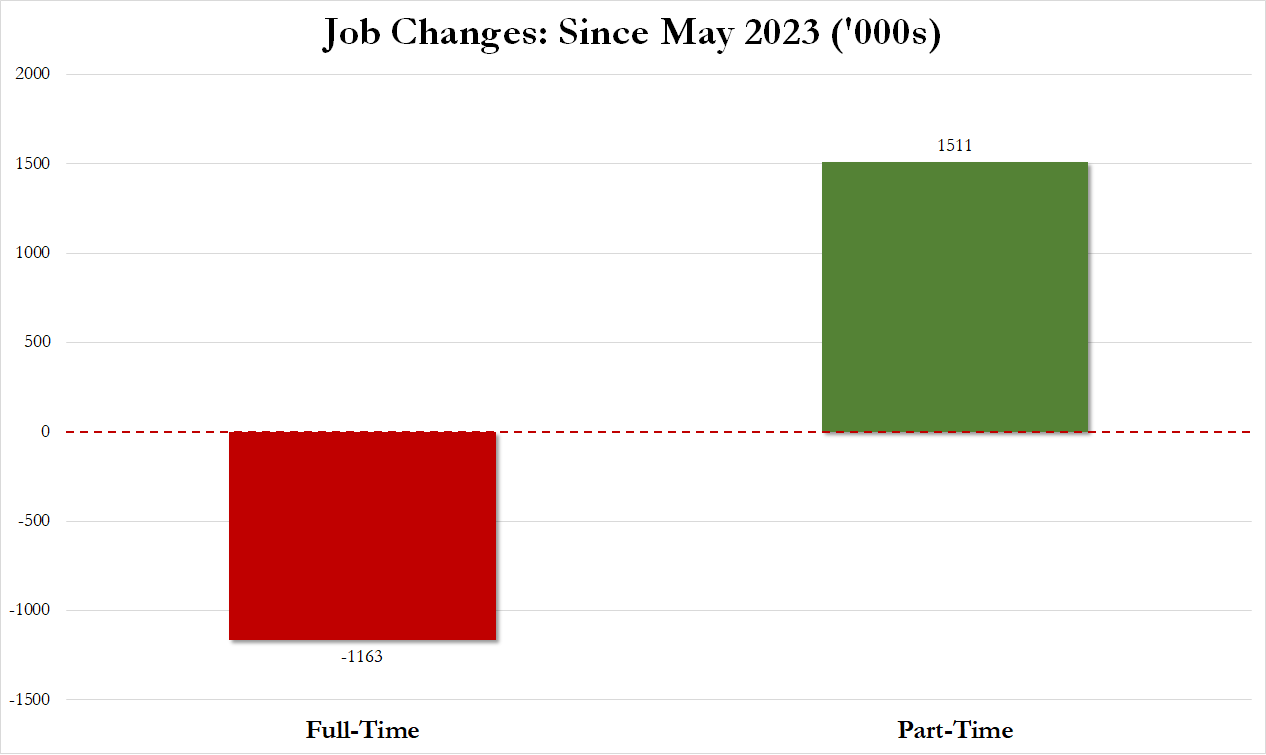

You can see that jobs are up over the past year, but that’s driven by part-time jobs while full-time jobs are in decline.

Wage growth is also steadily declining.

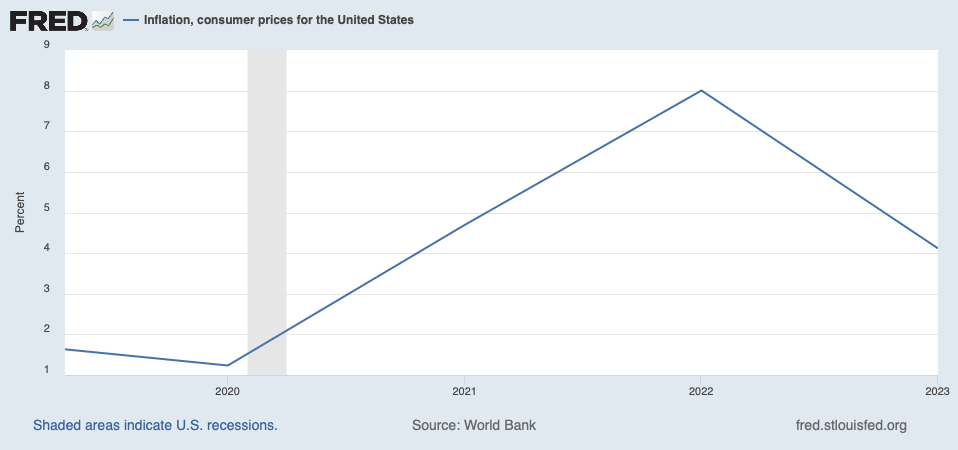

As inflation eats away at consumer spending.

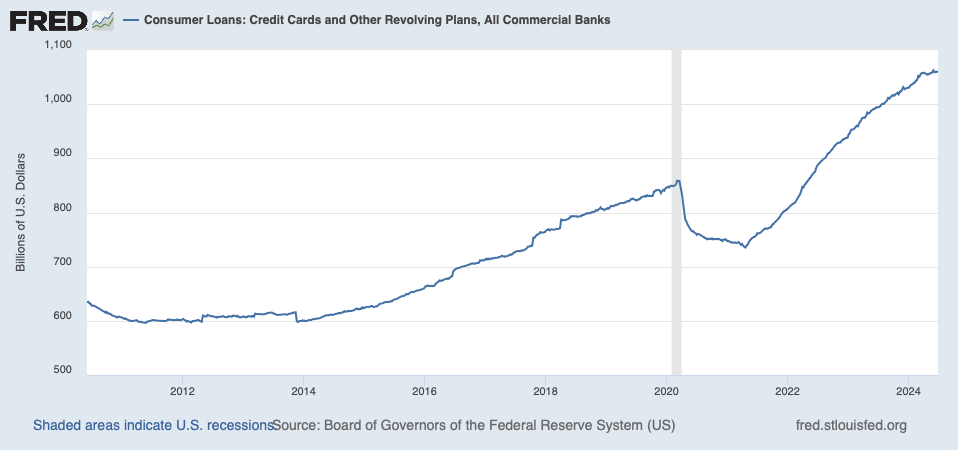

Instead of cutting back, consumers are taking out more debt on credit cards than ever.

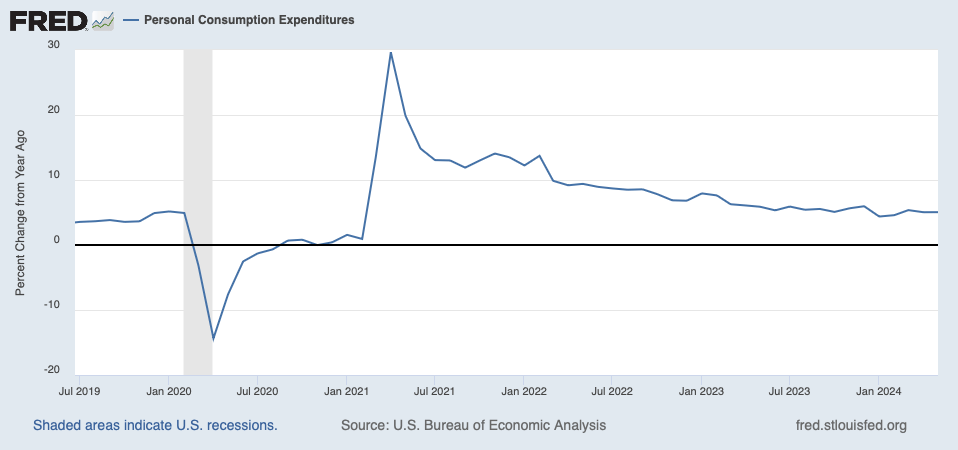

And consumption expenditures are growing at a faster pace than wages.

If consumers drive the economy — which they do — some caution is in order. But the markets trade for all-time highs because of the promise of AI.

The $600 Billion Question

I’ve laid out how consumer spending is at least softening and the labor market is weaker than it appears.

At the same time, the stock market’s strength is driven by artificial intelligence. Does this make sense? And what happens next?

There’s no doubt AI spending is growing as Meta, Microsoft, Alphabet, and others invest tens of billions of dollars in AI. NVIDIA CEO Jensen Huang has said trillions of dollars will need to be invested in AI infrastructure over the next decade.

We’re talking about big money here and right now there’s no payoff for investments. I see two potential outcomes.

The impact of AI is real and the first impact will be making companies more efficient. This means job cuts before we see any transformative innovation (which may be years away).

In other words, success in AI will make the overall economy worse short term and potentially lead to a recession while continuing to benefit a very small number of companies.

I don’t know what this would mean for markets, but the bifurcation you see in the first chart above could persist.

AI is a bubble and we see big tech and VCs pull back on AI investment starting later this year or in 2025. This would result in the unwinding of the outperformance of stocks like NVIDIA, Super Micro Computer, Microsoft, Apple, and others who have driven the market higher in 2024.

This could result in a falling stock market, but not a recession, similar to the correction in 2022 that saw SaaS stocks drop and layoffs in Silicon Valley, but didn’t impact most of the economy.

Neither outcome seems great, depending on where you sit.

What I see right now is an AI bubble driven by the investments made by a handful of companies — Microsoft, Alphabet, Meta, etc — in computing to own a market that has yet to show long-term value. VCs have added fuel to the fire and so have public market investors willing to pay ever higher prices for any stock with AI attached to it.

Eventually, even AI comes back to dollars and cents and ultimately consumer spending and if consumers are being pinched by inflation and a sagging labor market I’m not sure how AI is going to help.

As earnings season begins this week, keep an eye on the difference between consumer strength/weakness and AI hype.

After the reports from Goldman Sachs and Sequoia, it looks like Wall Street is ready to turn its back on AI and that’s a warning sign for some of the highest-valued stocks in the market.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.