This article continues my exploration of artificial intelligence business models and where value will ultimately be generated in the industry. I don’t have the answers but I’m searching to understand what investments will win long-term.

Below, I’ll get to why I haven’t been particularly bullish on AI in the Asymmetric Portfolio and why I’ve missed NVIDIA thus far.

There’s one word I’ve been thinking a lot about lately: Generalizability.

According to Merriam-Webster, generalizable means “to give a general form to” or “to give general applicability to.”

In the context of artificial intelligence, generalizability refers to a model or application that has a general purpose rather than a specific purpose. As AI models get better and smarter the quality of what they generalize improves and they generalize more outputs from text to language to images.

Usually, generalizing involves tradeoffs for a business. A general-purpose product may not a answer niche or power user’s needs. The general-purpose product typically has a lower value to the average user but has value to a wider number of users than a specialized product.

In the context of AI, this dynamic seems to have turned on its head. Models understand more and are becoming more capable based on feeding increasingly vast amounts of data into their training. This could upend huge swaths of the tech ecosystem and even AI itself as everything becomes generalizable.

Asymmetric Investing has a freemium business model. Sign up for premium here if you want to skip ads and get double the content, including all portfolio additions.

Make your money rise and grind while you sit and chill, with the automated investing and savings app that makes it easy to be invested.

AI and the App Ecosystem

In Wednesday’s update on Stratechery, Ben Tompson explained the AI tech stack as being apps, a platform for developers to build on, the AI model, cloud infrastructure, and chips. His visualization of Microsoft’s strategy looks like this:

In this visualization, revenue flows from the top down. Without AI apps — which could be Copilots from Microsoft, Gemini from Google, or an application built into your favorite piece of software — there’s no demand for platforms or models. Without models, there’s no demand for the exploding cloud and chip business.

The entire ecosystem depends on apps generating some kind of value. In other words, AI apps need to do something people are willing to pay for.

But what apps are creating value?

What apps are generating a return on their investment?

What apps are sustainable?

AI is moving so quickly we don’t have a good answer.

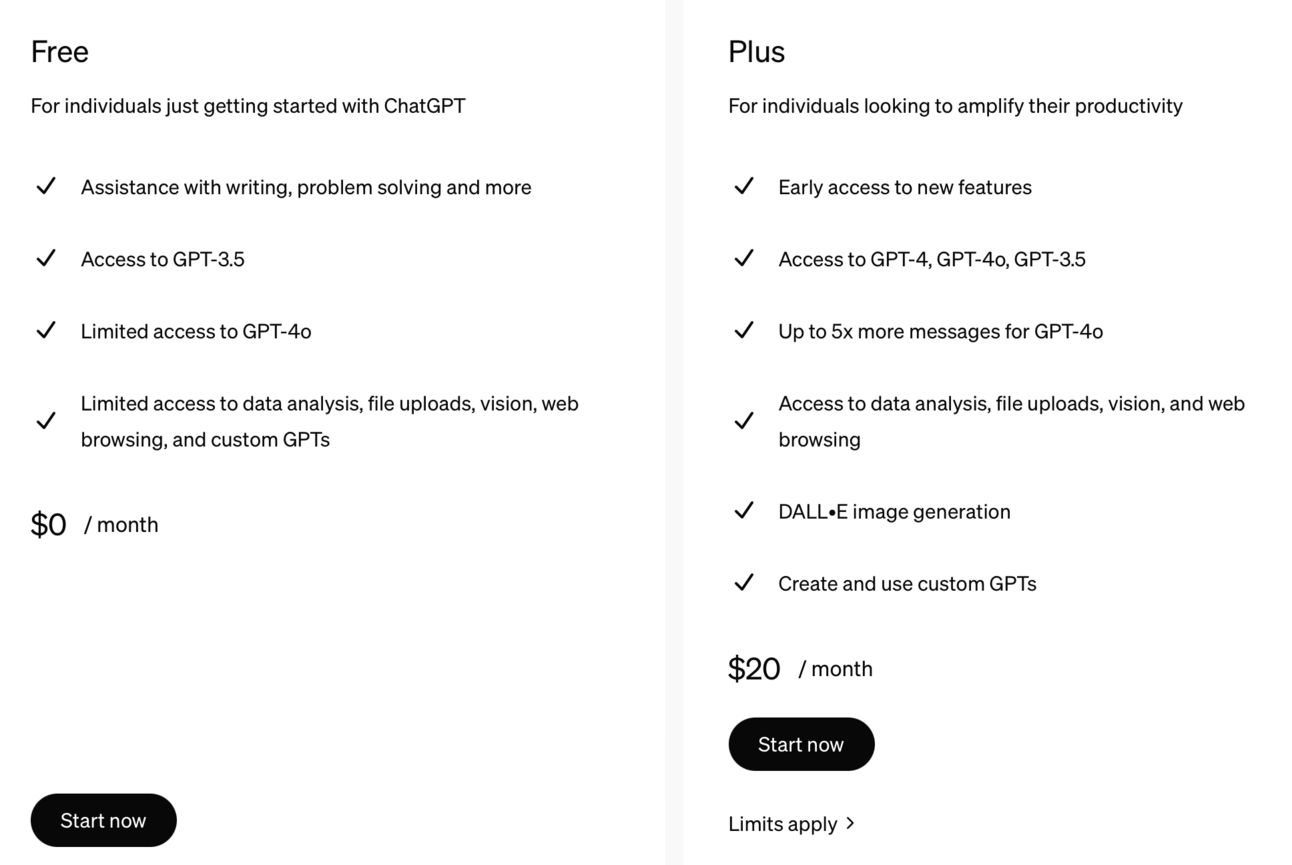

A year ago, ChatGPT was the must-have $20 per month subscription for AI users. Then Perplexity was the hot app. Now, Meta and Google have launched powerful AI tools within their app…and they’re free!

In response, OpenAI just announced ChatGPT, the best-known AI tool in the world, is going to be free for most users. Unless you’re a power user, upgrading to the $20 per month plan seems foolish. But if OpenAI is giving away ChatGPT to most users for free, what’s the business model?

AI capability is improving rapidly and the price to end users is somewhere between cheap and free.

Within the artificial intelligence app ecosystem, no one has figured out a sustainable business model. Billions of dollars are being invested in products that ultimately end up being free to users.

It’s head-scratching, but I don’t see this trend ending anytime soon. And the businesses these apps are impacting could create even more destruction.

ChatGPT and the Path of Destruction

GPT-4o was announced a couple of weeks ago and it improved the capability of ChatGPT, despite ChatGPT lowering its price. I could go through a laundry list of companies potentially disrupted by the general capability within ChatGPT, but a few big companies stuck out to me.

Duolingo

Chegg

Adobe

Autodesk

Duolingo

One of the more compelling demos in the GPT-4o launch was one doing language translation in real-time.

Not only could ChatGPT be a translator, but it could also be a language teacher. Vision in the app could recognize objects and teach users what they are in another language.

Duolingo has built a business teaching people new languages. Artificial intelligence might make language a commodity.

Chegg

Chegg is no longer just a book company, it’s an education company, powered in part by AI. But ChatGPT’s general model may have just made the entire business model obsolete. Will this change how we learn forever?

Adobe

Adobe is the go-to platform for creatives, but what if AI can do creation for you with a few simple prompts? Image generation has been available for two years, but now DALL-E, the image model embedded in ChatGPT, can modify images on the fly.

We already know Sora (OpenAI’s video tool) is making amazing videos and is advancing incredibly quickly, so what’s to say Adobe Premier won’t be obsolete in a few years?

Autodesk

This demo shows ChatGPT recognizing someone’s expressions in a live video. Wouldn’t the next step be to redesign your kitchen live with audio prompts?

We know GPT-4o can create 3D models and based on this video it may be a pretty good engineer.

Combined, these four companies have a market cap of over $250 billion and have complex software and sales ecosystems that employ hundreds of thousands of people.

And they could all be upended by a single general AI app.

My core question is, what’s NOT generalizable in a world of AI?

I’m not complaining about disruption from AI or GPT-4o. Disruption is part of technology advancements, innovation, and capitalism.

What I’m wondering is where value will ultimately be created.

AI and the Scorched Earth Theory

If all you knew about AI was what I’ve shown above, you may think OpenAI will ultimately be the most valuable company in the world. But I highlighted earlier that ChatGPT is now giving away most of its capabilities for free, partly because it never reached escape velocity with a subscription model.

Why can’t ChatGPT charge $20 per month for all of this amazing AI? Isn’t the model itself worth billions?

No, because Meta Platforms has open-sourced the Llama models that are similar in capability to GPT-4 and Mistral has also entered the open-source AI model game.

Meta is including AI tools in Facebook and Instagram because it doesn’t need to make money on AI, it makes money on advertising in its family of apps. More AI content could be good for social media apps.

Google isn’t giving away its models, but it’s giving away a lot of AI capabilities that OpenAI would like to charge for because it has a sustainable business model in search.

AI developers are building amazing things today. But new tools and features are copied almost instantly and someone always seems to be willing to give away the last hot AI tool for free.

Where’s the sustainable value of anything in AI?

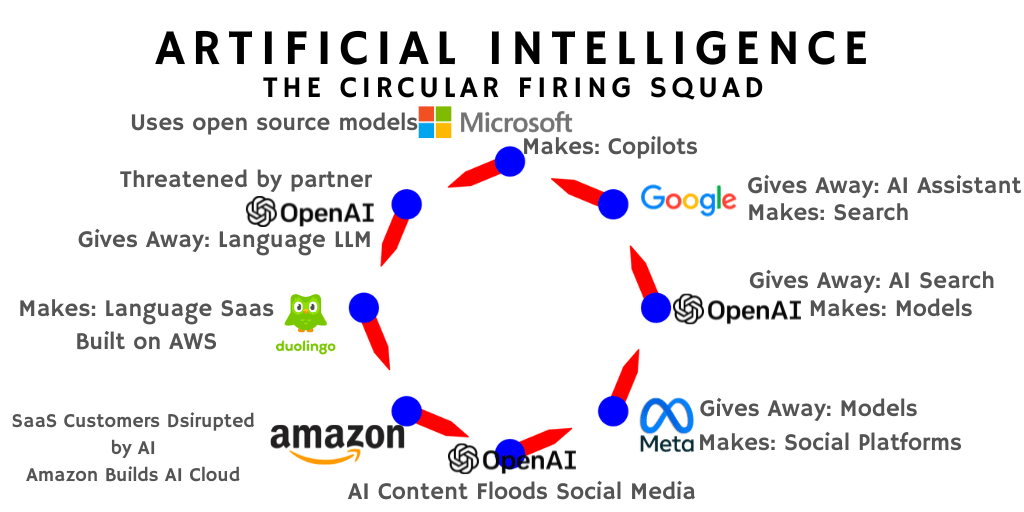

I call this the scorched earth theory in AI and the basic idea is that everything valuable in AI will be commoditized by someone who sees that point of value as a threat to their core business. Logically, the company scorching the earth is trying to commoditize its compliments, but when AI has an application for almost everything, every AI app is a compliment to someone else.

AI’s Circular Firing Squad

Base image from ChatGPT.

Everywhere you look in AI, someone is willing to scorch your business.

OpenAI is a model maker selling app access and APIs for some of the world’s leading models.

Meta is giving away similarly capable models for free.

Microsoft wants to sell copilots for everything. Google is giving away AI tools within search and Gmail.

Google, Microsoft, Corweave, and AWS are spending tens of billions of dollars to build out cloud infrastructure to build AI models and serve inference.

Apple and Qualcomm are trying to make those investments unnecessary by moving inference on-device.

These are just a few examples of products being built and disrupted almost in real-time.

Where is the monetary value created by AI applications?

I ask this honestly because I don’t yet have an answer. And this is probably the most important question in AI today.

Value derived from apps leads to demand for better AI models that drive value through APIs, which leads to hyperscalers creating value from building the infrastructure to support models and apps, which leads to demand for chips.

What if generalizable AI applications destroy the value of both existing companies and fellow AI startups because generalization in AI is so powerful?

Who pays for $1 trillion of NVIDIA chips?

History, Disruption, and Investing

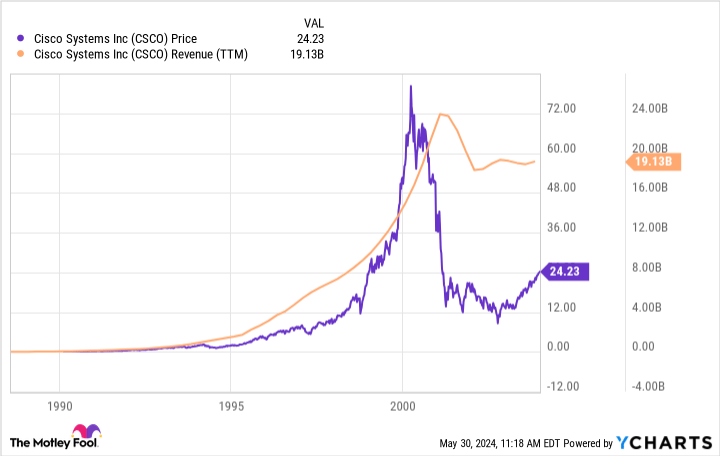

I’m not the first to suggest the 1990s is the best analogy to today’s AI market. But it makes all the sense in this context.

In the 1990s, internet companies saw tremendous growth in usage and funding, which drove the need for more infrastructure like Cisco’s networking products and JDS Uniphase’s fiber optic cables, just to call out two of the winners during bubble times. There was an infrastructure boom.

The only problem was, that very few websites knew how to make money.

In 2000, the bubble burst and web companies that had billion-dollar valuations vanished. When websites and ISPs were no longer funding growth, demand for infrastructure fell. Notice that demand didn’t fall off a cliff, but growth stopped and the high multiple Cisco earned in the late 1990s no longer made sense.

Even the most profitable and valuable companies in the Internet ecosystem saw their valuations collapse because there were very few sustainable business models on the Internet in the early 2000s.

Over the next decade, business models like Google’s search engine, Amazon’s AWS, Facebook, Square, Shopify, and many others would emerge from the ashes of the .com bubble.

What took time was figuring out what customers wanted, what they would pay for, and what business models would work on the internet. This process took over a decade.

I think artificial intelligence is somewhere between the internet in 1997 and 1999. We can all see there’s something “there”, but no one quite knows what’s real and what’s not.

If AI stocks are in their 1997 era, there’s still more upside before the bubble peaks. But if it’s more like 1999 or early 2000, the fall could come quickly and it’ll be long and painful. Since I don’t know where we are in this cycle — and I know we aren’t early — I’m largely staying on the sidelines of the AI hype cycle ($GOOG is the one exception because I see AI as pure upside).

The sustainable rise in internet stocks coincided with the rise in sustainable internet business models and more reasonable valuations that arrived in the mid-2000s.

I don’t think we’re “there” yet with AI.

Or Maybe I’m Just Missing the Boat?

I may be wrong about my skepticism of AI business models and I’ll be proven the be a curmudgeon doubting the next great tech revolution.

Or maybe I’m avoiding FOMO, impatience, and gullibility?

Historically, asymmetric investment opportunities don’t come from buying stocks at the peak of the hype cycle. Opportunities lie in finding gems in the ashes after the bubble pops.

I’ve outlined why I don’t yet see sustainable business models in AI and I don’t see value in the companies that do seem sustainable (NVIDIA).

Maybe it’s different this time. Or maybe AI’s future will rhyme with the internet’s growing pains of the late 1990s?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.