I hope you had a wonderful week!

Earnings season turned into a flood last week and this upcoming week will include reports from a number of Asymmetric Universe stocks. I’ll be covering those throughout the week for premium subscribers.

Before we get to the week that was in investing, here’s something you may be interested in!👇

You may know that a lot of my content is published by The Motley Fool and they’re giving away their Top 10 Stock to Buy Now. You can find it right here:

In case you missed it

Here’s some of the content I put out this week. Enjoy!

Q3 Earnings Preview: This is a preview of what I’m looking for in every Asymmetric Universe stock.

Pricing Power and What We Will Learn: I think a big trend over the next year will be price increases. Unprofitable may have no choice but to raise prices now that growth has stalled and we will find out who has pricing power and who doesn’t.

New Asymmetric Spotlight Stock: I covered a new stock with a spotlight article. It’s a well-known company, but an undervalued stock.

The Rise and Fall of Enphase Energy: I see a lot of investors saying Enphase is a value because the stock has fallen. This video gives some history behind the company's rise and fall.

3 Amazing Stocks to Buy Now: I love these stocks over the next decade.

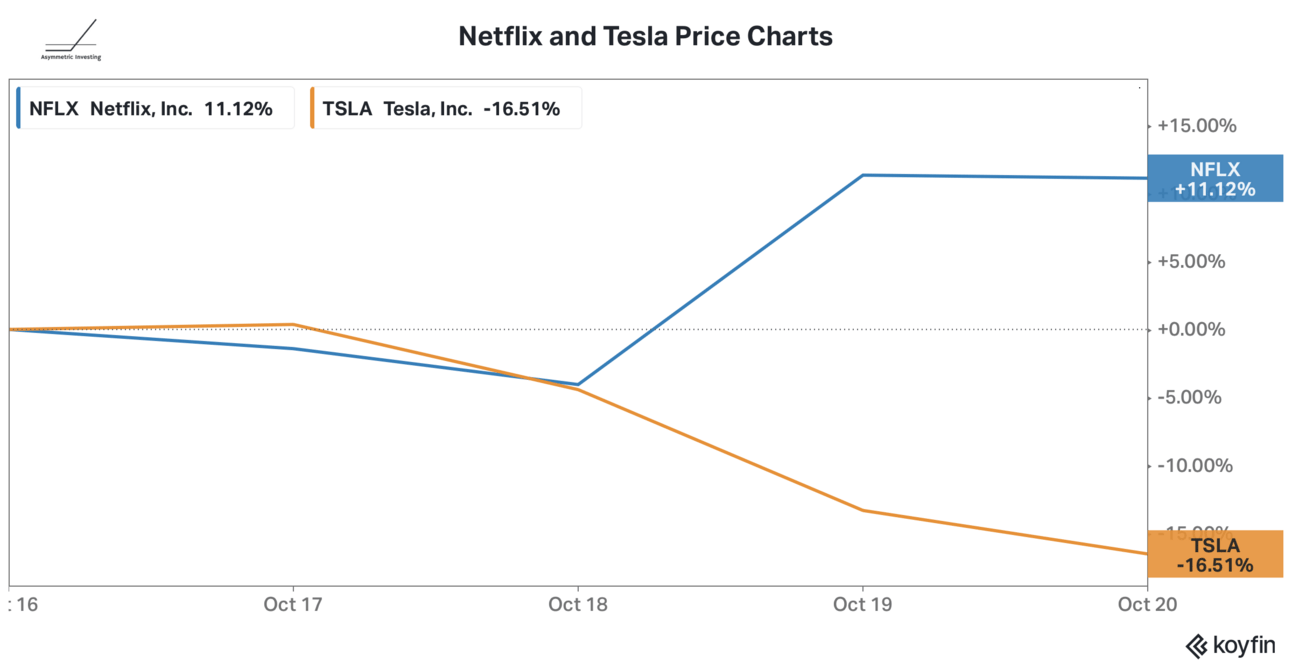

Netflix Is Up and Tesla Is Down

The biggest stories of the week were earnings reports from Netflix and Tesla, which sent the stocks in opposite directions.

Netflix Impresses

In a shock to the market, Netflix added 8.76 million subscribers in the third quarter to end at 247.2 million. How can a huge company like this continue to dominate?

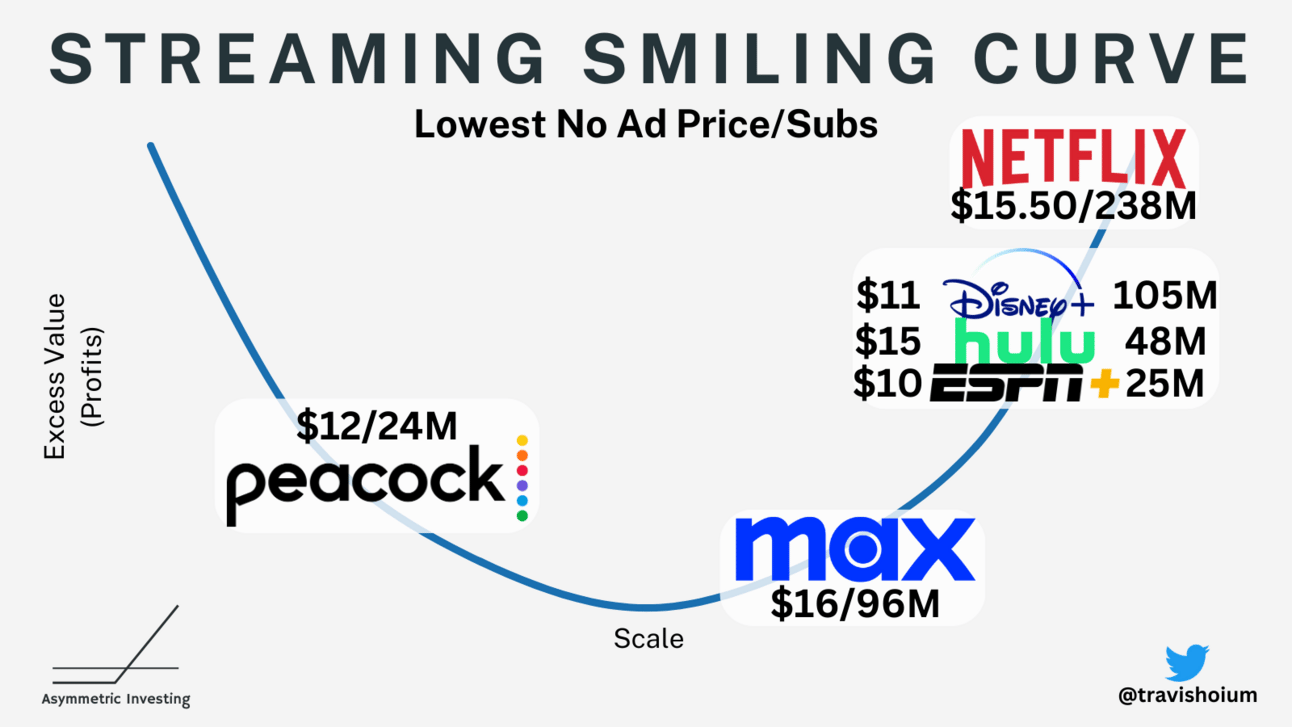

In The Smiling Curve, I used Netflix as an example of a company that lives in the top right of the curve (exactly where you want to be), extracting more profit from more users than any other company. Only Disney has a real chance to compete. That has proven true and if Netflix can continue to grow the user base while increasing subscription prices and advertising revenue, there may be no way for anyone to catch up.

Tesla Depresses

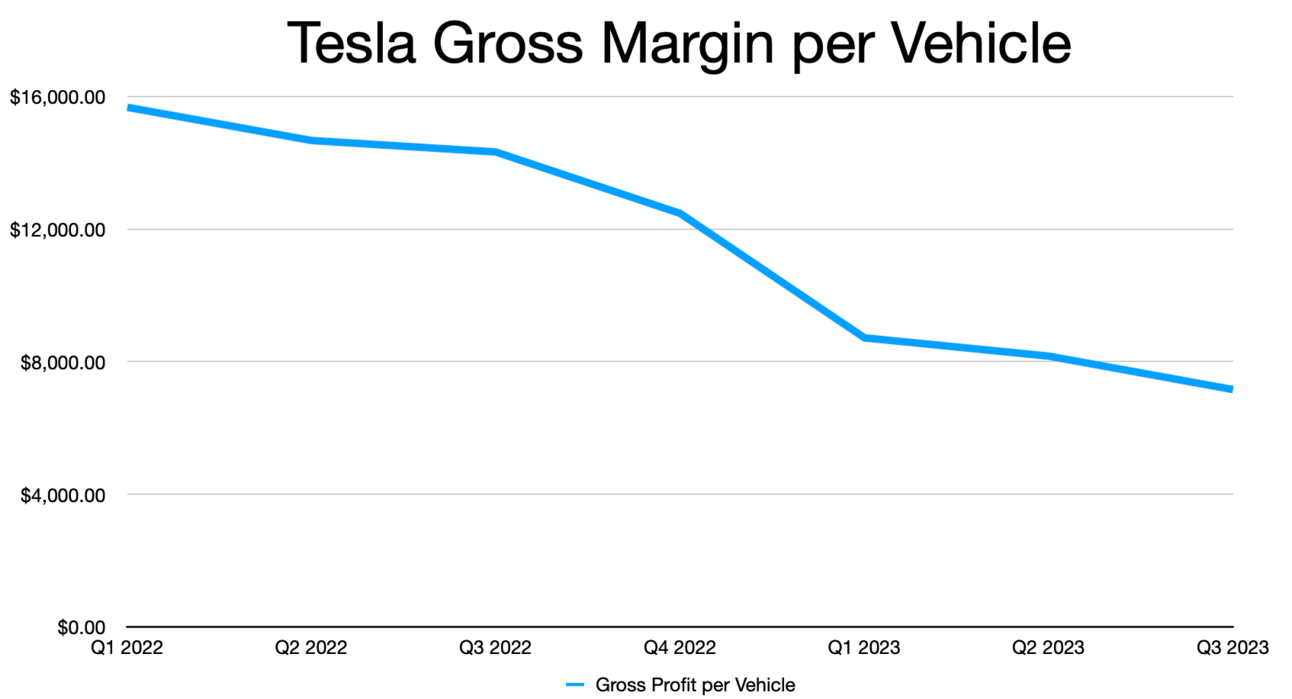

Tesla was a different story. Despite flat production over the past year, Tesla has reduced prices and profit per vehicle has dropped by more than 50%.

Increased supply of both ICE and competing EV vehicles have made the auto market more competitive and Tesla has chosen to compete on cost. Musk has explicitly stated that he will sacrifice profits to grow the percentage of vehicles powered by electrons. We’re seeing the impact of that decision.

The good news is that Tesla is slowing expansion plans in Mexico and it looks like the Cybertruck ramp will be relatively slow.

For investors, high growth expectations are now colliding with a slower growth reality. The lesson is that we need to pay an appropriate price for companies and I’m not sure the price of Tesla’s stock is anywhere near appropriate even after this week’s drop.

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, stock updates, and access to Asymmetric Portfolio trades before I make them you can subscribe below. The premium subscription is what makes this newsletter possible so I appreciate the support.

How are we doing?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.