The zero interest rate policy (ZIRP) era of 2008 to 2022 was defined by companies giving away their products in order to reach scale and doing a “yada yada yada” analysis on how they would eventually make a profit.

Giphy

No-profit companies were everywhere in the ZIRP era. Uber, Doordash, Asana, ChargePoint, Carvana, Unity, the list goes on and on. The problem is, that treasury rates now yielding over 5%, and investors are demanding that companies make money (gasp). Not all of them will be able to.

The biggest lever a lot of companies have is raising prices and that’s going to create some problems — and some opportunities — for investors.

What Happens If Prices Doubled?

One way I like to frame this is by asking how many customers would cancel if the price of a product or service doubled.

Would 50% of customers cancel (bad)? Or 5% (good)?

We may find out as companies across the board start to raise prices.

Streaming: Disney, Netflix, Paramount, and Peacock are just a few of the services have have announced price increases this summer and fall. Even YouTube has raised its prices.

Disney+ has gone from $6.99 at launch to $13.99.

Gaming: Unity announced a price increase recently and Microsoft upped the cost of Game Pass. These costs will eventually get passed on to gamers.

Tech Services: Don’t look now but Uber, Doordash, Grubhub, Postmates, and other tech companies have raised prices (or take rate), which eventually make their way to you and me.

There’s a balance in price increases between price and churn (aka. the rate of users canceling a service). In a subscription business, a price increase of 10% that causes churn to go from 1% to 2% per month would be a money loser in less than a year. But if churn only goes from 1% to 1.1%, that tradeoff may be worth it.

In some cases, companies don’t have a choice. If current pricing isn’t enough to cover operating costs and future growth doesn’t project profitability, price increases are the one lever that makes sense.

Bundles and the Hidden Price Increase

We’re going to see plenty of price increases. But another tactic we will see more of is bundling in order to add more value to a wider swath of users and increase revenue while reducing churn.

Spotify is clearly trying to do this with their recent inclusion of 15 hours of audiobooks with a premium subscription at the same time a $1-$2 price increase is going into effect.

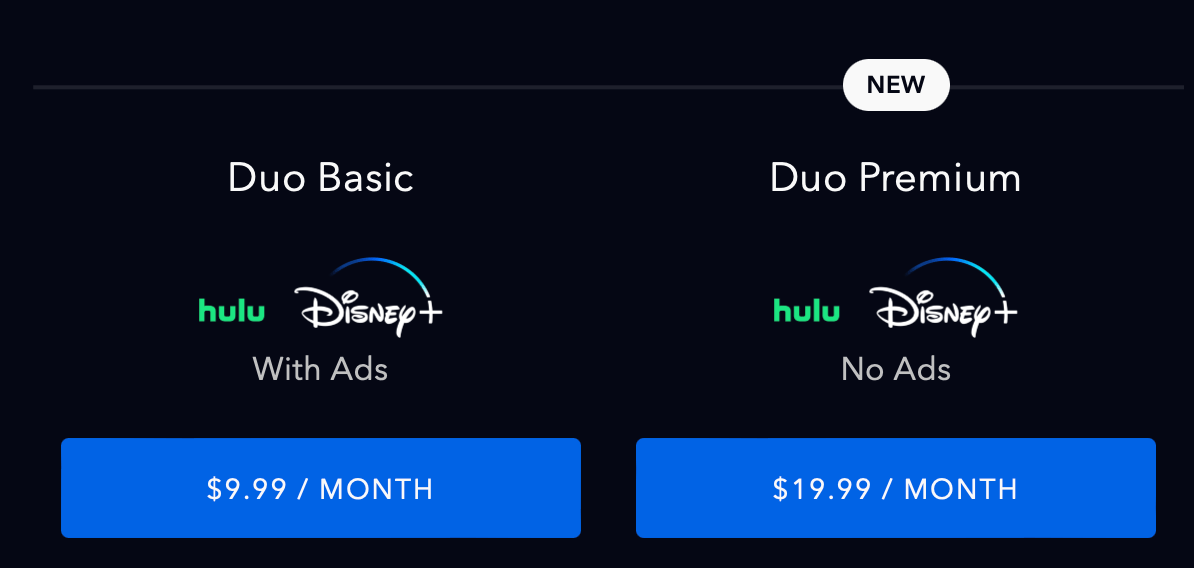

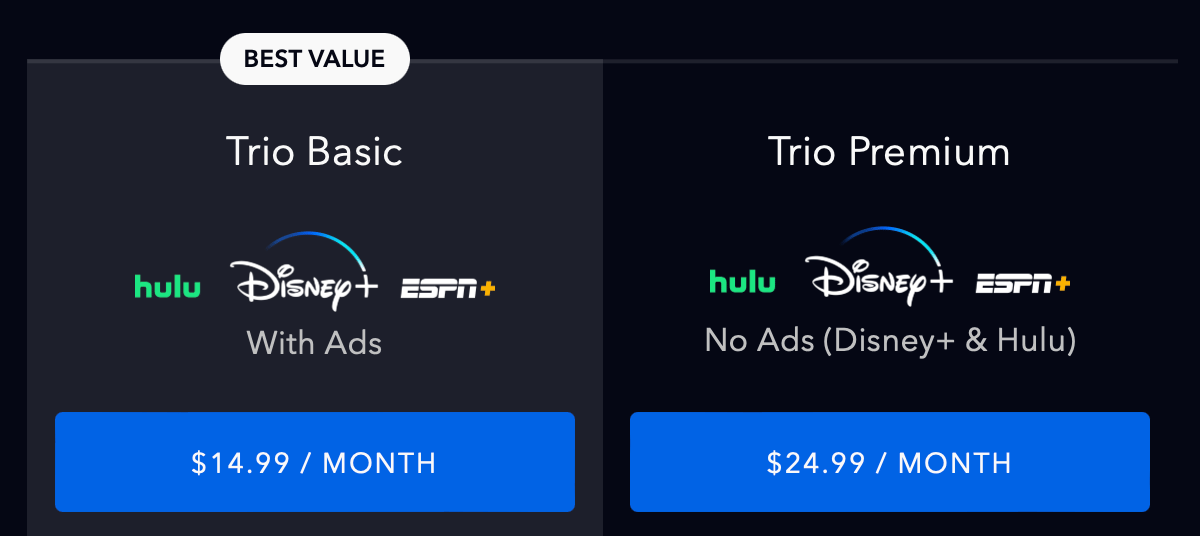

Disney is trying to do the same, offering Disney+ without ads for $13.99 or you can add Hulu for $19.99 per month or get Disney+, HULU, and ESPN+ for $24.99. The bundle is very clearly Disney’s future pricing strategy.

Bundles aren’t just about extracting more from the average user. They’re also about reducing churn. As long as there’s someone in the house who would kick and scream about canceling a service, the bill gets paid.

Advertising Is the Invisible Icing On the Cake

Another way to monetize customers is through advertising. Ads are great because users don’t have to “pay” for them with anything but their attention. Revenue goes up without prices going up.

Speaking of ads, this free article is brought to you by The Motley Fool. You can get their latest top stocks for free below.

Lower price advertising tiers can also reduce churn while generating just as much revenue. And this has become a very lucrative business.

Netflix and Disney have had so much success with ads that the delta between Disney+ ad-supported and no-ads is $6 and at Netflix the delta is $8.50.

Advertising takes scale, so not every company will be able to build an ad-supported business. But those who can will have much more flexibility with pricing in the future.

Scale, Pricing Power, and Advertising

I’ve written about the smiling curve many times on Asymmetric Investing and this is where it becomes pertinent to our investments. Companies that have the ability to raise prices and/or the scale to build an advertising business will generate more revenue and profits long-term, pushing weaker rivals to the side. They live in the top right of the smiling curve.

I think Spotify has that kind of pricing power in music. Disney has this kind of power in streaming (at least compared to Peacock, Paramound+, and Max). Airbnb could raise prices for rentals. Even Alphabet has all the pricing power in the world in digital advertising.

There’s a reason these stocks are in the Asymmetric Portfolio. They’re more powerful than rivals and they’re in winner-take-all markets. We’re just in an early phase of the shakeout that will ultimately lead to them taking market-leading positions with high profitability. Testing pricing power is the first step in that process.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.