I hope you had a wonderful week!

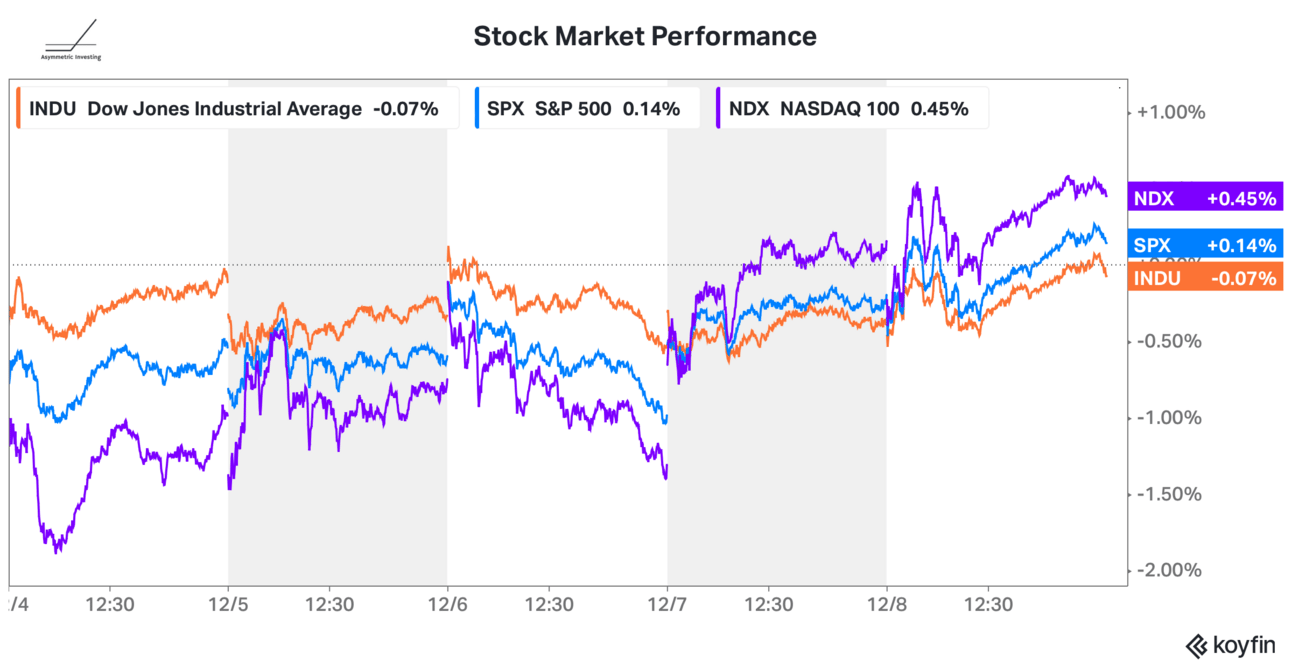

The market is in its holiday lull as earnings season slows to a crawl and traders make holiday plans. The next season is the 2024 prediction season, which I’ll get to in just a second.

Before we get to the week that was in investing, I want to share some of our partners!👇

The tools available for investors today are amazing and these are the sites I use every day while doing research:

The Motley Fool — I contribute to The Motley Fool in part because of their investing track record. The Motley Fool Stock Advisor returns are 509% as of 12/7/2023 and measured against the S&P 500 returns of 133% as of 12/7/2023. And they’re giving away the Top 10 Stocks to Buy Now right here.

Finchat — Pictures are worth 1,000 words and Finchat makes investing visuals easy. You’ll see Finchat’s platform in most articles on Asymmetric Investing.

Koyfin — Koyfin is like having a Bloomberg terminal without the price tag. Charts, data, transcripts, and more are all in one place.

In case you missed it

Here’s some of the content I put out this week. Enjoy!

Spotify Gets Efficient: One of the largest holdings in the Asymmetric Portfolio, Spotify is learning from some of its tech contemporaries and focusing on efficiency. A 17% cut in staff was announced early last week and could help drive a rapid improvement in profitability as growth picks up and price increases hit in 2024.

Costco Isn’t Playing Fair: If you’ve never looked into Costco’s business model, this article explains how lower prices become a weapon for the retailer.

Rivian’s 2024 May Disappoint: Upgrades are coming to Rivian’s plants and that will hurt output in 2024. Plus, we get a better idea of when R2 will get here.

3 Great Foreign Companies: Not all great companies are in the U.S. and these are foreign giants with growth to spare.

Prediction Silly Season

Don’t worry, I’m going to make predictions about 2024. As someone who produces content about the market, it’s part of the job and the truth is the prediction articles get a lot of clicks (you stop clicking, I’ll stop writing this silliness).

It’s also silly to predict what will happen with the market or economy over a year or less when we have plenty of evidence that even the smartest predictors are as accurate as a coin flip.

The future is inherently uncertain and we seem to forget that.

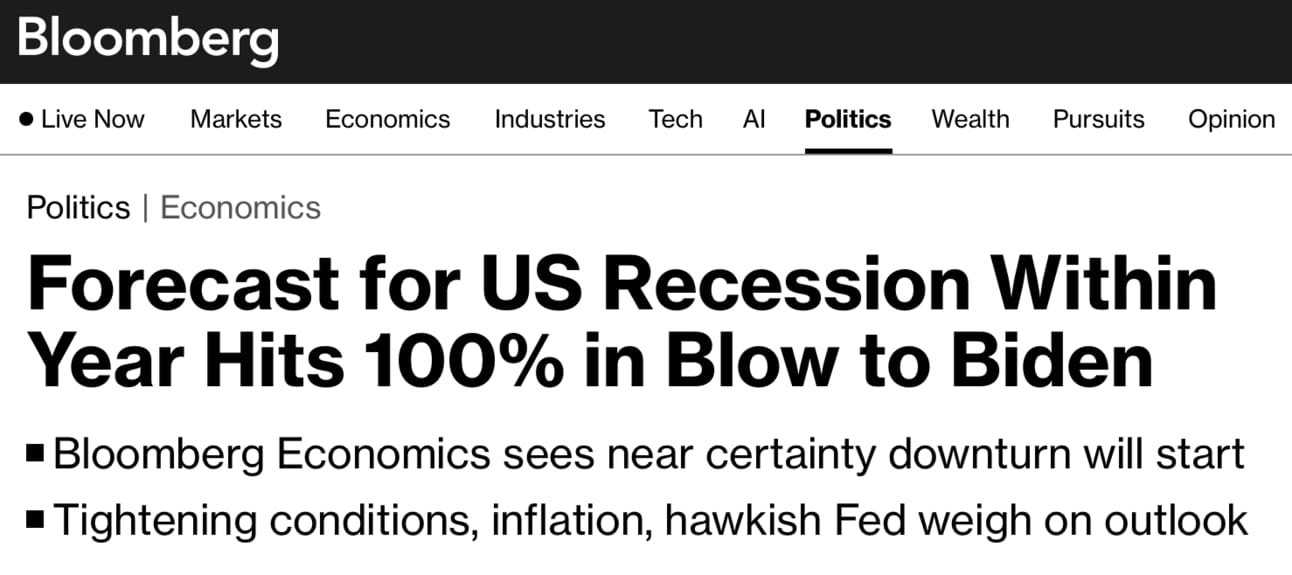

My favorite recent prediction comes from Bloomberg, who put out this gem on October 17, 2022.

If you didn’t know, this very certain prediction was flat wrong, and the economy — and stock market — did quite well in 2023.

Predictions are hard.

Getting predictions right is even harder.

Going into prediction season with a framework of how to think about predictions may be helpful. While this isn’t an exhaustive list, it’s directionally correct:

Things we can’t predict

Recessions

Interest rates

Wars

Pandemics

Politics

Unemployment

Innovation

Where the stock market will be in 12 months.

You get the point. There’s a lot of uncertainty in investing and we need to accept that.

Things we can predict

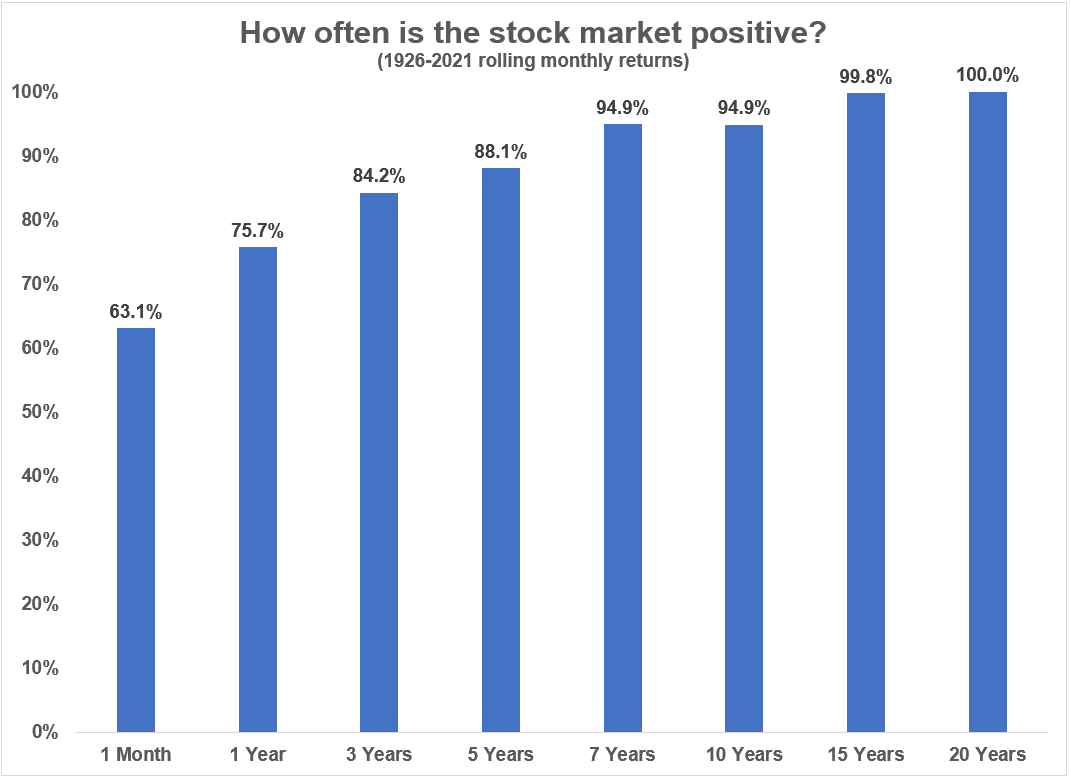

Over the long term, the stock market will go up and stock returns will beat bonds, treasuries, and most other common investment vehicles.

In any given year, there’s about a 2/3 chance the stock market will go up.

Holding stocks for a long period has a better chance of a positive return than holding for a short period.

The problem is, “100% Chance Stocks Will be Higher in 2043” makes for a crappy article headline. But it has a better chance of being true than any prediction about the market being higher or lower in 2023.

As investors, we need to lean into the few things we can predict about investing rather than gambling on the things we can’t predict. Over time, it will give you an advantage over the market.

Keep that in mind when you see predictions about the unpredictable for 2024. Even if those predictions come from me.

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, stock updates, and access to Asymmetric Portfolio trades before I make them you can subscribe below. The premium subscription is what makes this newsletter possible. I appreciate the support.

What do you want more of?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.