This article builds on the Spotify Spotlight article written on March 31, 2023. Since the article was published, Spotify stock has risen 45.3% compared to a 12.4% total return for the S&P 500.

Premium members get all of the Asymmetric Spotlight articles and stock updates. You can upgrade here.

There’s a reason technology companies are some of the most profitable and valuable in the world. No business in the history of humanity is as scalable as software at a near-zero marginal cost.

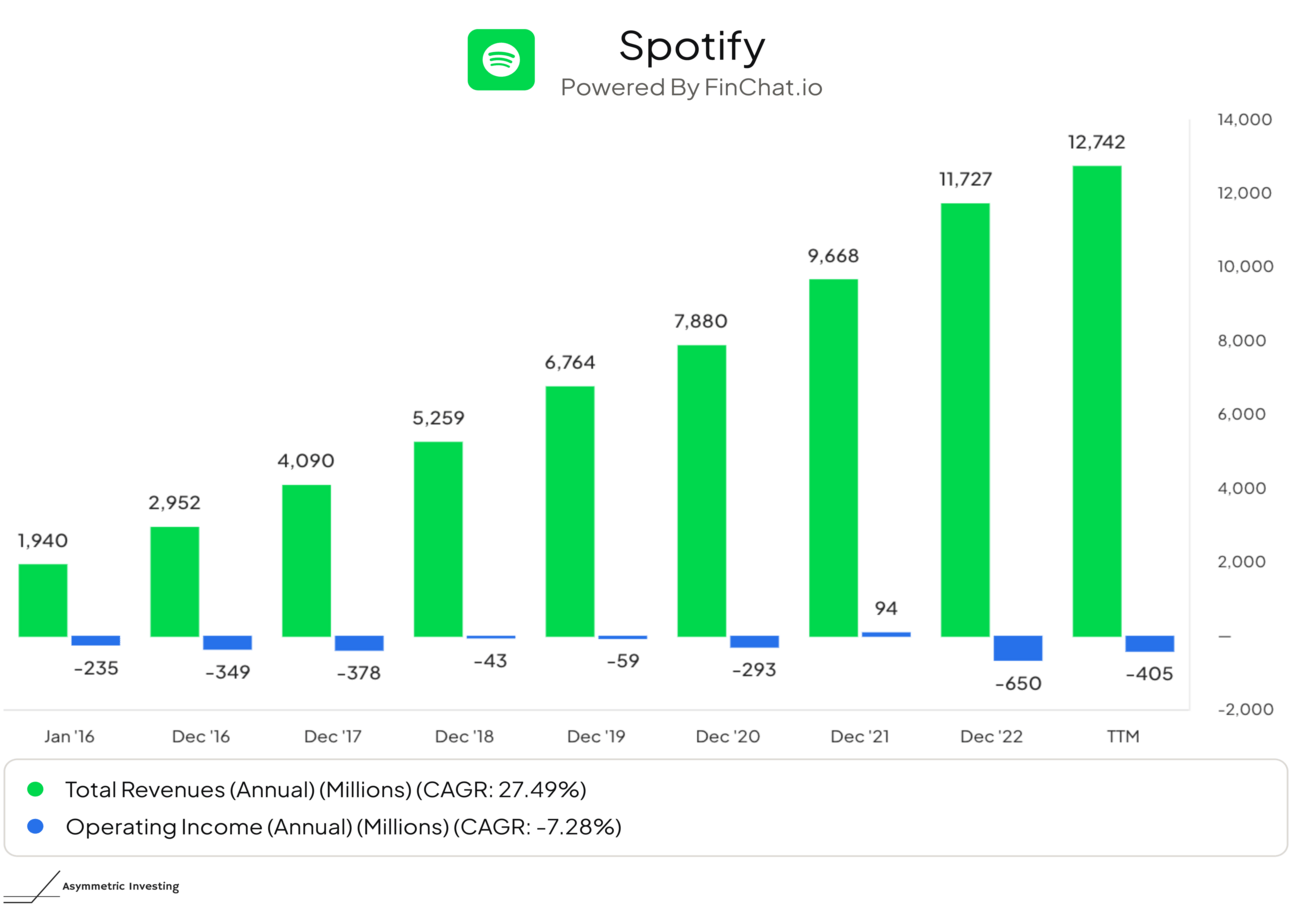

But too many tech companies are unprofitable and Spotify has long lived in that category, spending billions on sales and overhead that doesn’t seem to impact the business.

Like many of its tech rivals, Spotify seems to be learning that it needs to get costs operating costs under control and announced a huge layoff on Monday that could drive the company toward profitability in 2024.

Spotify’s 17% RIF

On Monday, Spotify announced a reduction in force (RIF) of 17% of the staff, the third labor cut this year. The cuts come at a time when Spotify is growing both users and revenue at a double-digit rate, so it seems like the business is doing well.

So, why cut now?

It’s all about operating leverage. For years, Spotify has had no (or negative) operating leverage and CEO Daniel Ek seems to have discovered that spending on operations needs to generate real returns.

What is operating leverage?

We say a company has operating leverage when revenue grows faster than operating costs. A little revenue growth leads to a lot of operating profit growth.

Looked at another way, operating costs are spread across a larger revenue base, increasing operating margins.

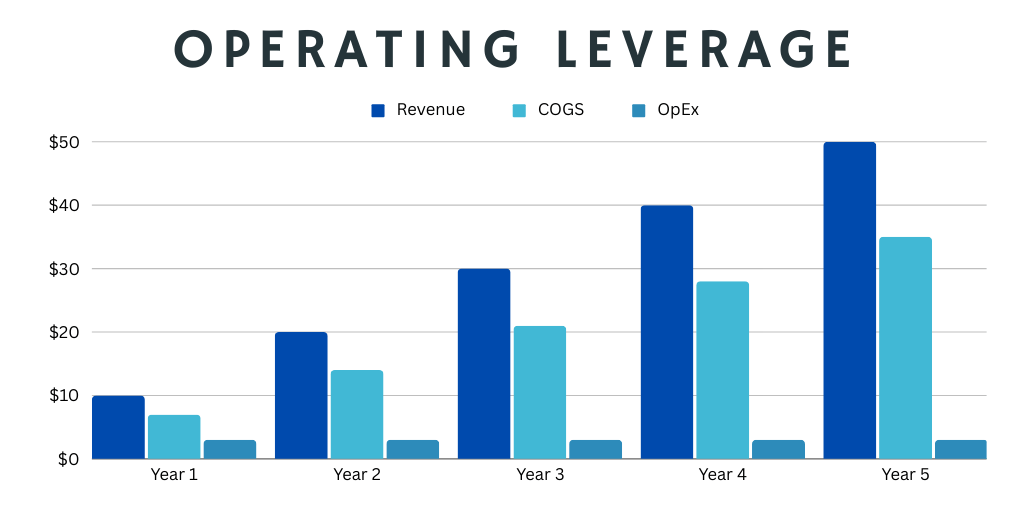

Here’s a quick example. The chart below shows a business that has:

Revenue in Year 1 of $10 and grows by $10 each year to $50 in Year 5.

Cost of goods sold (COGS) is a constant 70% of revenue, meaning gross margin is a constant 30%.

Operating expenses are $3 each year and held steady.

Operating expenses are flat as sales grow, so $0 in profit in Year 1 eventually becomes a $12 operating profit in Year 5.

As you can see below, there’s leverage in the operating margin.

A tech company should have high leverage on its operating costs because technology is nearly infinitely scalable. But Spotify has shown no such leverage.

The question is, why?

Getting a return on spend

The lack of operating leverage isn’t a Spotify-specific problem. A lot of tech companies spend heavily on operating expenses without a clear return on investment. If top-line growth is all that matters to the stock market, why not add another marketing team or a new office in New York?

Paradoxically, Spotify may be seeing higher returns from lower overhead.

The chart below shows Spotify’s SG&A and other expenses compared to subscriber growth. Spotify started cutting opex earlier this year and those cuts have been focused on sales, marketing, general, and administrative costs (R&D is about flat). However, subscriber additions have accelerated from 67 million new subscribers in the final three quarters of 2022 to 85 million new subscribers in the most recent three quarters.

This has to tell both investors and management that there was a mismatch between Spotify’s operating spending and the returns it got from those operations.

Hopefully, these cuts get costs more in line with a level that will generate a return, driving operating leverage for the business.

Spotify’s momentum

We started to see increased margins and cash flow in the third quarter and that momentum should accelerate in 2024.

Price increases kick in during Q4 2023 and will drive higher dollar gross margins in the future.

Layoffs started to reduce opex in Q3 2023, but this latest round will lead to falling opex through at least Q3 2024.

Bundling (audiobooks included in premium) has yet to show an impact on premium adoption or churn.

Advertising improvements — like better targeting and AI voices — will accelerate revenue from the ad-supported tier in 2024.

There’s a lot to look forward to from Spotify in 2024 and I’m excited this is one of the largest holdings in the Asymmetric Portfolio.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.