It has been an absolutely crazy week for Asymmetric Investing and that’s why this article is out a day later than usual. On Thursday alone, the Asymmetric Portfolio was up 6.8% and four stocks were up double-digits after earnings. Year to date, the portfolio is up 22.5%. These gains won’t continue, but we do want to celebrate success when it’s here.

Here’s what’s coming up later this week.

Now: Lyft earnings and autonomous driving update.

Later Today: Update on Robinhood and MGM Resorts earnings.

Saturday: Update on Crocs, Airbnb, and Coinbase earnings.

Sunday: Normal portfolio update and market recap article.

3 stocks in the Asymmetric Portfolio have autonomous driving as a core thesis and the one “Special Situation Short” position is also very related to autonomy. And there was a lot of news around this growing basket this week.

To start, Lyft and Mobileye continue to push forward. I’ll cover this more below, but it certainly looks like autonomy will become a commodity and the ride-sharing networks will be in a good position long-term.

And Tesla, which I have a short position in via Jan 2027 puts, continues to fall behind in autonomy, despite what Elon Musk says. Not only is Tesla still not a “known AV operator” in Austin, where it says it’s launching a robotaxi service in 4 months, but there was an FSD accident that’s worth our attention.

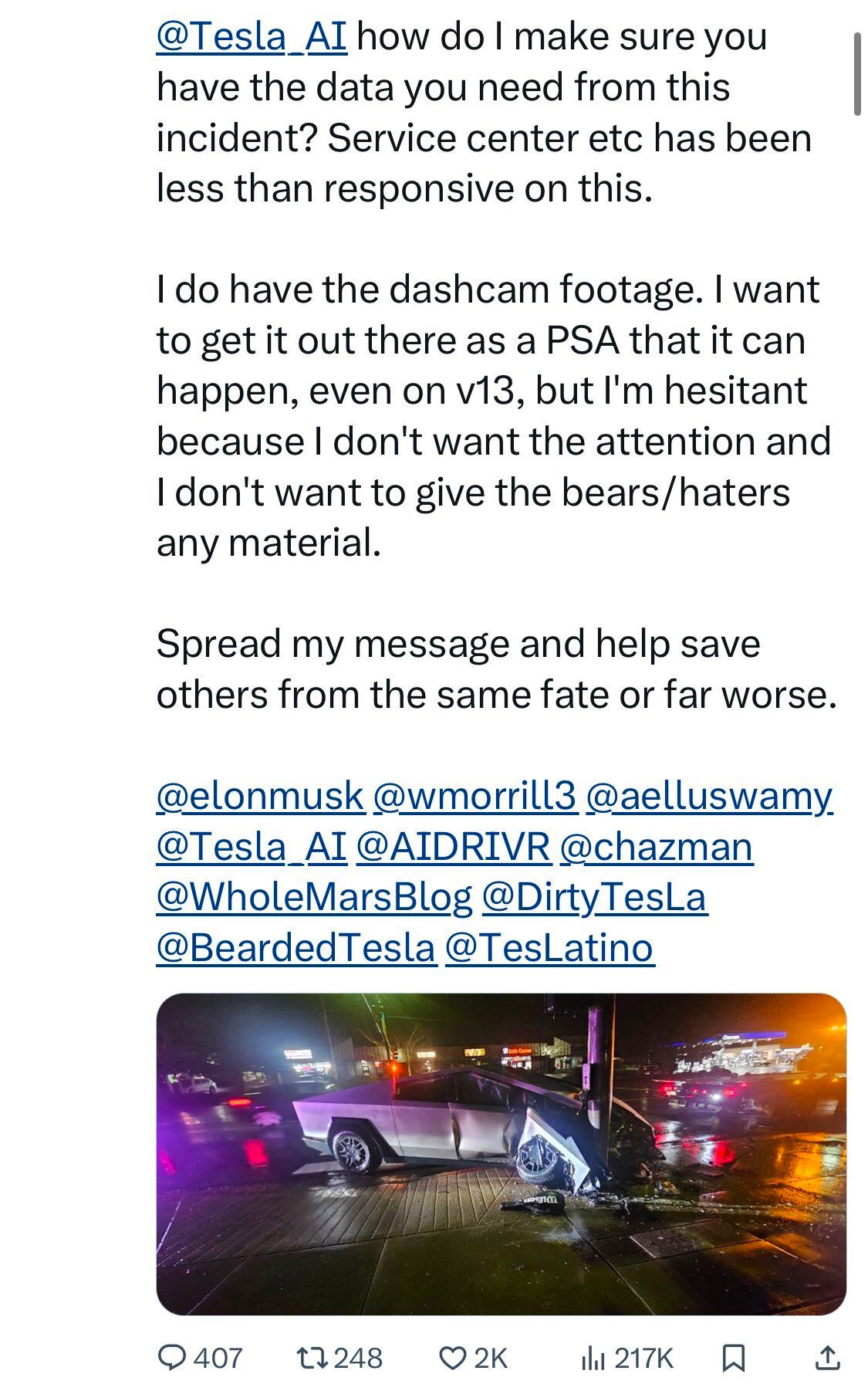

A Cybertruck owner on FSD 13.2.4 posted earlier this week that his truck crashed into a light post while FSD was active. You can see from the image below that this was no ordinary fender bender and if you dig further you’ll see the Tesla missed clear road signs, drove over a curb, and crashed into a common physical object, the light post.

The tweet — which was on Musk’s owned social network — has now disappeared. The poster was a big fan of Tesla and Elon Musk and said he was trying to help by posting the incident, but after over 10 million views, it’s now gone as are the rest of the author’s posts. Here’s the original link and screenshots of the post.

I point this out because my argument for being short Tesla via puts is that FSD isn’t anywhere near ready for fully autonomous driving. It’s easy to waive away these accidents when technically the driver is at fault, but if there’s no driver to take over when needed these accidents could be more frequent…and that’s worrying for both the public and Tesla.

We are seeing more and more autonomous vehicles on the road and safety needs to be a focus of every company looking to scale this technology.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Fuel Your Ambitions

40g protein, plus 27 essential vitamins & minerals

Ready in 30 seconds – just shake, sip, go

New customers get 15% off with code BEHUEL15

Lyft Taps May Mobility and Mobileye For 2026 Autonomous Launch

I highlighted Uber’s autonomy focus last week and this week we got results from Lyft and a view of its autonomy strategy. This quote from the conference call covers a lot:

In 2025, you'll see the Lyft platform expand to include autonomous vehicles. This will come to life with our partner, May Mobility in Atlanta, which is one of the only 2 players providing AV rides to the public today. Beyond that, yesterday, we announced a partnership with Marubeni. They'll be the first to use Mobileye, our partner's, Lyft-ready AV technology with the goal of deploying their fleet to thousands of vehicles on the Lyft platform over time, starting in Dallas as early as 2026 with other cities to follow.

We're in advanced discussions with a number of other partners. The AV future will have many players across the value chain, including several emerging from behind the scene. They're coming to Lyft for our unique combination of fleet management expertise derived through our Flexdrive subsidiary and access to our network of more than 44 million annual riders. I'll share more with you soon. As I've said before, AVs will be a transformational addition to the marketplace. The more AVs, the more rideshare market expands, and the better Lyft does.

Lyft is enabling autonomy in the way it should as a ride-sharing marketplace. It’s trying to create an abundance of financing and technology while providing needed infrastructure.

Financing: The deal with Marubeni, which has more detail below, is important to provide financing for individuals and businesses who want to own an autonomous fleet.

Flexdrive: This is Lyft’s fleet management subsidiary, which could help provide infrastructure for charging and cleaning AVs.

Technology: Mobileye and May Mobility are currently partnering with Lyft, but others like Zoox, Waymo, Pony.ai, and many more are possibilities in the future. Bringing more technology players along will commoditize autonomy.

On the financing front, Lyft is helping enable fleet ownership to operate on its platform.

It will take time for this strategy to play out, but Lyft seems to be moving in the right direction, pushing to scale its AV supply and commoditize its compliments.

Lyft’s Business Pushes Forward

I have focused on the opportunity in autonomy, which is the 10x+ upside, but there’s also Lyft’s core business to look at and there’s a lot to like.

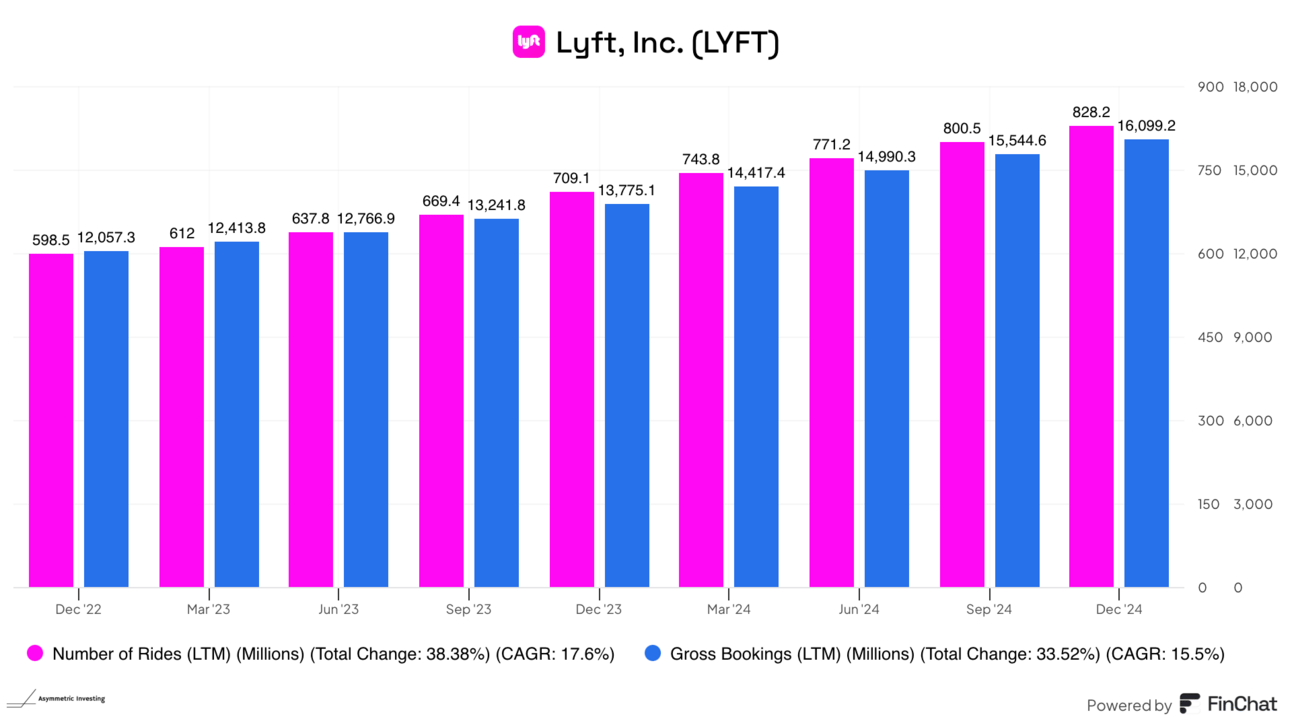

Both the number of rides and gross bookings continue to grow by double-digits. The number of riders is growing more slowly, but the fact that existing users are using it more is good news.

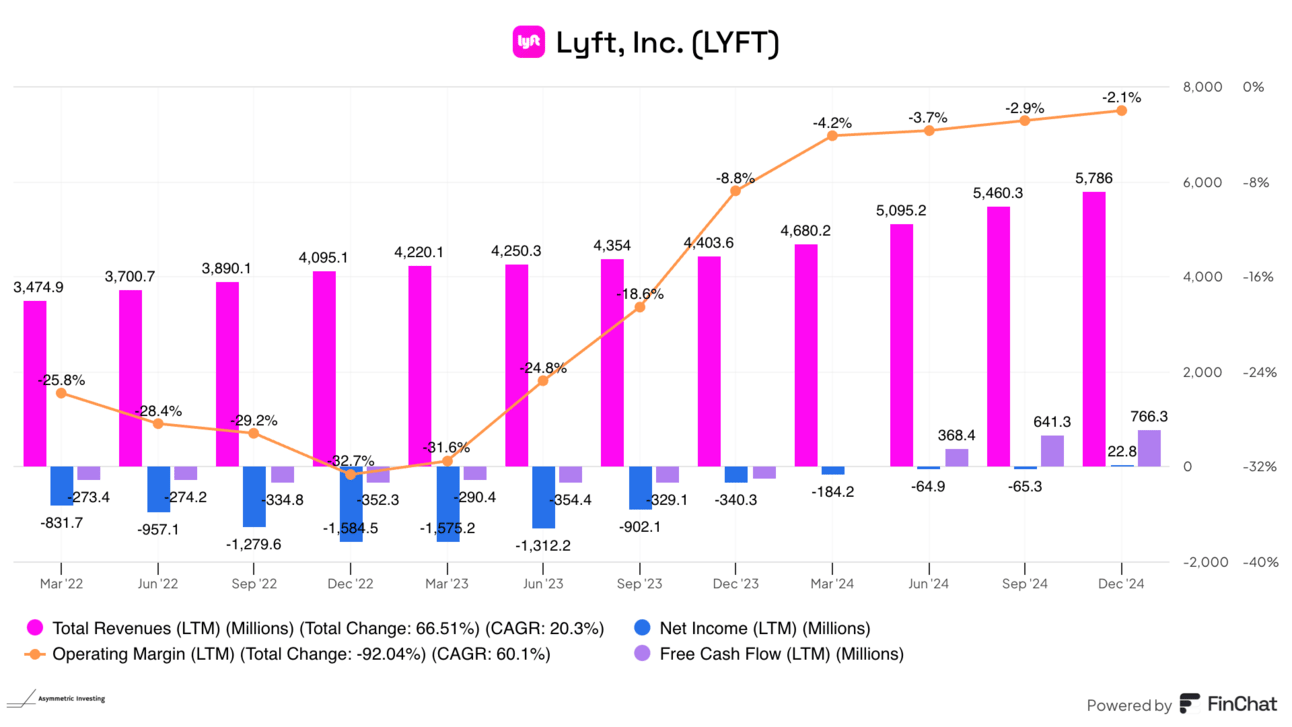

Lyft has now been profitable over the past 12 months and is generating positive free cash flow. Management even announced a $500 million buyback, which would be nearly 10% of shares outstanding before accounting for stock-based compensation dilution.

The orange line in the chart above is the operating margin and you can see that’s also moving in the right direction.

Management said on the conference call that a more competitive pricing environment will hurt growth in Q1, but I would expect that to be a blip in the long-term improvement of the business.

I think David Risher and the team have made subtle, but important improvements to the Lyft experience that make it differentiated enough to be a great niche player in ride-sharing. And with an upside in autonomy, this is a stock I will likely buy more of in 2025.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.