On December 14, 2024, I wrote a spotlight article on Uber (and Lyft). I also added Uber to the Asymmetric Portfolio as a replacement for GM, which I sold after GM shut down Cruise.

My thesis didn’t just center around Uber’s improving business, it posited that Uber could be the dominant player in autonomous driving, particularly if autonomy becomes a commodity. In short, the company holds a market-leading position in the 2-sided ride-sharing market, and autonomy could lower costs and expand the market by making supply abundant.

Color me surprised on Friday morning when Bill Ackman, hedge fund manager at Pershing Square, announced he had acquired a $2.3 billion position in Uber, which he began buying in early January.

I won’t complain about a billionaire following my investment, but did he get the idea from Asymmetric Investing?

I can’t confirm he didn’t get the idea from these digital pages.

But enough with the fun, let’s get to how Uber seems to have gone all-in on autonomy.

Uber’s Results

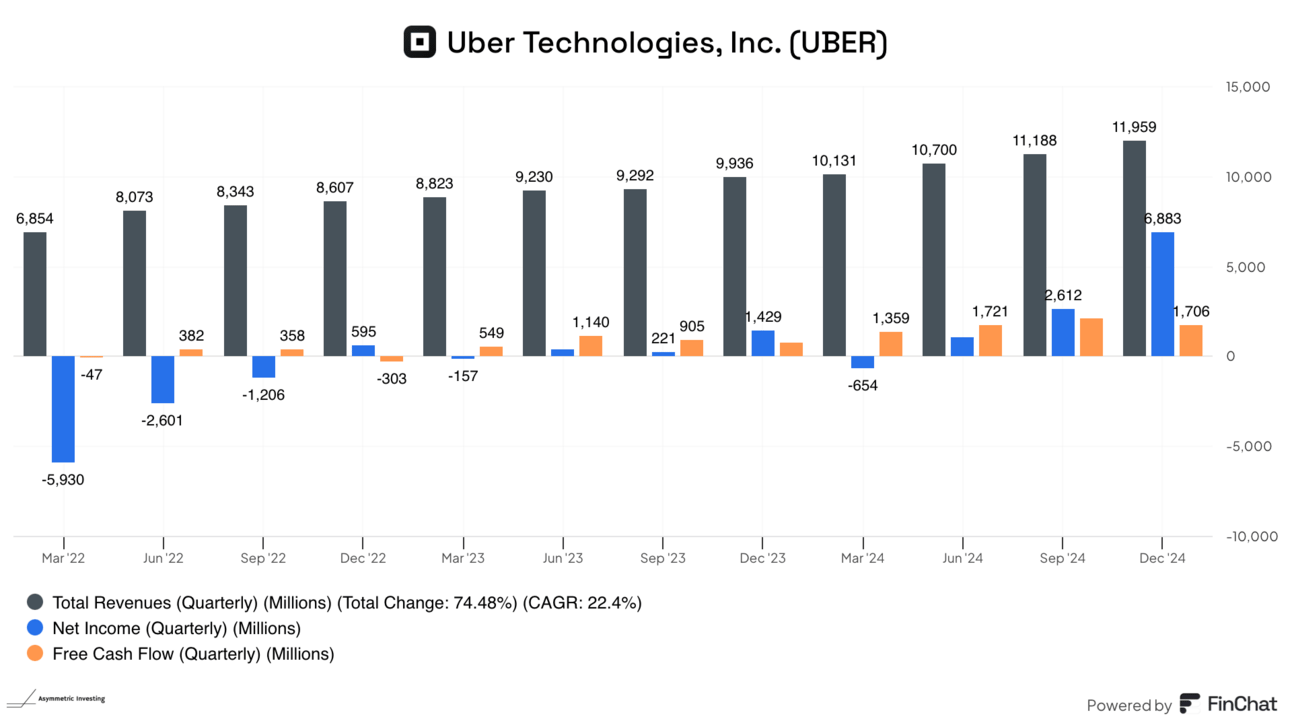

Uber’s fourth-quarter results were impressive on nearly every front. Gross bookings were up 18% to $44.2 billion, revenue was up 20% to $12.0 billion, and income from operations jumped from $118 million a year ago to $770 million. Net income benefitted from a $6.9 billion tax benefit valuation release, but even without that, the bottom line is heading in the right direction.

What’s not to like?

This business alone, growing at a 20% compound annual growth rate, is potentially a 10x stock in a decade. But the bigger opportunity is in autonomous vehicles and Uber spent a lot of time in its presentation to investors and the conference call with analysts laying out plans that may take a decade to unfold.

Uber’s $1 Trillion Opportunity

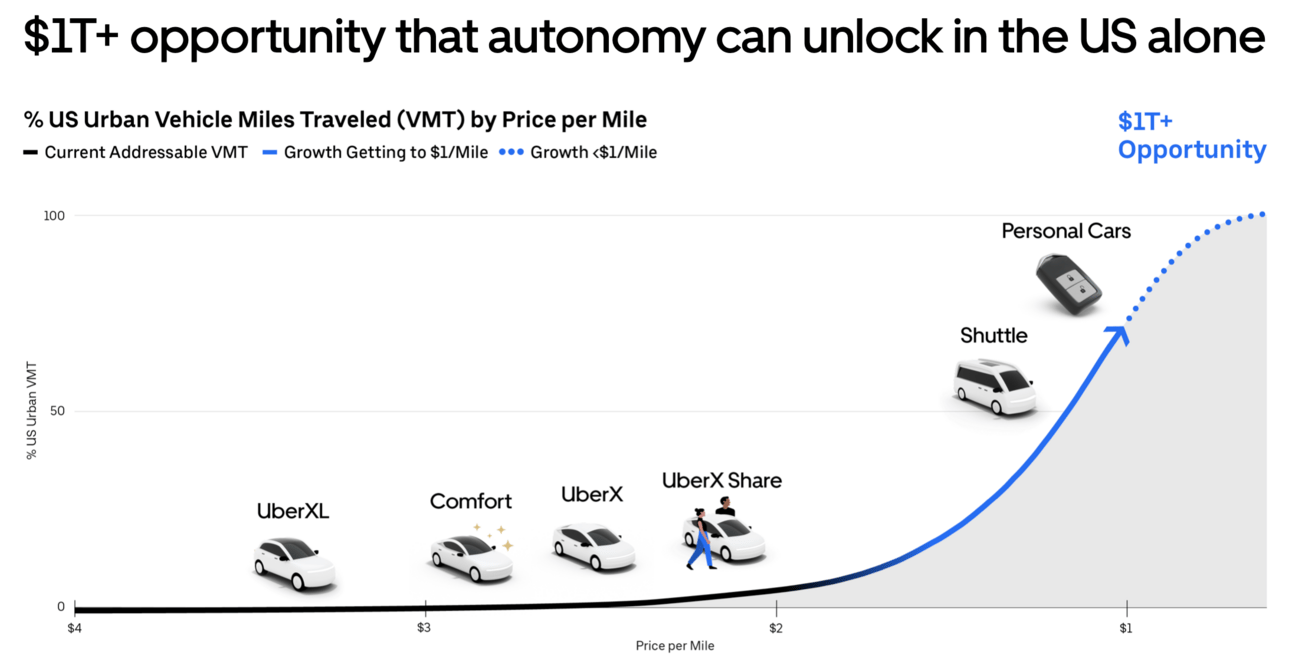

As I have written before, autonomy is not only a way to potentially add supply to Uber’s business, it’s a way to lower costs and expand the addressable market. Uber put the opportunity at over $1 trillion in the U.S. alone.

Notice that this is a progression of market expansions Uber has been taking on for years. It’s just the biggest and most transformative we’ve ever seen.

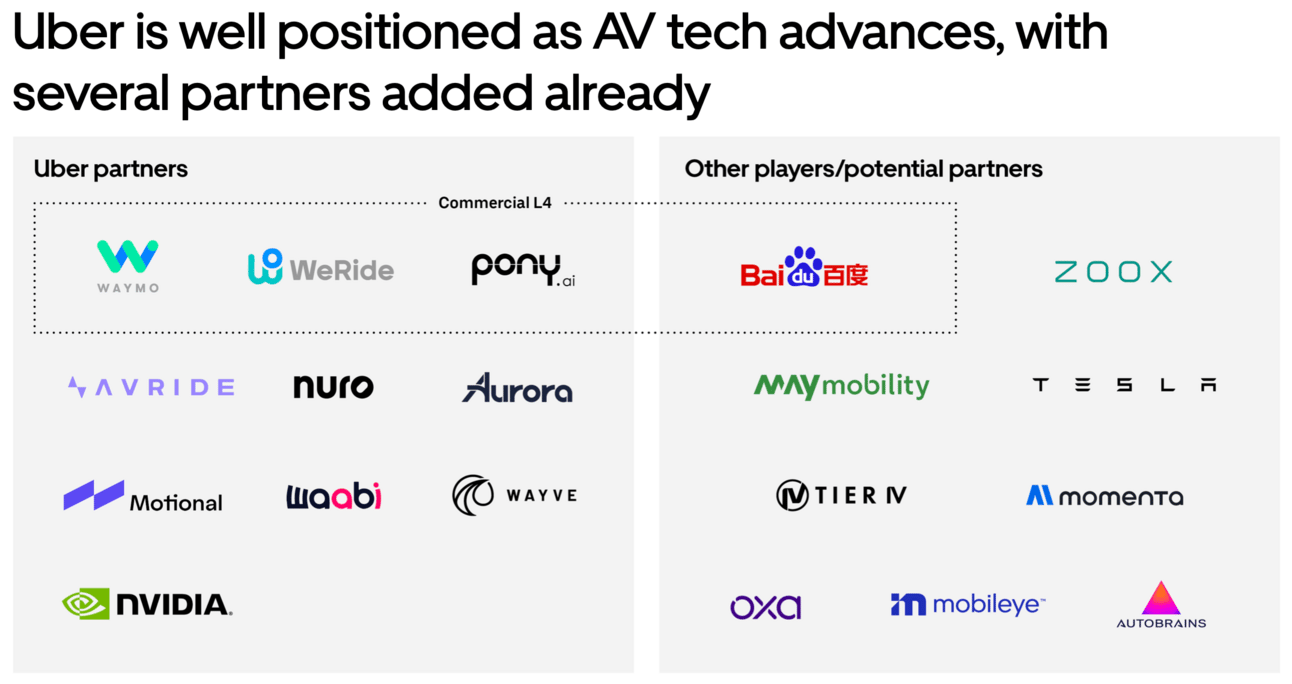

The key to Uber winning autonomy is not developing technology, but rather making sure no one supplier is too powerful. Uber wants autonomy to be a commodity with many winners, none of whom is able to build the scale to replace Uber’s network. Here are the leaders they pointed out in a presentation to investors.

Waymo is already on the Uber network in a few cities, but imagine if May Mobility, Zoox, Nuro, and Mobileye (VW and others) joined the fray.

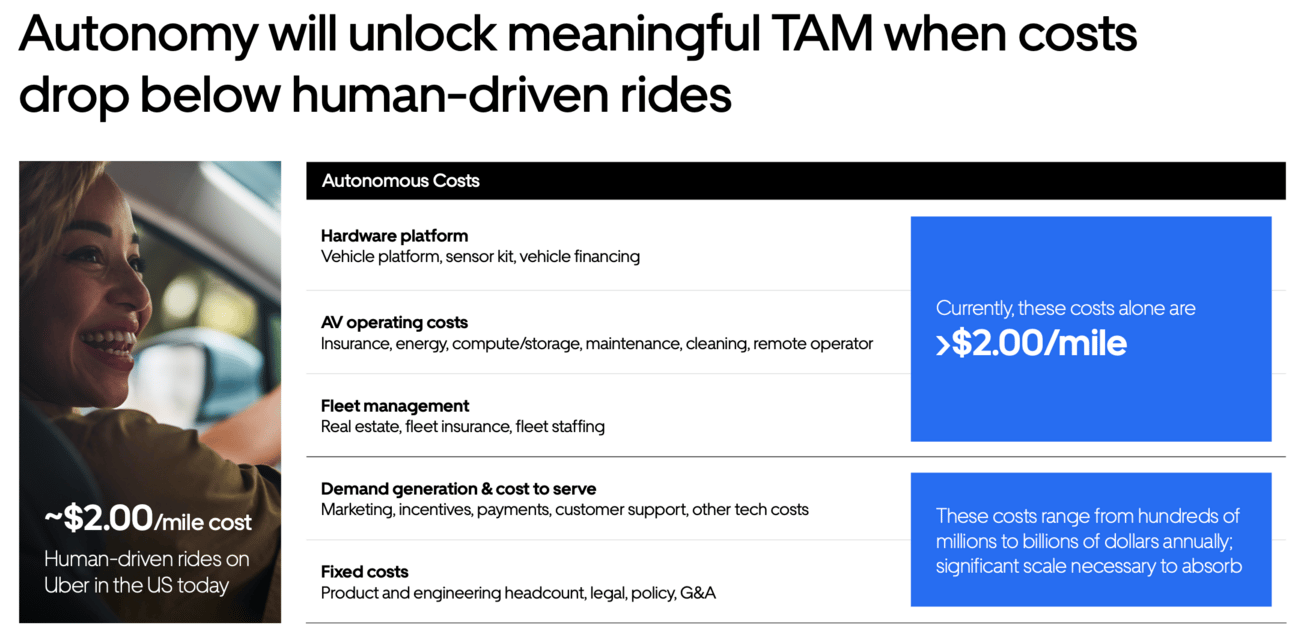

This could increase supply and allow innovation in vehicles and business models. All of this would help lower the cost per ride, potentially from between $2 and $3 per mile today to under $1 in the future. But no one company would be a threat to Uber itself.

This is the vision. It’s what I wrote about in the Uber (and Lyft) spotlight and it’s what management is talking about.

Uber’s results were great, but the fact that they’re advertising to potential suppliers (and I think that’s what this presentation was about) that they’re opening for business and want to help push autonomy forward is the best news for investors.

It looks more likely that autonomy will be a commodity and Uber/Lyft will remain in a great strategic position long-term. That’s great for Uber’s business long-term and in the meantime management is performing about as well as anyone could hope.

The future looks bright for Uber and I welcome Bill Ackman to the bullish side of the investment thesis.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.