This week has been a whirlwind of news that could have dramatic impacts on the market long-term. I promise, I’m going to try to stay apolitical, but unfortunately, politics is having a big impact on markets right now from DC to California. It’s worth discussing how policy changes could be well-intentioned, but lead to unintended consequences and ultimately risk and opportunity for us as investors.

Here’s a small list of what happened in the last week or so:

President Trump proposed capping credit card rates at 10%.

President Trump ordered Fannie Mae and Freddie Mac to buy $200 billion of mortgage-backed securities, hoping to lower mortgage rates.

The new mayor of New York wants to lower the cost of rent and has brought into question ownership rights in the city.

California has proposed a billionaire tax that has already caused people worth over $1 trillion in total to flee the state.

In my home city of Minneapolis, arrests and deportations continue with disruptions (to say the least) to everyday life. (I’ll get to this impact in a moment)

To top it off, the Department of Justice sent a subpoena to the Federal Reserve, threatening criminal charges for the Fed Chair over Congressional testimony related to construction budgets.

Individually, any of these actions could be seen as a good thing (maybe not the last one). Lowering the costs of housing and credit cards is a noble goal, billionaires probably have enough, and people should follow the law.

But unintended consequences are often more impactful on the economy and markets than the intended consequences.

Just look at some big policies in recent memory.

In an effort to fuel the economy out of the dot-com-induced recession in the early 2000s, Alan Greenspan kept rates low and oversight so relaxed that it led to the CDS crisis (among other things) that caused the Great Recession.

President Obama’s efforts to insure more people and bring down the cost of care…drove costs higher!

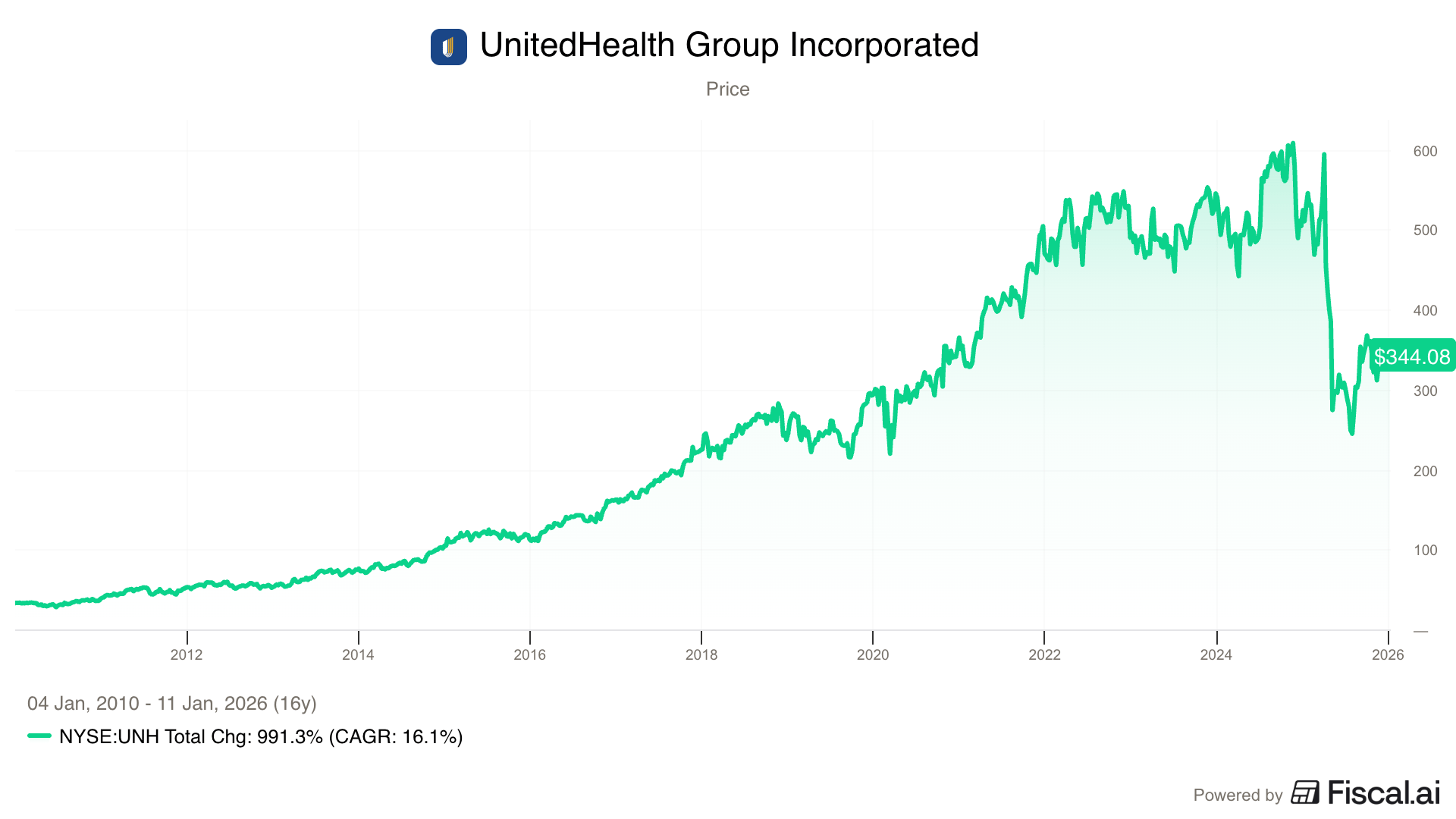

Surprisingly enough, UnitedHealth Group's stock was one of the big winners of this policy, rising ~10x since the bill passed.

Intentions can be good.

Consequences can be unintentional, which I’ll expand on in a moment.

Weekly Update

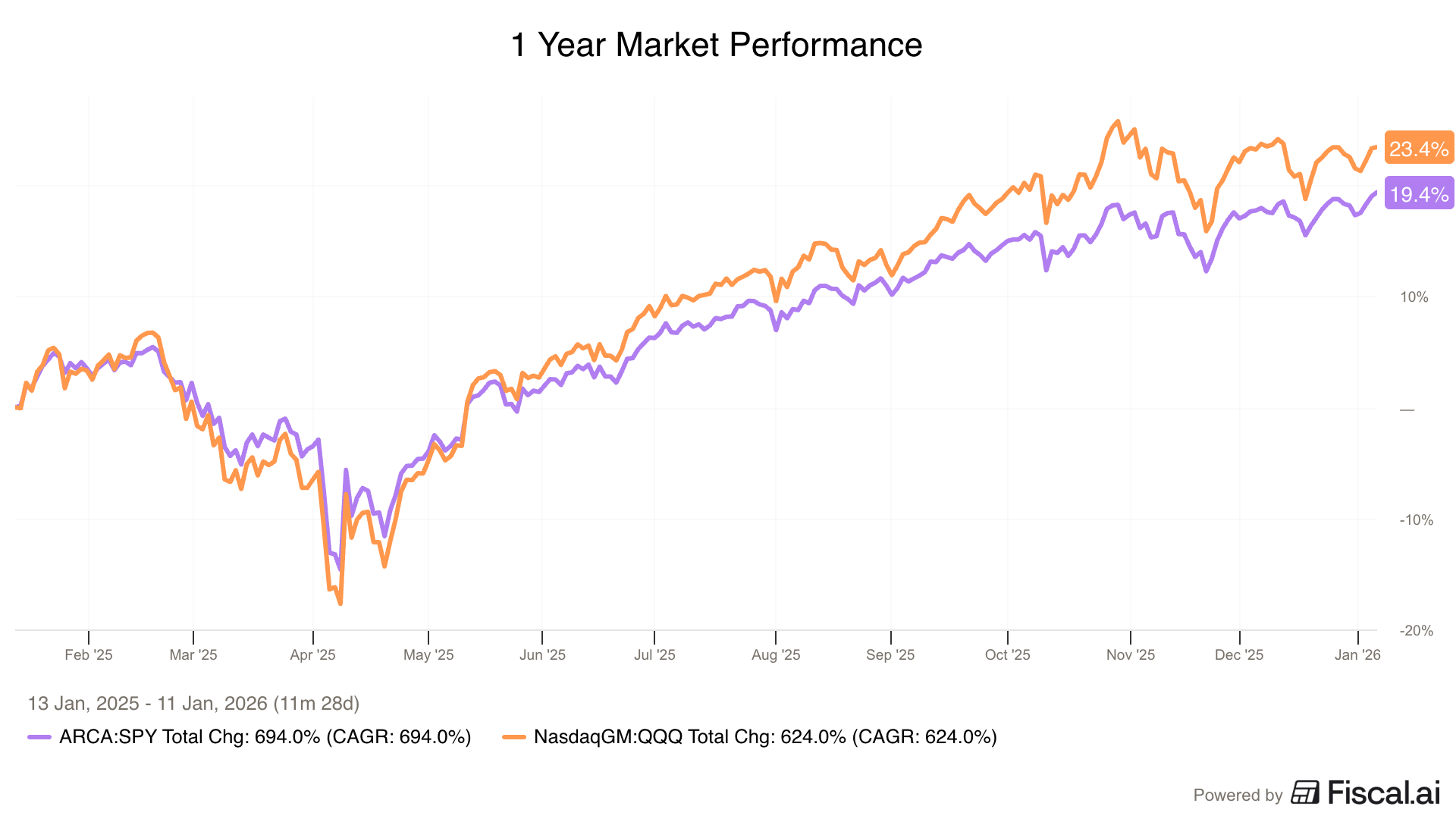

There were some big movers early in 2026, but overall, the market has been pretty quiet. This week, earnings season starts, so it’s likely we’ll get more fireworks soon.

The Asymmetric Portfolio has been bouncing in about the same spot for 6 months. I don’t like it, but the volatility and declines have been driven by a small number of stocks ($HIMS ( ▼ 1.2% ) $HOOD ( ▲ 0.61% ) $SPOT ( ▲ 1.09% )) that have driven the portfolio’s outperformance over the past two years.

I’m happy to be buying some of the companies I like most long-term at what I view to be more reasonable prices than we saw at the peak.

In Case You Missed It

January 2026 AMA: I’ll do these at least once a month and love all the questions coming in!

Mobileye’s Wild Week: Mobileye announced a big partnership and a new acquisition.

I Shorted Tesla (again): Yes, I did it again. I’m short Tesla and hope another 260% gain is on the horizon.

The Day Healthcare Changed Forever: AI is coming for healthcare, and I believe in the disruption story.

Unintended Consequences

Let’s just go through a few examples of how consequences could be far from what the original intent is.

Capping Credit Card Rates at 10%

Intent

Lower interest rates for those who struggle most to pay their bills.

Unintended Consequence

Credit won’t be offered to those same borrowers in the first place.

They’ll then spend less overall because they don’t have access to funds.

Note: Maybe this will be a good thing long-term?!?

Cash back and points rewards will be worse for lower-risk borrowers.

More people will use BNPL and payday loans.

Banks (not the credit card companies) determine who gets a card, what their limits are, what the rate is, what rewards look like, etc. They’re likely to close up that credit profile to some borrowers if the profit from credit card balances take a hit.

High interest rates pay for all of the benefits you and I may get from using a given card. That will disappear. That wasn’t the intent, but it’s likely to be a consequence.

Note: Maybe that’s good for blockchain payments?!?

Buying Mortgage Securities, Capping Rent, etc

Intent

Lower housing/borrowing/rent costs for residents.

Unintended Consequence

Less housing supply is built.

Lenders pull back, rates rise, and loans become harder to get.

Housing prices go up.

Almost every attempt to manipulate the existing housing market has backfired. The only path to lower costs is more building.

The President Pushes the Fed to Lower Rates

Intent

Lower rates to grow the economy.

Unintended Consequence

Bond investors (who control long-term rates) see more risk of inflation and a recession, which leads to higher rates.

Confidence in the free market falters, and rates rise because of higher perceived risk.

This isn’t an example of unintended consequences that I made up. Look at the direction of the Fed Funds rate (the short-term rate the Fed sets) since mid-2023. There have been 6 rate cuts for a total of 1.75%.

Now look at the 10-Year yield, which is the benchmark used for everything from corporate loans to mortgages, over the same timeframe.

Not only are rates not falling, depending on the time frame you look at, they’re rising.

What happens if the Fed cuts rates to 1%, as the president has asked for?

I would wager that 10-year and mortgage rates won’t fall and may actually go up.

This is why the Fed had independence in the first place.

This one is especially interesting to me because CEOs like Anthony Noto at SoFi have been much more bullish on the economy and lending because of falling rates. But rates aren’t falling on the long end of the curve, and the economic boon he expects may not come as a result.

I’m not going to open the immigration can of worms, but you can imagine how shrinking the workforce and lowering available low-cost labor could impact home construction, food prices, and even GDP growth. Maybe that’s good for the economy. Maybe it’s not. But the consequences for the economy and the job market may be very different than the intention.

I wanted to write this today as a word of caution.

I see a lot of certain prognostications like, “Because of X, Y will happen.” In all of the examples I cited above, we have no idea what the real impact is going to be long-term.

You may agree or disagree with any one of these policies, and your reasoning may be sound. But there are always unintended consequences.

Often, unintended consequences are more impactful — sometimes in the opposite direction of the intent — than the action itself.

I like to make the case against a decision or policy I may like. That helps balance my opinions and forces me to keep an open mind.

But being aware that the outcome may be different from what you thought is a good start.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.