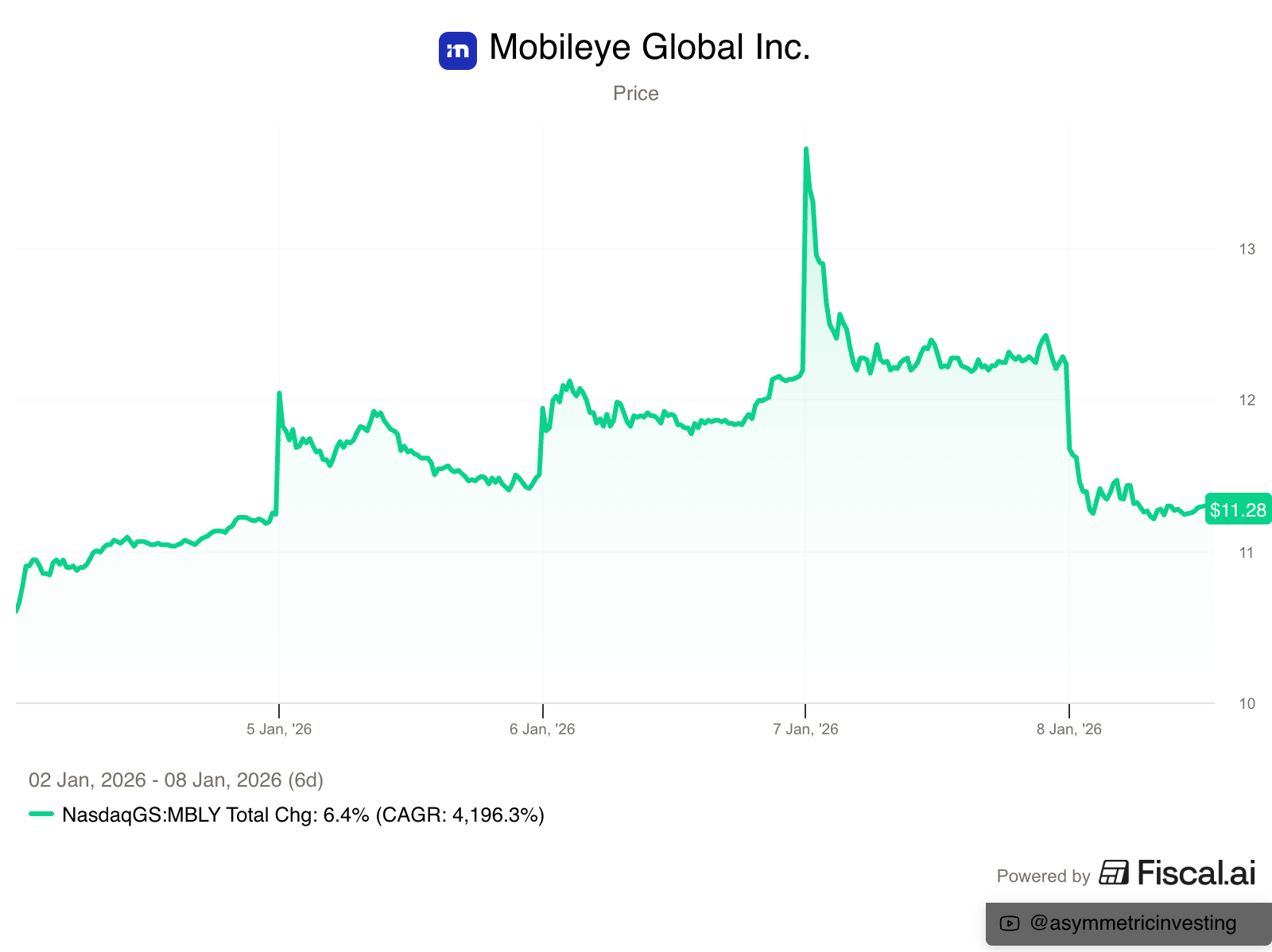

When I bought shares of Mobileye $MBLY ( ▼ 1.52% ) for the Asymmetric Portfolio on January 2, 2026, I didn’t think shares would skyrocket shortly after. And I didn’t expect that enthusiasm to die off only hours after hitting .

There have been two catalysts for the moves over the past week:

Mobileye announced a design win with a U.S. OEM.

Mobileye acquired robotics company Mentee.

The impact of these announcements could be huge for the company.

And they bring in doubts about management too…

This publication is supported by its premium subscribers.

If you’re getting value from posts like this and want to get access to my market-beating Asymmetric Portfolio, become a premium subscriber below. Thank you for your support!

Mobileye’s U.S. Automaker Win

I think the most consequential announcement this week was Mobileye announcing a second design win with “a US-based automaker”. Here’s the meat of the announcement.

Mobileye today announced that a US-based automaker has chosen the Mobileye EyeQ™6H to power future advanced driver assistance systems with hands-free driving on select highways across millions of vehicles worldwide. This deal reflects accelerating demand for Mobileye Surround ADAS™ systems globally, and Mobileye now estimates future delivery of more than 19 million EyeQ6H-based Surround systems, including 9 million from the new automaker announced today in addition to programs by Volkswagen Group announced in March 2025.

The new customer will offer Surround ADAS as standard equipment across many mainstream and premium models in software-defined vehicle architectures. Compared to first-generation hands-free, eyes-on highway ADAS systems, the Mobileye Surround ADAS approach significantly lowers costs and supports ECU consolidation efforts for automakers by vertically integrating software systems and multiple driving functions on one chip and one ECU, a key feature for software-defined vehicles.

The OEM wasn’t announced, but there aren’t a lot of options to choose from. There’s Ford $F ( ▲ 1.67% ), General Motors $GM ( ▲ 0.05% ), and Tesla $TSLA ( ▲ 0.03% ) as OEMs with high volume that have their headquarters in the U.S.

Stellantis $STLA ( ▲ 2.93% ) is headquartered in the Netherlands, but does have subsidiaries based in the U.S., so that’s a possibility given the vagueness of the announcement.

Who is it?

My initial guess was Ford.

Tesla is obviously on its own. I wouldn’t consider Stellantis a U.S. automaker. And GM has a partnership with NVIDIA, announced in March, and has developed its own solutions through Cruise.

Until I saw this 👇.

Look closely…Where is GM?

What happened to NVIDIA’s partnership with GM?

Maybe GM is the new partner for Mobileye.

Maybe that’s why this announcement was announced when it was, just ahead of Mobileye and NVIDIA’s keynotes at CES.

I’ll also point out that NVIDIA is a relatively new player here and could be a threat to Mobileye. But look closely above. Only 2 of the top 14 automakers in the world are listed in NVIDIA’s presentation, and no company based in the U.S. or Japan is a partner with NVIDIA. (Stellantis is the #5 automaker by volume with 5.5 million units and BYD is #7 with 4.3 million.)

But Mobileye has VW as a partner, and they’re #2 globally with 9 million units, and either GM at #4 (6 million) or Ford at #6 (4.5 million) would make Mobileye’s partner platform bigger than NVIDIA’s.

The momentum for Mobileye amounts to $24.5 billion in projected revenue through 2033, which would be about $3.1 billion annually.

That’s more than 50% higher than revenue today. And remember, these wins likely won’t provide significant volume until 2027 and beyond.

More wins for higher-level autonomy, even if it’s Surround ASAD and not Chauffeur or Drive, will push the pipeline even higher.

The autonomy growth story is real at Mobileye, and it’s gaining momentum both in capability and backlog.

Betting on Robotics

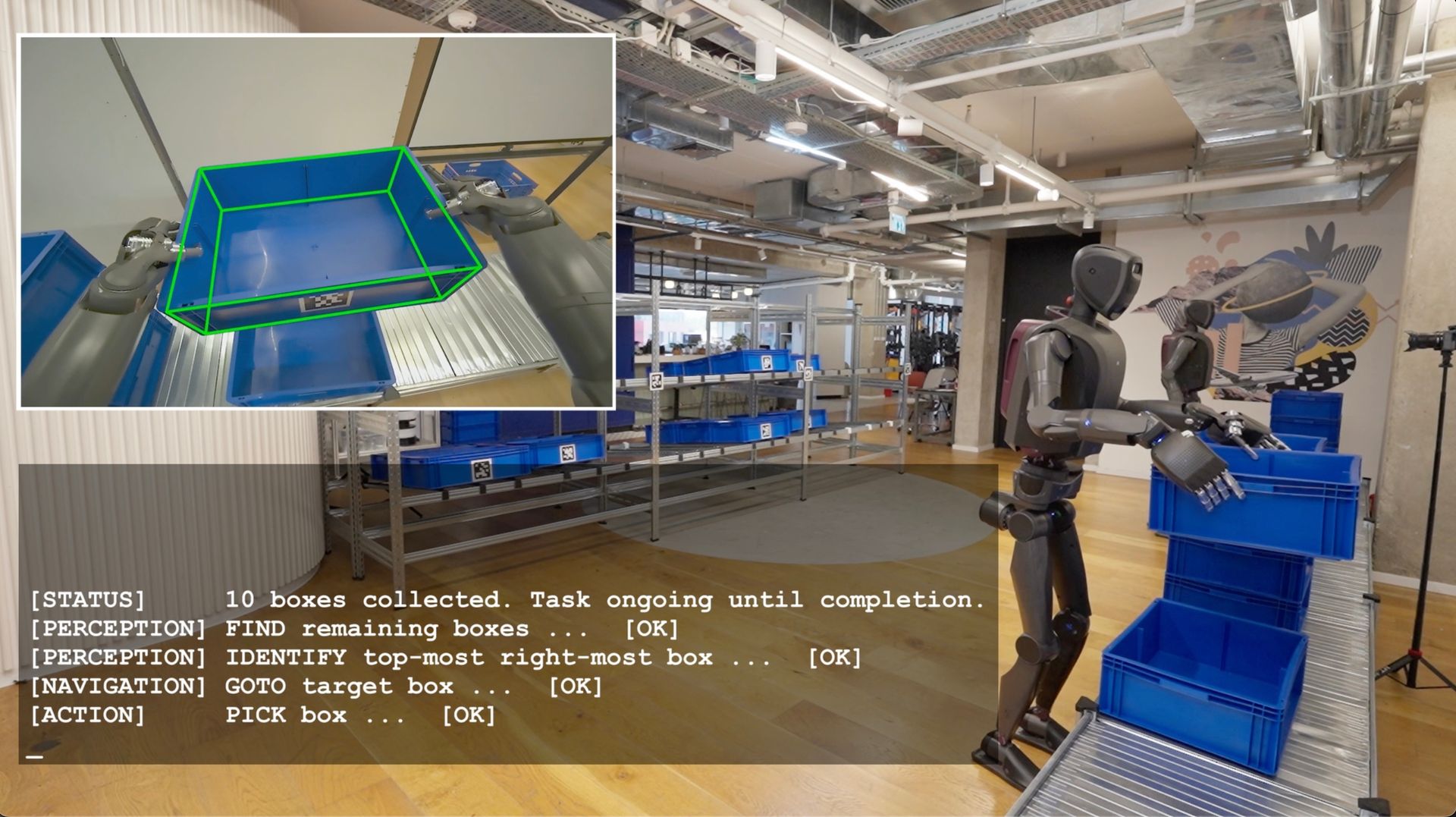

The attention that’s getting more attention today is Mobileye’s $900 million acquisition of Mentee Robotics.

This obviously gets Mobileye into a hot market, but let’s be upfront about there being significant conflicts of interest. Mobileye CEO Amnon Shashua and CTO Shai Shalev-Shwartz are co-founders of Mentee and will obviously be getting a big payday.

That doesn’t mean this deal won’t work out for Mobileye, which has the cash to pay the $612 million portion of the acquisition, but it does raise my eyebrows.

The idea behind the Mentee robot is that it can watch a human do a task, train itself on that visual input (“mentoring”), and execute the task based on what it learns and feedback over time.

Everyone from Tesla to Google to NVIDIA is convinced that autonomous driving and robotics are more similar AI problems than they are different, so maybe this makes sense.

I guess it’s optionality and a growth opportunity.

I’m skeptical that this will be a big deal and don’t want Mobileye to be distracted, but I’m willing to see how this plays out. Maybe Mobileye will be a trusted partner for manufacturers?

Mobileye’s Upside

A design win for more advanced autonomy features is big for Mobileye because the company is winning higher revenue sales than it has had in the past.

Here’s a look at the levels of autonomy and the average sale price expected for each product.

Product | Price Range | Level of Autonomy |

|---|---|---|

Base ADAS | $45-$55 | Level 1 - Smart Follow, Lane Assist |

Surround ADAS | $100-$200 | Level 2 - Hands-Free |

SuperVision | ~$1,500 | Level 2+ - Eyes-On, Hands-Off |

Chauffeur | $2,500-$3,000 | Level 3/4 - Eyes-Off |

Drive | $5,000+ | Level 4 - Robotaxi |

As you can see below, Base ADAS dominates Mobileye’s revenue today.

That ASP should increase by 100%, or more, and “Mobileye now estimates future delivery of more than 19 million EyeQ6H-based Surround systems.“

Revenue will increase even faster if we see SuperVision, Chauffeur, and Drive systems in the future. If those announcements come this year, the momentum in shares will likely continue.

Autonomy Is Playing Out As Expected

I also want to point out that autonomy is playing out exactly as I predicted in 2024 in the Lyft & Uber Spotlight.

Vertical integration business models from Tesla and Waymo are unlikely to be the long-term winners.

Instead, modular business models, where each company focuses on a single piece of the value chain that it does best, will likely win.

Auto manufacturers will…manufacture cars.

Ride-sharing companies will aggregate demand for rides and deliveries. (this is why I own $LYFT ( ▲ 0.36% ) and $UBER ( ▲ 1.26% ))

In the middle will be technology companies like Mobileye. If Mobileye can develop a modular solution from chips to software and sensors that it could sell to any manufacturer.

Uber showed off its Nuro-powered Lucid vehicle this week. Mobileye is the Nuro in this case, but its partners are producing millions of vehicles per year, not thousands.

I like where Mobileye sits in the value chain as the industry plays out. Having the right business model doesn’t guarantee success, but it stacks the deck in our favor.

And that’s the best thing we can do as investors.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.