Spring is in the air, but at retailers all across the country, the topic is Christmas.

What are they going to put on shelves?

How much is the product going to cost?

And how much are they going to charge?

As it stands today, tariffs on imports from China are 145%. If you’re planning on buying toys, blankets, a portable speaker, a hat, or just about anything on a kid’s Christmas list, it probably comes from China.

145% tariffs are no joke for these items.

Just look at the basic math on how a $20 item gets hit by tariffs.

0% Tariffs | 145% Tariffs | |

|---|---|---|

Price Exiting China | $5 | $5 |

Tariff | $0 | $7.25 |

Import Cost into the U.S. | $5 | $12.25 |

Product Company Mark-Up | 2x to $10 | 2x to $24.50 |

Retailer Mark-Up | 2x to $20 | 2x to $49.50 |

Shelf Price | $20 | $49.50 |

Prices would go up 150% in stores...or more!

I’ve heard the ballpark math is a 4x increase in prices because tariffs may go up from here.

And these decisions need to be made NOW!

More on that in a second.

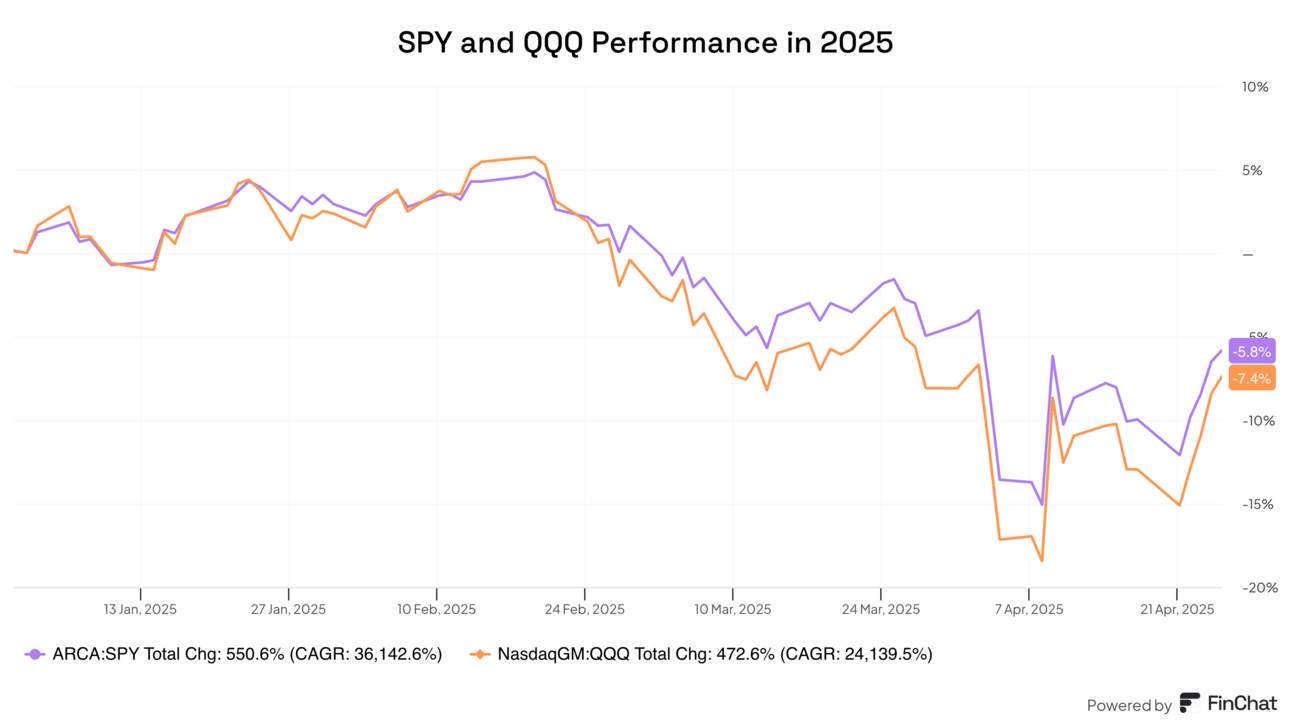

I’m writing this with a backdrop that the market doesn’t seem to be worried about tariffs. Stocks are back within shouting distance of breakeven for the year.

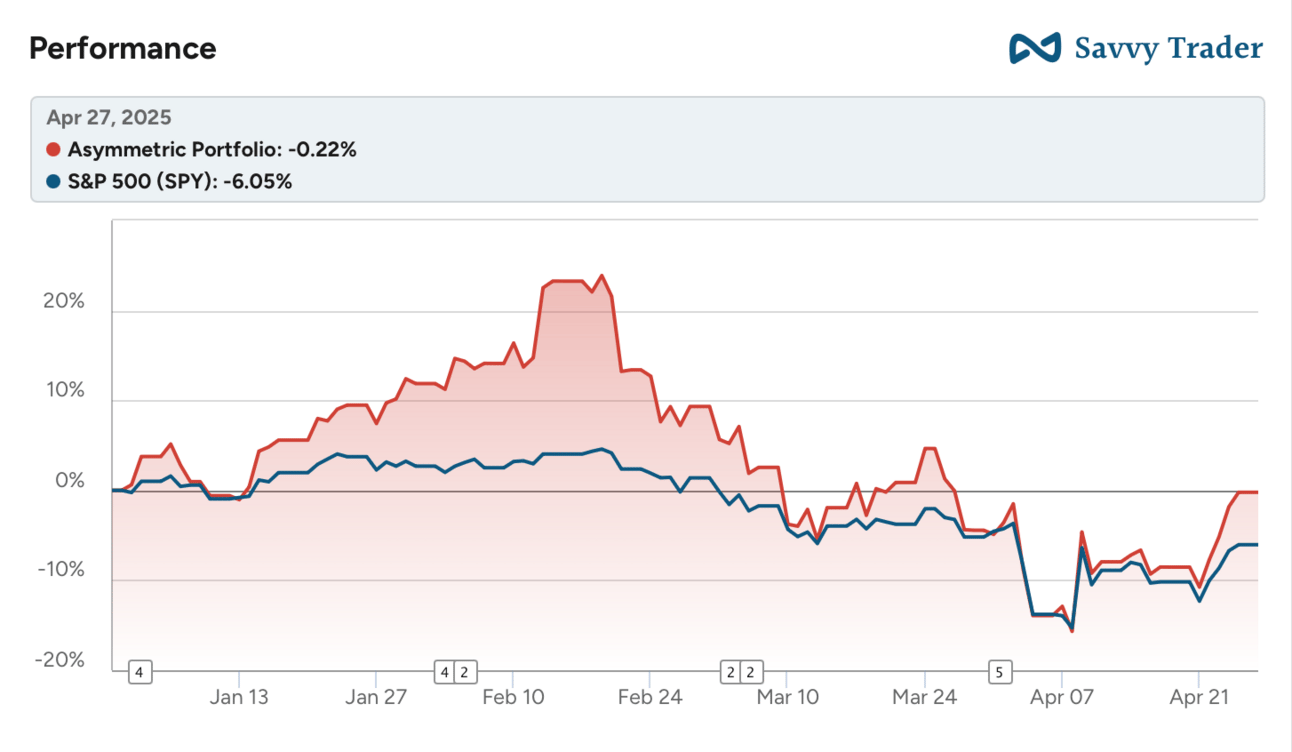

The Asymmetric Portfolio is also nearly breakeven for the year. And outperforming the market in a down year is a feat for my style of investing.

FinChat rarely runs sales, but they’re running one this week. Starting tomorrow, you can get 25% off through this link.

All of the charts you see here are easy to make, research like finding transcripts and insider buys is easier than ever, and you can even ask an AI about earnings transcripts. I can’t say enough how much easier it’s made my research, and you can start with 2 weeks free. 👇

In Case You Missed It

Here’s some of the content I put out this week.

The Game Is Rigged: Insiders are making millions by knowing about tariff news and White House comments before they go public. That’s why we need to play a different game.

Mobileye’s Robotaxis Are Coming: Robotaxis powered by Mobileye are coming to Lyft and Uber next year.

Alphabet’s AI Chapter: Alphabet may be better positioned in AI than you think.

Who Stole Christmas?

The decisions for retailers aren’t easy.

They need to balance price with anticipated volume and buy the right amount of inventory.

Get inventory wrong and you’re screwed.

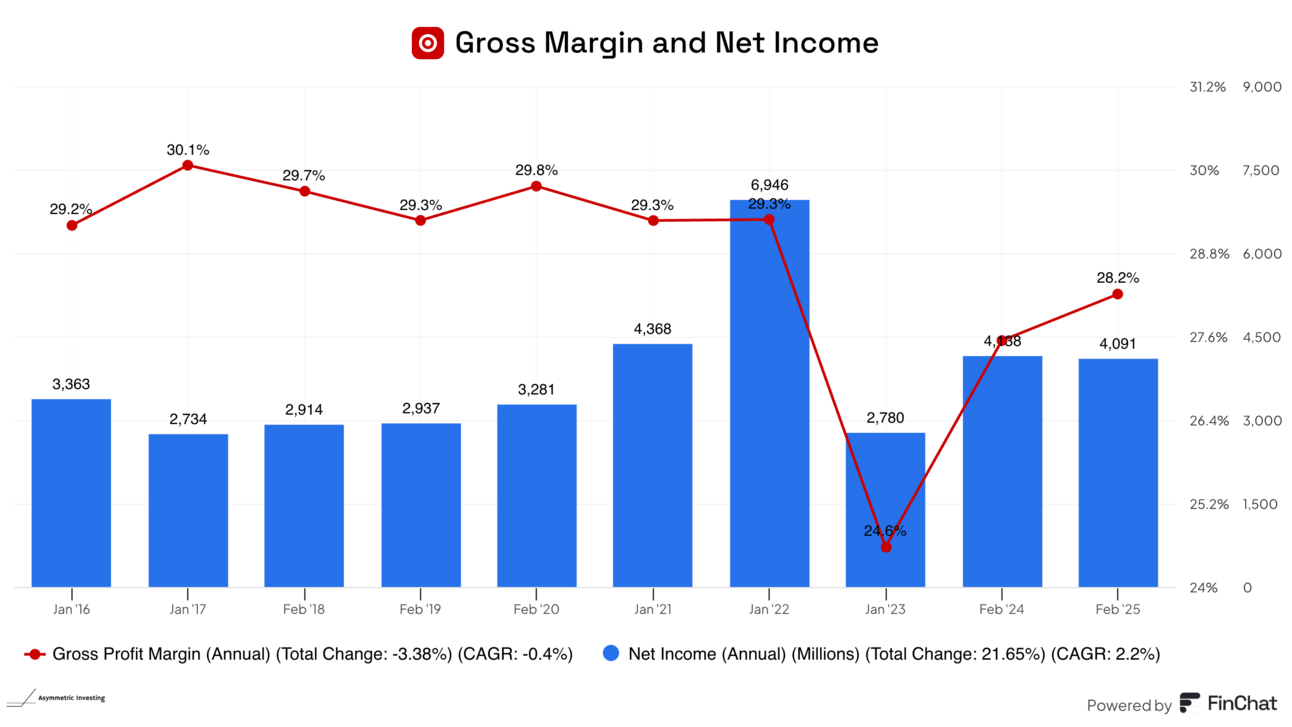

On the chart below, can you spot when Target bought too much outdoor furniture, thinking COVID-era spending would continue for another year?

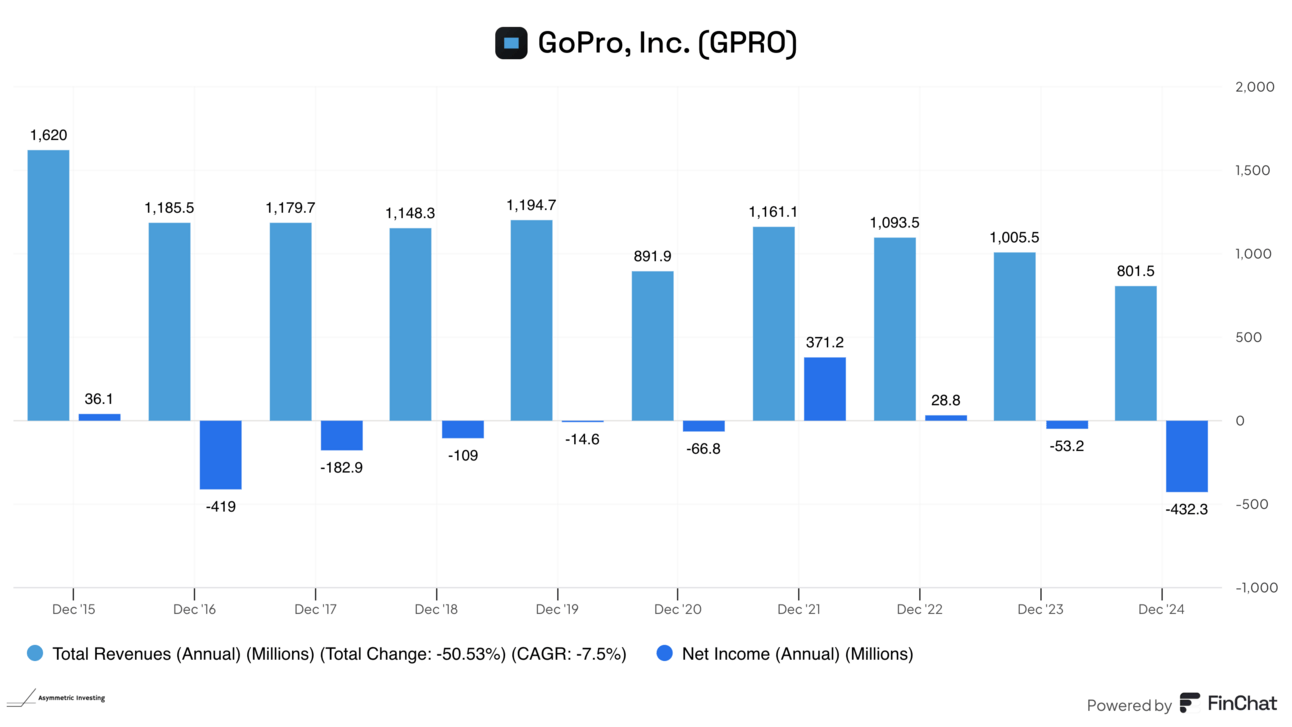

GoPro nearly bankrupted itself in a single year in 2016 when it bought too much inventory of a product people didn’t want to buy during the holiday season.

These are high-stakes bets companies make every year.

And now we have a massive wrench thrown into the system.

What happens to toy volume when the price increases from $20 to $50?

To complicate that question even more, what happens to toy sales when you also consider that socks are 150% more expensive, and so are shirts and shoes, and grocery costs are up as well?

Retailers are talking about empty shelves for the holidays because everyone in the value chain is terrified of what happens if they get inventory and pricing wrong.

The low-risk option is to order too little.

If that happens, Christmas won’t be much fun for anyone.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.