On Tuesday morning, Treasury Secretary Scott Bessent held a closed-door meeting with large investors like hedge funds and pension funds at an event put on by JPMorgan. He said the trade war with China was “unsustainable,” and he thought tension would come down soon. Not surprisingly, the market shot higher when news of his comments broke.

Bessent knows the market hangs on his every word about tariffs, so who did he tell?

Wall Street insiders.

He didn’t make the comments when the market was closed either, which is the standard time to release market-moving news.

Let’s be honest. Wall Street has a leg up on all of us, and this is just another example of how.

The game is rigged.

You know it.

I know it.

To make matters worse, someone inside the meeting may have made a $2 million profit in 30 minutes on this (not quite illegal) inside information.

The outrage on Twitter was widespread.

And even Bloomberg’s Joe Weisenthal, who works for the publication that broke the news, is asking questions.

Here’s the hard truth. This happens all the time.

We can’t beat Wall Street at its own game. I realized that in 2009 when I interned at a hedge fund and saw what high-frequency trading looked like up close. They have more screens, faster information, better algorithms, and computers sitting next to the exchange to beat you at every step.

We could get upset about this, or we could realize that this is the reality of markets.

It always has been.

One of the most interesting books I’ve read on the market is Jim Cramer’s Confessions of a Street Addict. He’s not a particularly insightful investor. Rather, he tells the truth about how the game was played in the 1990s.

Corner a CFO at a conference and get them to spill if they would beat estimates next quarter or not.

Call up every analyst and tease out who is upgrading or downgrading a stock the next day.

Befriend an analyst high enough in a publicly traded company to know something but low enough to be off the radar of regulators.

The trading of Anacott Steel in the 1987 movie Wall Street shows an example of how this was done — and if you haven’t seen the movie, it’s a must!

In the short term, insiders have the advantage. It’s a game of milliseconds or information, and you and I don’t have an edge in either.

The faster you accept that, the faster you can accept where we do have an advantage.

Thinking Long-Term

While the game is rigged short-term, it’s inefficient long-term.

If it weren’t, the market would have valued companies like Alphabet, Netflix, Tesla, and Amazon more highly early on.

We have a disadvantage in the market today and this week, but extend that timeframe and we have an advantage over traders.

Why?

The ability to differentiate by milliseconds doesn’t translate to the ability to see strategic shifts in an industry or new markets forming and compounding for decades.

This is our advantage.

It’s why I’ve been talking about autonomous driving and adding leaders like Uber, Lyft, and Mobileye while the market was chasing shiny robotaxis from Tesla. Long-time readers shouldn’t be surprised that Volkswagen, powered by Mobileye, will be launching autonomous vehicles at scale after years of testing and using Uber’s network.

Mobileye’s $MBLY ( ▼ 0.54% ) stock is up over 10% today, partly driven by this news. And we had an advantage by seeing this coming months ago.

Thinking long-term has, and will continue to, give us an edge in autonomy.

We can take a simple thesis like “the blockchain will be disruptive and Coinbase is the blockchain leader” to market-crushing returns without worrying about whether this quarter beat or missed the analyst’s guess at revenue and earnings.

The advantage we have is thinking on a different timeframe from Wall Street.

With that strategic thinking in mind, eventually, you get news that PayPal and Coinbase are working together to disrupt payment networks. I couldn’t have told you when this announcement would happen or who the deal would be with, but it’s this type of disruption that I discussed in the Coinbase spotlight in 2023.

If we try to play Wall Street’s game, we’ll lose.

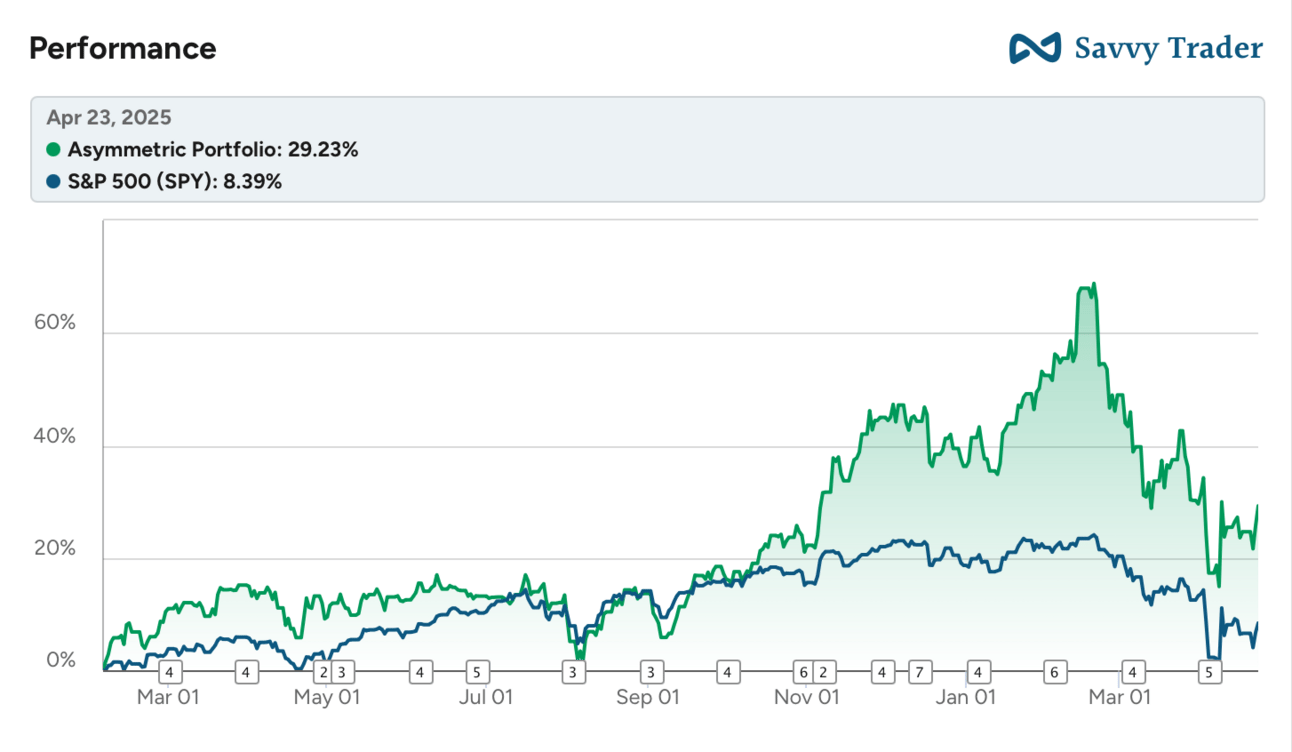

But play the long game, and we’ll slowly get outperformance, like this.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.