One of the things that often surprises people about Asymmetric Investing is that I don’t typically invest in small, unknown companies.

Instead, most of the portfolio is in the most well-known names on the market. Alphabet (#1 holding), Hims & Hers (#2), Robinhood (now #3), Zillow (#7), and Uber (#8) are just a few examples of well-known and highly followed holdings.

And I still see opportunities ahead for these companies.

Understanding why is key to understanding why I see them as opportunities.

To follow my portfolio, you can become a premium subscriber to the newsletter, or you can follow it on Autopilot.

The Reason Behind Investing in Big Names

One of the things I try to do is understand why things have worked out the way they have in the past.

I’ve written a lot about how formerly strong brands like Kraft, Budweiser, and Coca-Cola have lost their power position, as limited shelf space that drove supply’s advantage shifted in an internet world of unlimited shelf space.

But where are the opportunities?

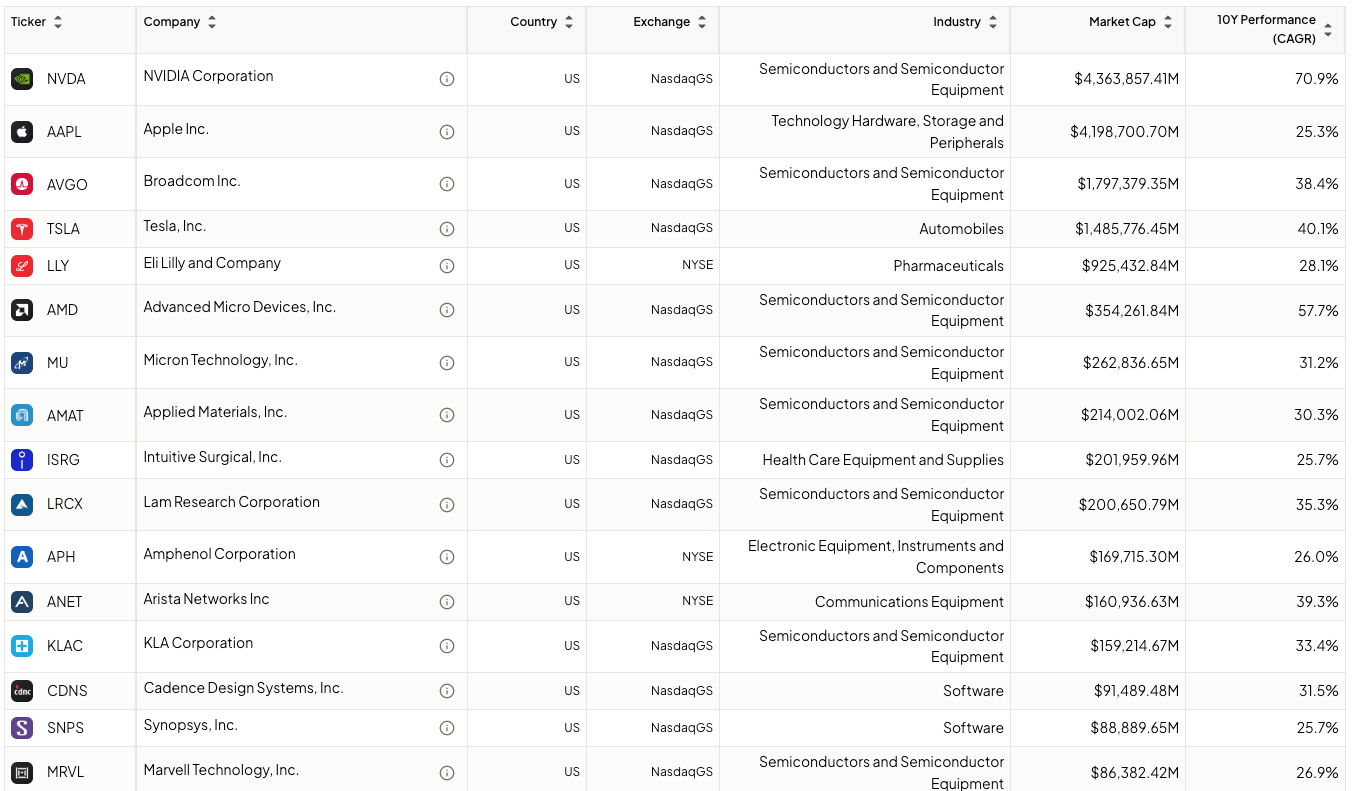

A simple screen of the stocks that have generated a 25% compound annual return (25.9% is a 10x in 10 years) shows that most of the big companies on the list were household names a decade ago. And yet, they still generated huge returns.

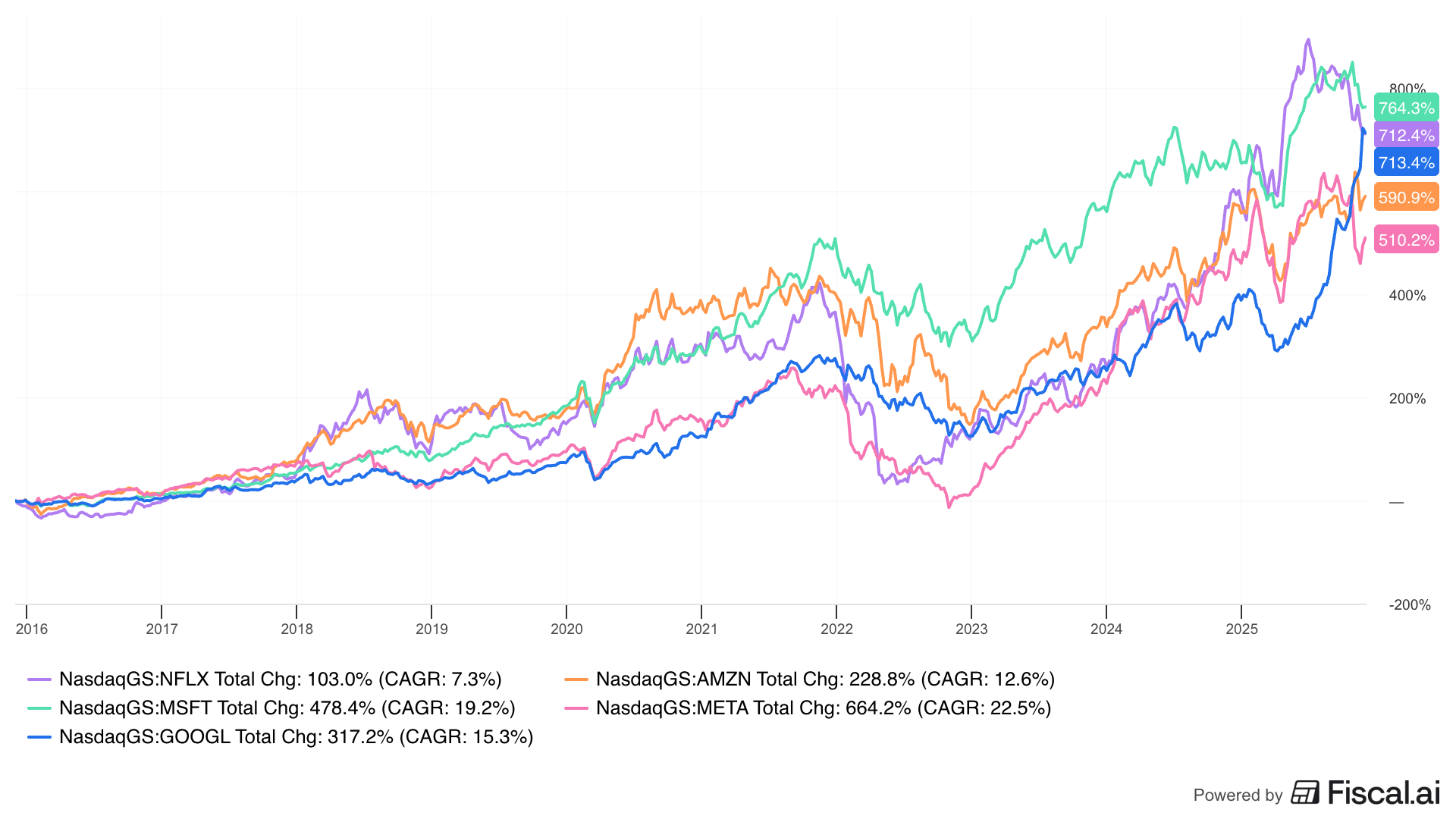

Even if we look at some of the most popular stocks of 2015, we see that buying any of them would have worked out pretty well. You don’t have to go swimming in high-risk, low market cap pools to find opportunities. They’re staring you in the face.

So, the stocks we talk about a lot can do well and are still often undervalued, given a long-term lens. But why?

Smiling Curve

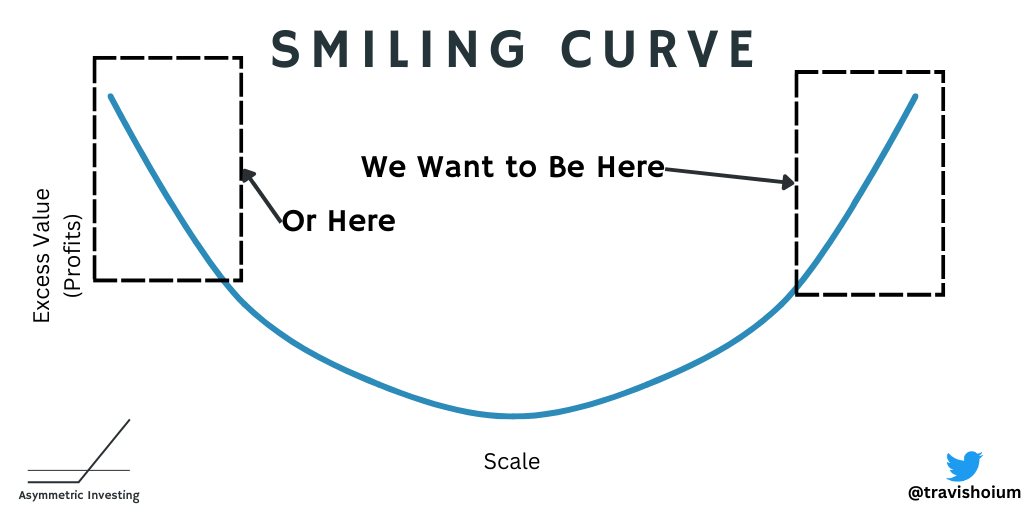

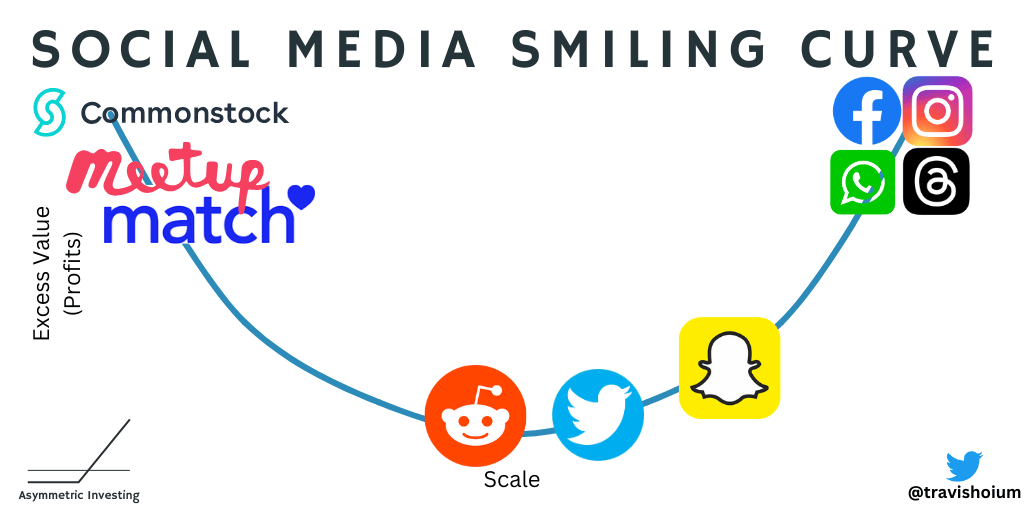

One of the core strategic insights I use is the smiling curve to explain where I want to look for opportunities.

On the internet, there are a myriad of options, so the companies that win usually generate value by attracting the most users (right side of the curve) or operating in a valuable niche (left side of the curve).

On the right side of the scale, companies can build a big business and leverage operations to grow profits in an outsized way. In simple terms, the economics of a company with 1 billion users are much better than a company with 100 million users. And in a global industry, the upside can be several billion users of your product.

Advertisers want to reach the platform with 10x the scale, which drives higher revenue per user, and that extra money can be used to continually make the platform better and more attractive for users and advertisers.

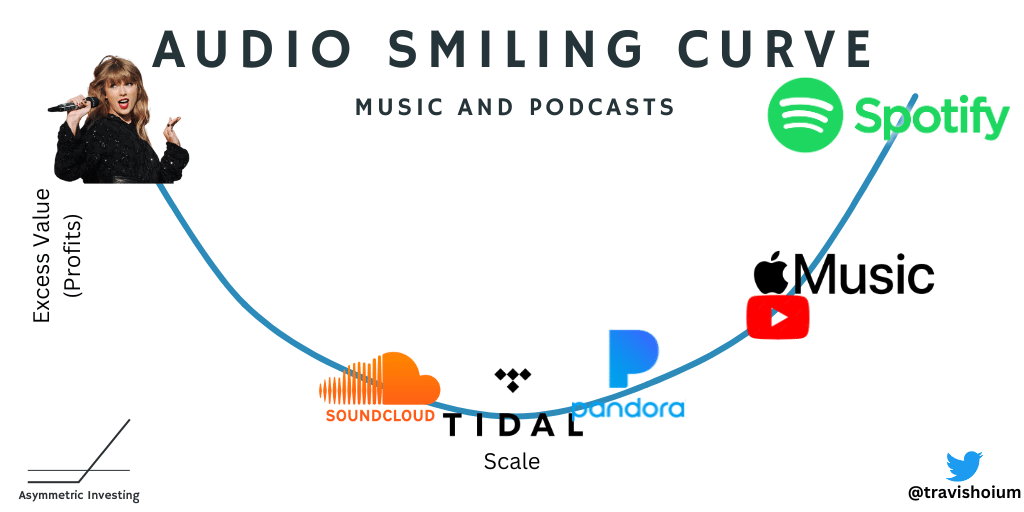

Take music as an example. Why is Spotify a massive company with rapidly improving cash flows, and Tidal, Pandora, and Soundcloud are fading into irrelevance? Because Spotify has more scale!

Social media is the same.

The companies with scale will have a compounding advantage.

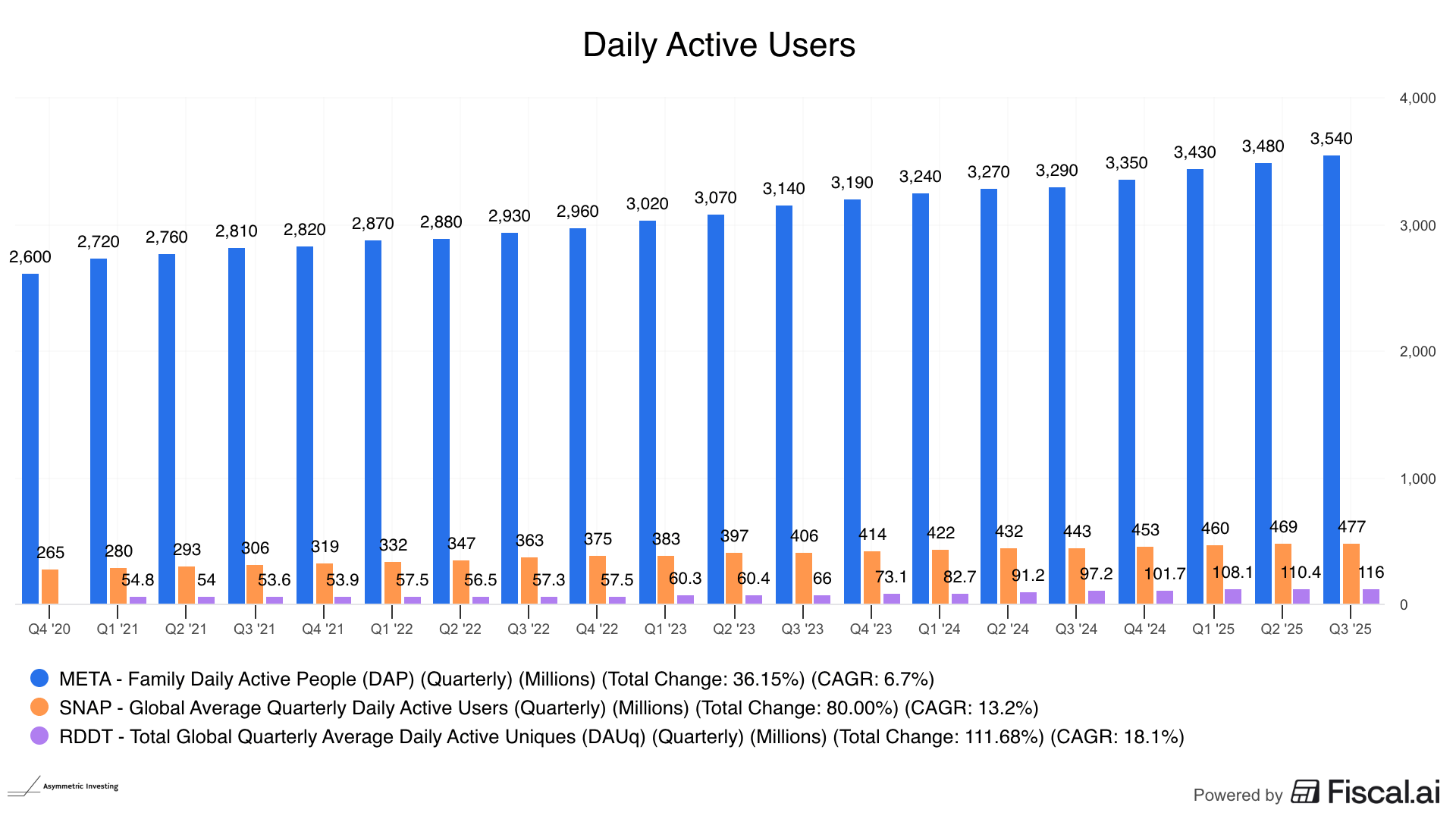

We see this with user numbers. Meta’s lead is compounding despite already serving nearly the entire world.

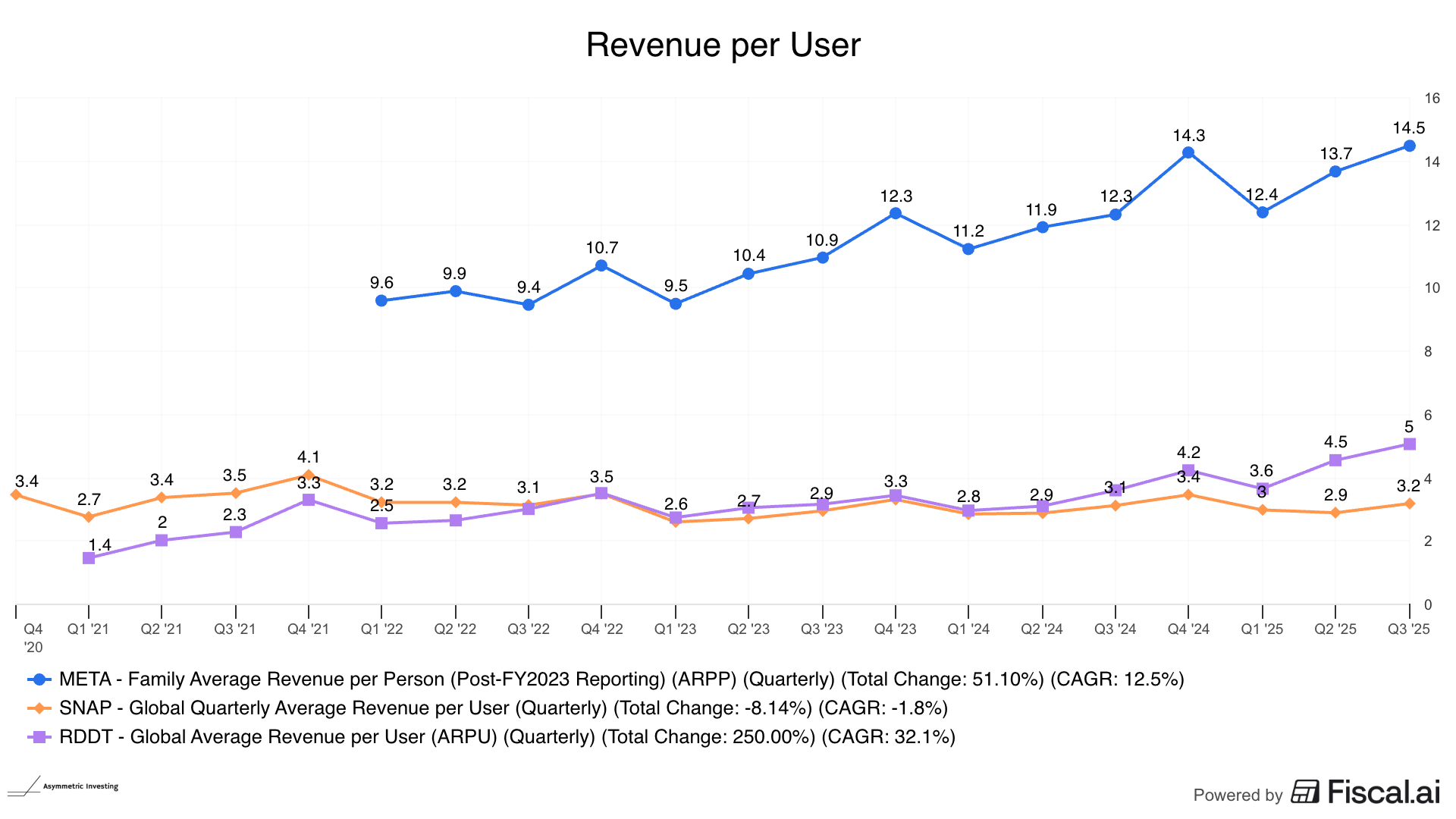

AND revenue per user is higher for the biggest platform, too!

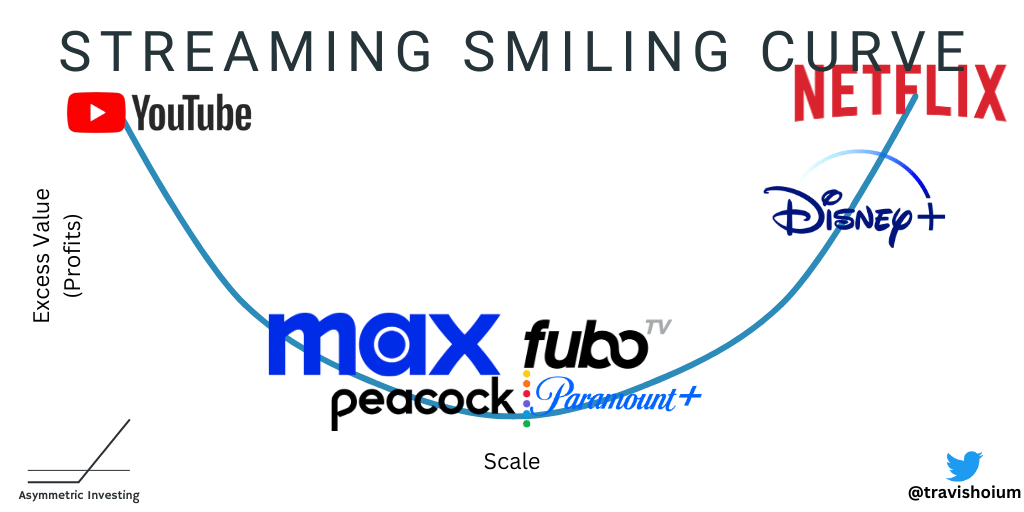

Why is Netflix worth more than all of Comcast, Warner Bros. Discovery, Paramount Skydance, and Disney combined? Because it has more users AND more revenue per user than any other streamer!

None of these outcomes was surprising 10 years ago.

Spotify was already winning music.

Facebook/Instagram was winning social media.

Netflix was winning streaming.

Apple had won in smartphones.

Tesla had won in EVs. The list goes on.

None of these companies did anything revolutionary over the past ten years. They just compounded their winning for a decade, driving market-beating returns.

Compounding Is Hard to Model

How does the market undervalue such obvious trends?

It’s hard to build a valuation model that assumes growth of 20% or more for a long period of time.

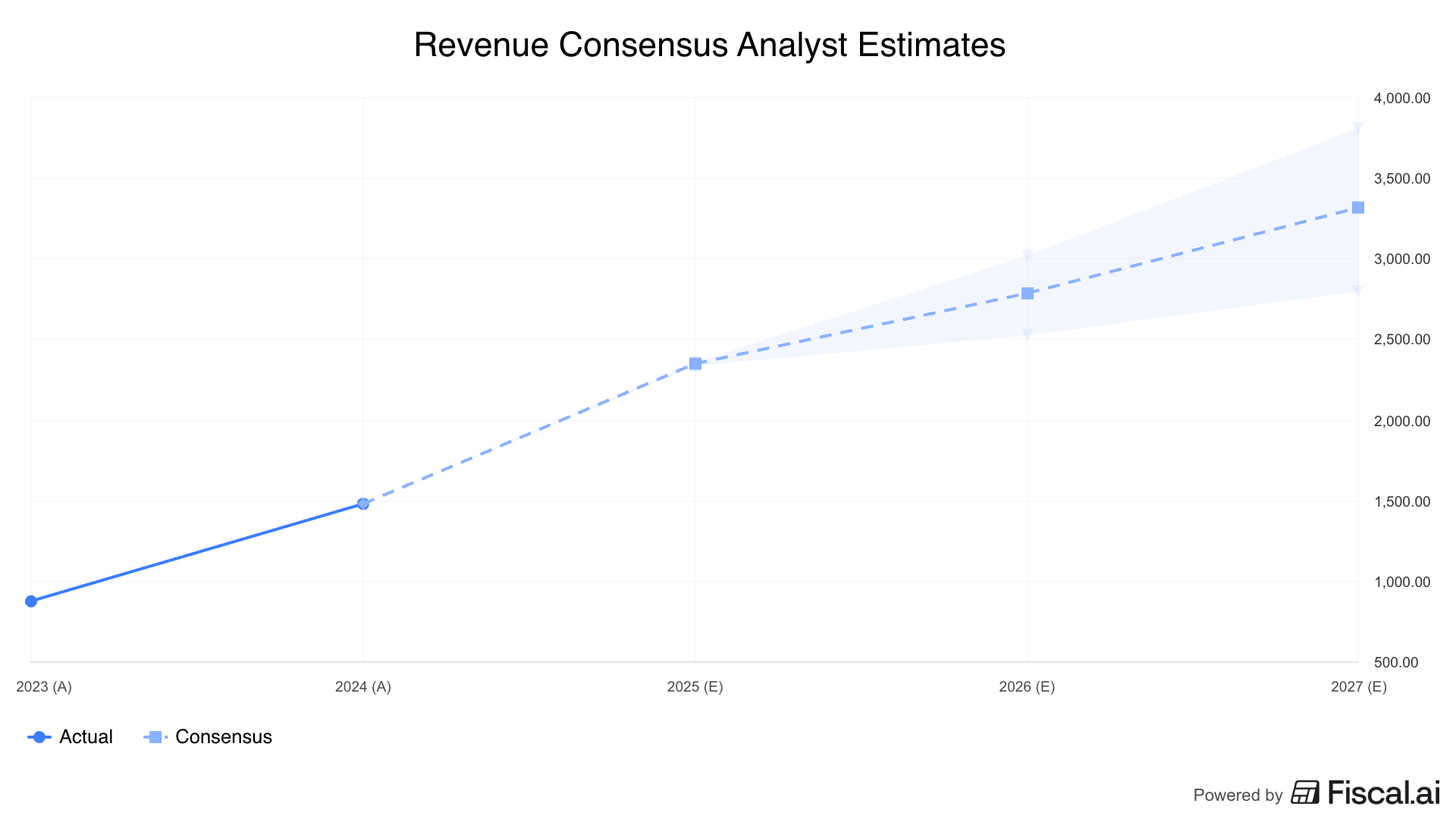

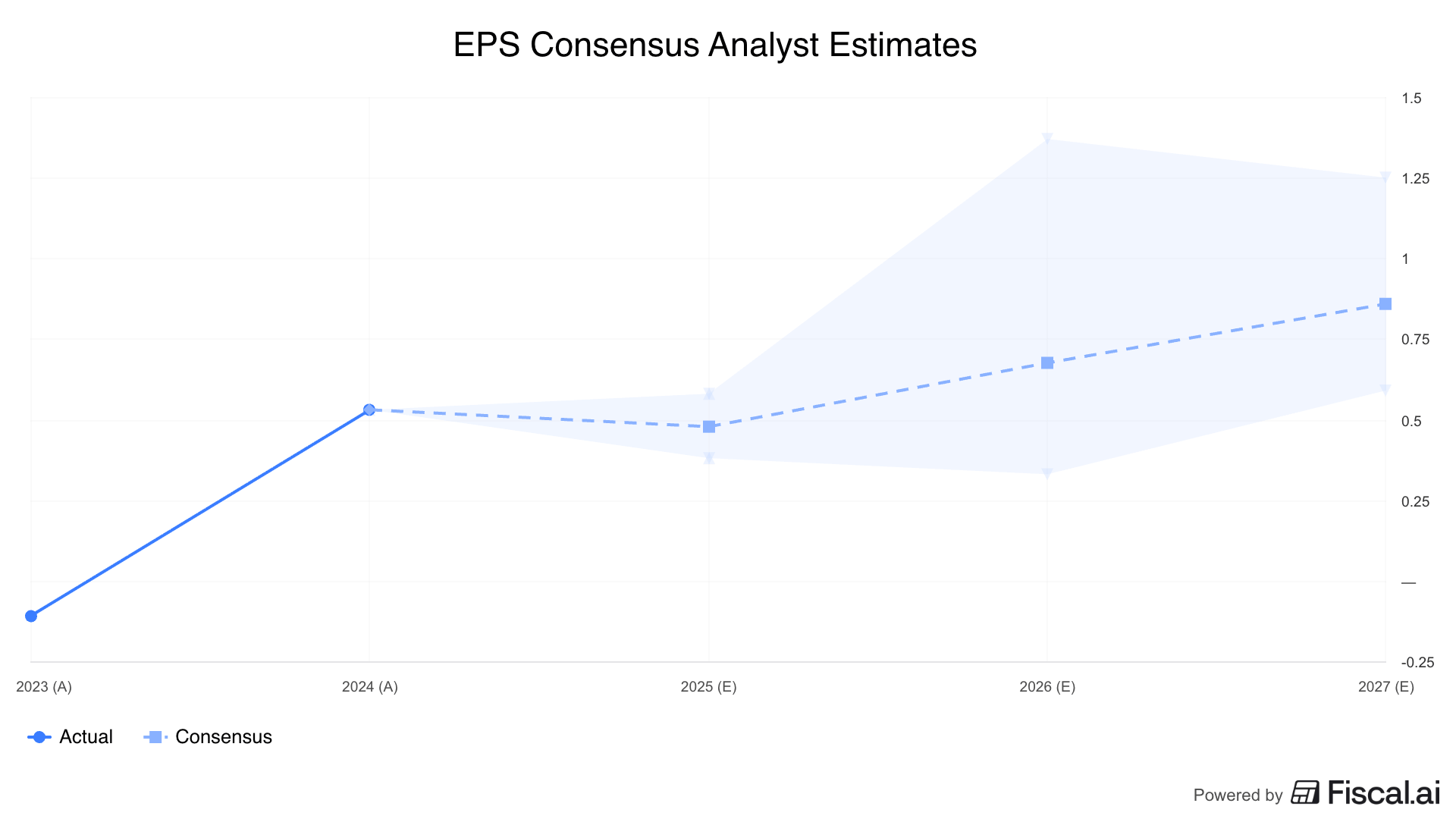

Take Hims & Hers as an example. The company is trying to disrupt the multi-trillion dollar medical and pharmaceutical industry and has grown at a compound annual rate of 77.1% since 2019…

And yet, analysts only expect 18.6% revenue growth in 2026 and 19.1% in 2027.

You can see above that earnings have also been moving up and to the right, but analysts are only projecting a modest EPS increase over the next two years.

Even companies that have proven the ability to grow are being underestimated.

The opportunity is simply holding the companies that can grow double digits annually and let them compound. Eventually, the market will catch up.

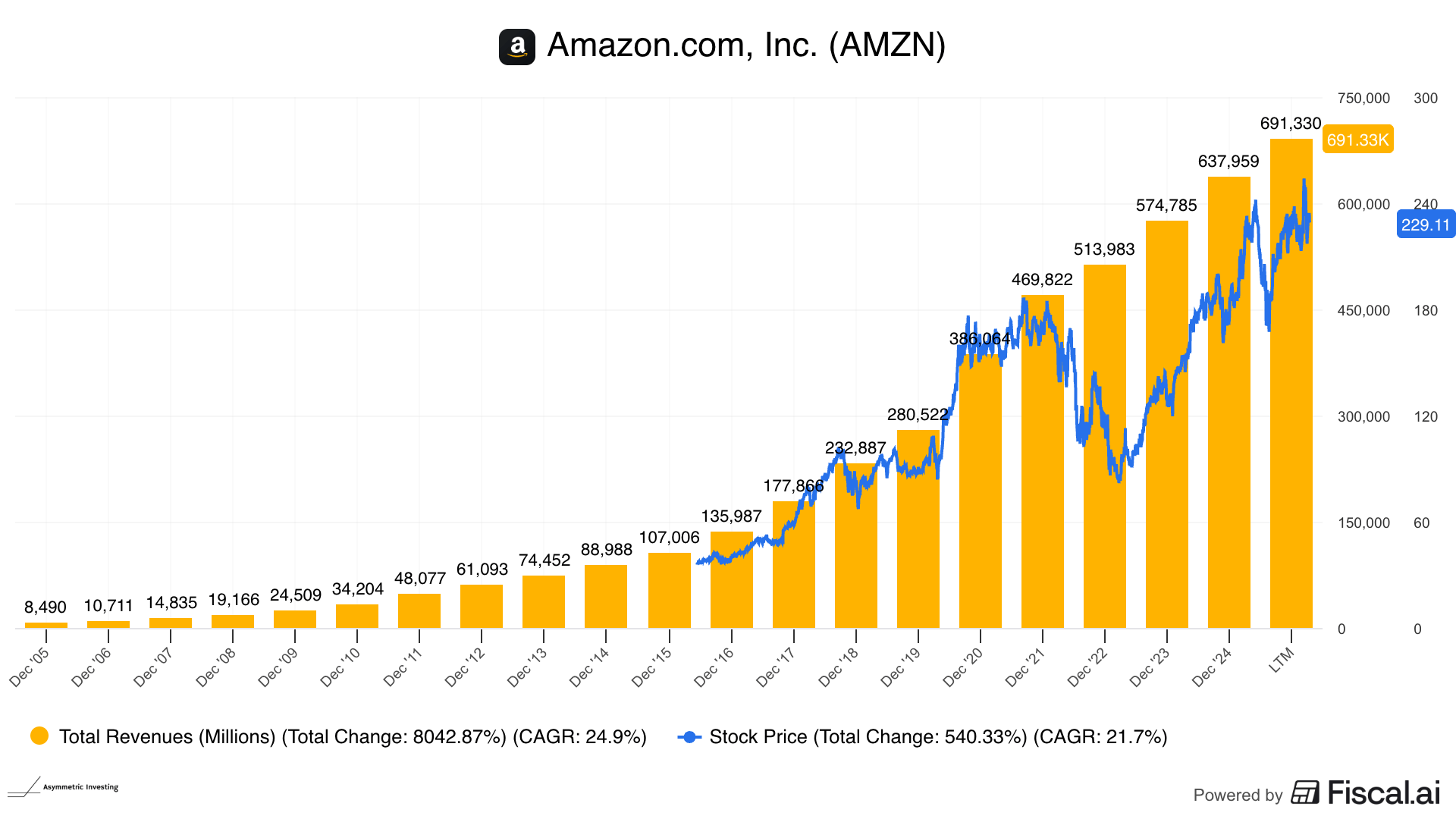

It did when Amazon’s growth compounded at 24.9% for 20 years.

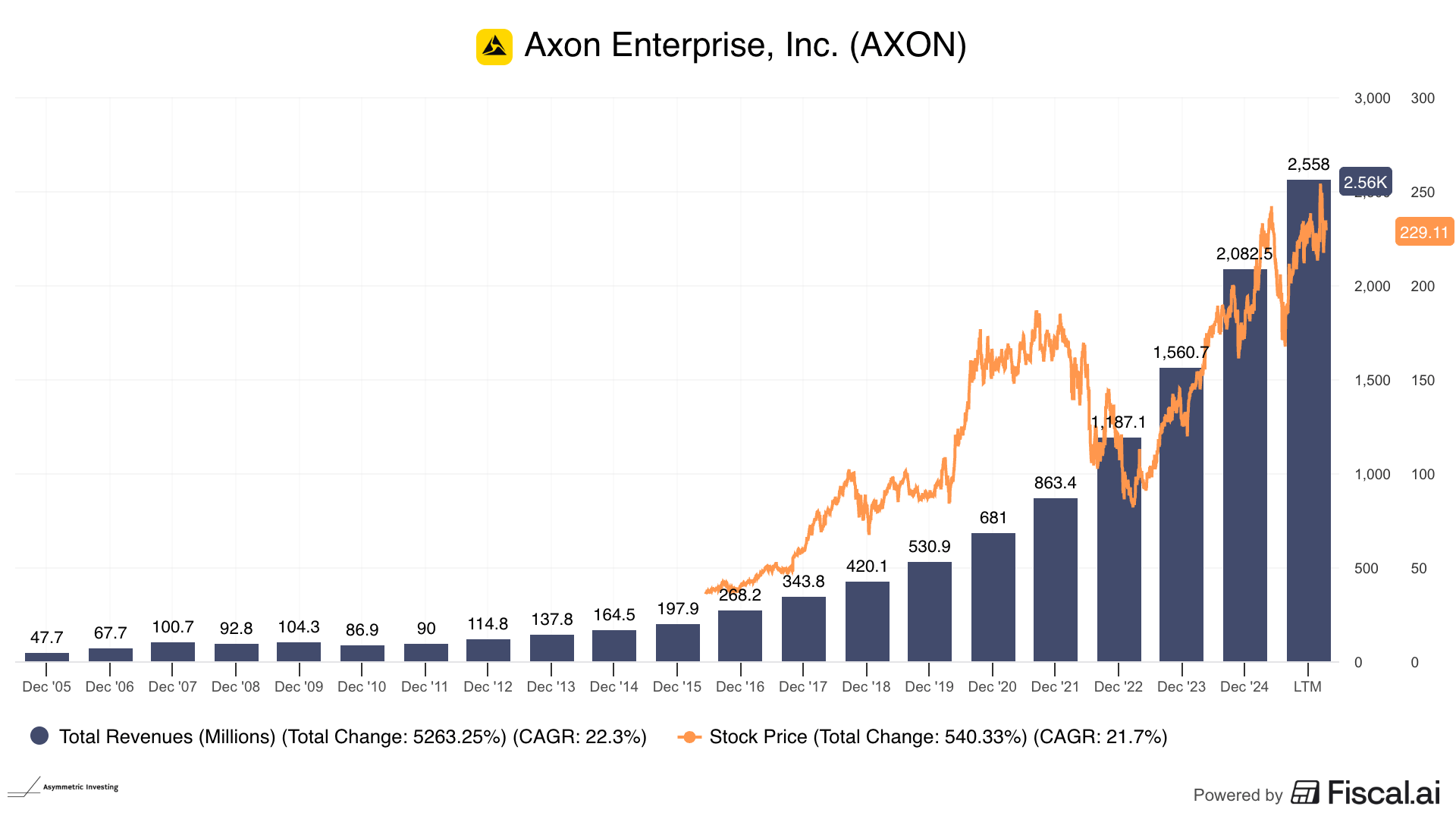

Investors eventually realized Axon’s 30% annual growth that started a decade ago was sustainable.

And Alphabet has been compounding at over 20% since going public.

High levels of growth compounded year after year are nearly impossible to model, which is why the companies that can win in big markets and compound their revenue and earnings year after year are worth holding onto for dear life.

What Will Compound Over the Next 10 Years?

I’ve been explaining how companies have performed over the last 10 years, but I don’t necessarily think Apple, Tesla, and NVIDIA will continue to outperform the market over the next 10 years.

Business models and valuations still matter, and a few companies are winning in potentially enormous industries and have a chance to go from household name to asymmetric returns. In each case, their users and revenue per user will compound, just like the winners above.

Alphabet Will Win in AI: For as much attention as ChatGPT gets, Google is putting up the numbers. The cloud is growing 30%+ year over year, and Gemini 3 shows that Google can build world-class models. I’ve been saying it for years, but Alphabet/Google is the best way to play AI, and in 10 years I think we’ll see them winning as obvious.

Hims & Hers Will Be the Winner in Healthcare: Who is disrupting an incredibly broken healthcare system? Hims & Hers is one of the few names, and as much as it’s a well-known stock today, it may be a household name with tens of millions of subscribers a decade from now.

Zillow Will Win Housing: Where do you go first to look for homes? Zillow? Did you know Zillow is also the #1 place to look for rentals? Zillow is almost a verb in housing, and I think that will be true in a decade. Follow the eyeballs.

Uber Will Win Rides and Deliveries: Uber is the biggest name in ride-sharing today. Are we not going to need rides in 10 years? K-I-S-S

I own every single one of these four stocks because they’re household names today that have a chance to be 10x returns over the next 10 years.

Often, asymmetric ideas are staring us in the face. We don’t need complicated models or theories of what the world will look like to beat the market.

Learn from the past and implement logical strategies to win in the future.

That simple strategy is working and will likely continue to work for many years to come.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.