The best investment thesis is often as simple as “In 10 years I think Company X will be much bigger than it is today.”

The details, frankly, don’t matter all that much.

But we often fret about whether a company missed its quarterly estimates or whether a growth rate is accelerating or decelerating. Below, I’m going to give 5 examples of where zooming out and focusing on the 30,000-foot picture was more effective than a deep understanding of a business.

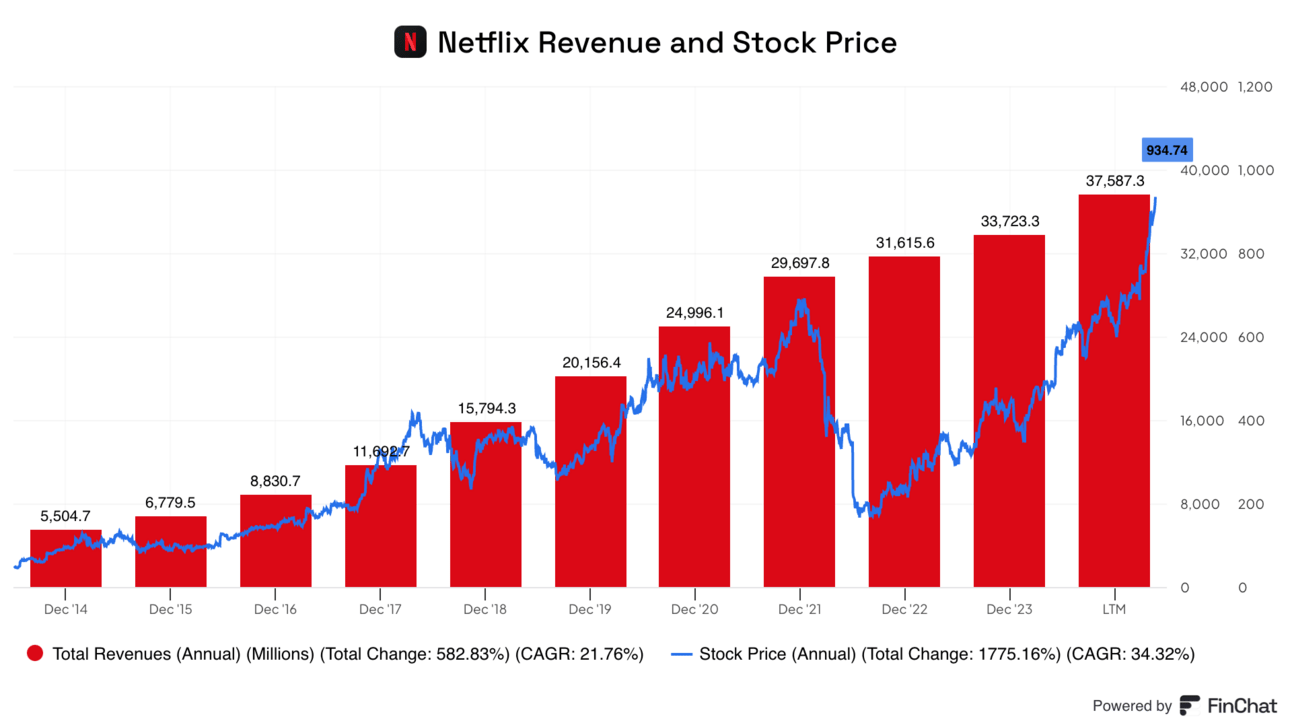

“I like Netflix” can be enough of a thesis to beat the market.

As for the stock market this week, the Nasdaq 100 did extremely well while industrials pulled back. This is a reversal of the trends this fall and early winter when big tech lagged the market, but we’re back on the big tech train.

What can I say about the Asymmetric Portfolio this week? It’s going crazy. Everything seems to be “working”. That won’t last forever, but I’m happy to ride the tailwinds while they exist. As I constantly “zoom out” to assess if I want to sell any of the hot stocks in the portfolio, I look around and see businesses I think can be much bigger a decade from now. So, I’m staying the course.

Asymmetric Investing is a freemium business model, meaning ads make the free version possible. Sign up for premium here to avoid ads, get 2x the content, and gain access to the Asymmetric Portfolio.

The $9M Market Cap Mystery: Why We Believe This Stock is Grossly Undervalued

Bank of America Predicts Gold Will Hit $3,000 by 2025 — This Gold Stock is Just Getting Started.

As gold climbs once again, savvy investors are paying attention. This under-the-radar stock has already posted impressive gains and continues to see strong insider buying, signaling significant growth ahead.

Up 200% in recent years and primed for the next breakout, this hidden gem stock is one you don’t want to miss adding to your watchlist.

This is a sponsored advertisement on behalf of Four Nines Gold. Past performance does not guarantee future results. Investing involves risk. View the full disclaimer here: https://shorturl.at/73AF8

In Case You Missed It

Here’s some of the content I put out this week.

What I’m Buying in December: This is the monthly allocation to the Asymmetric Portfolio. I bought 4 stocks this month.

Commoditizing Complements: One of the best ways to build a moat is commoditizing your suppliers. Amazon is doing just that in AI.

Robinhood is More Than a YOLO Trade: In 2021, Robinhood was a YOLO platform for young traders. It’s a real business with a growing retirement business and expansion opportunities that could last a decade.

2025’s Biggest Disruption Is Here: Autonomous driving will be the biggest theme of 2025 and the big players are already staking out their piece of the industry.

When In Doubt, Zoom Out

At any time since 2007, when Netflix’s streaming business launched, a market-crushing thesis could have been “streaming is the future.”

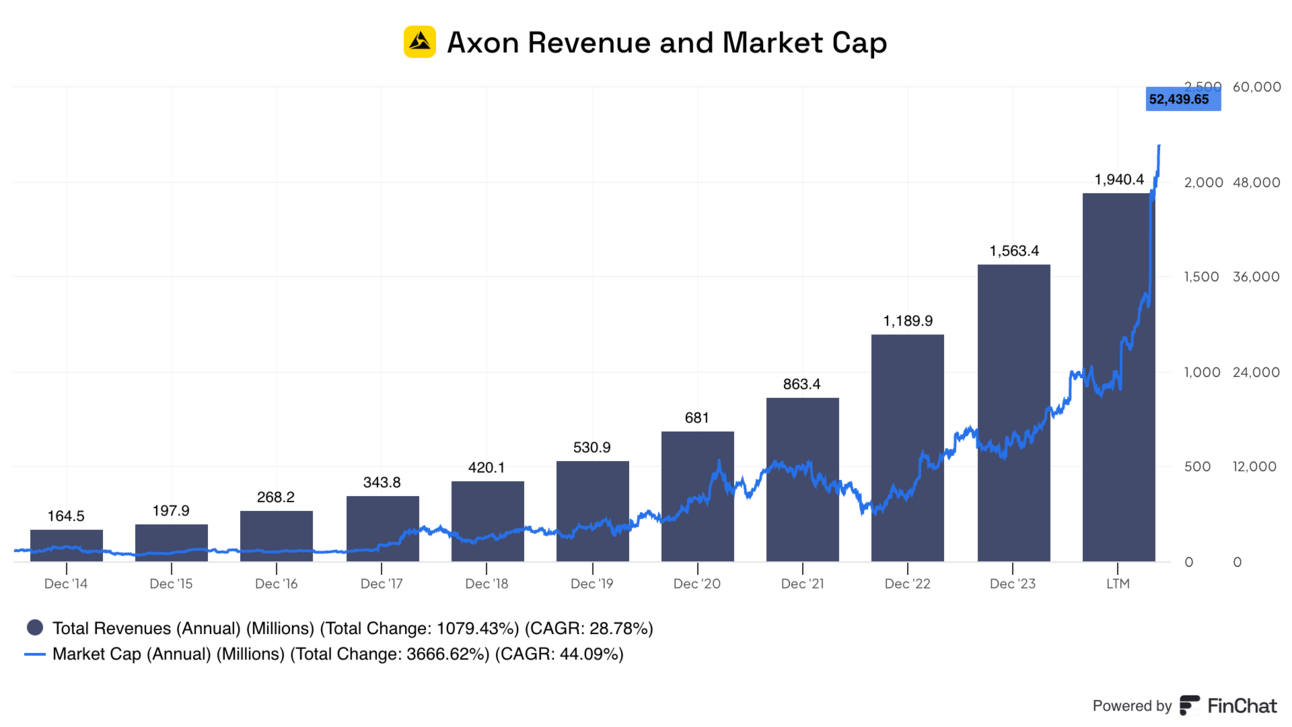

I started buying shares of Axon in 2014 on the simple idea that every police officer should have a body camera and all of that data will likely end up in the cloud (Axon’s cloud). There were bumps along the way, but that simple high-level thesis led to incredible returns.

“I like my iPhone” was a pretty good investment thesis going back as far as 2007.

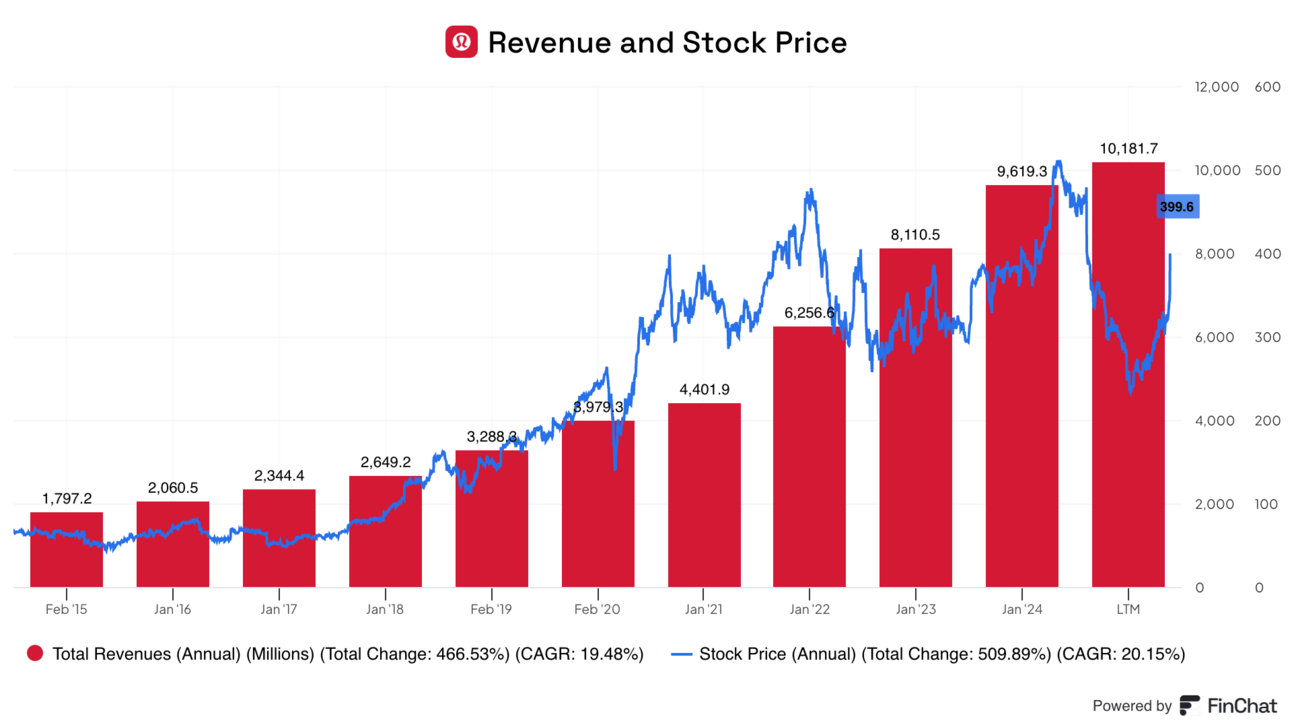

I remember sitting in my apartment in 2007 listening to a friend rave about Lululemon’s pants. The company had just gone public and has returned 2,750% since the IPO. Pro tip: Pay attention to what women are excited about buying!

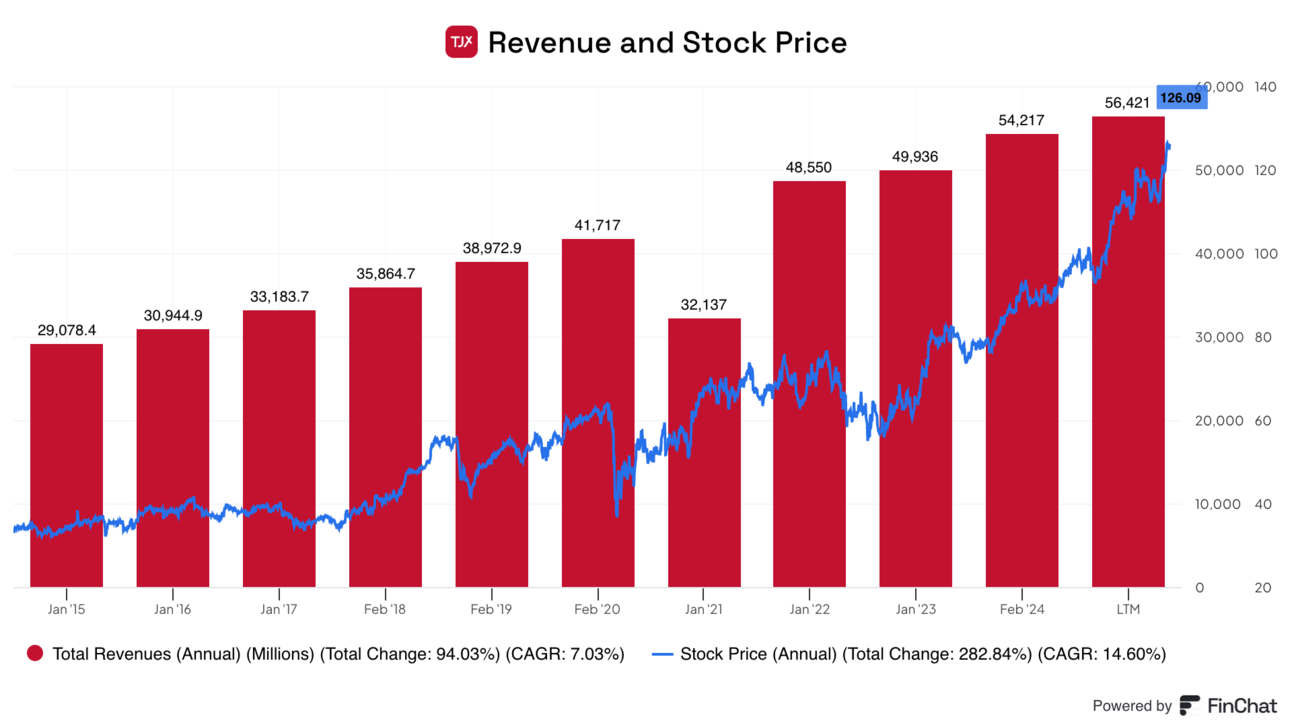

This one blew my mind. Since 1989, The TJX Companies — TJ Maxx, Homegoods, and Marshall’s — has generated a 22,320% return and outperformed Walmart, Costco, and Nike. Seems obvious in hindsight for as many times as I’ve heard, “I’m going to Homegoods.”

When in doubt, zoom out.

What is your 10-year view on an industry or business?

Ask simple questions.

Do people seem to like shopping there? (TJX)

Does “everyone” have it? (Netflix)

Does the market trend seem obvious? (AXON)

Are there lines when a new product is released? (AAPL)

We make investing too complicated by focusing on quarterly numbers and economic reports. The simple answers are often more accurate than the more complicated ones.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.