Last night, President Trump announced a 25% tariff on imported cars and car parts coming into the U.S. This isn’t surprising or out of left field, but the market seems to be surprised it’s now reality and not a negotiating tactic.

Let’s be honest. Tariffs are going to be a reality of the world in 2025 and we might as well talk about them like adults. I’m not here to make a case for or against anyone’s politics, so leave that at the door.

What I am here to do is talk about what the impact of tariffs will be on companies I own, may own, and follow.

I see four potential impacts from tariffs, depending on the industry.

All higher costs are passed on to customers

Higher revenue per unit and maybe higher margins (assuming margin % stays constant)

Potentially lower volume if customers cut back purchases

Some costs are passed on to customers, some costs are eaten by companies

Slightly higher revenue per unit

Lower margins

Less lost volume than #1

All higher costs are eaten by the company

No change in revenue and volume

Lower margins

Higher costs are prohibitive and the supply chain changes to replace imported supply with domestic supply

It’s a question of where each company fits in this continuum the market is trying to decipher today.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Apple's New Smart Display Confirms What This Startup Knew All Along

Apple has entered the smart home race with its new Smart Display, firing a $158B signal that connected homes are the future.

When Apple moves in, it doesn’t just join the market — it transforms it.

One company has been quietly preparing for this moment.

Their smart shade technology already works across every major platform, perfectly positioned to capture the wave of new consumers Apple will bring.

While others scramble to catch up, this startup is already shifting production from China to its new facility in the Philippines — built for speed and ready to meet surging demand as Apple’s marketing machine drives mass adoption.

With 200% year-over-year growth and distribution in over 120 Best Buy locations, this company isn’t just ready for Apple’s push — they’re set to thrive from it.

Shares in this tech company are open at just $1.90.

Apple’s move is accelerating the entire sector. Don’t miss this window.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

The Auto Industry’s Test Case

If there’s a place to test the impact of tariffs, it’s in the auto industry. Higher costs won’t slowly be rolled out, like they may with tariffs on avocados, and vehicles are a discressionary purchase. They’ll likely hit stocker prices within the next month.

What will customers do if the price of a vehicle rises $3,000 to $10,000, as some project?

How will dealers and automakers adapt?

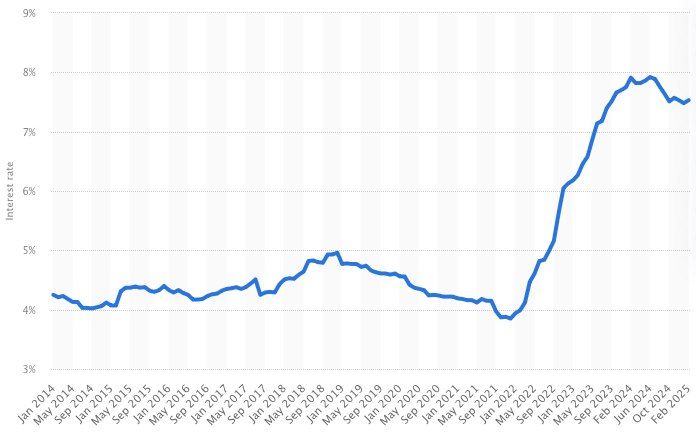

It’s likely we see fewer sales because prices will go up. That said, the impact of imports will likely be lower than auto loans nearly doubling. And that didn’t cripple the industry.

Auto loan rates.

Many vehicles are already manufactured in the U.S. and some components won’t see tariffs yet. So, final assembly can be shifted and component supply could move as well.

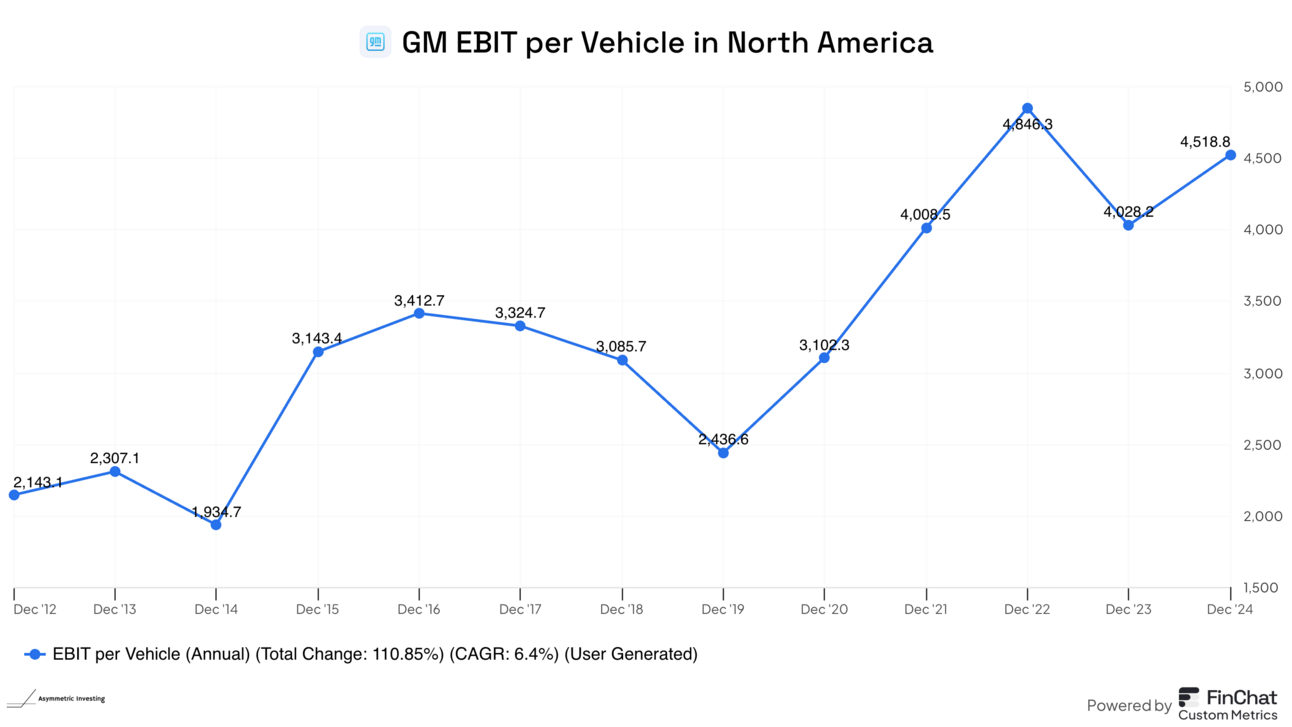

This will take time, but I don’t think it’s devestating for the industry, especially when you look at the profitability per vehicle today. GM may see lower margins in the future, but I think most cost increases will quietly be passed on to consumers and there’s some room to eat tariffs and not destroy profits.

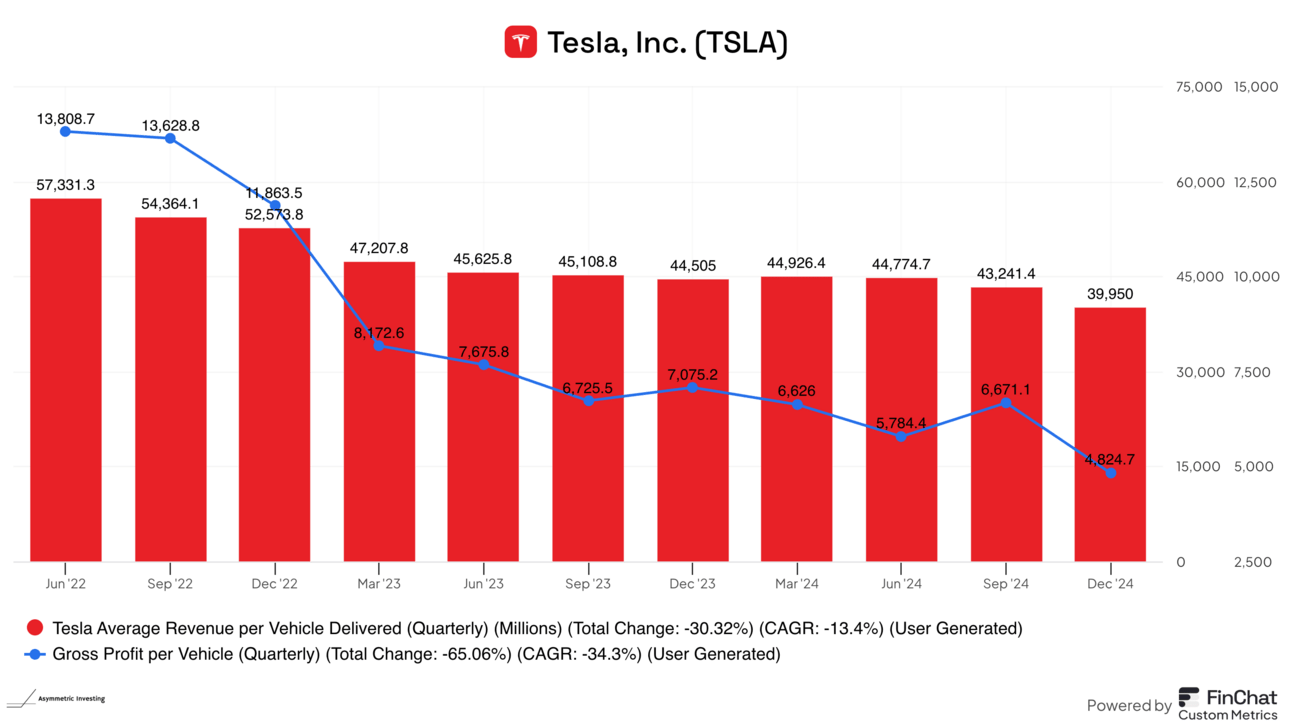

Tesla is seen as the winner from tariffs because it generally has fewer imported components. But supply and demand is more important in the auto industry than the cost of tariffs.

Deliveries are falling despite Tesla lowering prices over the past three years and profitability has plunged since 2022. Tesla may be better off than it was yesterday, but that’s not saying much.

As with most things, “it’s complicated” is probably the right answer when it comes to tariffs.

What I think we can expect is the following:

Slightly higher auto prices

Lower auto volumes

More auto jobs/plants moving back to the U.S.

The president clearly values the last point over the others. Maybe that’s great for the economy long-term? Maybe it causes a recession this year?

What we need to understand is the rules of the road and tariffs are here to stay. It’s now time for management teams to adapt a.

Will M&A Floodgates Open

I think Alphabet made a masterful move this week. It announced the $32 billion acquisition of Wiz, the cloud security firm.

I’m not a cybersecurity or cloud security expert, so I won’t play on here. Everything I’ve read is this is a high price but a potentially valuable asset for Google Cloud to have in the market.

What may matter most about this deal is whether or not it gets through regulators. Under the Biden Administration, Amazon was blocked from buying Roomba, Spirit couldn’t merge with JetBlue, and Meta went through the ringer trying to acquire a tiny VR workout app. This put mergers and acquisition on hold for most of the last four years as big tech companies didn’t even try to buy any startups.

Have the tables turned?

I think this acquisition will be looked at closely by investors and tech because if it’s approved the floodgates open again.

The process will be important as new regulators have said they will be decisive rather than use delay tactics, like the previous administration.

Alphabet is putting the pressure on the administration with this deal because it’s the first big move made by big tech. If this deal closes, others will follow.

If it doesn’t close, investors and executives will be wondering if the talk of a better business environment was all a lie.

I think that’s brilliant by Alphabet. The Trump Administration won’t want to look like it’s anti-business so the deal likely goes through.

How to Invest Now

There’s a lot of uncertainty in the market today and for Asymmetric Investing that’s good. We want to embrace uncertainty because it gives us better prices for great assets to hold long-term as investors try to decipher what the next quarter or two will look like.

I’m not changing anything about how I invest in a tariff-filled world. If anything, it’s made me more bullish on some of the domestic-focused companies like Robinhood, Hims, SoFi, Zillow, and Lyft.

These companies aren’t going to be crippled by tariffs (not that anyone will) and they may see tailwinds if tariffs lead to higher employment and more economic activity. And yet, they’re cheaper today than they were a month ago.

Sounds like buying opportunities are starting to open up.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.