There’s uncertainty all around us. The weather, the economy, our health, and even our safety are uncertain from moment to moment. As humans, we accept most of this uncertainty and go along with our day.

Investors, however, don’t like even the slightest uncertainty. They want to know what interest rates are going to be, how fast the economy is going to grow, and how much companies will earn each quarter down to the penny.

The desire for certainty is understandable in finance. When money is on the line, we want someone to tell us we’re right or wrong with a high level of certainty using concrete numbers. Even if those numbers are made up.

Certainty in financial markets is often derived by calculating the “intrinsic value” of a stock. Investors often talk about how a stock is trading for a premium or discount to its “intrinsic value”, which justifies buying or selling a stock.

But what is intrinsic value and how does it relate to uncertainty?

Intrinsic value is derived from models and spreadsheets that create an attempt to predict what a company will do in the future. Billions of dollars are spent each year building these spreadsheets by people who went to the best of the best schools in the country. And I’ll tell you a secret.

They’re ALL wrong.

The projections are ALL made up.

No one knows the future.

If you’re looking for certainty, investing isn’t for you. Learn to embrace uncertainty.

Sounding Smart vs. Sounding Crazy

If all of the value in a company is quantifiable in a spreadsheet, the only upside is in making a better model than the next investor. That’s not a game worth playing.

Where true opportunity lies is in finding value that’s not quantifiable. Maybe the market doesn’t put value on a business that will ultimately be very valuable. Maybe the market doesn’t believe a company can execute on something. Sometimes the upside is in a product or business that doesn’t exist yet. Or maybe the payoff is so far in the future that traders thinking about the next quarter simply don’t care.

Let me give some examples from the Asymmetric Universe:

Cruise (via GM): Autonomous driving company Cruise could be an enormous business, but Cruise currently generates very little revenue and loses billions per year. There’s nothing certain about Cruise’s future and therefore no value put on it by the market.

MGM Resorts: MGM is building a $10 billion resort in Japan that (I think) could be the most profitable resort and casino in the world, but it may not be completed until 2030 and we have no idea if it will be a success or failure. Given the stock’s valuation today, no value is being put on that project.

Coinbase: Blockchain technology will be disruptive to something, somewhere, somehow. This is the epitome of uncertainty, but it’s like betting on the internet in 1995 or streaming in 2005. There’s something there, we just don’t know what it is yet.

On Holdings: How do you model a company growing 25%+ per year for the foreseeable future?

These are just four examples of businesses that have upside from a business that doesn’t look right on a spreadsheet. And if you can’t model it, the market doesn’t like it.

I know this sounds a little crazy. It would sound a lot smarter to say that a “stock is trading for a 30% discount to its intrinsic value.” But intrinsic value can only possibly calculate what we know. It has no way to put value on what we don’t know.

I think that’s a way to underperform the market long-term.

I’m much more interested in what’s uncertain about investing.

Backtesting the Uncertainty Theory

If we accept there’s uncertainty, it allows us to see opportunities where we may otherwise see risk. I’ll give three historical examples.

NVIDIA has been one of the best-performing companies on the market over the last two decades, but the company you see today didn’t even exist a decade ago. The data center (which includes the AI business) was a spec on the income statement in 2013 and now it’s a $10 billion business that seems to have unlimited potential.

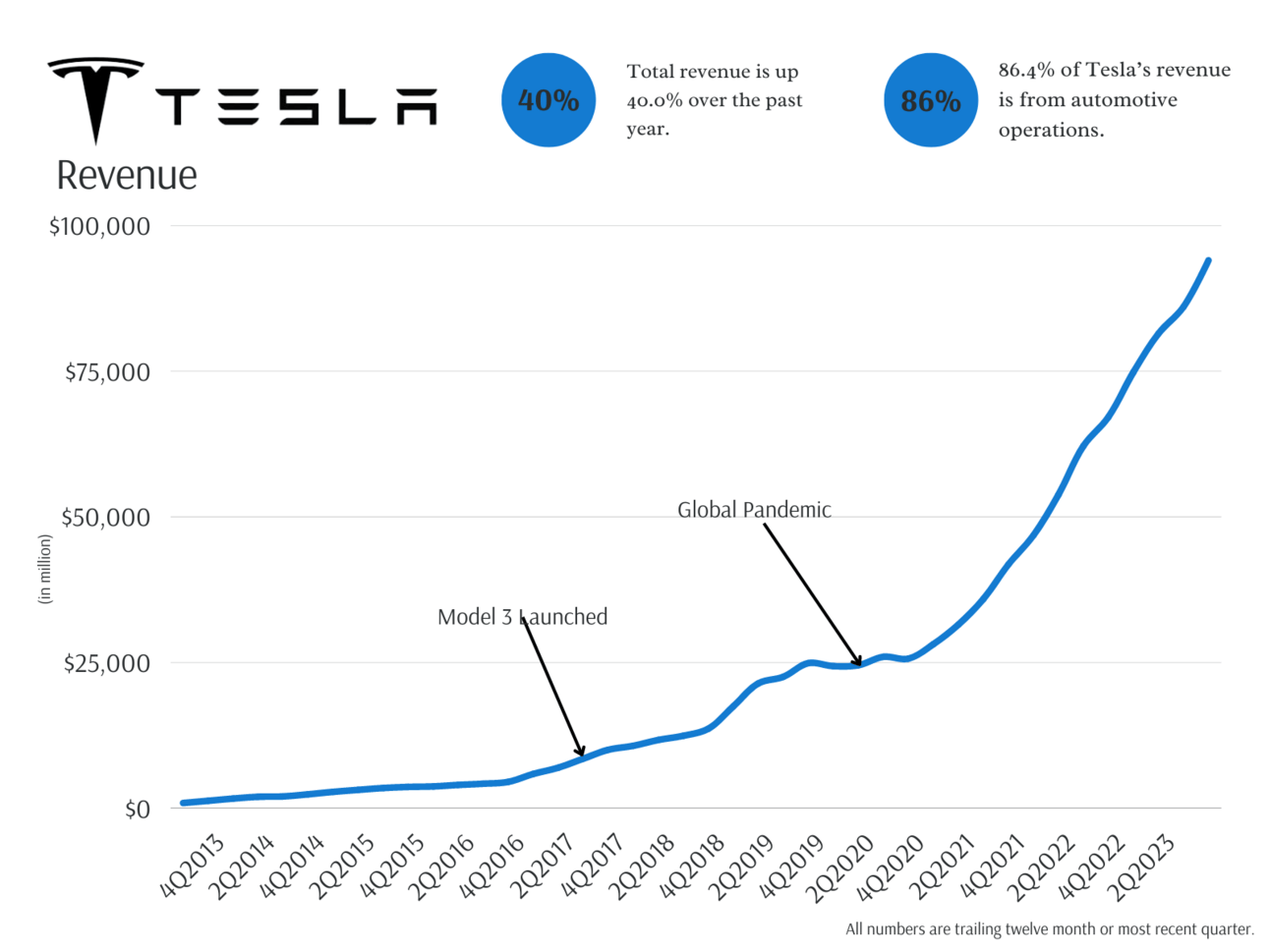

Tesla’s very survival was uncertain when it launched the Model 3. The company was questioned again when the pandemic hit. You can see how the company performed after those two moments in time.

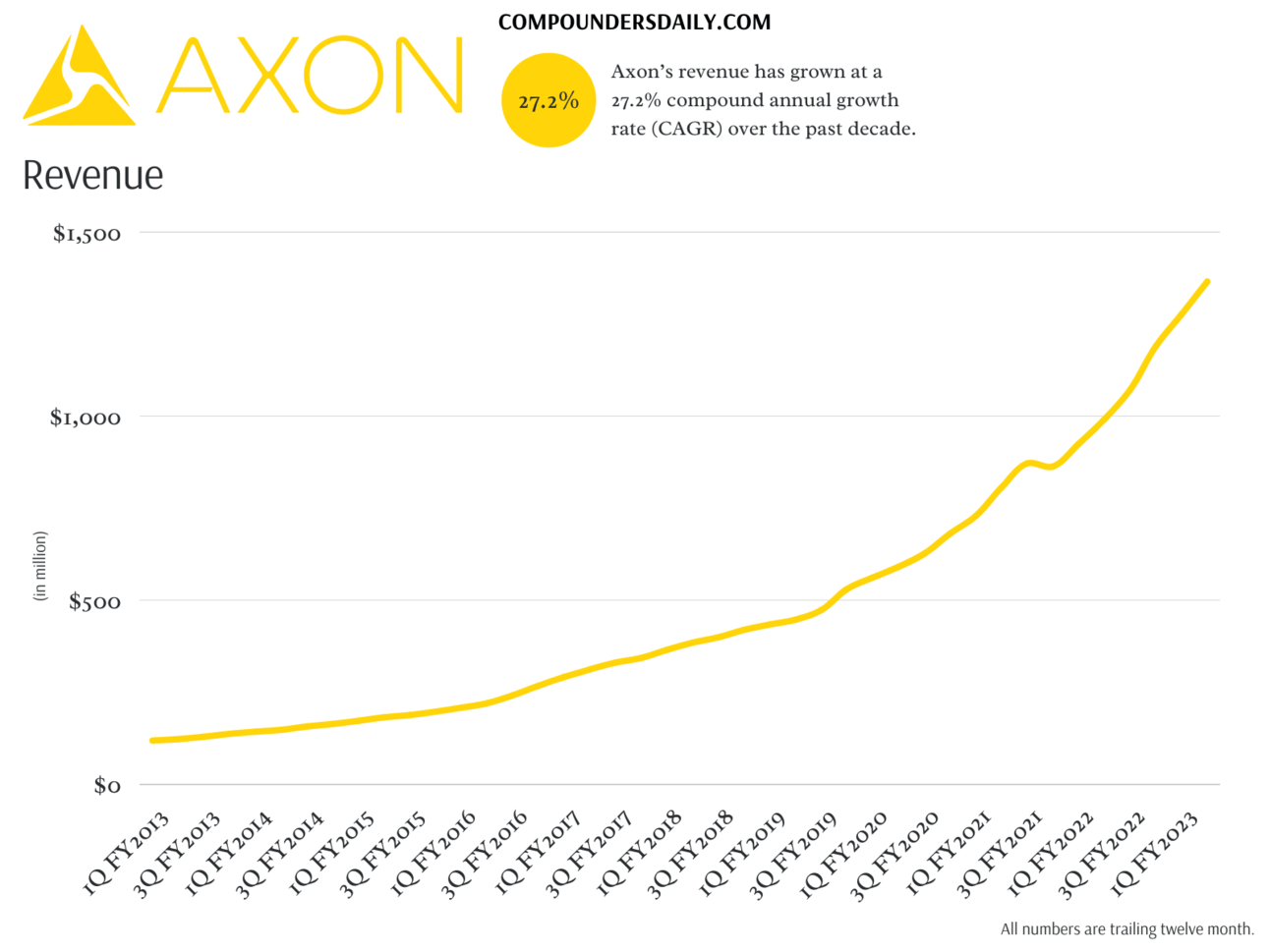

Why has Axon outperformed the market by a wide margin? Can you imagine putting a 27.2% 10-year CAGR into a spreadsheet in 2013? Yet, here we are.

I’m repeating myself, but I want to reiterate this point. The reason most investors struggle with uncertainty is because there’s no way to model this kind of upside. No intrinsic value model that used a 20% growth rate in perpetuity or put a $1 trillion valuation on a business that doesn’t exist would be taken seriously.

But the best companies have either grown at double-digit rates for long periods of time or created huge businesses out of thin air (or both). Apple, Amazon, NVIDIA, Axon, and Tesla are just a few of the companies that were defined by uncertainty throughout their history that have paid off brilliantly.

It’s only in hindsight that their success seems obvious and we’ve forgotten about companies who didn’t reach enormous success.

The Challenge

What’s next?

The challenge is finding investment opportunities where there’s uncertainty that can ultimately bring asymmetric upside for our investments. And taking enough shots on goal to spread our risk (buying one stock is just gambling) and find the winners in a large basket of stocks.

Over time, those winners will outweigh the losers by a mile.

There’s no perfect formula, but I try to find these companies with investing frameworks, strategic thinking, and long-term holding periods. And you’ll see these concepts repeated over and over again on Asymmetric Investing.

Play a Different Game

Investors smarter than me will try to calculate the value of stocks using complex models that I’ll never understand. They’ll find certainty in the inherently uncertain numbers that go into their models.

I choose to embrace the uncertainty in investing and will try to put uncertainty on my side. I’ll be wrong about many stocks I buy. But the ones I’m right about, or who create value in ways I had never dreamed of, will overshadow the losers who will be lost to the sands of time.

Maybe that makes me crazy. And maybe that’s the point.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.