Netflix started as a DVD rental business and is now a streaming TV giant.

Amazon was built as an e-commerce company, but its value today is as a cloud provider.

Apple started by making desktop computers and is now the world’s most successful smartphone company.

Where companies start isn’t often where they finish. And sometimes that’s the plan.

I’ll get to some of these Trojan Horse stocks below, but first…

This Week on Wall Street

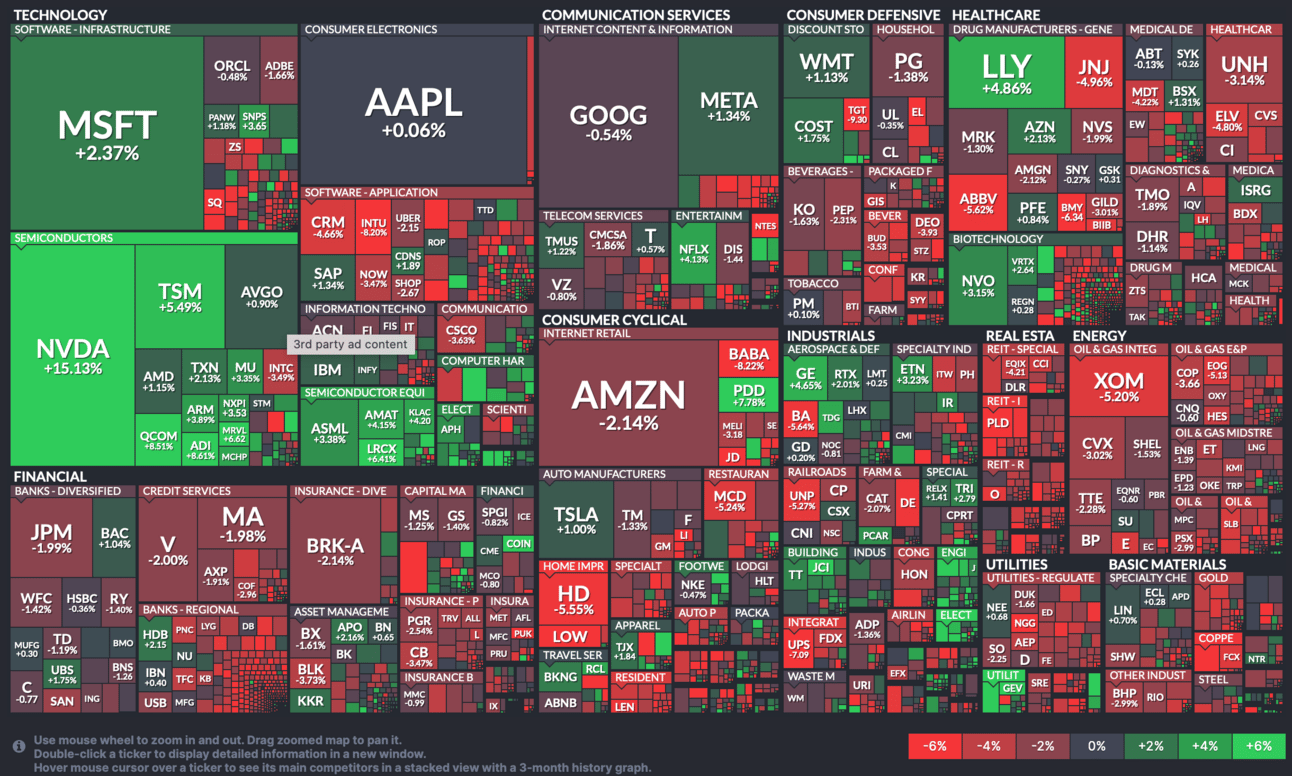

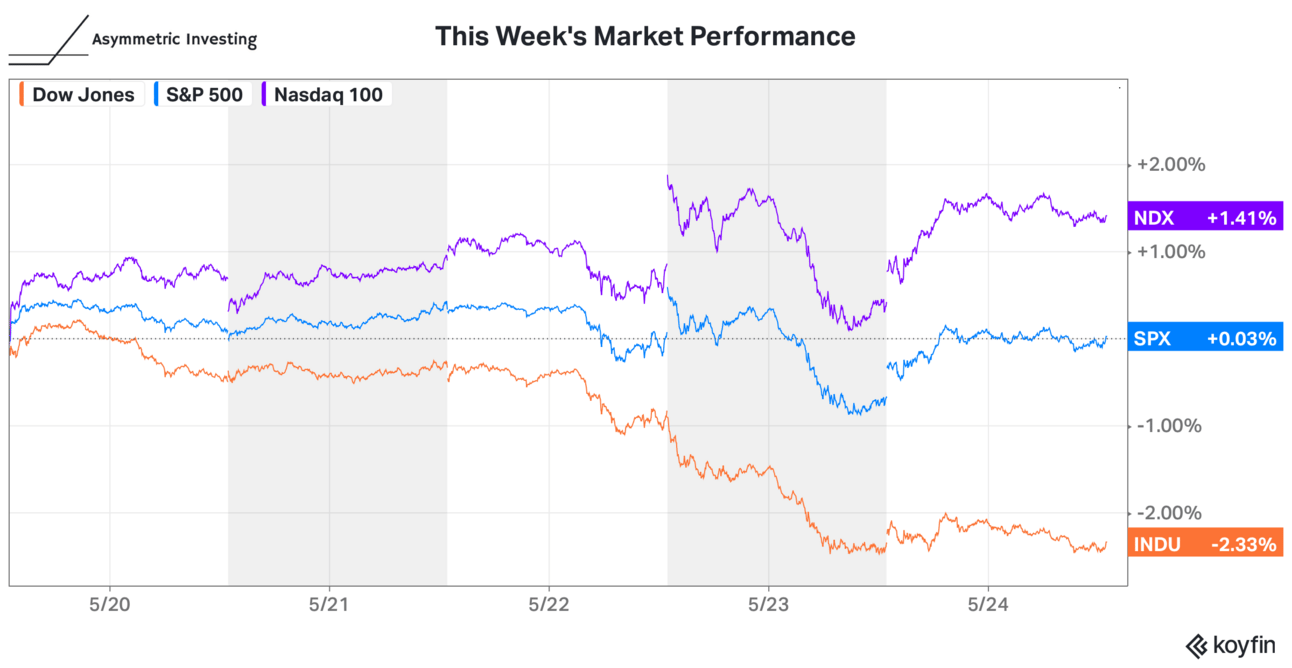

This week, the stock market was dominated by NVIDIA and AI. NVIDIA was up 15.1% for the week and TSMC followed by climbing 5.5%, but most of the market was down sharply.

Dominated by NVIDIA, the tech-heavy Nasdaq 100 did fine, but the more diverse industrial Dow Jones Industrial Average took it on the chin. I’ve been writing about this for months, but there’s a divergence between the hype building in artificial intelligence and the “real” economy.

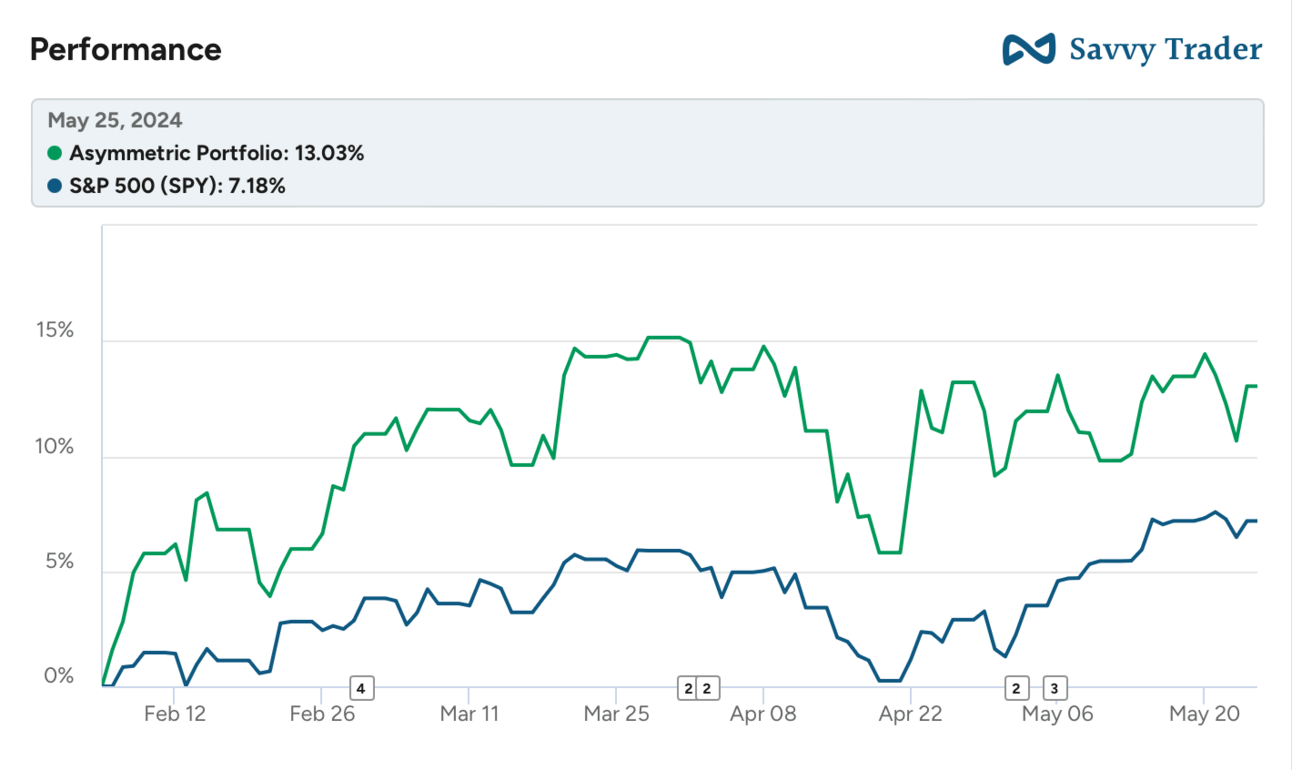

The Asymmetric Portfolio held up well against the market despite not holding NVIDIA, which has been massively overweight in the S&P 500’s market-weighted performance.

Asymmetric Investing has a freemium business model. Sign up for premium here if you want to skip ads and get double the content, including all portfolio additions.

Boost Your Marketing Performance with Anyword

Even the largest AI models don’t know what works for your marketing. They don’t know your brand, audience, or what resonates. Anyword does.

Trusted by over 1M+ marketers, Anyword generates optimized content trained on your marketing channels, with predictive performance scoring & insights for any copy, channel, and audience – so you don’t have to guess what content will perform best.

Easily create engaging, on-brand content at scale that boosts marketing performance and achieves team goals.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Amazon’s Advertising Tax: Did you know Amazon’s retail business wouldn’t be profitable without those pesky ads?

Hims & Hers Spotlight: I’m excited to introduce the latest stock in the Asymmetric Universe.

Upending Finance: Don’t look now, but Coinbase is becoming a power player in finance.

5 High Growth Stocks I Love: What’s stopping the growth of these stocks?

Trojan Horses and Asymmetric Opportunities

Most of the themes and frameworks I have for Asymmetric Investing are well thought out. I’ve studied concepts like internet economics or the smiling curve for years and have a clear idea of what I’m looking for.

Sometimes, themes and frameworks come naturally out of opportunities I see in the market. One I’ve noticed covering more and more is the idea of a Trojan Horse product as a way to break into an industry.

This concept first came up when referencing Spotify’s video ambitions, which I continue to see more and more through video podcasts.

Then it explained how Zillow is using a real estate agent business as a trojan horse to eventually be a housing platform connecting sellers and buyers directly.

Eventually, it helped explain why crypto ETFs were a trojan horse for Coinbase in disrupting the finance industry.

Three recent spotlight articles used the Trojan Horse concept as a central theme to the thesis.

Sofi used personal and student loans — two categories big banks avoid at all costs — as a trojan horse into the finance industry.

Robinhood used YOLO trading during the pandemic to build a brokerage platform and is now making its way to banking and credit cards as more wealthy customers take the platform more seriously.

Hims & Hers was “the ED site” when it started, but now you can treat hair loss and even get GLP-1s at a much lower cost than the competition. Why not EpiPens and inhalers someday?

Sometimes, there’s more than meets the eye with a company’s strategy. Attacking finance or healthcare head-on is nearly impossible. But entering through an unloved segment where everyone — including investors — will blow you off as less serious than the competition?

That’s a Trojan Horse strategy I can get behind.

I’m adding to the Asymmetric Portfolio again next week and premium subscribers will find out my trades before I make them.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.