Premium subscribers make Asymmetric Investing possible and this earnings recap for Spotify is an example of the analysis premium subscribers get for all companies in the Asymmetric Universe. Consider subscribing if you like what you see below.

The first Spotlight article written for Asymmetric Investing was on Spotify.

The largest holding in the Asymmetric Portfolio is Spotify.

It’s fair to say, Spotify is my highest conviction stock. And this week’s earnings report has made me even more bullish on the future.

When Strategy and Performance Collide

The theory behind Spotify being an asymmetric stock is that it’s in the process of solidifying the #1 position in streaming music and from that position in the top right corner of the smiling curve it will be able to command higher advertising revenue and expand into adjacent markets like podcasts, audiobooks, and even video.

Signs of success would be:

A rapidly growing user base (market share gains)

Rising revenue per user (price increases)

Expanding margins as operating leverage takes hold.

In Q4 2023, we got all three!

Get the best stock ideas

Our AI tool scours the internet every day for the best stock ideas that we share with you each morning in our free, daily email.

We find stock ideas from:

Billion-dollar hedge funds

Professional analysts

Millionaire investors

and more…

We’ve already found stock ideas like:

Carvana ($CVNA) - +822% in 4 months

Myomo ($MYO) - +507% in 3 month

ImmunityBio ($IBRX) - +313% in 1 month

and a ton more…

Subscribe to our free, daily email to start getting the best stock ideas sent to your inbox each morning.

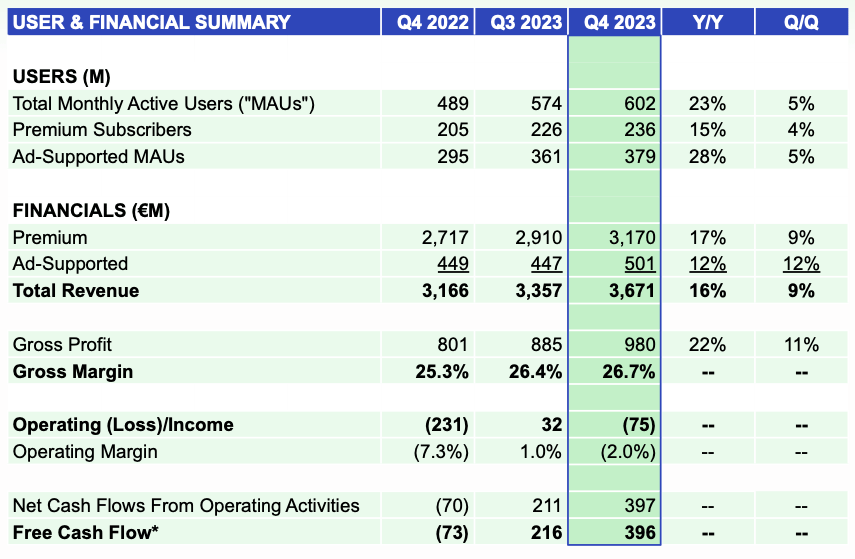

Compounding User Growth

It’s not often a company with 602 million users can grow at a 20%+ compound rate, but that’s exactly what we’re seeing from Spotify. In the fourth quarter, total monthly active users were up 23% to 602 million and premium users were up 15% to 236 million.

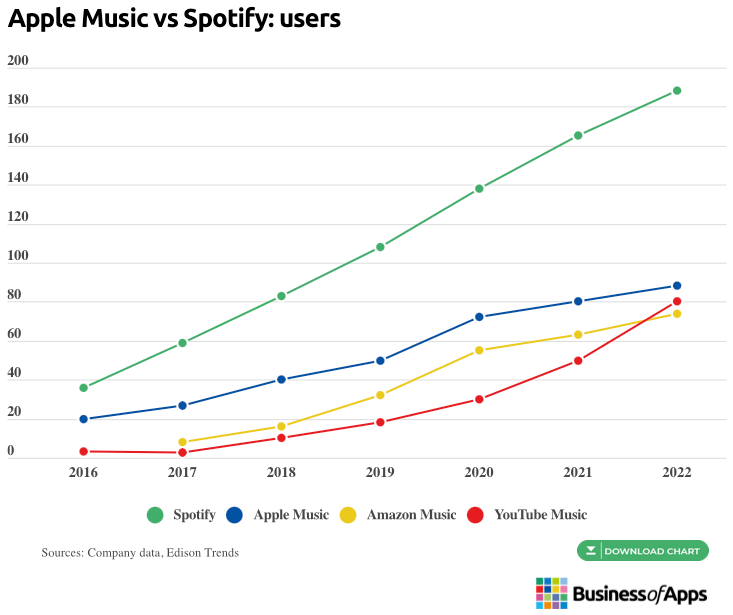

The user base is not only growing, it’s gaining market share. The chart below doesn’t yet include 2023 numbers, but you can see the trend. Spotify is growing more quickly and gaining market share over rivals.

In other words, Spotify is moving up and to the right in the smiling curve while competitors slump lower (YouTube may be the outlier, but that’s why Alphabet is in the Asymmetric Universe).

In time, having significantly more scale than competitors will mean Spotify can charge higher prices, attract more advertisers, and have better operating leverage than competitors.

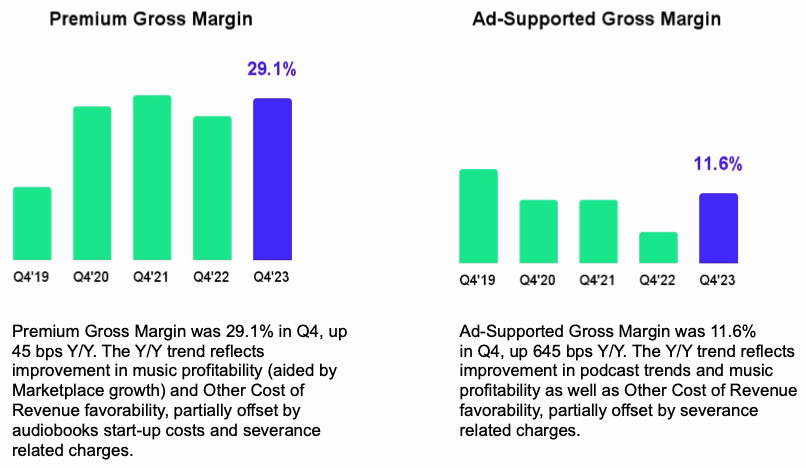

My biggest critique of the quarter is the lack of progress in advertising. If that ever picks up in a meaningful way, it’s off to the races.

More Efficient At the Core

The cost side is where Spotify has struggled historically. For years, operating costs like sales and marketing have increased alongside revenue, but that started to change in 2023.

In January 2023, Spotify reduced the workforce by 600 jobs. Another 200 jobs were cut in June 2023. In December 2023, 1,500 jobs were eliminated. The cost reductions haven’t fully flowed through the income statement yet, but we’re seeing progress with SG&A flat and revenue rising at a 16% CAGR since late 2022.

Over the next few quarters, severance costs and ongoing expenses related to job cuts will fall and we will likely see operating expenses fall on an absolute basis.

Operating leverage is taking hold and we are seeing that with higher cash flows and operating margins (adjusted for layoff costs).

Maturing in Podcasts

The playbook in music is pretty straightforward. Grow the user base and contain costs to grow profits.

Podcasts are another story entirely.

Spotify has spent the last five years acquiring companies and talent to stake out the #1 market share in podcasts. But it’s been throwing ideas at the wall and seeing what sticks.

From the Q4 2023 conference call:

when we walked into podcasting, we actually went in with multiple strategies at once. We did exclusives that you're referencing to, but we also did our own and original programming, and we also did licensed nonexclusive deals, too. And what we said at the time, I think many people mostly sort of made a reference to thinking that this was an all-out exclusive effort similar to that of Netflix. But we said we take much more of an opportunity approach to the strategy and we're going to try many different things. And for some shows, exclusive matters for some others, it don't. So I think the general story, just to be candid here with all of you on the line is that, what we've seen is that while exclusivities were net positive on the side, it's not driving as much as the opportunity that we see on the ad side. And so by broadening distribution, we think we can accomplish a number of different goals.

Most notable among them, we are going to be more aligned with the creator. The creator obviously wants to be on many different platforms and wants to have as big of an audience as possible. So that's important. And then the second part is, when you think about the revenue growth story on advertising, we're very excited with what we've been seeing in early 2023 with these new types of deals that we've been structuring because we really become aligned with the creator. And long term, that is the reason why I started Spotify. We care equally about consumers, and we care equally about creators. So I feel like with this new strategy, we're actually even better aligned with the creator because we're not asking the creator to trade one for the other. And because advertising is in such a strong growth position for us, I feel I'm really excited about the opportunity we can bring both the creators and to Spotify itself with that strategy.

The age of throwing ideas at the wall is ending. Spotify knows what sticks and it’s now starting to execute on those ideas. Podcasts specifically aren’t yet breakeven, but we can see the ad-supported business (where podcast costs are housed) is starting to improve.

Expanding the surface area for advertising by ending exclusivity should help the ads business grow. And if Spotify is effective in building tools creators want and creating monetization opportunities, it will still be the platform of choice for creators, which is the ultimate goal in music, podcasts, and more.

Management said the next few quarters will see podcasts turn positive and I think advertising has tremendous upside as the user base grows and Spotify builds out tools advertisers need to reach customers. There’s a lot of work to be done, but Spotify is now investing from a point of strength rather than a point of desperation.

Growing the Pie

While Spotify grows in music and podcasts, it’s already building out the next phase of growth in audiobooks.

This isn’t going to be a massive business like music, but it’s a value-add for users, a churn preventer for premium customers, and it grows the pie for Spotify.

With over 600 million users, Spotify can suddenly become an audiobook discovery engine. This grows the pie for authors and raises the value of a premium membership.

In time, Spotify will show the value of bundling music, podcasts, and audiobooks and go back to customers with another price increase.

In the top right of the smiling curve, a company should not only have more users than competitors, it can make more revenue from each user as well. Spotify is on that path and audiobooks play an important role in keeping the company there.

The Next Phase

Audiobooks are what’s next for Spotify, but there’s a Trojan Horse that I don’t want to overlook: Video!

If you use Spotify, you may already be seeing videos when some podcasts play. But it’s hidden in the background unless you’re looking at your phone or computer.

Could Spotify turn this background video into a path for creators to make video content for the platform?

It’s early days, but the optionality is intriguing.

For now, I’m extremely happy with Spotify’s performance both strategically and financially.

The theory of why Spotify was an asymmetric stock in March 2023 is turning into reality. And 2024 looks like it’s set to be another great year for the company.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium has a long position in all stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.