This week on the Plain English with Derek Thompson podcast there was a discussion that put into focus some of my thoughts on Spotify. In earnings updates, I’ve covered user growth, operating expenses, and margins, but quantifying the opportunity I see for the business has been difficult.

The Ringer’s Matt Belloni summed it up well when talking about the year in podcasts.

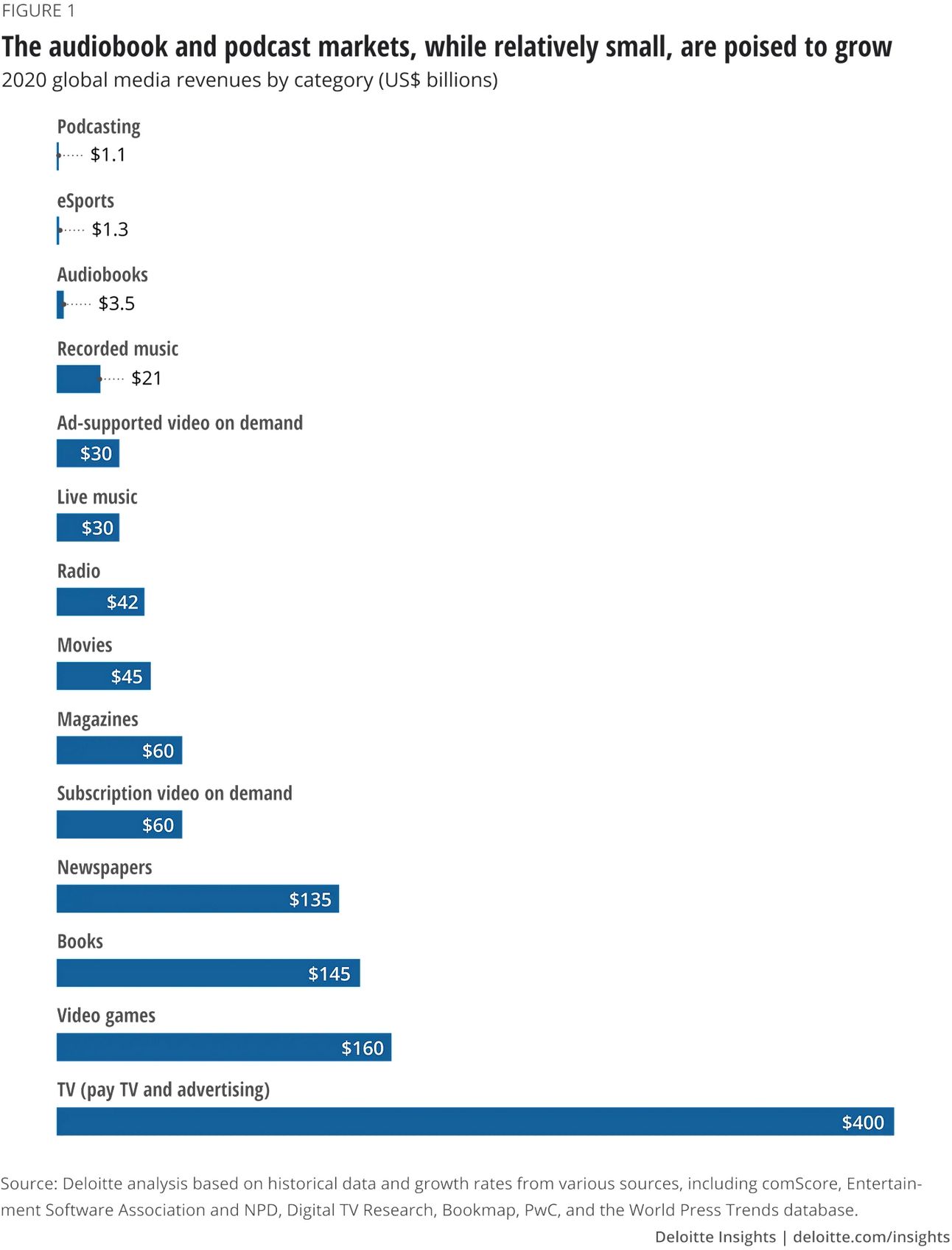

Podcasts have had a really weird year and of course the obvious disclosure here that this is a Spotify podcast owned by Spotify, Ringer owned by Spotify, et cetera. We've seen celebrity shows that are canceled. We've seen popular, highly edited shows that are canceled. There have been layoffs. Spotify you made a really interesting point in one of your recent shows where you said there are about, I think this might have been a, was it a Deloitte study? Maybe 1.7 billion people listen to podcasts worldwide. And that number is growing linearly. It's, it's still growing quickly. The annual global revenue of podcasts, however, is only 3.5 billion. Simple math. That's $2 per listener per year.

And when you compare that to the music industry or the audiobook industry or radio, it's like between five and 15 times worse on a dollar per listener basis than those other industries. And you can either be lugubrious about it and say, oh, well that just means podcasts are terrible business. Or you can weirdly be optimistic about it and say there's a lot of room for growth.

So, I tracked down the Deloitte study. The data is a few years old, but it shows the massive under-monetization of podcasts.

This begs the question why? And how does Spotify fix the monetization problem?

Same Story, Different Verse

There are many reasons podcasts may be underperforming, but we’ve seen this in large tech businesses before. In 2012, Facebook only generated $4.05 per user in advertising revenue. In the last twelve months, that number has jumped to $40.83 per user.

Spotify is currently generating 4.95 Euros per user on a run-rate basis and I think that’s scratching the surface of its potential.

Advertising is a strange business that has a lag between when it can have an impact and when businesses start spending money. It takes time to:

Get a budget

Setup an account/workflow

Build creative assets

Test an ad

Measure effectiveness

Request a larger budget for next year

This is literally a multi-year cycle for large businesses to grow an advertising business on a new platform.

It takes time!

And Spotify is still currently primarily a brand advertising medium, so we haven’t seen demand response (hear an ad, click, buy something) from smaller, more nimble businesses be a meaningful part of revenue.

It’s not entirely clear what the potential is for Spotify in advertising. Is it 5x, 10x, or 20x, who knows?

But Spotify’s ad revenue per user has the potential to grow sharply over the next decade and that’s on top of user growth.

Undermonetizing podcasts looks like it’s Spotify’s biggest opportunity to be a 10x stock from here.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.