Note: Premium subscribers can expect a spotlight article tomorrow, along with the normal monthly Asymmetric Portfolio buys on Tuesday.

It was the last full week of trading in the calendar third quarter of 2024, and the stock market was pretty quiet. Stocks drifted higher, but I wouldn’t say there was major news like earnings or monetary policy to drive the market.

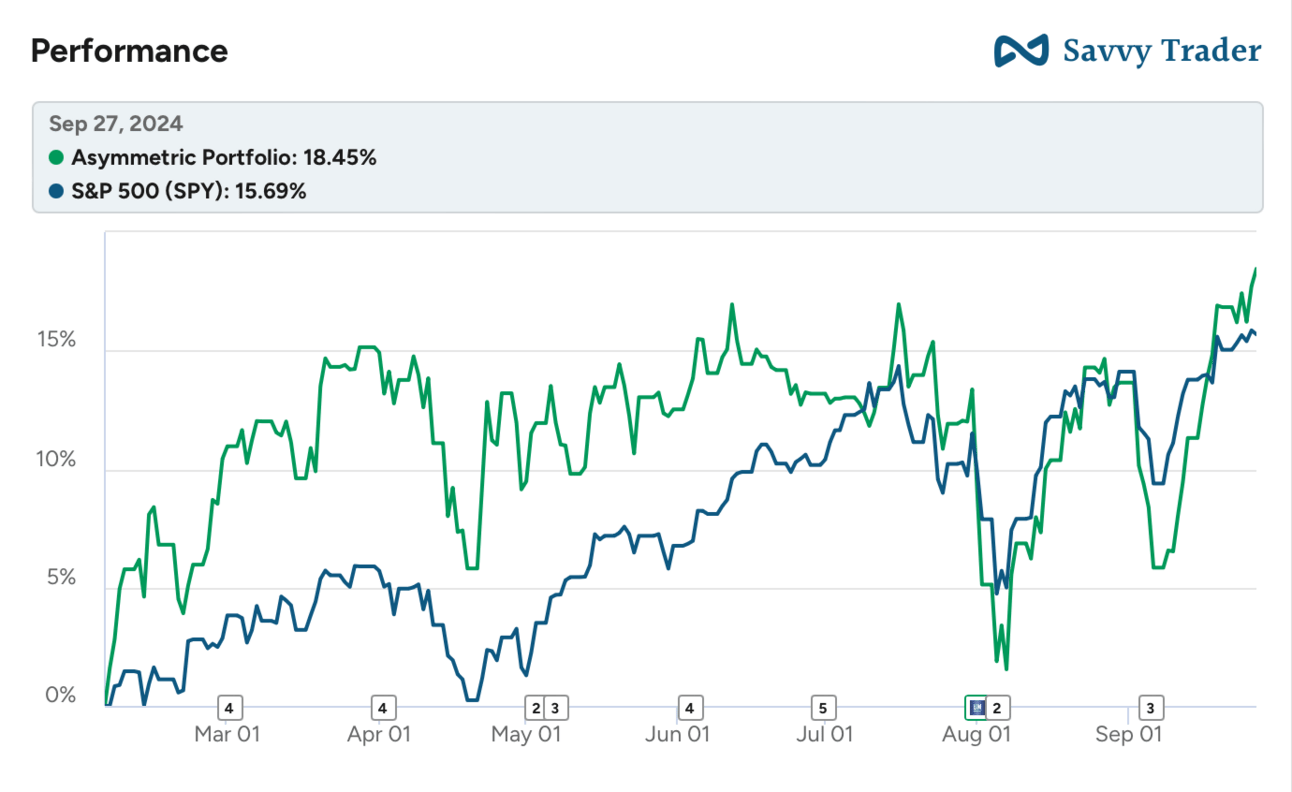

The Asymmetric Portfolio had another good week and is beating the market again. Interestingly, the portfolio has performed this year without holding NVIDIA, which is driving the S&P 500’s returns.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads like this one. Sign up for premium here to get 2x the content, access the Asymmetric Portfolio, and avoid ads.

Whiskey: A Hedge Against Market Volatility

Looking to protect your portfolio from the next recession?

Consider investing in rare spirits like whiskey.

Whiskey investing provides a proven hedge against stock market dips driven by inflation and other factors.

With Vinovest, you can invest in high-growth segments such as American Single Malt, emerging Scotch, Bourbon, and Irish whiskey. Thanks to established industry relationships, Vinovest overcomes industry barriers that have made historically whiskey investing expensive and opaque. As a result, you can enjoy high-quality inventory that boosts your portfolio value and enhances liquidity.

In Case You Missed It

Here’s the content I put out this week.

OpenAI’s House of Card: OpenAI is trying to raise money at a $150 billion valuation, and staff is fleeing. I got into the mess at OpenAI. Update: Since this was published, Apple has said they will not be investing in OpenAI’s next round.

GM and the Auto Market: Auto stocks are dropping, and the broader market will be worth watching. Is GM well positioned to hold profits and maybe even take market share?

Motley Fool Money Interview on Autonomous Driving: I was on Motley Fool Money’s weekend show yesterday to discuss the state of the autonomous driving market. If you want more, the spotlight on autonomous driving is here.

The Best Big Tech Stock

Investing isn’t just about finding the best companies to own; it’s about paying an attractive price for them. Today, I have a hard time not seeing Alphabet as the best of all the big tech stocks.

You can see below that it’s the cheapest for the Mag 7 stocks on a price-to-earnings basis (GOOG is in red).

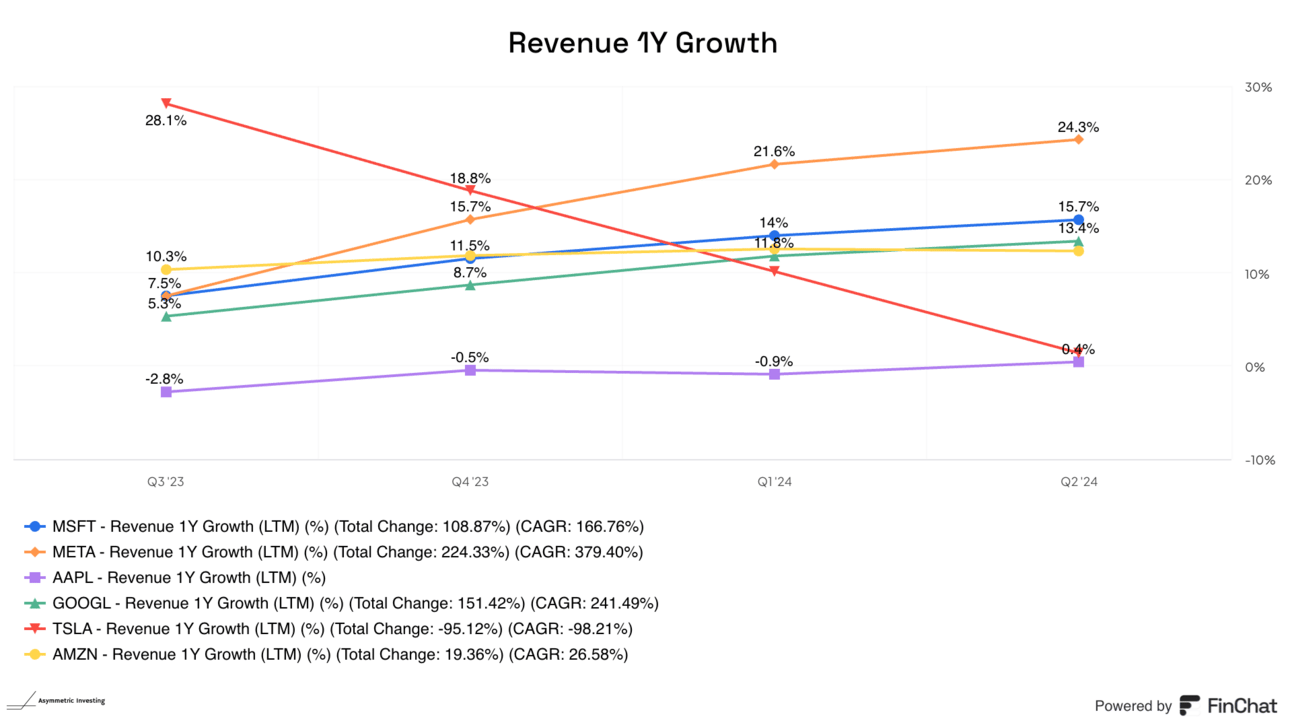

Alphabet is also growing more quickly than Apple, Tesla, and Amazon (I removed NVIDIA because its recent growth made the chart unreadable).

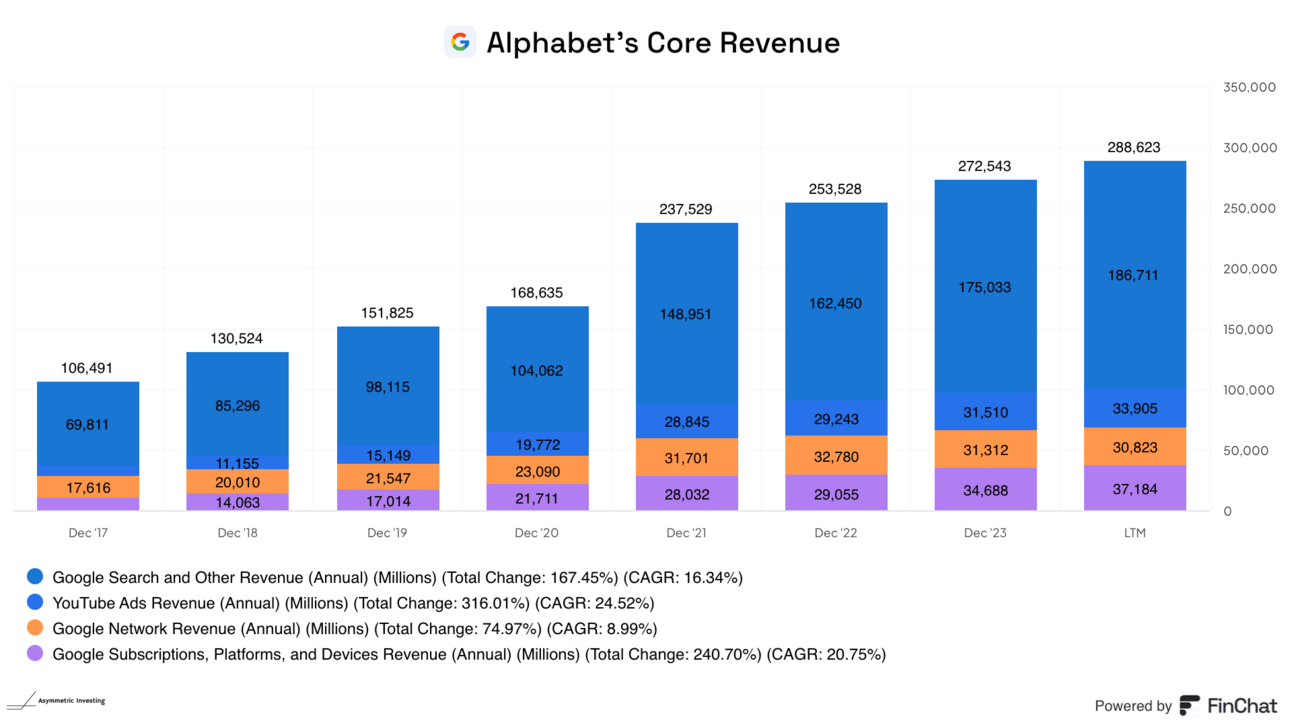

The narrative since artificial intelligence hit the scene was that Alphabet’s core businesses would be under threat. We don’t see evidence of that yet.

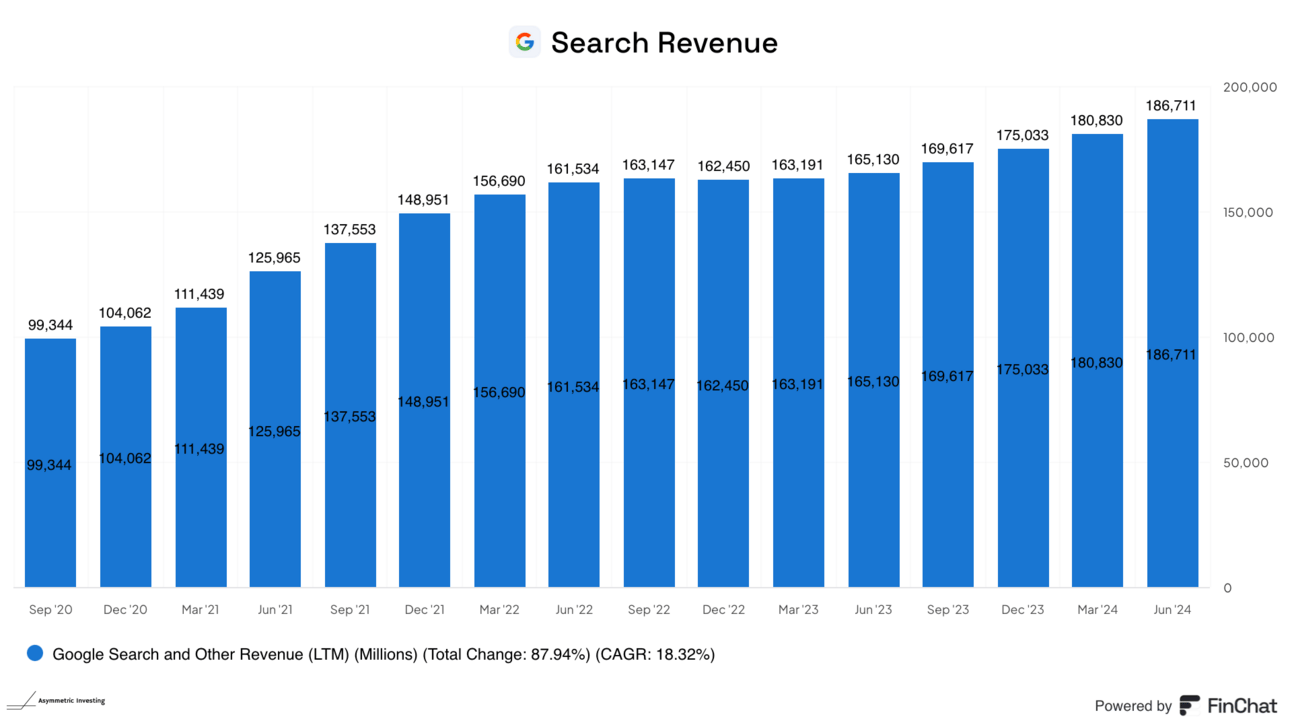

Even search is growing faster now than when ChatGPT was released.

On top of that, Alphabet has a lot of growth potential in new and emerging businesses.

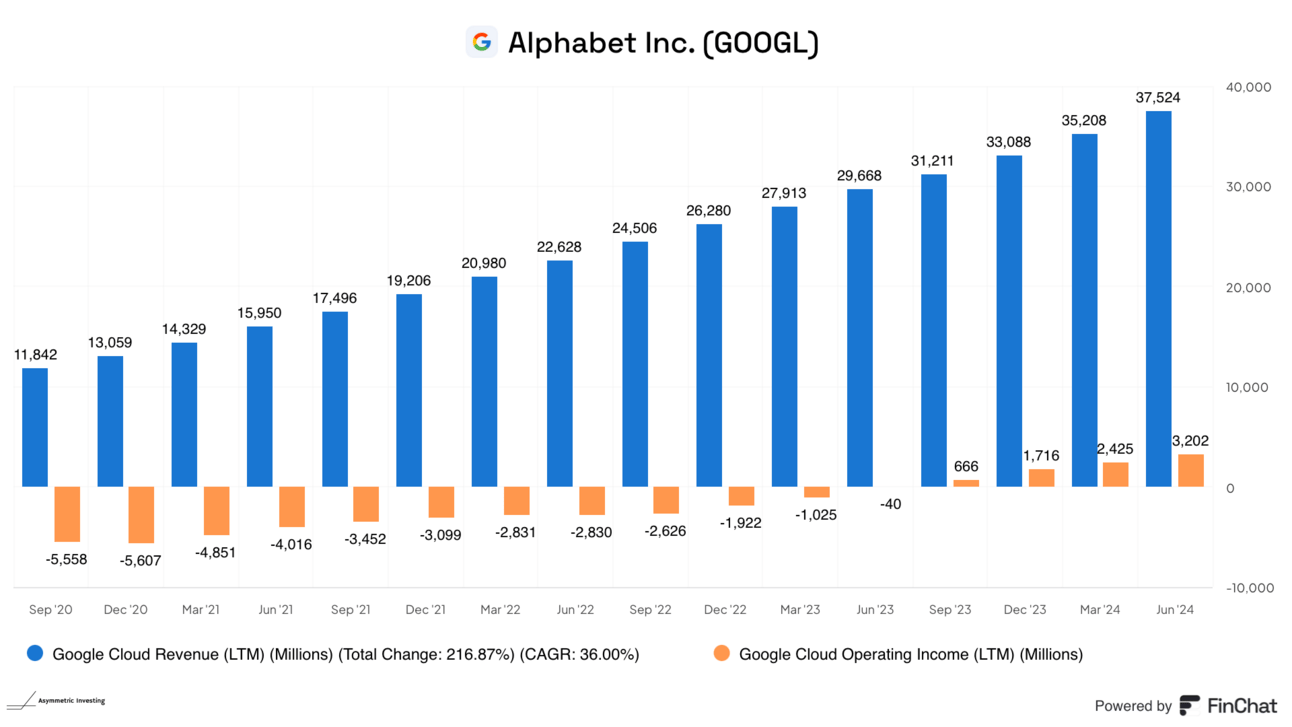

Google Cloud is now a profitable, high-growth business.

The cloud has been driven by AI, but Alphabet also has Android to distribute AI chips and software. Apple isn’t leading in smartphone AI today; it’s Alphabet that is putting its models and hardware on Android devices to deliver AI at your fingertips.

Then there’s Waymo, which could be a $1 trillion business on its own someday. Waymo is a leader in autonomous driving and has more fully autonomous vehicles on the road today than anyone in the world.

Keep it simple. Alphabet is a huge, profitable company with multiple future growth engines.

I dove into Alphabet’s 10x potential in the spotlight article you can find here. Shares are up a tidy 25.1% since then, and I think this is still an attractive stock.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.