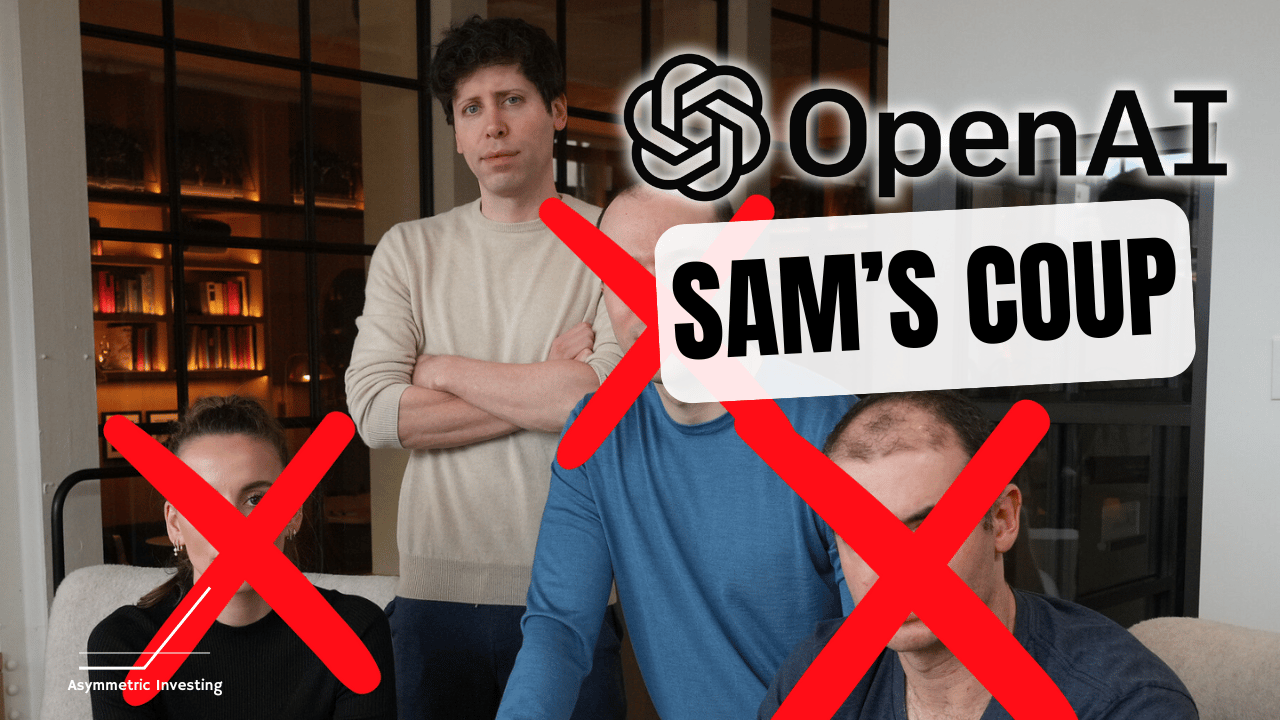

On Wednesday afternoon, OpenAI’s CTO Mira Murati (on the left in the image above) announced she was leaving the company.

Within minutes, Chief Research Officer Bob McGrew and Research VP, Barret Zoph followed with resignations from the ChatGPT creator.

On the surface, a few people leaving doesn’t seem like a big deal. But we have seen most of the talent at OpenAI leave in the past year. President Greg Brockman (shown in the center-right above) “took a sabbatical” and Ilya Sutskever (on the right) left in May and recently raised $1 billion to start a new company — Safe Superintelligence (SSI).

These names may not be familiar to the average person, but in the world of artificial intelligence and OpenAI, this was one of the best brain trusts in the world.

Sam Altman is the only one left standing out of the original founders and key players building OpenAI and he was the one who orchestrated the power play that pushed all of his rivals out of the company.

Don’t fall for the “nice guy” facade, he’s a savage operator who looks out for #1 first and foremost. And he may be in for a $10 billion payday if he can find a suitor to value OpenAI at $150 billion.

OpenAI and the AI Explosion

This newsletter is primarily about public companies, but AI is driving the market today and OpenAI’s tentacles extend deep into some of the most valuable companies in the world. It’s worth putting OpenAI’s impact on public markets into context. In November 2022, ChatGPT was unveiled to the world and reached an astounding 100 million users in 2 months.

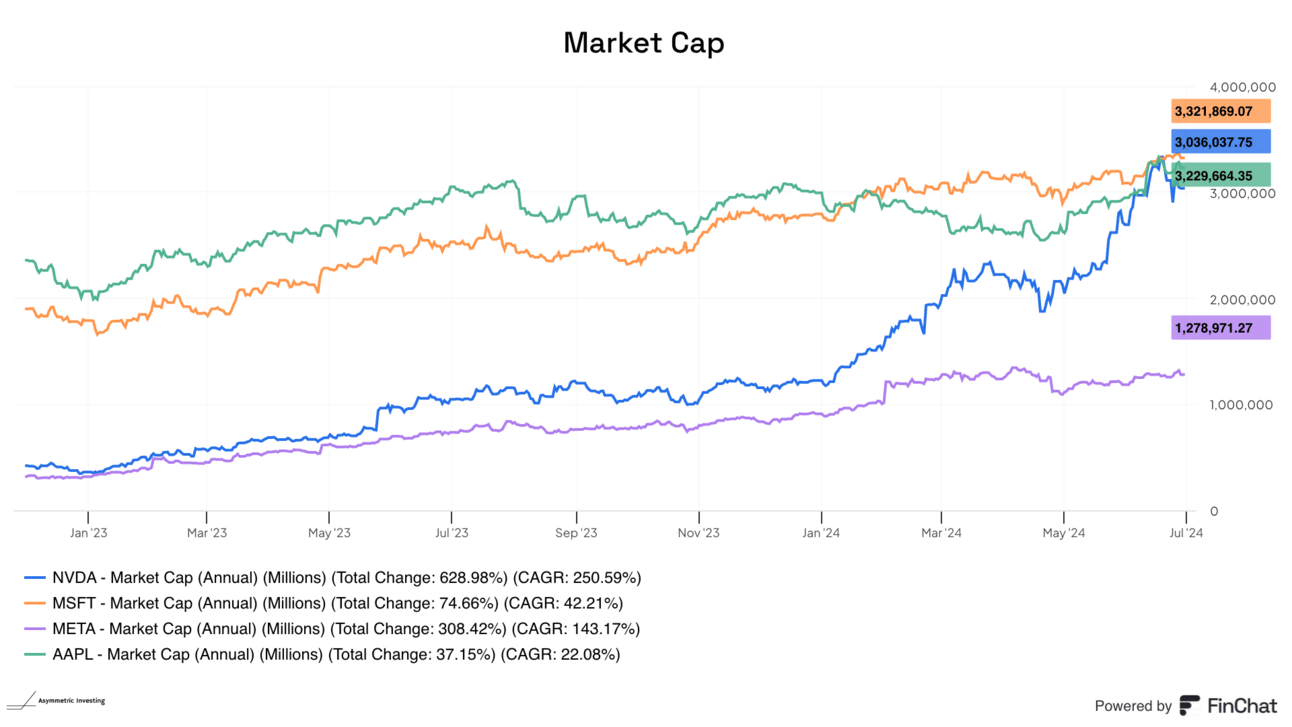

The success led to a $10 billion investment by Microsoft in January 2023 and trillions of dollars of market value added to NVIDIA, Microsoft, Meta, Apple, and many more. They say NVIDIA is holding up the market, but OpenAI and ChatGPT have really been the driver of NVIDIA.

The multi-trillion dollar increase in market value you see above is predicated on the idea that AI will generate real economic value someday, led by OpenAI.

Now we have to ask, will it?

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Free Daily Trade Alerts: Expert Insights at Your Fingertips

Master the market in 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

What Is Success in AI?

OpenAI — and Sam Altman specifically — has been great at raising money.

What OpenAI hasn’t solved is the business model behind its AI technology. The business relies on growing piles of funding to feed an ever smarter AI with unclear use cases and economic value.

Like most VC-backed startups, OpenAI is a financial house of cards until it reaches profitability or is acquired. This is standard in Silicon Valley, but we’re talking about valuations and a level of cash burn that we’ve never seen before. That’s where I get concerned how far a bad outcome will bleed into the market.

The business model problem isn’t unique to OpenAI. Some of the most valuable AI startups with the smartest minds in the world have run into problems and been scooped up by big tech in what’s being called “reverse acqui-hires”. Essentially, since regulators won’t allow big tech to buy these failing companies for the talent and underlying technology, they hire the staff and “license” the technology from the startup. It’s not a great outcome for VCs, but it often makes their investment whole, and talent is free to negotiate massive pay packages from big tech.

Inflection AI raised $1.3 billion in June 2023 only to be “acquired” by Microsoft ten months later.

Covariant raised $222 million before its founders were hired by Amazon and the company licensed its technology to the tech giant.

Adept AI raised $400 million and its team was hired by Amazon as the company ran out of money.

While these look like acquisitions, what they are is failures in the venture capital sense. At best, investors get their money back, but these are industry-leading companies and they have such unsustainable business models that they need to be bailed out by big tech, who just wants the talent.

If VCs don’t see big outcomes in AI, they’ll naturally pull back their investment. And the AI business is getting crowded.

xAI, Mistral, and Anthropic are all building models and there are models from Google and Meta as well. Competitors “acquired” by big tech companies can develop some of these tools in-house. And while big tech is acquiring talent, OpenAI’s talent is leaving.

Is OpenAI heading down a path of — at best — being swallowed up by big tech for pennies on the dollar?

A Complex Structure and Sam Altman’s $10 Billion Cash Grab

The funding piece of venture-backed companies is critical because these businesses rely on raising money, proving progress on certain key performance indicators, and then raising more money.

Without more money, OpenAI won’t exist because its business is burning billions of dollars each year.

Unfortunately for Altman, talent is fleeing exactly when OpenAI is trying to raise a reported $6.5 billion at a $150 billion valuation. As part of that capital raise, OpenAI wants to give up its non-profit status and become a for-profit company.

OpenAI was already a complex structure, but this is becoming a mess.

OpenAI itself is currently a non-profit but there’s a for-profit subsidiary.

Microsoft reportedly gets 75% of OpenAI’s profits until it gets its $10 billion investment back.

Reportedly, Altman — who has orchestrated this mess — has no equity in OpenAI today but would get ~7% of the $150 billion for-profit version of OpenAI after it’s restructured. A $10 billion payday!

I didn’t even mention the coup that led to Altman being fired as CEO and eventually restated after most of the board of directors quit.

Will someone give Altman the money he needs?

Read Between the Lines

The future was bright for OpenAI not long ago, but if we read between the lines its closest partners are backing away.

Microsoft is the biggest OpenAI backer and it “reverse acqui-hired” Inflection AI by paying a $650 million licensing fee to the company and hiring all of its talent. Microsoft also has foundational models from Mistral, Stability AI, Meta, Hugging Face, Phi, and more on Azure today.

Management has also gone from bragging about its OpenAI partnership to barely mentioning it. Here’s the number of times OpenAI was mentioned on the last ten Microsoft earnings calls:

Q3 2022: 1

Q4 2022: 1

Q1 2023: 5

Q2 2023: 10

Q3 2023: 15

Q4 2023: 8

Q1 2024: 4

Q2 2024: 12

Q3 2024: 3

Q4 2024: 1

Then there’s Apple Intelligence, which will use OpenAI to offload “world knowledge” questions that can’t be served on-device or in Apple’s limited data center.

OpenAI was mentioned in the Apple Intelligence release, but was notably absent when the iPhone 16 was announced.

The brain drain and corporate upheaval at OpenAI can’t make corporate partners — who have plenty of AI model options — happy. And ChatGPT is reportedly losing users as competitors pick up their game.

What Happens Next?

OpenAI’s talent is fleeing.

OpenAI needs money to access GPUs.

Who gives OpenAI the billions of dollars it needs when there’s no end in sight to the cash burn and competitors (Meta) are giving away equally capable models for free?

Something big will happen.

In 12 months, I don’t think OpenAI will be a private company. Someone will scoop up the talent and the tech. Microsoft would be my bet, but Apple could be in play too.

The question is: What happens to future AI investment if the Golden Goose falls?

VCs are already wounded by Inflection, Covariant, and Adept reaching very un-VC outcomes and the bill to build the next foundational model is already over $10 billion and going higher by the day.

Meanwhile, Meta and Alphabet aren’t letting off the gas.

I’ve been writing about the unsustainability of this level of AI investment for months but the money train keeps rolling on hope some kind of value will emerge in the near future.

But this train runs on confidence.

If OpenAI fails to raise a massive round, momentum could reverse.

Former market darling — and Top 5 NVIDIA customer — Super Micro Computer has fallen 67% since March 2024 and is a warning sign that all is not well in AI.

When the top talent is leaving the company that’s supposed to be the leader in AI weeks before they could have multi-billion dollar paydays, something is very wrong in the world of AI.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.