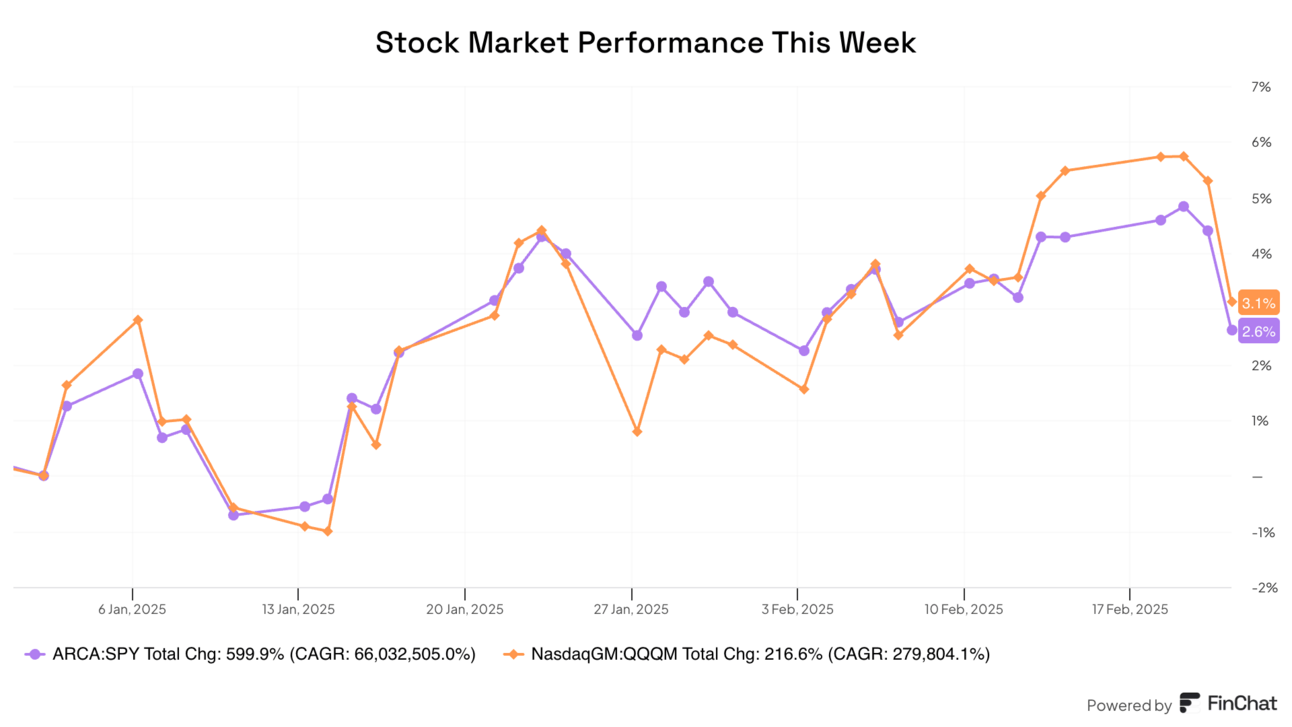

The stock market had a rough end to the week after Walmart said consumers are starting to pull back spending, and economic reports show they’re starting to worry about inflation and tariffs. These are topics I’ve covered before but it’s never clear when the market will decide it’s worried about these macro trends.

This is another reminder that it’s nearly impossible to predict what will happen to stocks short-term and it’s over the long-term that we have an advantage over the market.

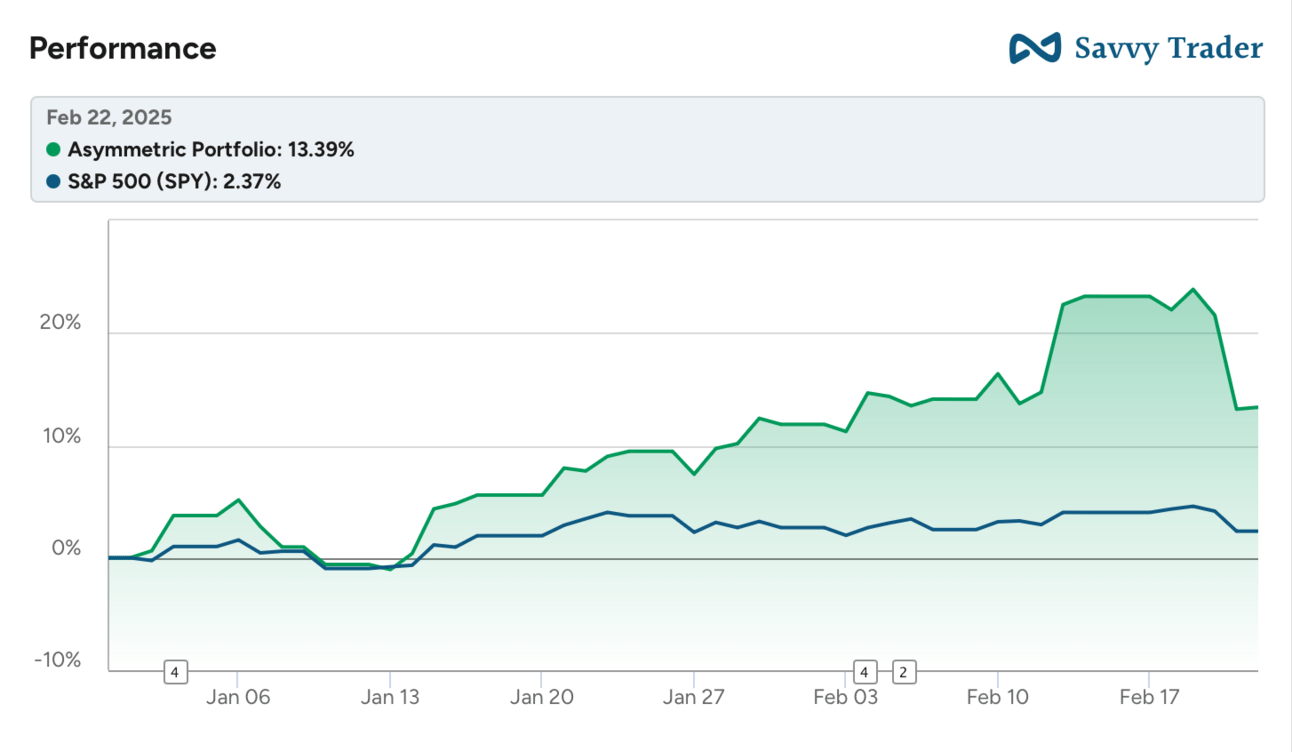

The Asymmetric Portfolio had its worst week since starting nearly two years ago, falling 8.0%. On Friday alone, the portfolio fell 6.8% as the biggest holding fell 25.8%. But that stock is up 103.8% in 2025 alone, so I’m not losing sleep over one day’s move.

The “Special Situation Short” did offset some of the market losses and is now up 13.1%. But there’s no denying it was a bad week. That said, let’s pull back a bit and look at the performance for the year.

Pull back even further and you can see the frameworks that got the portfolio here are working and I’ll continue to deploy them, including buying stocks each month, holding long-term, and over-indexing to founder-led growth stocks.

What stocks am I adding to my market-beating portfolio each month? You can sign up for premium here to find out, get 2x the Asymmetric Investing content, and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

How do I make all of the charts in Asymmetric Investing? Simple. With Finchat. You can get started with FinChat Pro free for 2 weeks below. After that, you’ll get 15% off for being an Asymmetric Investing subscriber. I can’t say enough how much easier it’s made my research. Check it out 👇

In Case You Missed It

Here’s some of the content I put out this week.

Apple’s Lost Magic: Apple defined tech for the last two decades, but the magic is gone.

Celsius Soars, Hims & Hers Drops: Celsius stock popped after a huge acquisition and the market worries about Hims & Hers and GLP-1s.

Coinbase Beats the SEC: Coinbase has won its case against the SEC and that could open up a brighter future for crypto. What that means is TBD.

Stocks Can Go Down

It’s easy to forget that stocks can go down when the market is going up. I don’t know who said it or what the exact saying is, but as David Gardner said, “Stocks go down faster than they go up, but go up more than they go down.”

I want to stress a few points in Asymmetric Frameworks that are key at times like this:

We need to think in years and decades, not days and weeks. This is our biggest advantage over the market.

You should feel greedier when stocks fall and more fearful when they rise.

Buying when sentiment is bad is hard, but it’s key to asymmetric returns.

Uncertainty is our friend.

If a stock falls despite great financial trends, that’s good news for us as investors.

These are easy words to write. They’re simple to understand in theory. They’re more difficult to live through.

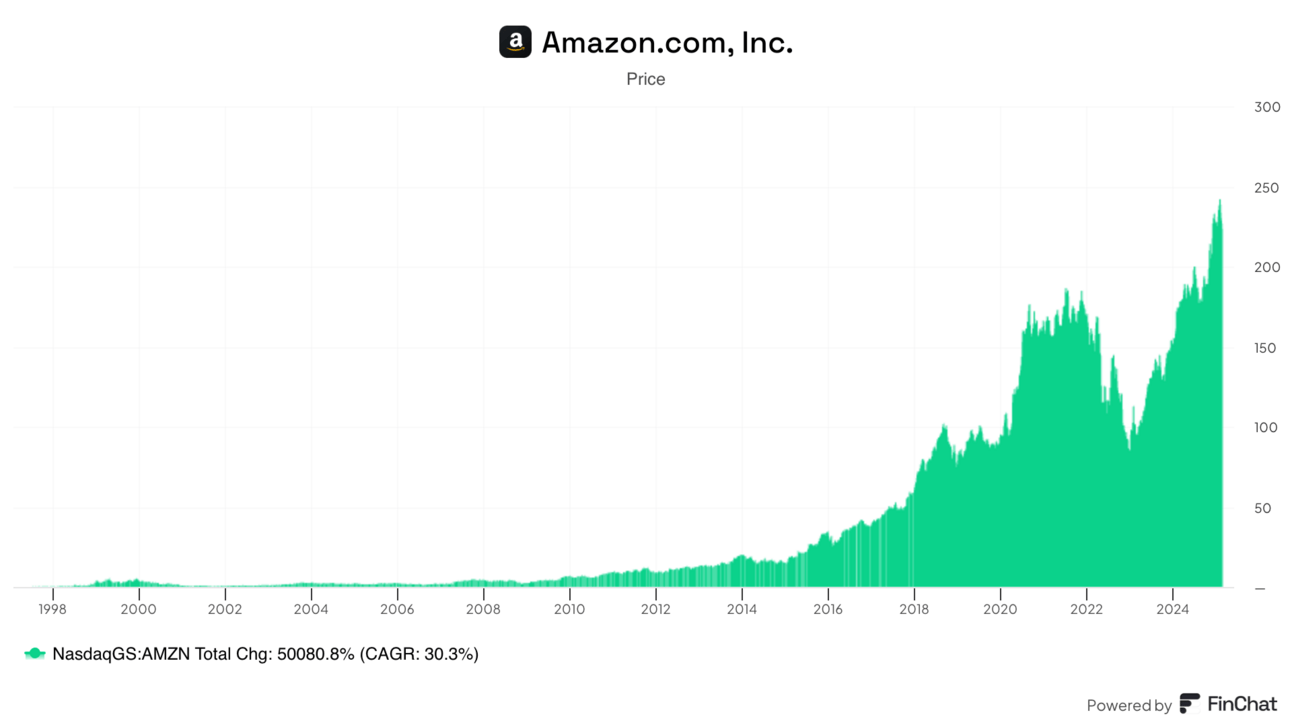

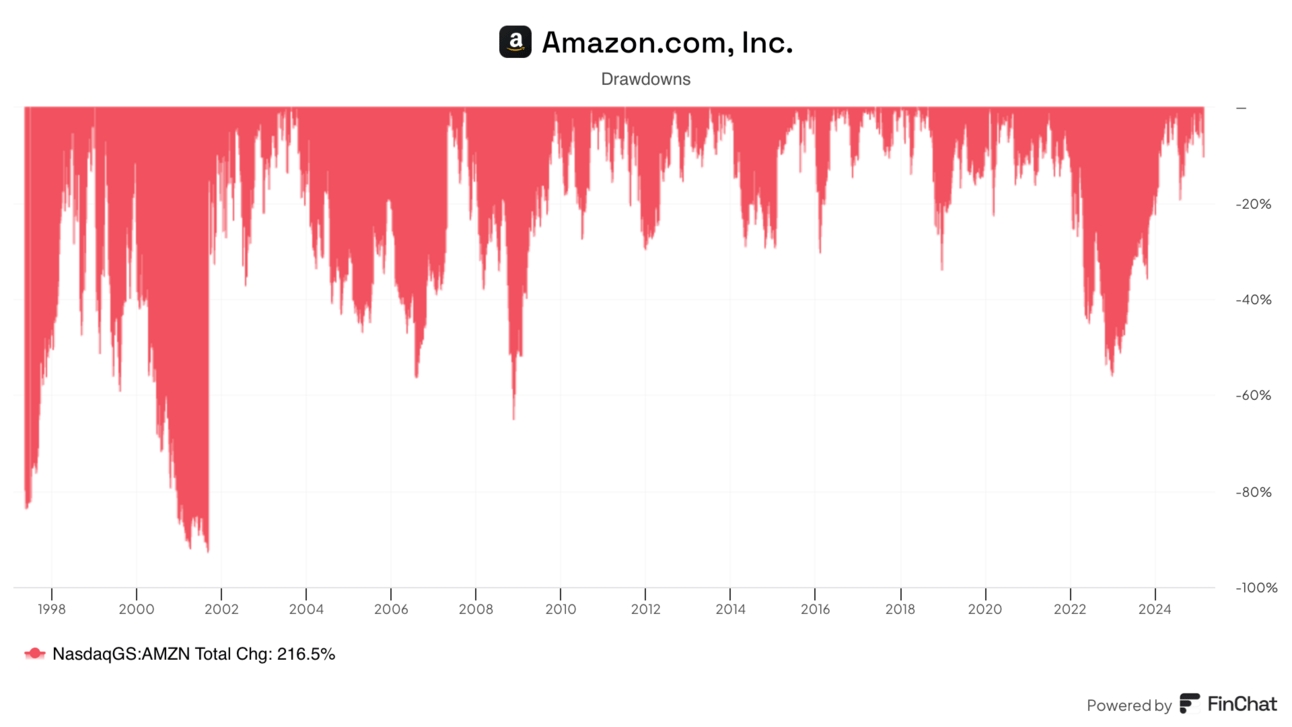

Amazon’s Asymmetric Returns and Volatile History

Amazon is a perfect example of an asymmetric stock that has been a massive winner for investors since its IPO.

But if you think this was an easy ride for investors, you’re wrong. Amazon’s stock fell over 80% twice and was down over 50% in 2007, 2009, and 2022.

Even great companies that grow consistently for decades have volatile stock prices.

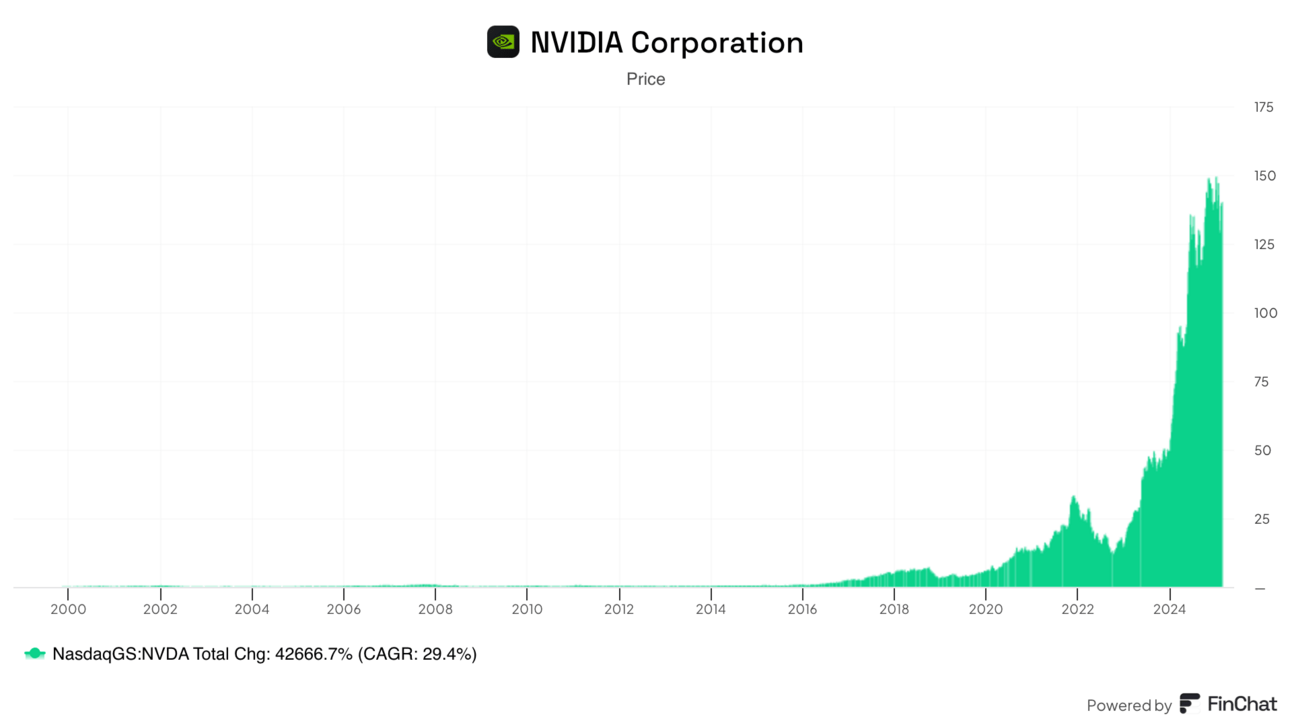

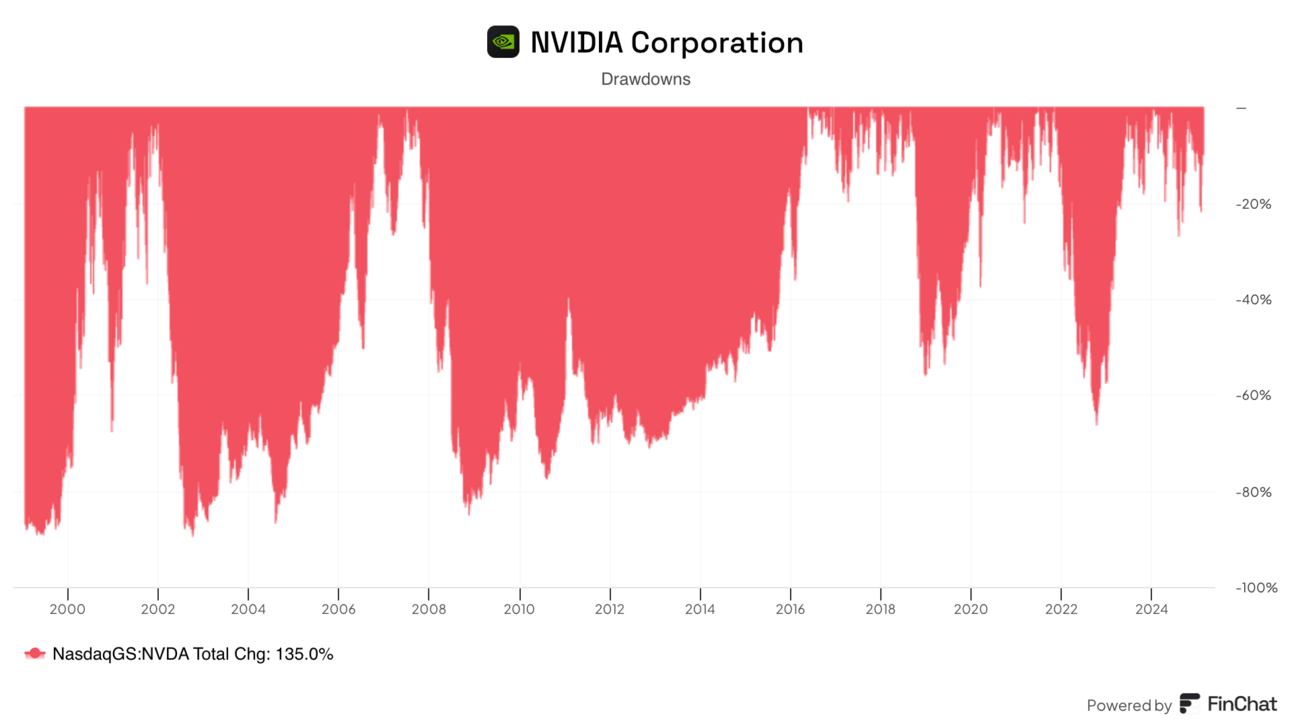

NVIDIA’s Rollercoaster

NVIDIA is an even wilder story. It’s been a massive winner, but do you think this was easy to hold for decades?

NVIDIA stock has fallen over 80% three times since 1998, over 50% in 2018, and over 60% in 2022. It was a money loser for nearly a decade from 2007 to 2016. But if you had ridden it out or bought more at low points, it was a huge winner for investors.

I don’t know if any of the stocks in the Asymmetric Portfolio are the next Amazon or NVIDIA, but that’s the goal. And huge returns will come with volatile stock prices. We were on the downside of that this week.

It’s all part of the process.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.