You can now give the Gift of Asymmetric Investing to your favorite investor for the holidays. For as little as $0.27 per day, you get:

Stock spotlights that dive deep into a company’s business, strategy, and valuation.

Access to the Asymmetric Portfolio that’s up 35.2% in 2024 compared to 23.1% for the S&P 500.

Notification of every trade I make before I make it.

Exclusive interviews…(1 CEO in 2024 was just the start)

There’s a monthly option and an annual option and you can choose the date the gift is delivered. Click here to get started.

The stock market dropped on Wednesday after the Federal Reserve said it was lowering short-term interest rates. The big surprise is the Fed expects inflation and unemployment to both rise in 2025.

What happened to the booming economy we were promised?

The truth is, there are a lot of unknowns and a lot of factors outside of the Fed’s control. Tariffs could cause more inflation. AI could cause more efficiency…and layoffs. Fewer regulations could spur economic activity…and jobs. Credit card debt is rising. And on, and on.

No one knows exactly what will happen. And that uncertainty (periodically) causes a panic in the market. This panic appears to have only lasted a few hours, but the next one could last for months.

In many ways, the Fed is stuck between a rock and a hard place trying to figure out how to keep the economy going while also keeping inflation at bay. It may be in a no-win situation, overheating the economy and causing inflation if rates are too low or crushing the economy to tackle stubborn inflation.

At the same time, stock valuations are at historic highs, despite all of the economic, policy, and rate uncertainty.

As we end the year, I want to give my thoughts on where we are for markets, what I’m doing with the Asymmetric Portfolio, and where I’m exploring opportunities that may be outside the norm.

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Secure Access to Digital Assets

Bridging traditional finance & blockchain.

C$152.4M YTD revenue.

Global ETP leader.

Has The Stock Market Has Gone Insane?

Let me give a few stats to start the discussion:

The S&P 500’s P/E ratio is 30.0, which has only been seen 3 times in history.

Dot Com Bubble and Crash (1999-2002)

Great Financial Crisis (2008-2009)

COVID (2020)

Interest Rates Are Going Up!

The Fed controls short-term rates, which span a few months. But markets control long-term rates, which is more pertinent to the rate a business may see when borrowing money.

Over the past year, the U.S. 10-year Treasury rate has increased 63 basis points (0.63%) to 4.56%. That’s up 16 basis points in the past month and 5 basis points since yesterday when the Fed cut rates.

This tells us the market is expecting higher rates in the future, likely driven by inflation.

GDP growth was revised higher to a 3.1% annualized rate in Q3 2024.

Unemployment Is Rising (more on this below)

Tariffs Are Coming

This will raise prices and cause inflation short term.

It may also be a boon for the economy and help employment and wages long-term.

The truth is, we won’t know the true impact until tariffs are implemented. But the market is pricing in the best and that may not be what we see in 2025.

These are mixed signals, to say the least.

On the employment front, the trends are worth watching. This is the U-3 unemployment rate, which is the percentage of people in the workforce without a job who are actively seeking a job.

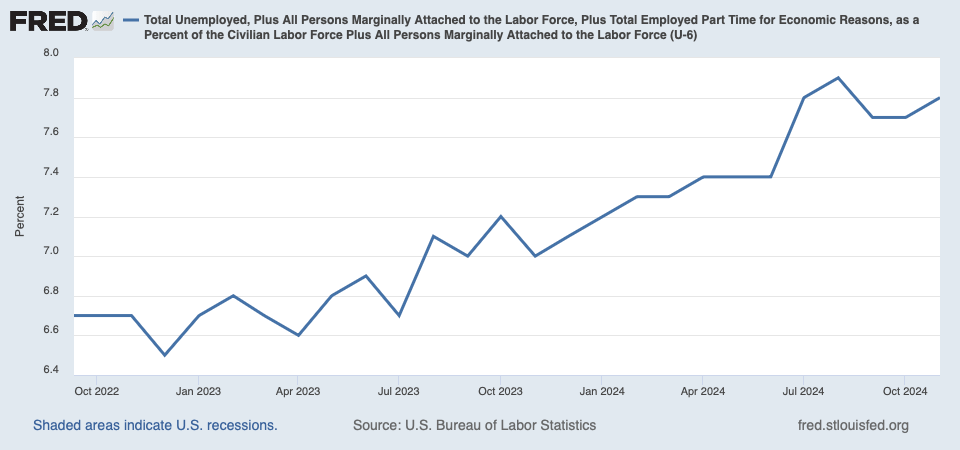

The U-6 rate includes people who are underemployed, gave up on finding work, or went back to school because they couldn’t find work. This is seen as a better gauge of the economy overall. And the rate is creeping up toward 8%.

Why is 8% important? And why is the upward slope something to worry about?

The U-6 unemployment rate didn’t pass 8% in the dot com crash until August 2001. Prior to the great financial crisis, the U-6 didn’t get below 8% until December 2006, but then it started moving higher and by December 2007, when the recession officially started, the U-6 rate was 8.8%.

A rising U-6 rate with a backdrop of rising interest rates, high inflation, and a stock market at all-time highs is a warning sign that we may be in for a crash in 2025.

The question now is, what do investors do about it?

Asymmetric Investing & Frameworks

The framing above makes it look like I’m very bearish on the market. But I’m not selling. Why?

The Asymmetric Portfolio has frameworks and I’m going to follow them.

One framework is staying fully invested because we don’t know when the big up days will occur and missing even a few of the best market days can lead to underperformance.

I could have made a very compelling argument the market was overvalued in July and if I had sold I would have missed some of the biggest gains of the year.

I’m also not stopping contributing to the Asymmetric Portfolio. I’ll buy at the top, but I’ll also buy at the bottom.

There are two additions to this point though.

As a preview for a change next year, I’m going to double the contribution to the Asymmetric Portfolio when the market is in “Bear Market” territory, signified by a decline of 20% in the market.

This gives a clear point of delineation where I can be “greedy when others are fearful”.

I’m also considering some short asymmetric investments, which I’ll discuss below.

This isn’t a short research service, but I do want to have an opportunity to be “fearful when others are greedy” if an opportunity arises.

All said, I’m likely to be more conservative in the next few months, but I’m not changing the plan because long-term the frameworks of Asymmetric Investing work.

Stick. To. The. Plan.

Opportunities and Risks in Today’s Market

There are still plenty of opportunities in the market, as there are in every market.

The first thing I’m considering is where NOT to invest. I want to avoid hype, FOMO, and bubbles.

Did your neighbor make a million dollars on fartcoin? Ignore it.

Did your Uber driver hear the U.S. government is going to buy Bitcoin? Ignore it.

But pay attention to people with a vested interest in valuations going higher telling you the obvious truth we can all see in front of our faces.

It’s peak bubble, AI bubble. Yes, of course.

I mean, it doesn’t take a genius to know that a company with five people which has no product, no innovation, no IP, just recent grads are worth hundreds of millions, sometimes billions. You get billion-dollar valuations on these startups that have nothing, that’s a bubble.

Watch for yourself here:

Techcrunch put together a list of 44 U.S. AI companies that raised over $100 million this year. It’s a wild list.

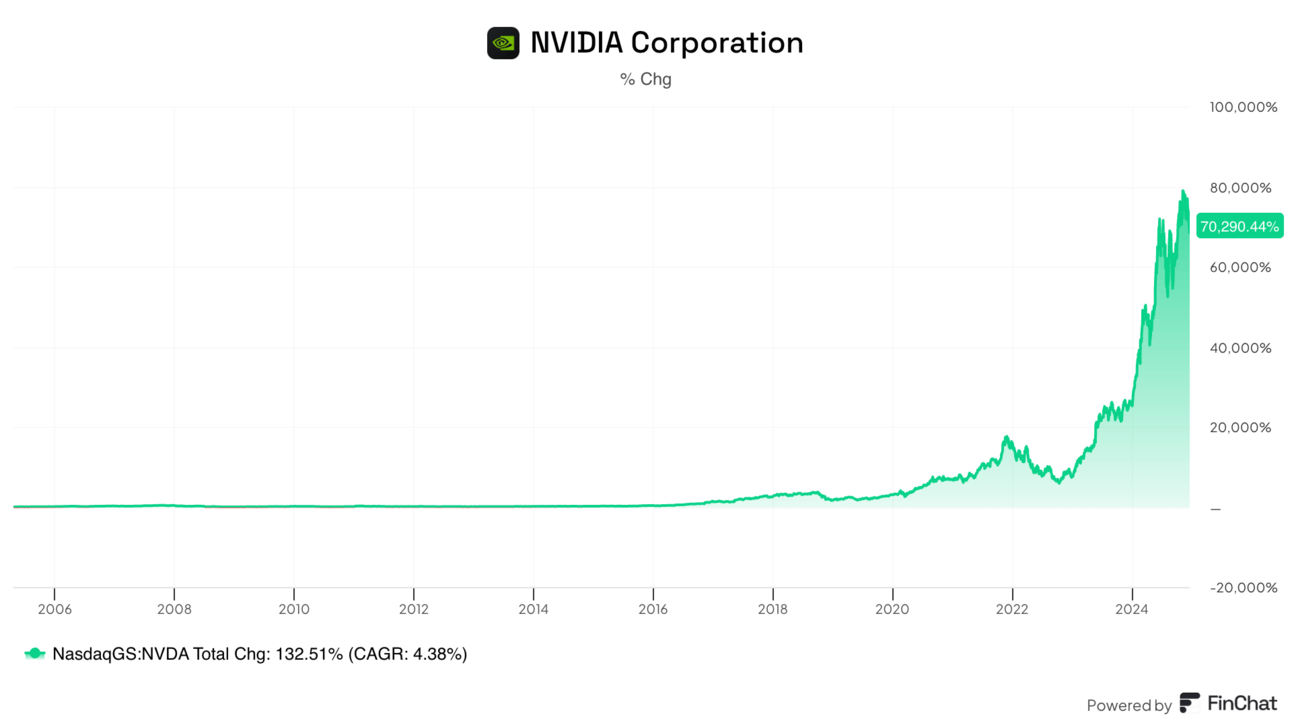

To be clear, there are amazing businesses like NVIDIA, Broadcom, and Tesla in this bubble territory. That doesn’t mean I have to buy them today. As an investor, price matters, and as I wrote last week, I’ll revisit these stocks after the bubble bursts.

In more value territory, I’m seeing opportunities in a few areas today:

Buy depreciated assets. MGM and Disney fall into this category. Think about the billions of dollars they’ve invested in resorts and theme parks and how much more expensive that would be to build in the future with inflation and higher interest rates.

Inflation is a tailwind for these stocks.

Cash flow companies buying back stock. In a downturn, these companies can use excess cash to buy back shares or acquire competitors.

Cheap value. Stocks are trading for low P/E multiples that are also the low-cost products consumers will keep buying in a recession. (think Crocs)

Mega-trend infrastructure. In AI and autonomy, who are the companies with the infrastructure products everyone else is relying on? These companies have decades of growth ahead.

Notice I’m not chasing bubbles. Fundamentals are more important to asymmetric returns than hype or FOMO, which will fade.

Where I’m Searching For “Special Situation” Opportunities

I want to find some asymmetric opportunities to short the market or bet against certain stocks.

If I find any good opportunities, I would put this in a “special situation” bucket outside of the Asymmetric Portfolio. But I think it’s important to at least explore these opportunities at this time.

The problem is, it’s not cheap to bet against stocks that look crazy expensive.

I like the idea of buying long-dated puts, which are options with a known upfront cost and upside when a stock falls. But the puts I’m looking at would require a stock to fall 50% or more to be profitable.

And the market can stay irrational longer than I can stay solvent.

That said, I’ll continue to look for opportunities and have a few stocks on my short list. I’m open to ideas if you have them (simply reply to this email).

What Happens Next?

I don’t know.

Long-term, I think great companies with strong strategic positions will outperform the market and that’s what I will continue to buy in the Asymmetric Portfolio.

But I’m also aware that uncertainty lies ahead and that could mean an unexpected recession or a continuing boom in the market.

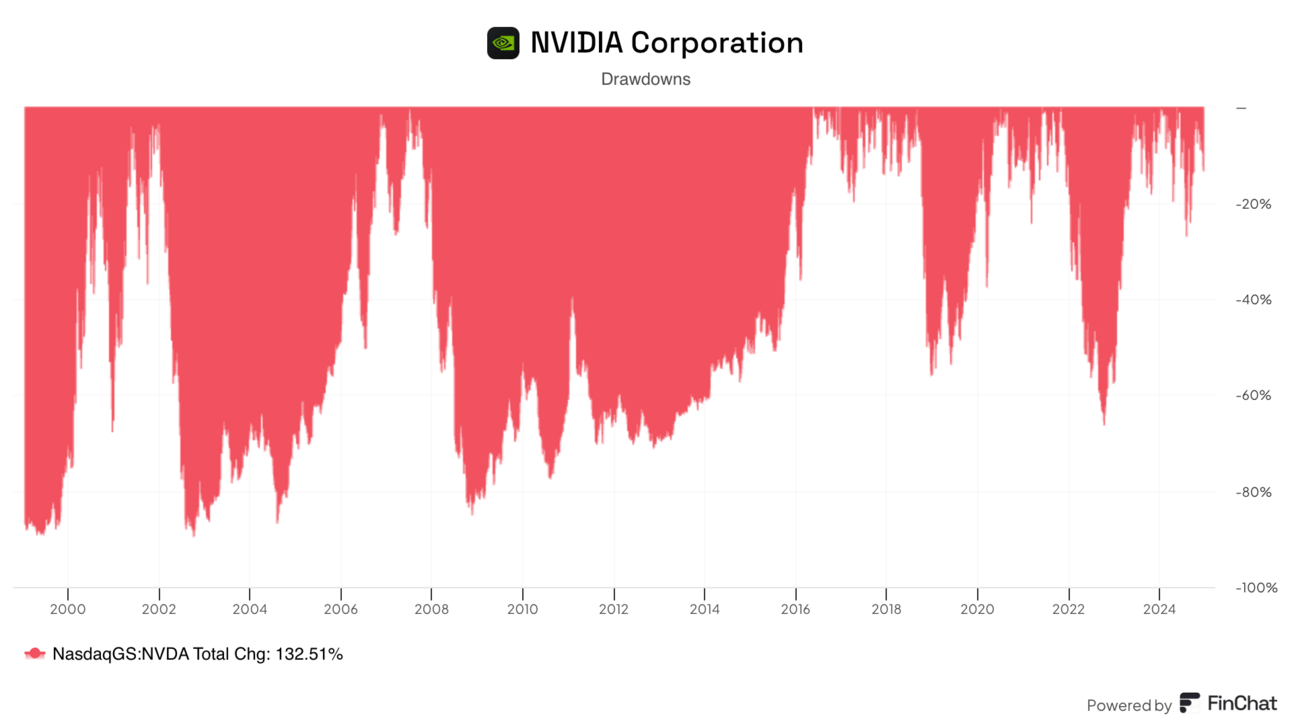

That volatility is the price we pay to beat the market. And even the best stocks in the world can fall 80%, or more, on their way to new high after new high.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.