I was running a day late this past weekend, so welcome to the Sunday email…on a Monday!

Last Tuesday, I did my first AMA in a long time, and it was a massive success. More than 1,500 people joined at one time or another, and I think I got to every question. The bad news is, I messed up my mic settings. Rookie mistake.

Find the replay here.

I will do these at least once a month going forward for premium subscribers to the newsletter, and I’ll be doing more live on YouTube for YouTube-native subscribers.

Let me know if you have thoughts/questions about live shows, and I plan to bring in some guests to add more value to the discussion.

Disney $DIS ( ▼ 0.4% ) didn’t spend a dime on Friday, but it “won” the bidding war for Warner Bros. Discovery.

Technically, Netflix $NFLX ( ▲ 2.17% ) won, but strategically, this is amazing for Disney.

It’s the reverse of what happened when Disney acquired Fox. Instead of taking out debt to buy a competitor, Disney eliminates a competitor and weakens two other competitors...for free!

It’s a counterintuitive take, but I think it’s the truth.

I’ll dig into the news and my takeaway in a moment.

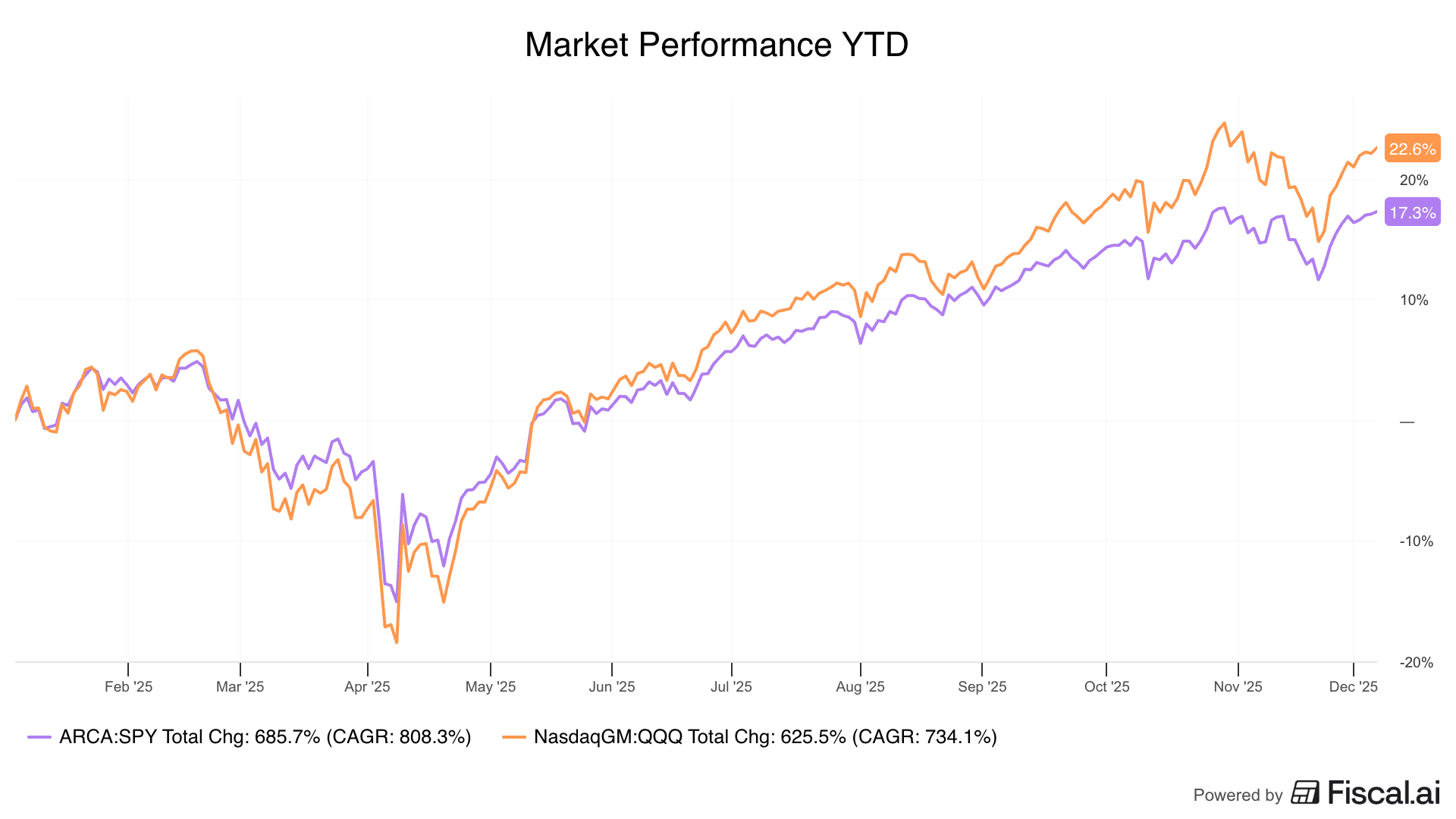

This week on the market, stocks moved slightly higher as optimism returned. Some investors see the potential for lower interest rates as a positive, and some are looking at strong earnings. For now, it’s “risk on” again.

The Asymmetric Portfolio had a solid week after a number of changes early in the week. As usual, look at the long-term performance and not what happens week to week.

In Case You Missed It

Here’s some of the content I put out this week.

Garmin Spotlight: I did a deep dive on Garmin, the latest stock in the portfolio.

My December 2025 Stock Buys: I didn’t just buy stocks; I sold some winners, which I explain in detail.

Where to Find Asymmetric Opportunities: Most big opportunities are hiding in plain sight.

Hims & Hers’ Bold Moves: After opening in Canada and acquiring another lab testing company, Hims & Hers’ strategy is becoming clear.

Zillow’s Rental Push: Zillow is known for being a home-selling platform, but rentals are key to its growing power.

Why Netflix Wants WBD

The big news late last week was Netflix agreeing to buy Warner Bros. Discovery’s $WBD ( ▲ 0.77% ) studios and streaming assets. The cable networks will go into their own publicly traded zombie companies, but the good assets are going to Netflix — assuming regulatory approval.

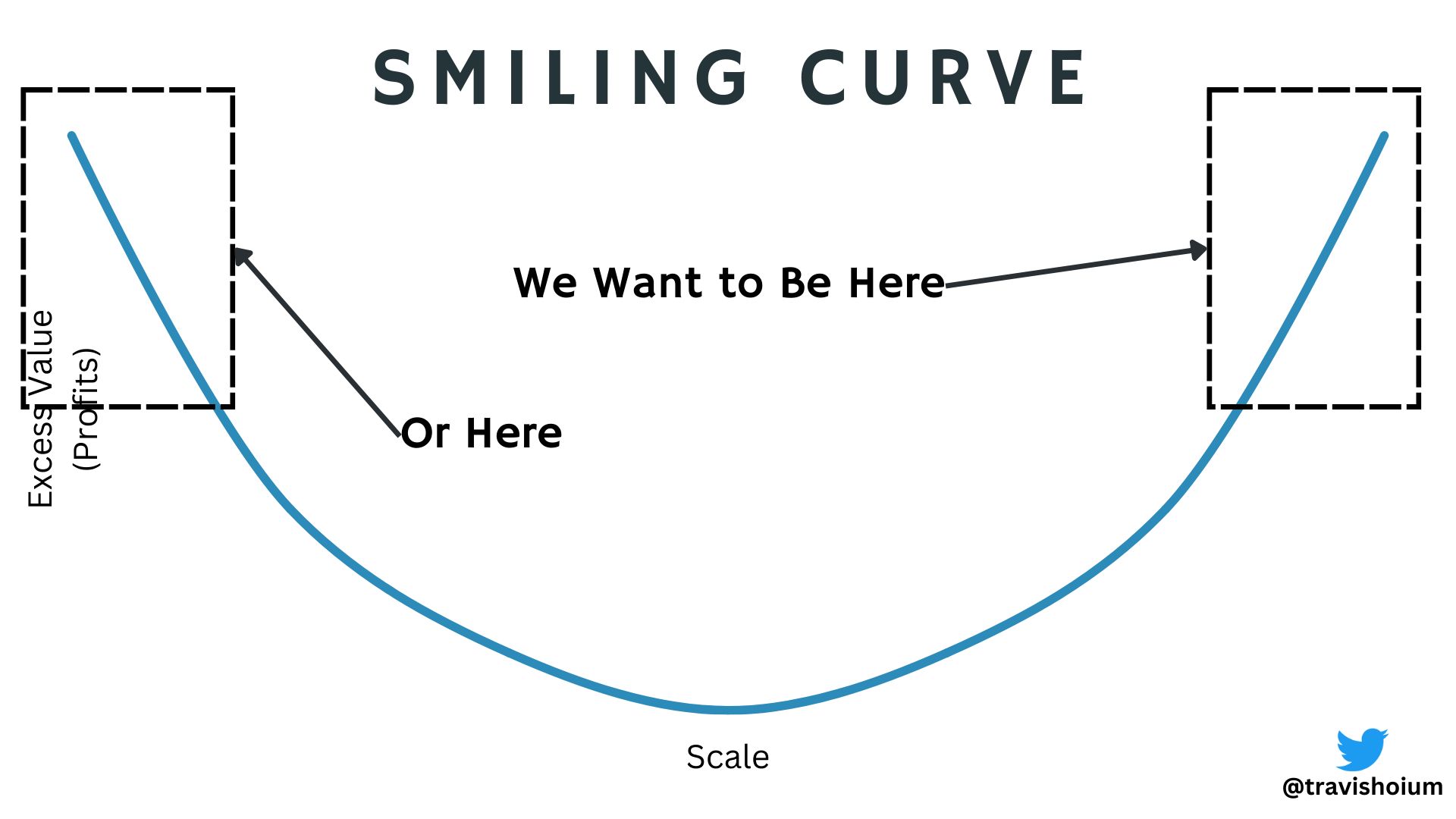

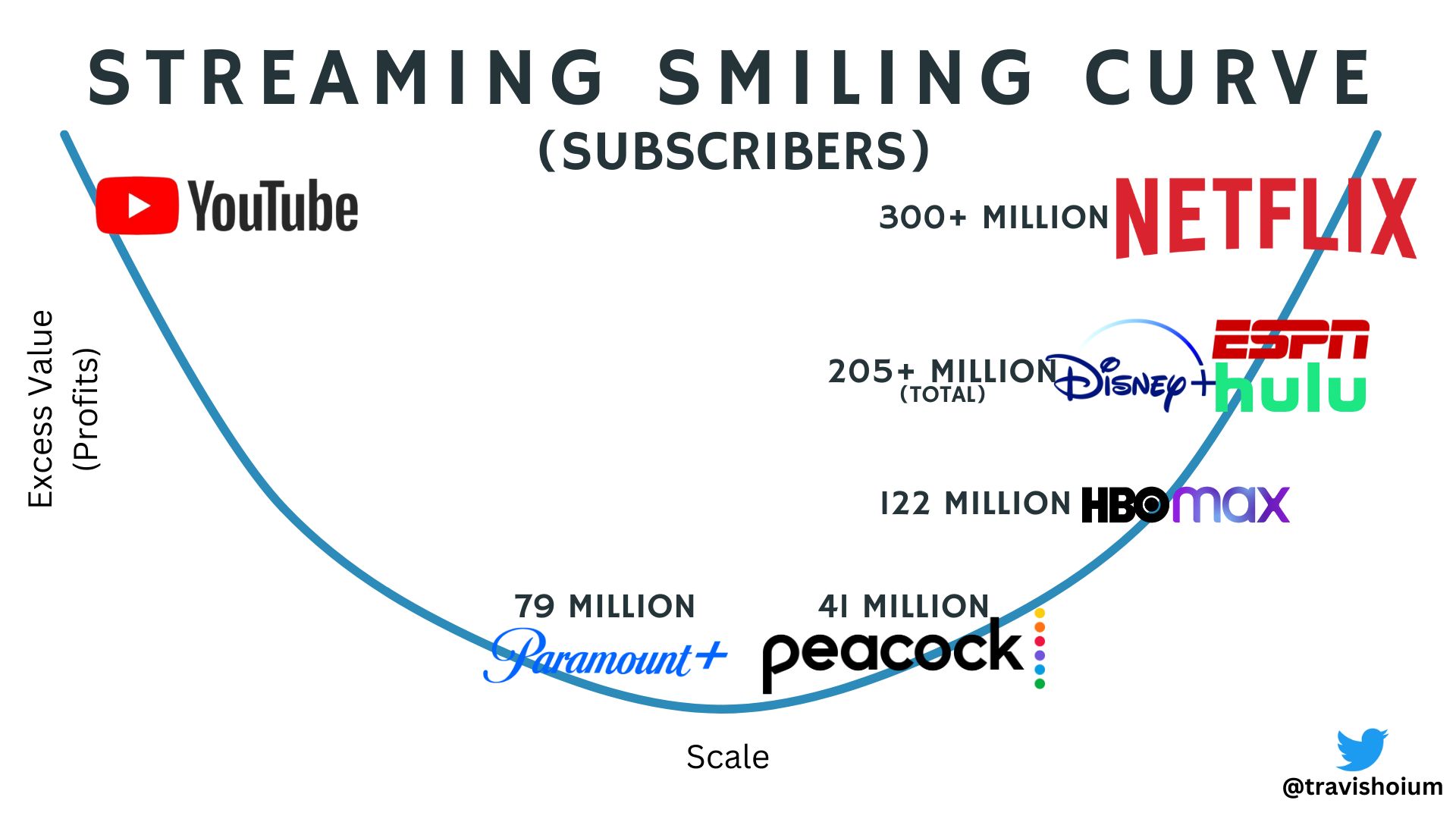

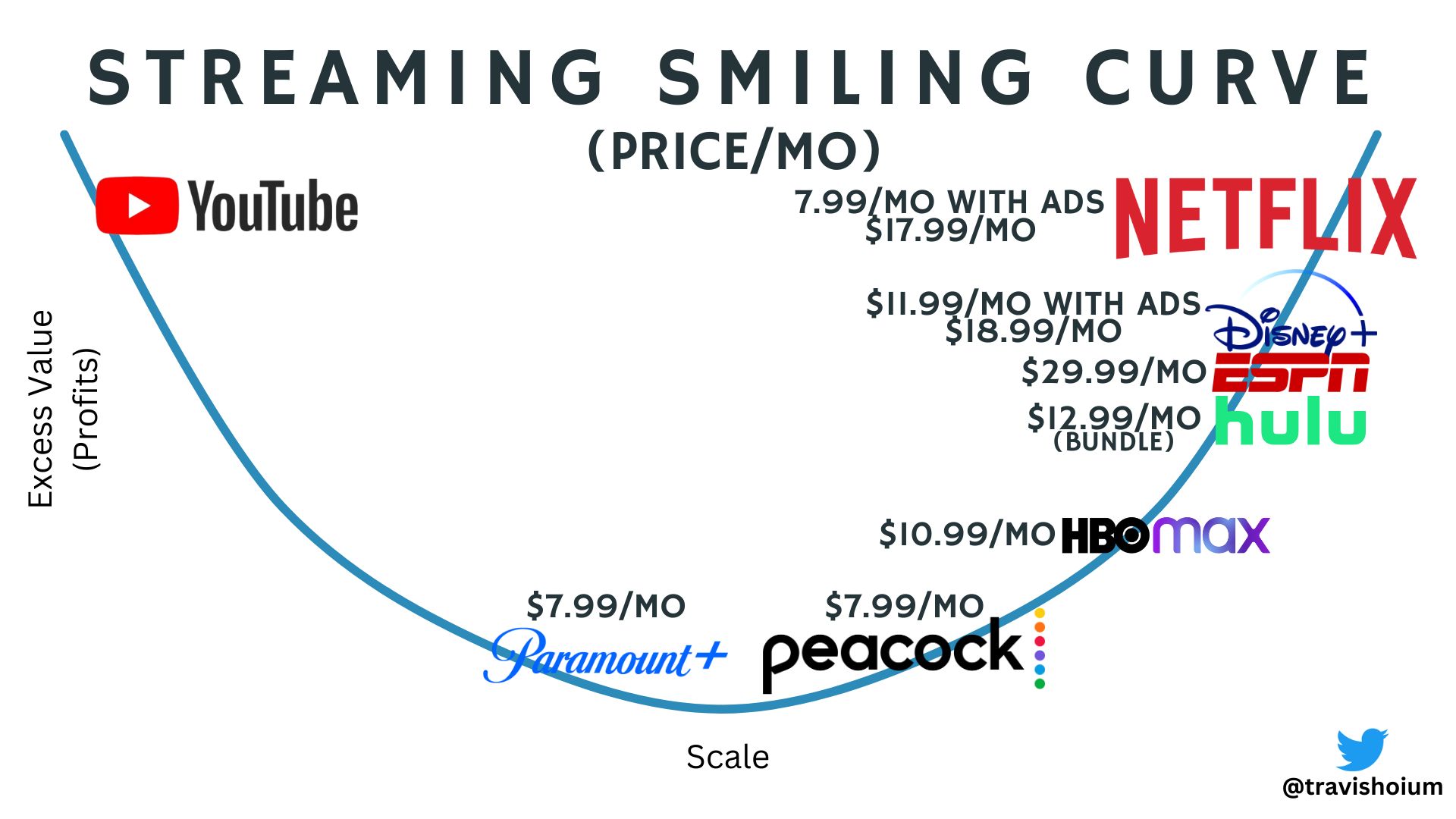

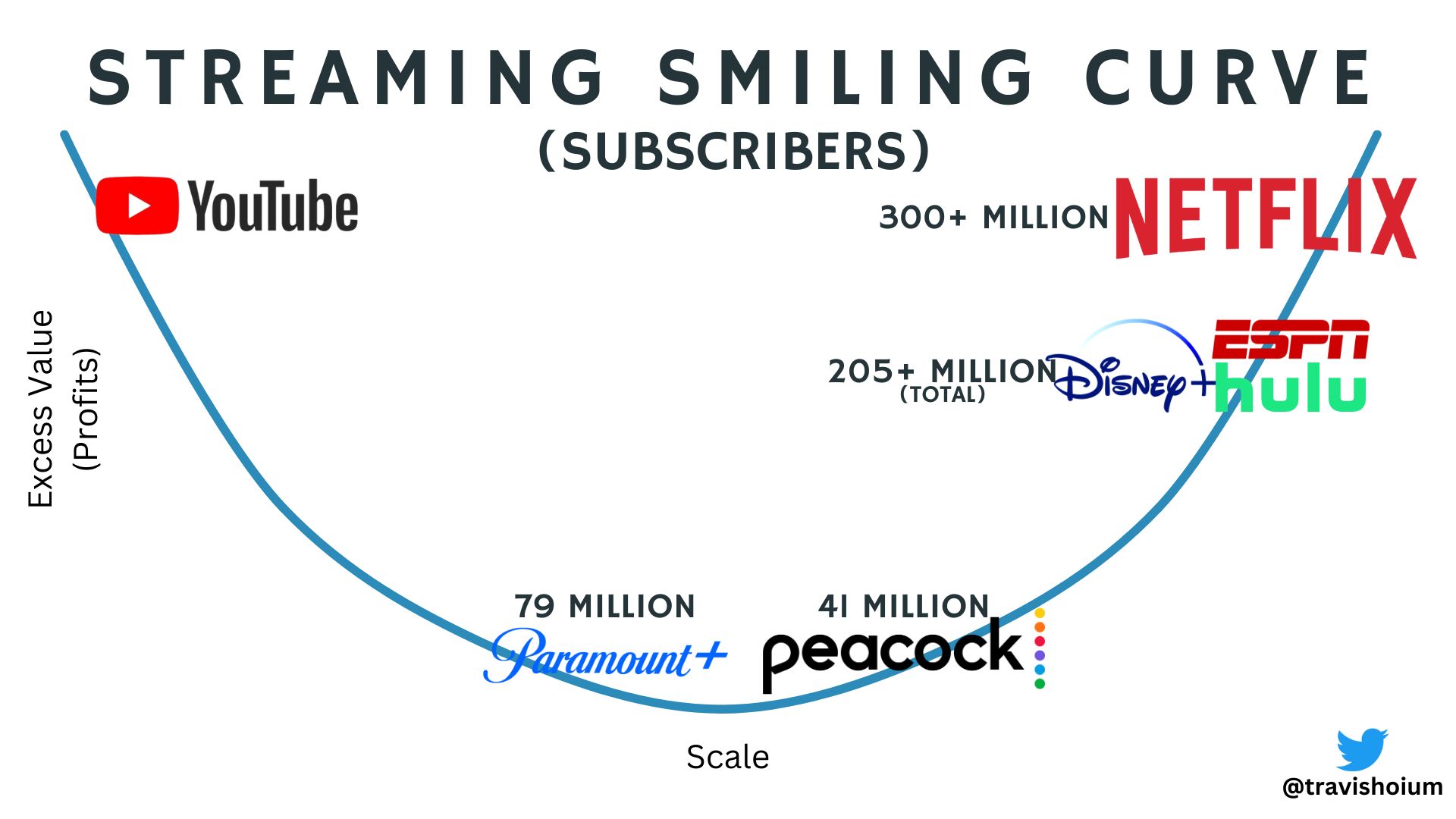

It’s pretty clear why Netflix wants these assets, and I don’t think it’s for the reason most pundits think. If you look at the Smiling Curve and where companies want to be, Netflix has already won in the top right.

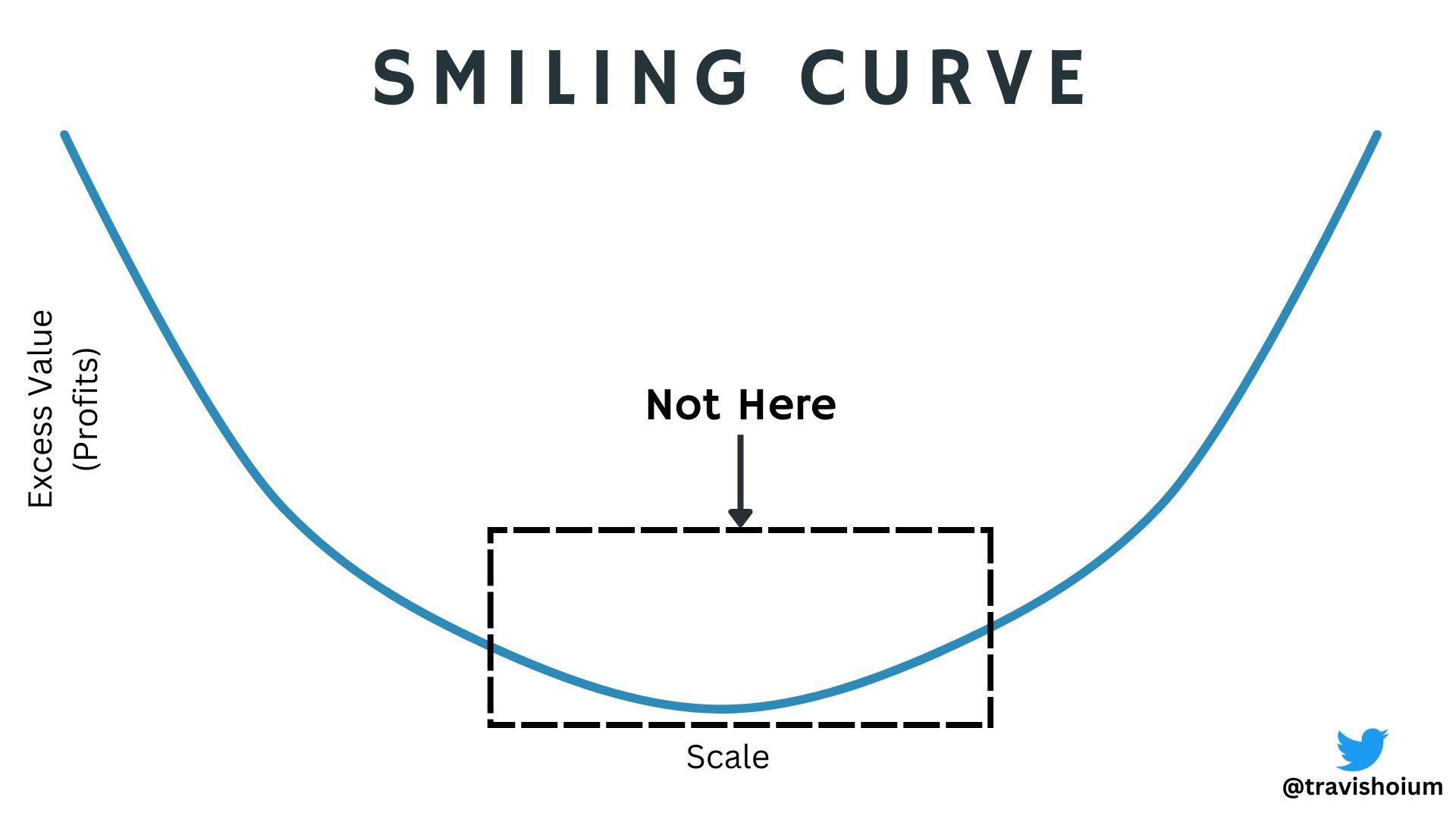

What it’s worried about is this middle section. Netflix is worried that Paramount, WBD, and Peacock will merge, creating another competitor that’s worth caring about.

As it stands right now, Disney is the only company within shouting distance of Netflix in streaming, and they’re playing very different games. Disney+ is really a kids and family entertainment service, and ESPN is the sports bundle. It’s Hulu that competes most directly with Netflix in general entertainment, and that’s not even a fair fight. Hulu is only relevant because of the Disney+ and ESPN bundle!

The subscriber numbers tell part of the story, but the reason the smiling curve is so instructive is that it shows not only the companies with the most users/subscribers, but also how that user base translates to better content and ultimately higher prices and exponentially higher revenue overall.

Netflix and Disney have pushed prices higher over the past few years, and Paramount, Peacock, and HBO Max simply can’t because they don’t have enough content.

So, the weaker players need to consolidate. That means either selling to one of the big guys or merging with each other. The assumption was that Paramount Skydance would merge with Warner Bros. Discovery to create a streaming service with scale. With content like the DC Universe, Harry Potter, Nickelodeon, and a little NFL, that could have been a compelling service.

Netflix saw it as a threat. Eliminate the threat of weak competitors merging by picking one off! Now you’re left with two weak competitors who can’t merge (NBC and CBS can’t be merged together and football rights are key to both services). It’s a win even if the deal gets blocked 18 months from now!

So, what happens if the deal goes through?

Netflix gains subscribers, but I think the key will be in future negotiations for movies and sports rights.

Who can pay the most for a hit movie?

Who has the audience creators want to reach?

The dynamic is most stark in sports rights.

The NFL has an opt-out of rights deals starting in 2029, and if the bidders are Netflix, ESPN, Paramount (CBS), and Peacock (NBC), who do you think wins?

Paramount and Peacock don’t stand a chance with both less money and smaller audiences (which the NFL doesn’t want).

It’s either Netflix or ESPN. (I’ll bring bit tech into the discussion in a moment)

The same goes for the next slate of movies. Who can afford to fund the next Avatar or Mission Impossible or Squid Games?

Probably not the weak studios.

Buying WBD helps Netflix solidify its position in the top right of the smiling curve.

But it also helps Disney separate from Paramount and Peacock without spending a dime!

Don’t Forget About the Kids

The kids/family angle is important too.

Netflix has kids’ content, I don’t want to diminish that. But kids aren’t the focus. And buying WBD does almost nothing to add kids/family entertainment.

And Netflix is about general entertainment, so that’s OK.

On a relative basis, Disney+ just got stronger in kids and family entertainment. And now Netflix will be saddled with $59 billion of additional debt that could keep it from out-bidding Disney for content like Bluey, which has been Disney’s top-watched show.

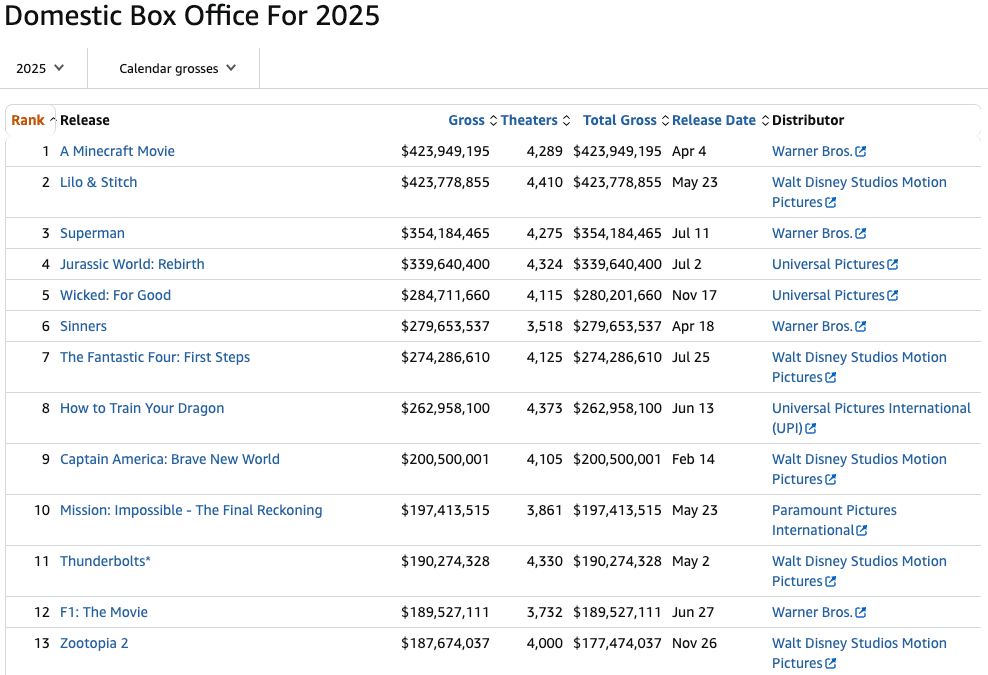

The kids/family content extends to the box office, too. WBD had a hit with Minecraft, but you can see that Lilo & Stitch, How to Train Your Dragon, and Zootopia 2 will all end up in the Top 10 movies of the year, and they’ll all be on Disney+.

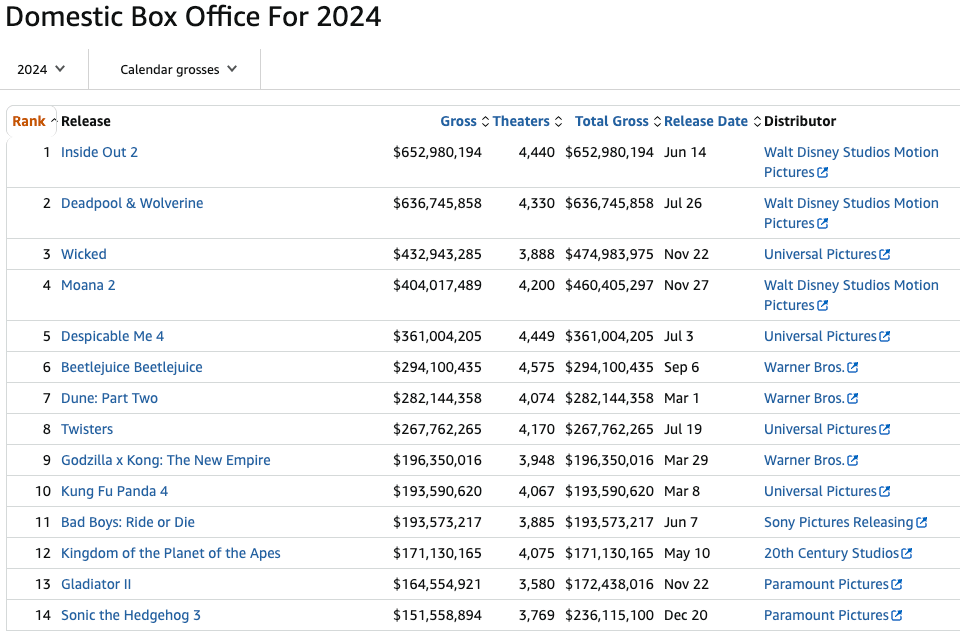

Last year was an even better year for Disney+ content, with Inside Out 2 and Moana 2 in the top four.

Streamers need to have a core market they’re the “must have” for. Netflix wins the largest segment in general entertainment, but when it comes to kids and families, Disney+ is the no-brainer.

My kids can watch whatever they want on Disney+. On Netflix, they’re pushed toward the sugar rush that is Cocomelon, which is why, in this segment, I give Disney the edge.

The Sports Angle

And then there’s sports, the other angle to look at this deal through.

ESPN is becoming a monopoly in sports broadcasting. Anyone who signs with anyone else is playing in a smaller pond or is a side show. Who wants that?

ESPN has the most NFL games, the biggest college football games, and everything else comes after that. Any sport trying to reach customers should ride the football tailwinds!

Now, go to the sports rights angle I talked about above. When new rights become available, Disney and ESPN will likely have the most sports-specific subscribers and the most ability to pay, especially compared to Peacock and Paramount.

Netflix wants sports, but it wants sports as a churn mitigation tool, not a core business. And keep in mind that Disney’s pockets are actually deeper to buy sports rights. And remember, Netflix will now have nearly $100 billion in debt!

Apple, Amazon, and YouTube have more money overall, but they also have bigger fish to fry and, like Netflix, look at sports as a churn-mitigation toy.

I think consolidation into clear verticals like Netflix in general entertainment and Disney in kids/family, with ESPN owning sports, is a natural outcome. In fact, it was key to my thesis on Disney more than two years ago!

Aggregation vs Monoculture

Another way to think about Netflix and Disney is through the modern tech-based algorithm that drives content today, driven by aggregators. Your Netflix or YouTube feeds are different than mine because they’re all about personalization.

Disney leans more into the old-school monoculture.

Big blockbuster movies we all see the same week (we already feel behind because we haven’t seen Zootopia 2).

The big game on ESPN is the same.

Disney is a monoculture play, like it or not.

There’s a place for both in streaming, but it looks like there will only be two, and if Netflix buys WBD, it’ll be Netflix and Disney, with the others being left to niche scraps.

Why Disney Is the Better Stock

Netflix won the bidding for WBD, but it’ll take on a huge debt load and be focused on legal battles, while Disney can execute its core business.

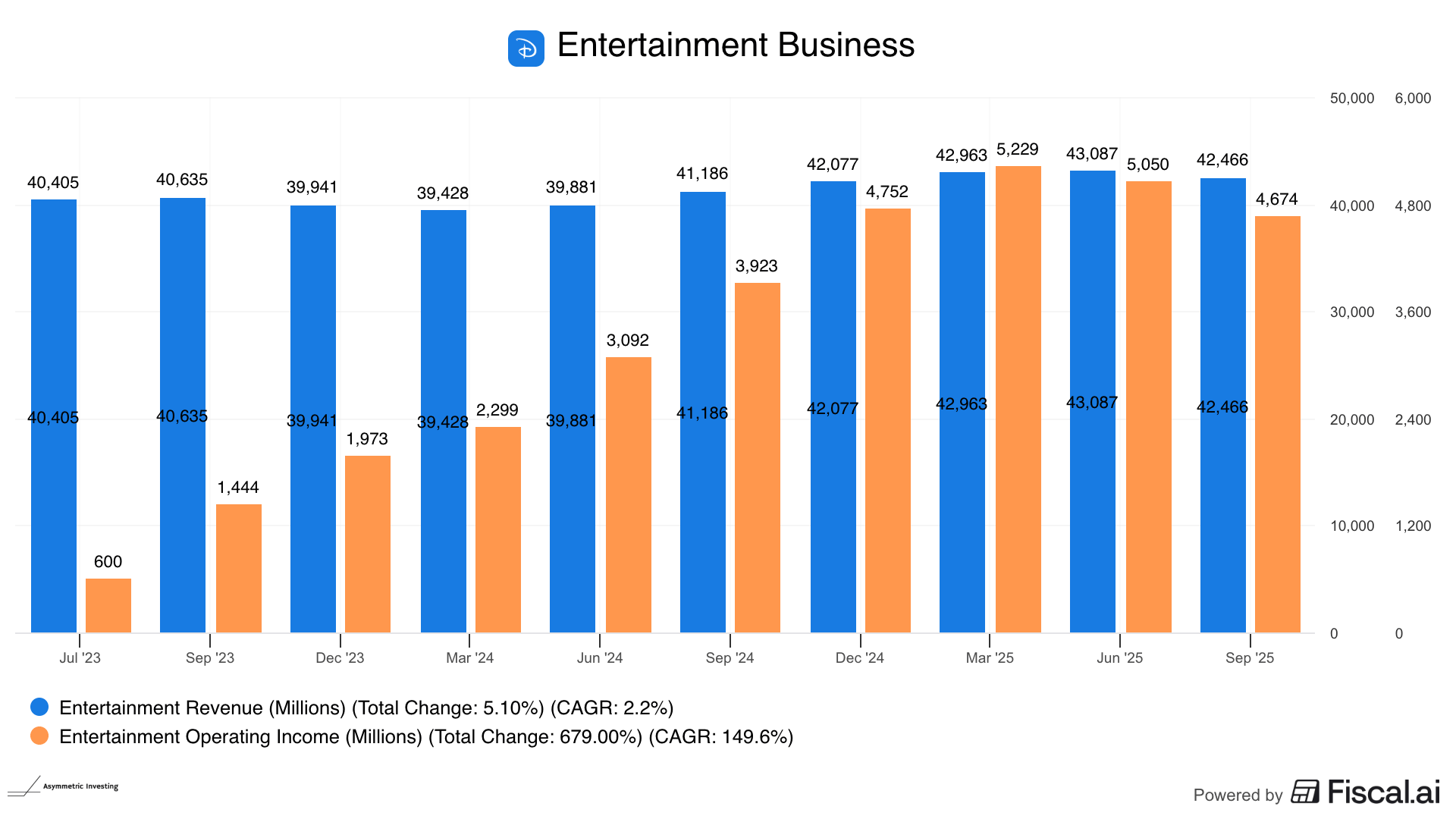

And entertainment has been heading in the right direction as streaming becomes operating income positive and studios start to kick out hits.

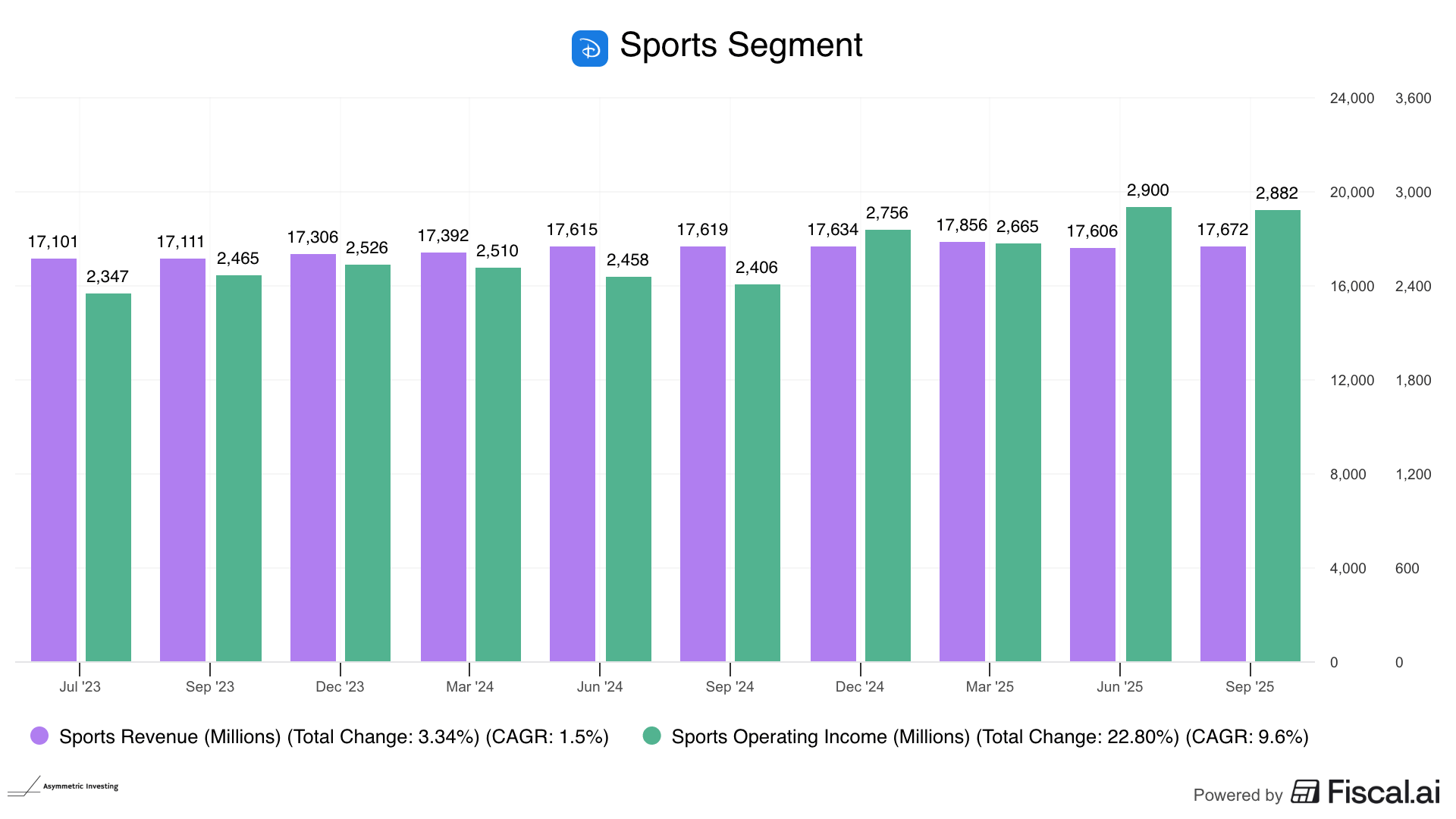

The sports segment has been flat in a dying cable environment and could explode now that ESPN is going direct.

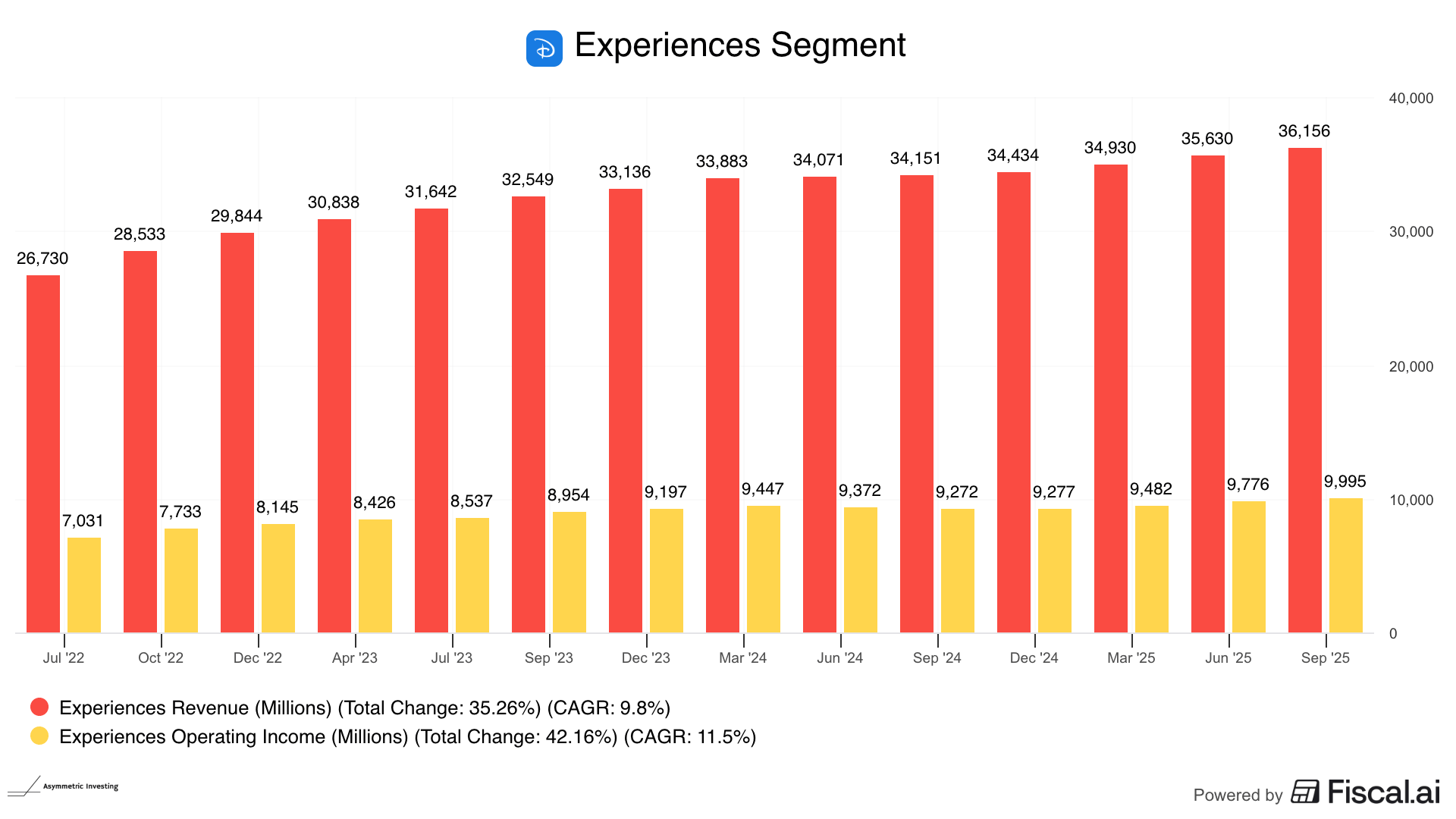

And experiences are a $10 billion operating income juggernaut that no other media company can match!

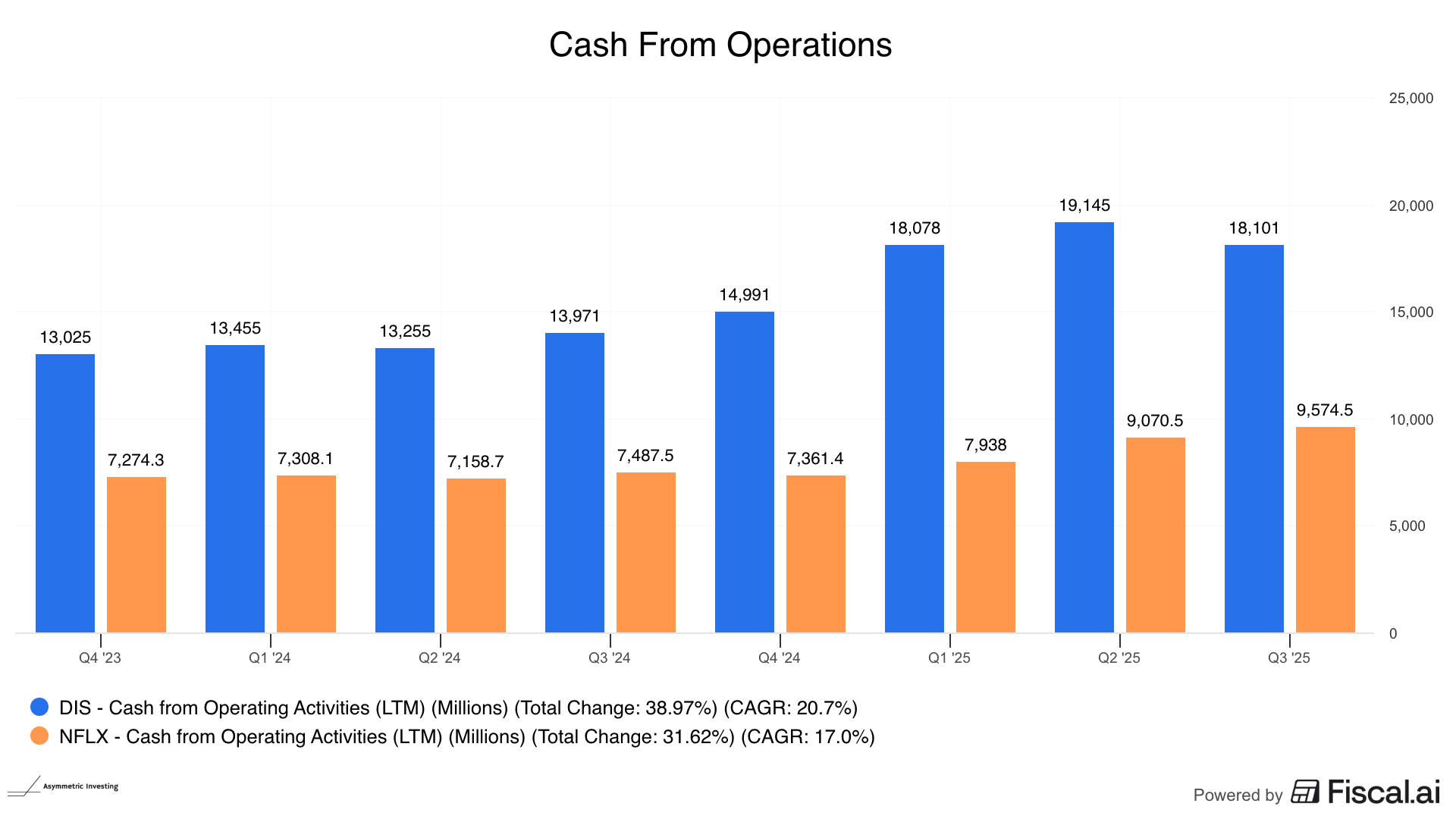

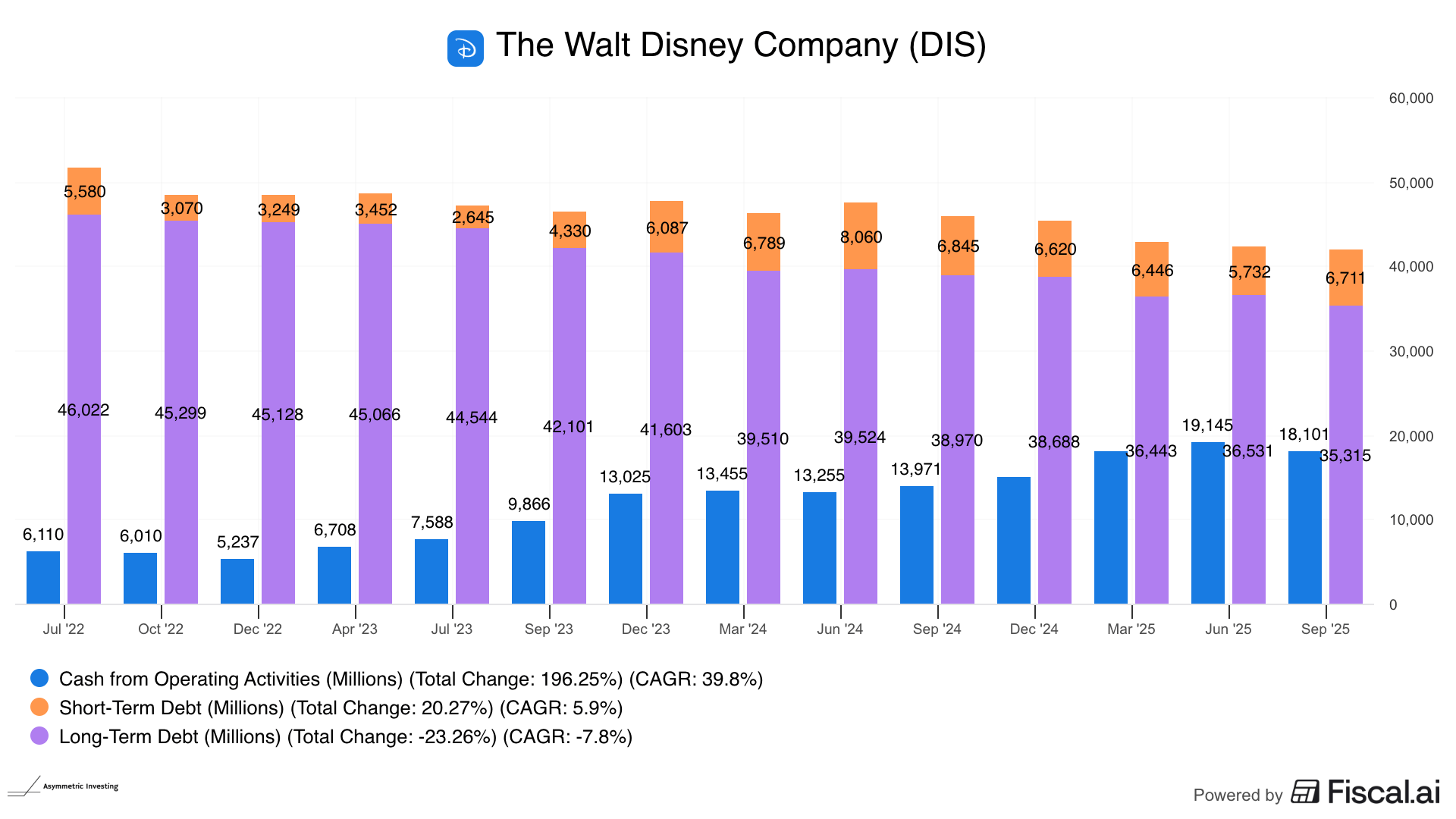

And Disney’s debt it falling as operating cash flow rises. That gives the company flexibility to invest in parks (which it’s doing), sports content, and customer acquisition.

At 15x earnings and 19x free cash flow, Disney is a steal compared to Netflix’s 42x earnings and 51x free cash flow multiple.

Strategically and financially, I think Disney is the best stock in media today.

Do you?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.