There are moments when I question the sanity of markets. Today is one of those days.

On Friday, President-elect Donald Trump launched a meme coin that has no value other than…memes. Within hours, the coin’s total market cap was over $25 billion. As I finish this article, the value is $65 billion.

This has to be peak absurdity. Right?

I’ll get to the token and how insane the market is below. But first…

On Wall Street, the week was solid with core inflation lower than expected and some economic and employment indicators stronger than expected. Right now, it seems like everything is pointing in the right direction. But next week earnings season begins in earnest and the rubber hits the road.

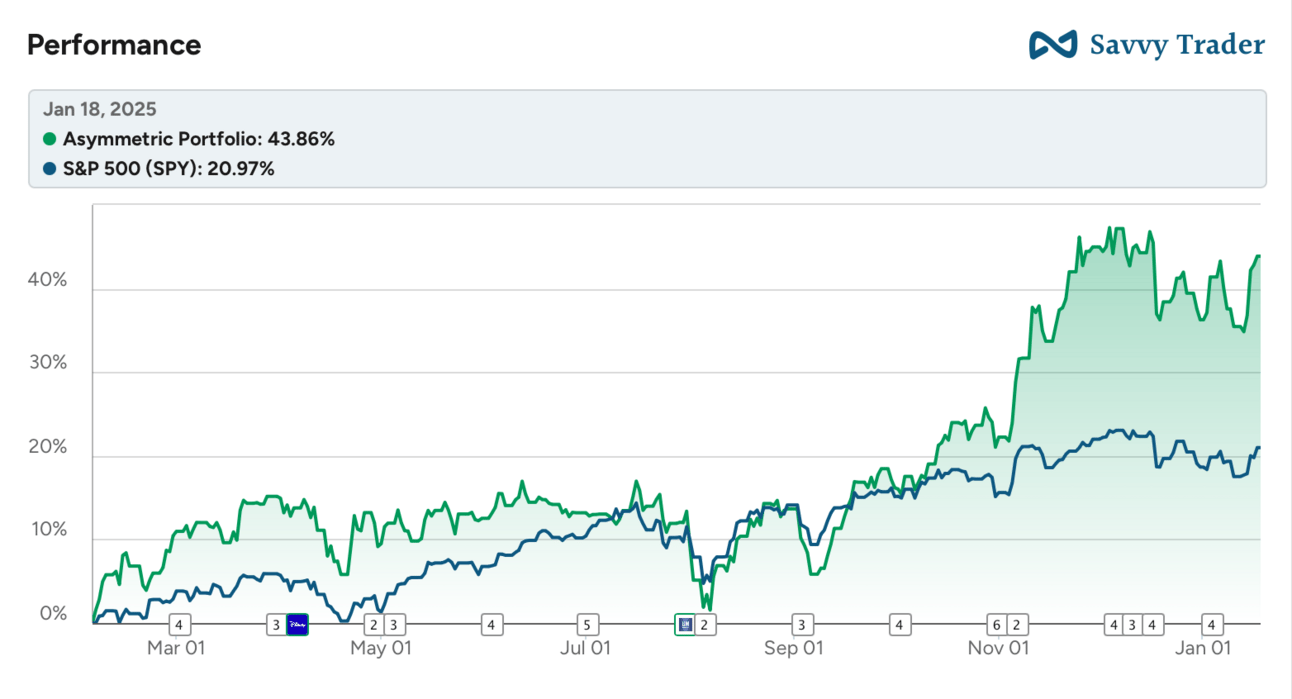

The Asymmetric Portfolio had another good week and is up 5.6% year to date compared to 2.0% for the S&P 500. This has compounded on last year’s great results.

What stocks am I adding to my market-beating portfolio? You can sign up for premium here to avoid ads, get 2x the content, and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

In Case You Missed It

Here’s some of the content I put out this week.

Valuation, Buybacks, and Massive Gains: There are companies with stocks so cheap they can buy 15% to 20% of outstanding shares each year.

Livestream + Portillo’s Update: Watch my live show with Jose Najarro and check out why Portillo’s has suddenly become a market favorite.

5 Things to Watch This Earnings Season: Earnings season is here and this is what I have my eyes on.

Meme Coins and Peak Absurdity

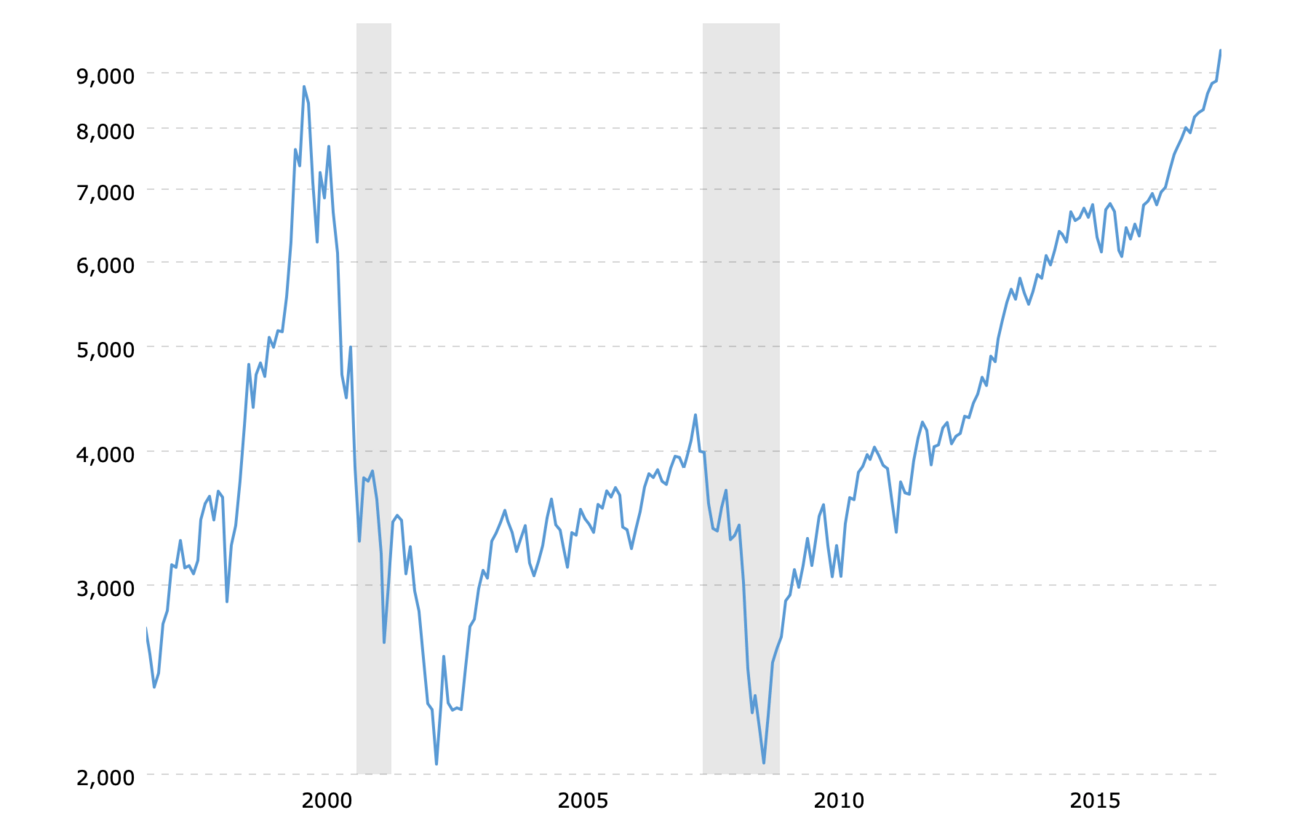

In 30 years as an investor, the only time we have rivaled the absurdity of the current meme coin craze is the dot com bubble. In that case, there were very real companies with VERY crazy valuations because people were making up values for a new business model. They used eyeballs, page views, and all kinds of other crazy metrics to justify the valuation of companies with little revenue and nothing but losses as far as the eye could see.

Eventually, sanity returned to the market when the bubble burst in 2000 and it would take more than 17 years for the Nasdaq Composite Index to get back to bubble highs.

The latest bubble is in memes, which are quite literally, an “expression of support” for “ideals and beliefs” which seems even more absurd in a lot of ways than the dot com bubble. From the official website of the Trump meme coin launched on Friday:

Trump Memes are intended to function as an expression of support for, and engagement with, the ideals and beliefs embodied by the symbol "$TRUMP" and the associated artwork, and are not intended to be, or to be the subject of, an investment opportunity, investment contract, or security of any type. GetTrumpMemes.com is not political and has nothing to do with any political campaign or any political office or governmental agency. CIC Digital LLC, an affiliate of The Trump Organization, and Fight Fight Fight LLC collectively own 80% of the Trump Cards, subject to a 3-year unlocking schedule. CIC Digital LLC and Celebration Cards LLC, the owners of Fight Fight Fight LLC, will receive trading revenue derived from trading activities of Trump Meme Cards.

This has to be the top, right? Can it get crazier than the President of the United States of America launching a meme coin?

I’m having trouble wrapping my head around how we got here and what happens next.

Maybe I’m getting old?

Maybe the world is now a meme?

Or maybe sanity will return eventually.

Unless there are major changes in the next few days, I’m going to make my first short investment in Asymmetric Investing history this week. It will be a limited downside and high potential upside investment, just like the stocks I buy.

At this moment of absurdity, I see too much risk to ignore and need to have some exposure to some upside in the case of a crash in the next two years. You may not like the pick. But if I’m wrong the Asymmetric Portfolio will likely charge higher making any loss from one short position meaningless. And if I’m right, it’ll ease the pain of any market crash.

Premium subscribers can expect the pick on Wednesday. See you then.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.