Asymmetric Investing isn’t just about buying the hottest names in the market and hoping for the best. The price we pay for assets is just as important as their long-term business prospects.

If we overpay for an asset there’s a risk of valuations dropping and even a well-run business can spend years just living up to lofty expectations.

Ideally, I can find stocks that trade for a value and provide limited downside with many possibilities for upside potential. And there’s one stock that’s a great example of that combination of value and potential growth with buybacks potentially driving its 10x returns.

Why I Bought More MGM Resorts Stock

I’m going to use MGM Resorts as a proxy here because I recently bought more in the Asymmetric Portfolio, but the same thesis can be applied to Crocs or GM (which I recently sold).

The analysis is pretty simple. I’m looking for:

Strong cash flow from a business with a wide moat.

They aren’t adding land to the Las Vegas Strip.

Macau has limited land, only 6 concessionaires, and limits both buildings and tables/slots.

Only 1 casino is approved in Japan (2030).

People need/want to go to destinations to get together and have fun. This goes for parties and businesses, which are increasingly remote. These destination hubs will benefit from this multi-decade trend.

A relatively low valuation that makes buybacks accretive over time.

When I see a value stock, a simple question to ask is, “Will this business be disrupted in the next decade?”

And I think the answer for MGM Resorts is clearly, “NO.”

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Wall Street loads up on surprising $2.1tn asset class

Bank of America. UBS. JP Morgan. They’re all building (or have already built) massive investments in one $2.1tn asset class—and it’s not what you think. It’s not private equity or real estate, but fine art. Why?

In partnership with Masterworks, data from Citi shows it’s a potent diversifier with low correlation, and certain segments have even outpaced traditional investments. Take blue-chip contemporary art, which has outpaced the S&P 500 by 64% (1995-2023).

Masterworks knows the power of art investing, with their platform giving 900k+ users the opportunity to invest in this asset class as part of their overall portfolio strategy. In fact, from their 23 exits so far, Masterworks investors have realized representative annualized net returns like +17.6%, +17.8%, and +21.5%* (among assets held for longer than one year).

With so many users, Masterworks offerings can sell out quickly.

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

How Buybacks Add Value

In The 4 Reasons Stocks Go Up, I said revenue growth, margin expansion, multiple expansion, AND buybacks are the 4 reasons stocks go up.

The first three are simple enough to understand. But buybacks can be more nuanced.

A buyback done at a 5 P/E multiple (GM in 2023) is very different than a buyback done at a 40 P/E multiple (ahem, Apple).

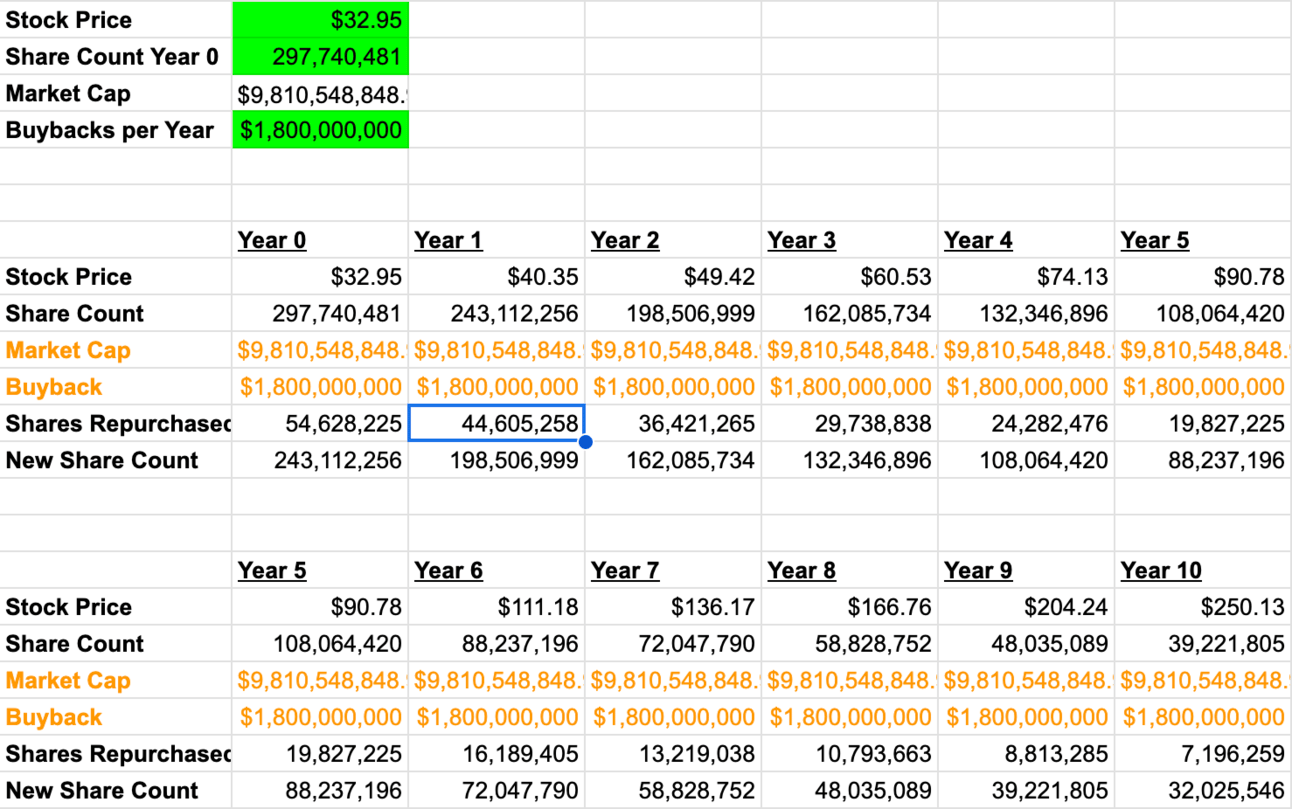

So, let’s do some math on how a buyback will add value to MGM Resorts investors over time given the current valuation.

Enterprise Value: $13.6 billion

Market Cap: $9.8 billion

Operating Cash Flow: $2.4 billion

Maintenance Capex: $600 million

Ongoing Free Cash Flow: $1.8 billion

Let’s assume the business is relatively stagnant and generates $1.8 billion in cash for buybacks each year. I’ll assume debt stays flat, and the market cap goes nowhere. All that happens over the next decade is stock is bought back and the stock price adjusts to account for the reduced share count.

Market cap, EPS, P/FCF, etc all stay the same.

This is what that table looks like for MGM Resorts over the next decade. Before any growth from Japan or online gaming or increases in spending in Las Vegas, the stock would increase 660% in 10 years just from buybacks.

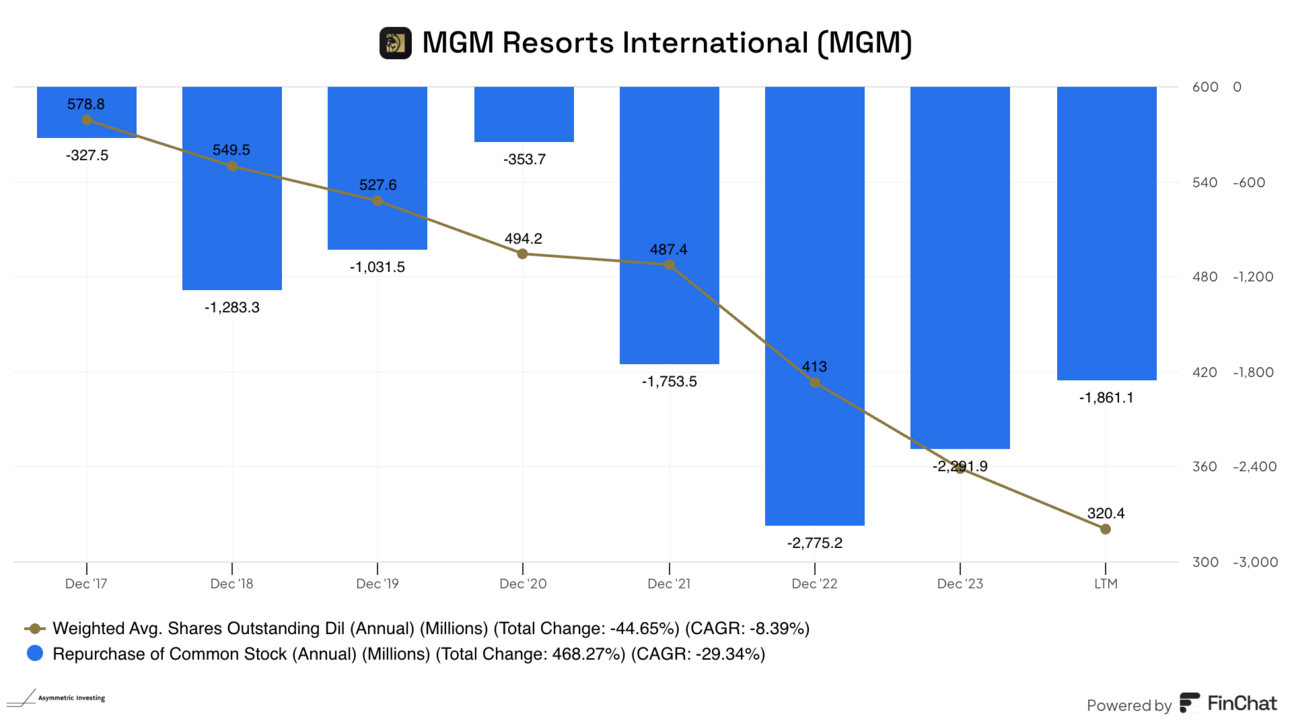

For perspective, this is the path the company has been on for a few years. And yet, the stock has fallen, which will make buybacks more effective.

This gives investors in a company like MGM Resorts protection on the downside. At worst, the company keeps buying back stock at the current pace.

How MGM Resorts 10x’s Or More

Now if we bring revenue growth, margin expansion, or multiple expansion into the equation you can easily see how MGM Resorts stock could 10x in value.

Revenue growth will come from the slow and steady increase in revenue from Las Vegas, regional casinos, and Macau. Remember, inflation is a tailwind here because revenue will inflate at a faster rate than costs because of operating leverage on depreciated assets.

And don’t forget about online gaming, which could contribute $500 million in additional cash flow relatively soon.

We don't anticipate any more capital in BetMGM. We don't anticipate any more acquisitions as it relates to MGM Interactive, in-house, we call it, which is the LeoVegas arm and some of the other stuff we've told you we've been doing. And look, I -- we have three markets under launch right now, U.K., Netherlands and soon to be Brazil. I think by the late part of next year, all of that will manifest itself, unless there's something else that breaks of scale, I think as we come out of '25, we're going to be something substantial across the board leading into '26. And I think for us to think about '26 and beyond $400 million, $500 million in cash flow and then some is just not out of the -- as I kind of suggested earlier, we could turn the lever on some of it today and push half of that out to the front door, I think. So I think that's a reasonable expectation.

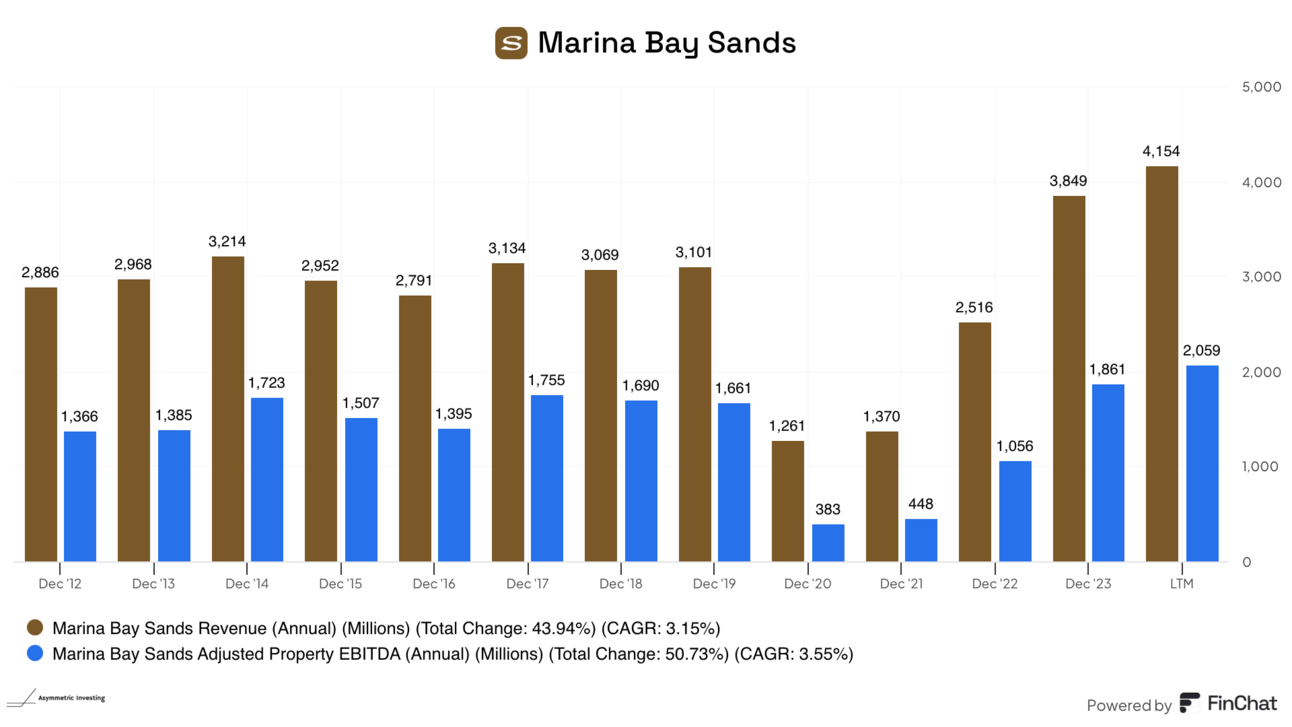

And Japan, which could rival Marina Bay Sands as the most profitable resort and casino in the world when it opens in 2030. MGM will own 40% of that property.

Revenue growth could also drive multiples higher, which would have a compounding effect.

And that’s how you get a 10x stock.

The formula is simple. And I think we’ll see management continue to be aggressive buying back stock in 2025.

I’ll be happily acquiring shares in anticipation of more appreciation of buybacks today and revenue growth in the future.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.