Why do stocks go up or down?

At an elementary level, there are four reasons. I will break them down and give you examples of how each factor is driving the Asymmetric Portfolio this year.

As for this week, the market was up once again. Momentum keeps rolling, and as we begin earnings season, it’s good to see positive reactions to early results. This week, things kick into gear with companies like GM, Tesla, Verizon, American Airlines, and UPS reporting third-quarter results.

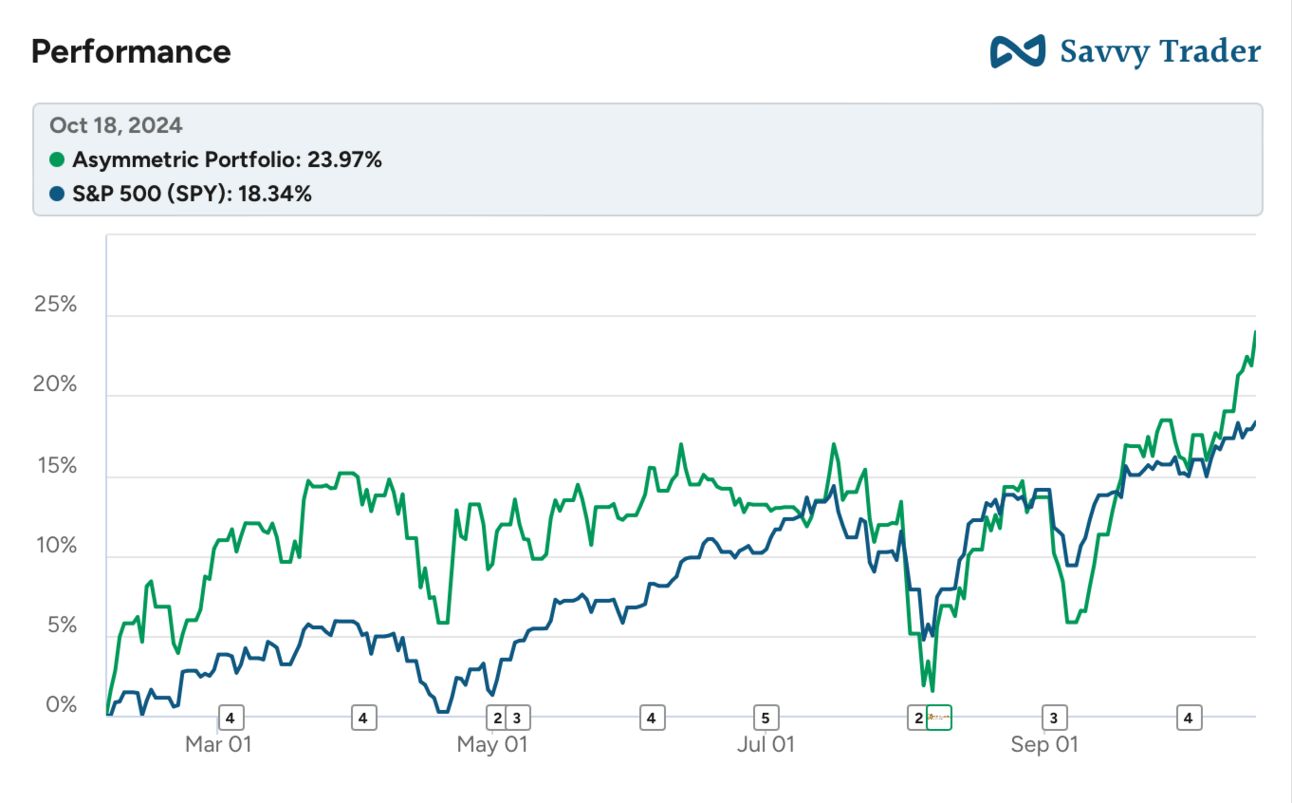

It was another great week for the Asymmetric Portfolio. It’s outperforming the market by over 5%! I’ve gotten a few notes from subscribers who have had big wins this year, and I couldn’t be more excited to be a part of your investing journey.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads. Sign up for premium here to avoid ads and get 2x the content and access to the Asymmetric Portfolio.

In Case You Missed It

Here’s some of the content I put out this week.

Disney’s Brilliant Sports Bet: The WNBA may be a massive growth driver for Disney’s streaming services long-term.

Earnings Preview Part 1: I covered what I expect from 4 hard goods companies.

Earnings Preview Part 2: Followed by what I expect from 5 tech stocks in the Asymmetric Portfolio.

The 4 Reasons Stocks Go Up

Broken down to their basics, there are four — and only four — reasons stocks go up.

Revenue growth

Margin expansion

Multiple expansion

Stock buybacks

Everything else is a subset of one of these factors. Let’s break it down.

Revenue Growth

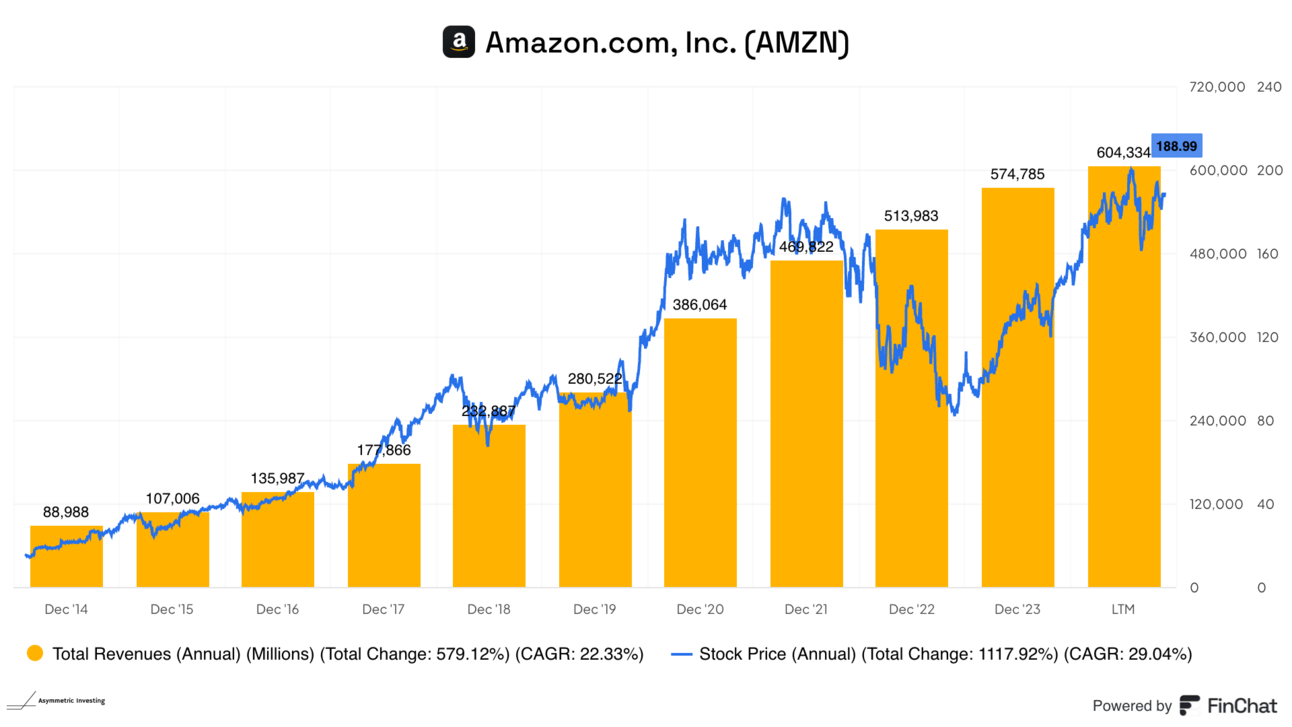

Over very long periods, revenue growth is the primary driver of stock prices. If you can find companies that compound revenue growth at 15%+ per year, they’re almost guaranteed to be market beaters. Just look at Amazon over the past decade. Note: The same holds true for the last 25 years of Amazon’s stock price, but Finchat is limited to 10-year historical data.

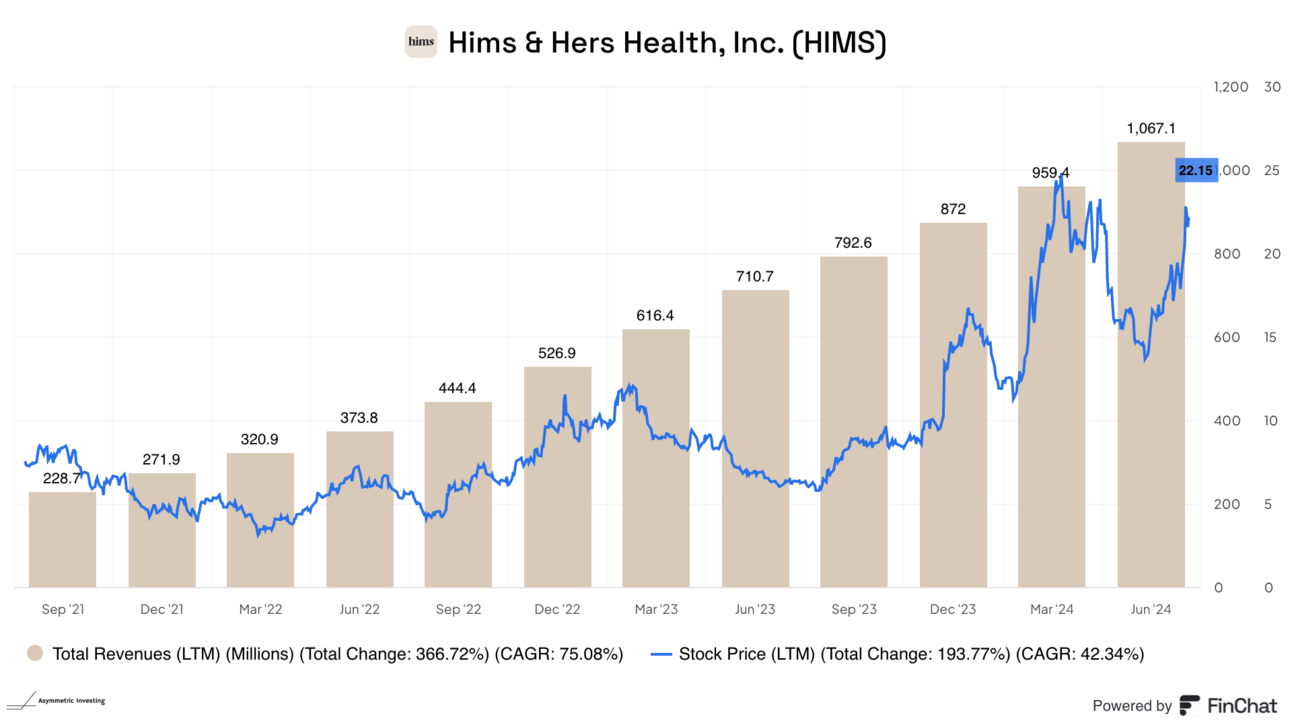

Not all growth is equal, and there are nuances to growth drivers, but I’m constantly looking for companies that can compound revenue growth for many, many years to come. Below, you can see an example of incredible growth from Hims & Hers, which has grown revenue at a 75.1% compound annual growth rate over the past three years!

Revenue growth will make up for a lot of other mistakes in an investment thesis or valuation, so put revenue growth on your side whenever possible.

Margin Expansion

Revenue growth is great, but if it never turns into profits it’s hard to value a company. That’s why finding companies that have improving gross and/or operating margins can be a great driver of returns.

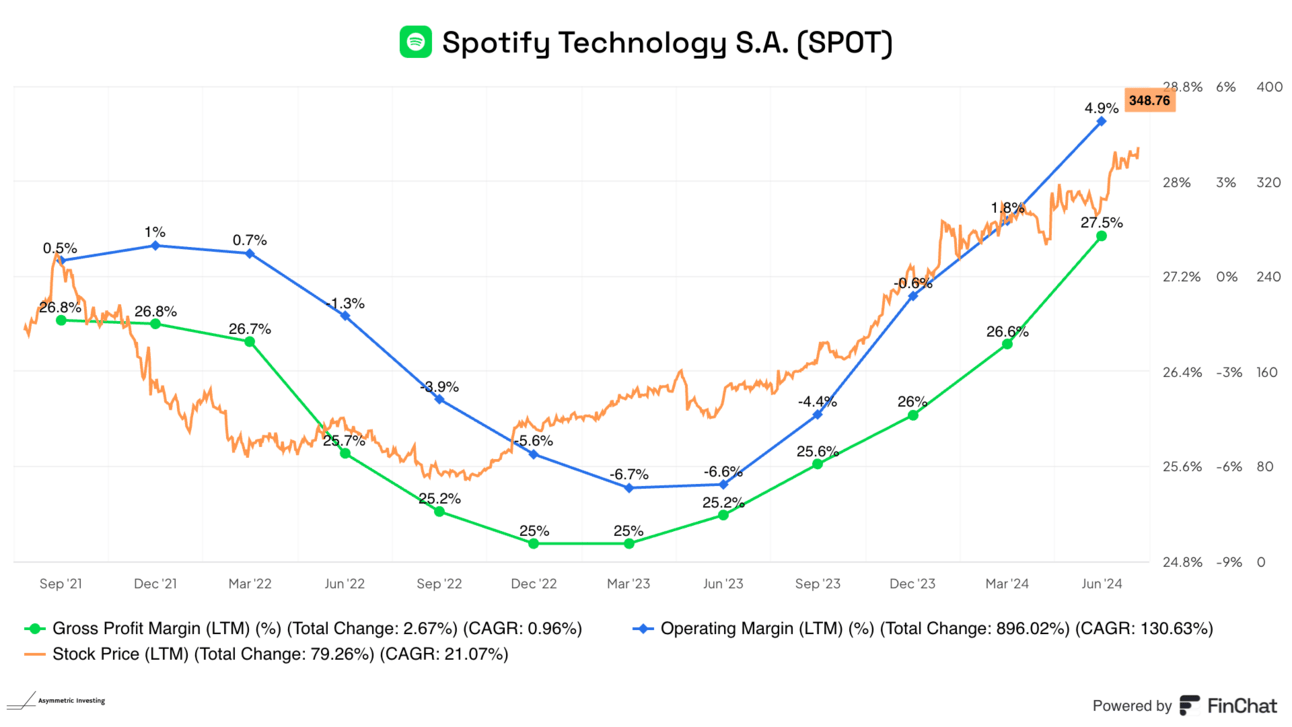

Look at Spotify’s margins over the past three years. I covered Spotify in a spotlight article on March 31, 2023, just when margins were at their worst.

Why did I start buying the stock then? Because operating cost cuts (layoffs) had already been announced and price increases had been telegraphed. I saw margin expansion as a driver of improved net income and free cash flow in the future. And that’s played out.

Multiple Expansion

Revenue growth and margin expansion are withing management and a company’s control, to an extent. Multiples — like price-to-sales or price-to-earnings multiples — are up to the market. And they’re much more difficult to predict.

I like to ask this question:

Based on the current valuation, are multiples likely to be a tailwind or a headwind?

In other words, is a stock relatively cheap or expensive?

If a stock is cheap and there’s an opportunity for multiple expansion to drive the stock higher, it can be a tailwind. If a stock is expensive, a lot of growth/margin expansion is already priced into the stock, making multiples a headwind.

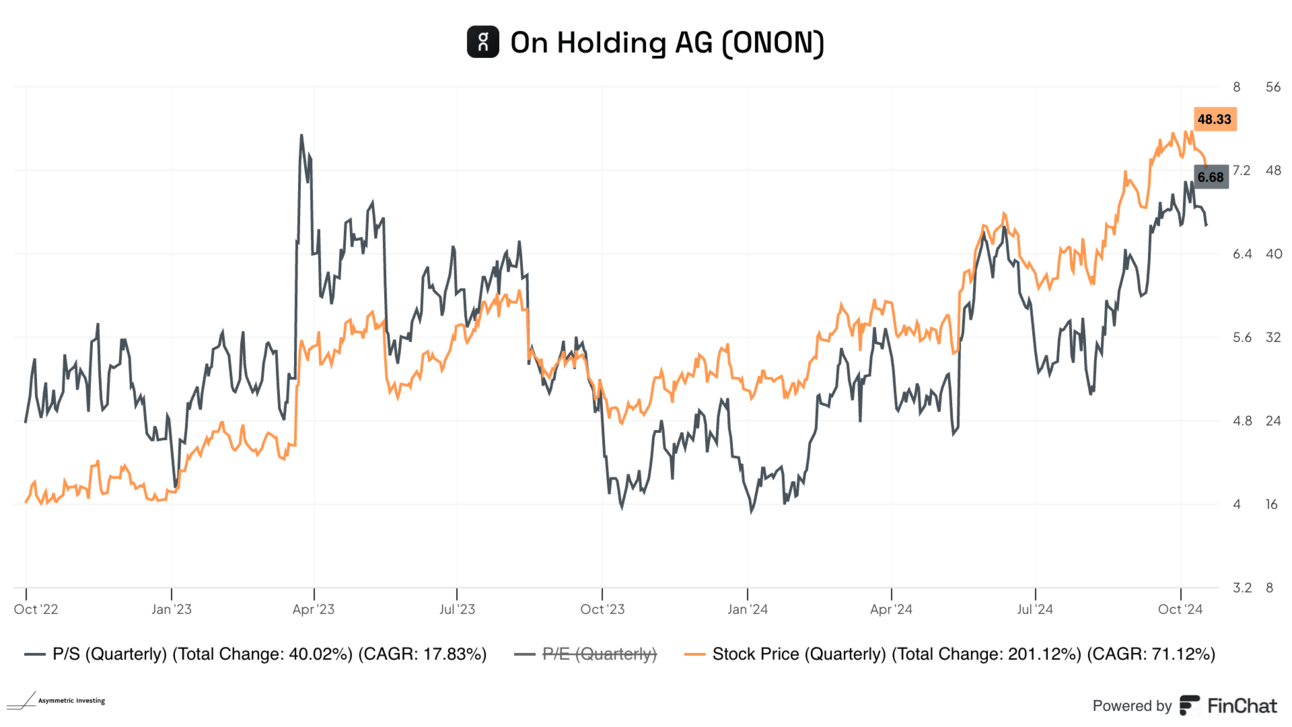

I’ll use On Holding as an example. Since October 2022, the company’s price to sales multiple has increased 39%, meaning multiple expansion contributed 39% to the stock’s gains. But the stock is up 200% over that time because multiple expansion combined with revenue growth to drive stock returns.

The same holds true for multiples like price to earnings or price to EBITDA.

If you can get a growth stock that’s cheap and improving operating metrics, it’s a huge win.

Stock Buybacks

The final way a stock can rise is simply buying back outstanding shares of the company. This reduces the number of slices (shares) the company is cut into.

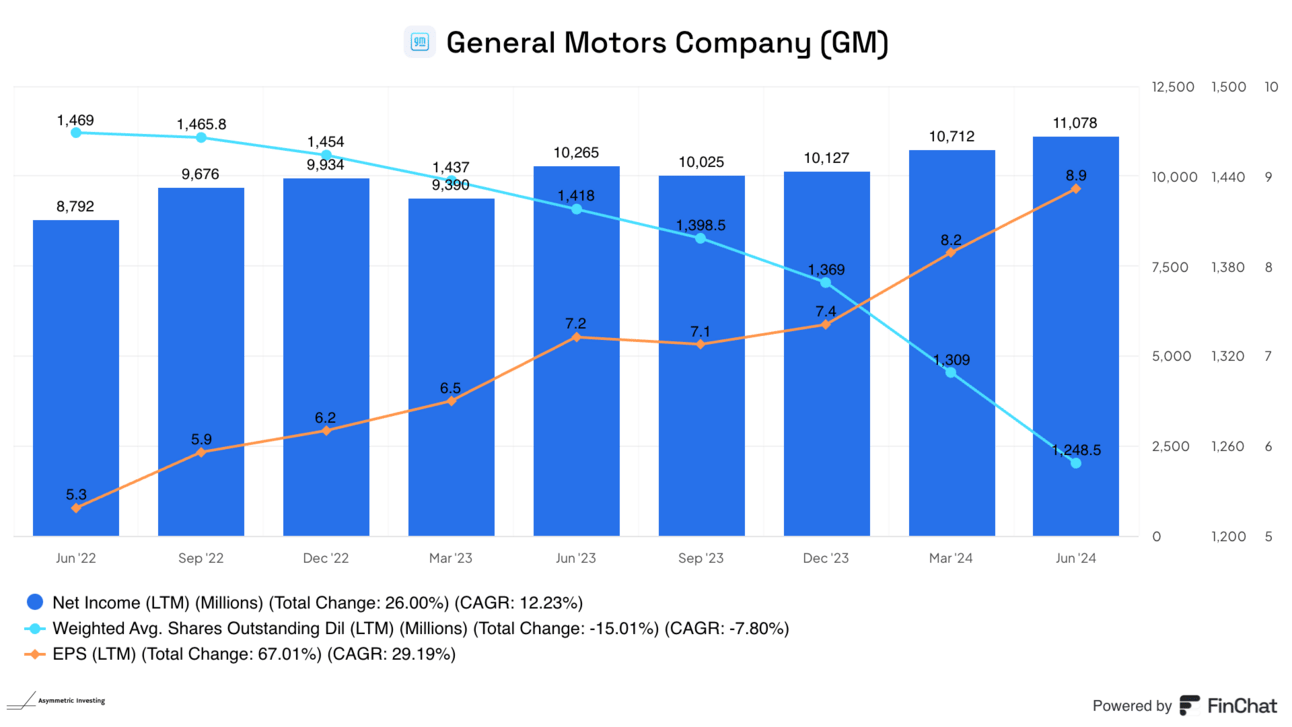

General Motors is a great example of this in the Asymmetric Portfolio. You can see below that revenue isn’t growing a meaninful amount and multiples aren’t expanding, indicated by flat-ish net income and free cash flow.

But GM is buying back stock like crazy at about a 5 P/E multiple, which reduces shares outstanding rapidly. You can see that since mid-2022 GM’s net income is up 26%, but earnings per share are up 67% simply because the number of shares outstanding has dropped.

And this chart doesn’t quite do the scale of the buybacks justice. Management expects to be under 1 billion shares outstanding by early 2025.

Today, GM isn’t growing revenue, margins aren’t expanding, and the multiple isn’t rising. But the number of shares is shrinking.

All else equal, that will drive the stock higher.

Set Your Portfolio Up For Success

Putting these four factors in your favor will set your portfolio up for success.

If you can get two, three, or even four of these factors working together it’s a recipe to crush the market!

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.