When Disney signed an 11-year TV and streaming rights deal with the NBA for $2.6 billion per season — up from $1.5 billion per year in the previous agreement — the numbers seemed eye-popping. Not only was Disney nearly doubling what it was paying the NBA, it was giving up about 20 regular season games in this deal and betting on a league with declining viewership.

Why make such a frivolous investment?

The logical answer was that Disney is betting on live sports to drive ESPN over-the-top subscriptions, which will launch in fall 2025. I have argued Disney’s bundling of Disney+, Hulu, and ESPN over the top could lead to a differentiated position in streaming, starting the flywheel that will give Disney a top two — and maybe #1 — position in streaming.

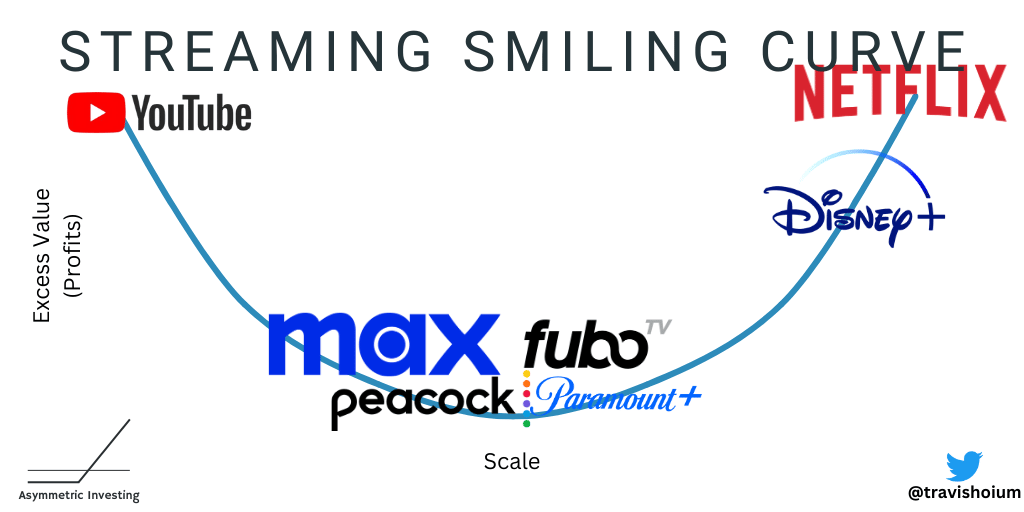

Remember, from the smiling curve, gains accrue to the companies in the top right of the curve. Winners have BOTH more users AND can charge higher prices. No surprise, we are seeing Netflix and Disney flex their pricing muscle while Max, Peacock, and Paramount struggle to add subscribers at lower price points.

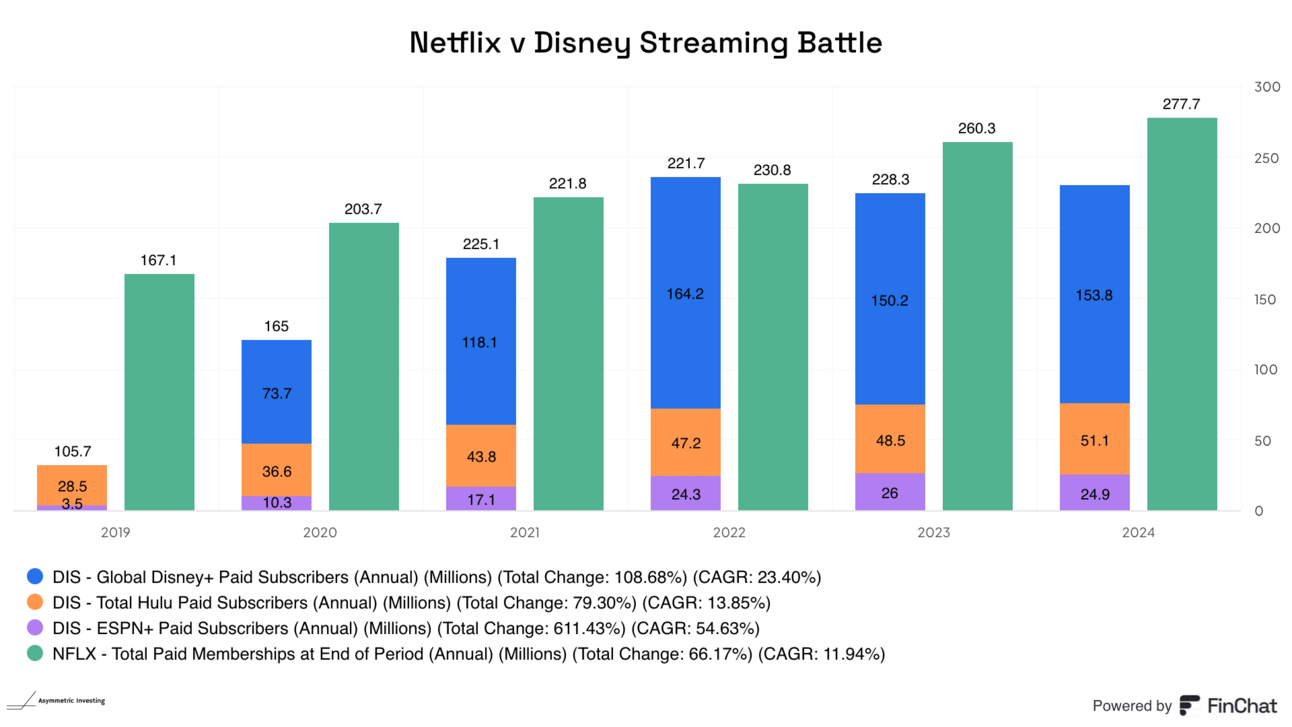

And Disney isn’t far behind Netflix. Add together Disney’s streaming services, and it’s already near Netflix’s scale, although well behind in viewing hours.

So, what’s the secret to the NBA deal that could make it a hit?

The WNBA!

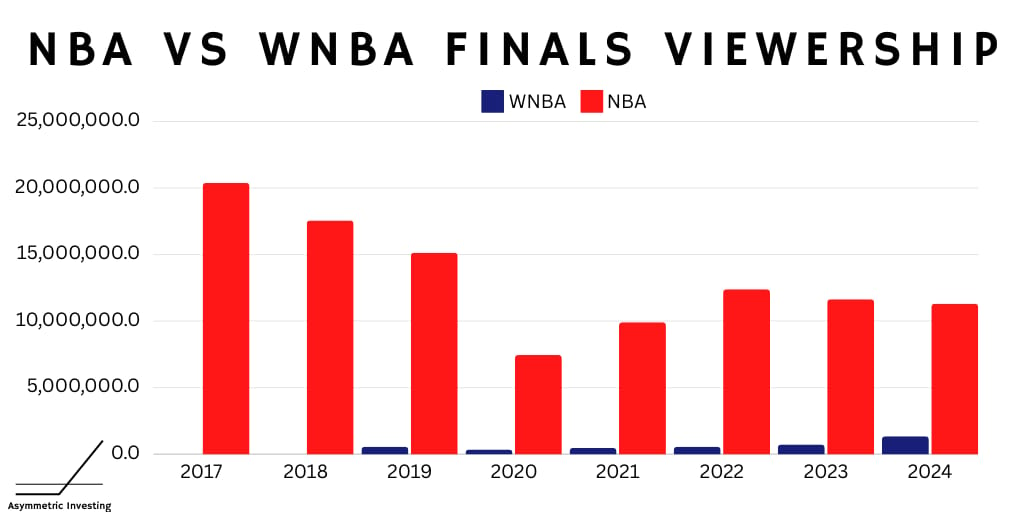

Viewership for this year’s WNBA finals is up 84% from a year ago. The NBA is shrinking, but the WNBA is growing!

Asymmetric Investing has a freemium business model. Sign up for premium here to skip ads and get double the content, including all portfolio additions.

Join the Revolution in Private Market Investing

All investments have the risk of loss. UpMarket is not associated with or endorsed by the above-listed companies. Only available to eligible accredited investors. View important disclosures at www.upmarket.co

At UpMarket, we make it possible for accredited investors to tap into high-growth private companies. With companies like xAI and Anthropic redefining what’s possible in AI, and SpaceX pushing the boundaries of space exploration, UpMarket’s platform has become a gateway for future-focused accredited investors. Join our network of 500+ investors who have placed over $175M in private opportunities since 2019.

The WNBA’s Magic-Bird Moment

The WNBA has been around since 1997, but this could be the inflection that makes it a real player in the sports landscape. And we’ve seen this story before.

In 1979, Magic Johnson and Larry Bird faced off in the NCAA Championship game before playing their first NBA games later that year. Michael Jordan would join the league in 1984 and take the league to new heights, but the inflection point for the NBA’s popularity was with Magic and Larry.

It’s worth wondering if the WNBA has reached a similar inflection point with the emergence of Caitlin Clark and Angel Reese in this year’s draft class. Their matchup in the 2024 NCAA Tournament brought in 12.3 million viewers, and they’ve become two of the most popular athletes in the sport.

We are even seeing an impact on viewership even though they aren’t in the WNBA Finals.

The WNBA is growing!

And compared to the NBA, the WNBA looks like a great bet.

WNBA Finals Viewership Growth 2019-2014: 19.6% CAGR

NBA Finals Viewership Growth 2019-2024: Negative 5.7% CAGR

The difference between the NBA and WNBA is scale. As fast as the WNBA is growing, it’s still only about 1/10th the viewership of the NBA. But here’s where the price comes in for Disney’s streaming deal.

The WNBA rights are (reportedly) part of the $2.62 billion Disney is paying for basketball rights. And it may be the biggest win in the deal, despite being less than $100 million of the price tag. (the full breakout of WNBA rights isn’t known, but the combined rights deal is worth a reported $200 million per year for the WNBA, of which Disney would likely pay less than half)

I could see a world where NBA Finals viewership continues to decline to 8 million viewers by the end of the decade, but the WNBA grows to 5 million viewers. In that case, the overall NBA/WNBA pie would get bigger for Disney!

According to Disney’s release — which incidentally mentioned the WNBA more times than the NBA, here’s what they get:

WNBA Finals exclusively for five out of 11 seasons

Exclusive WNBA Semifinals series in eight of 11 seasons

Extensive regular-season and postseason WNBA game packages for ESPN and ABC

Expanded WNBA Countdown rights

Exclusive WNBA All-Star Game broadcast annually

Exclusive WNBA Draft and WNBA Draft Lottery broadcasts annually

More highlight rights across platforms

Through 2036, any WNBA fans will need to sign up for cable or ESPN over the top to access games and other events like the draft. Remember, streaming is about getting users to sign up. If the WNBA is a draw to a growing number of viewers — and better yet, users who may not overlap with NFL, college football, and NBA viewers — it will be a huge win for Disney.

Don’t sleep on the WNBA’s potential to be a growth engine in sports. And Disney has locked up the best WNBA rights deal through 2036.

That’s a bigger win than investors might think. And I like the asymmetric potential of the WNBA.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.