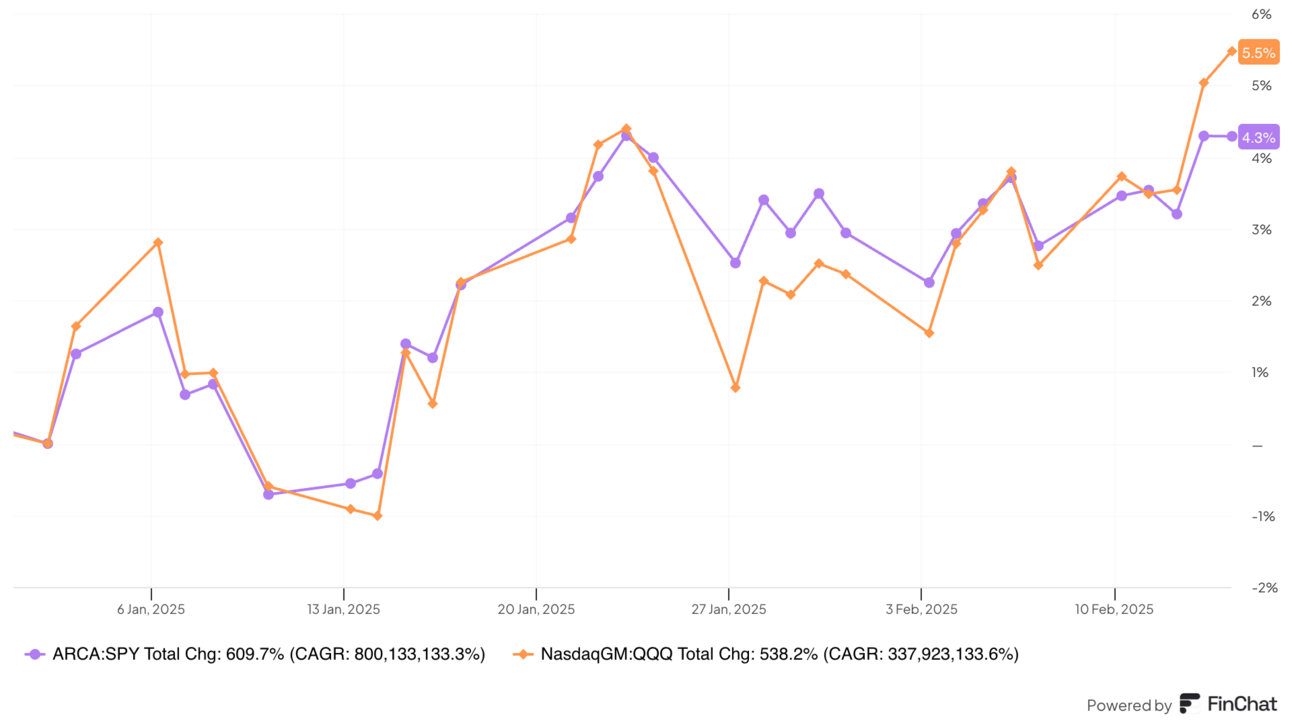

The stock market moved higher late this week, shaking off a 0.9% drop in retail sales. Investors have been happy with earnings in general, although the theme of earnings season has been relatively disappointing guidance across the board.

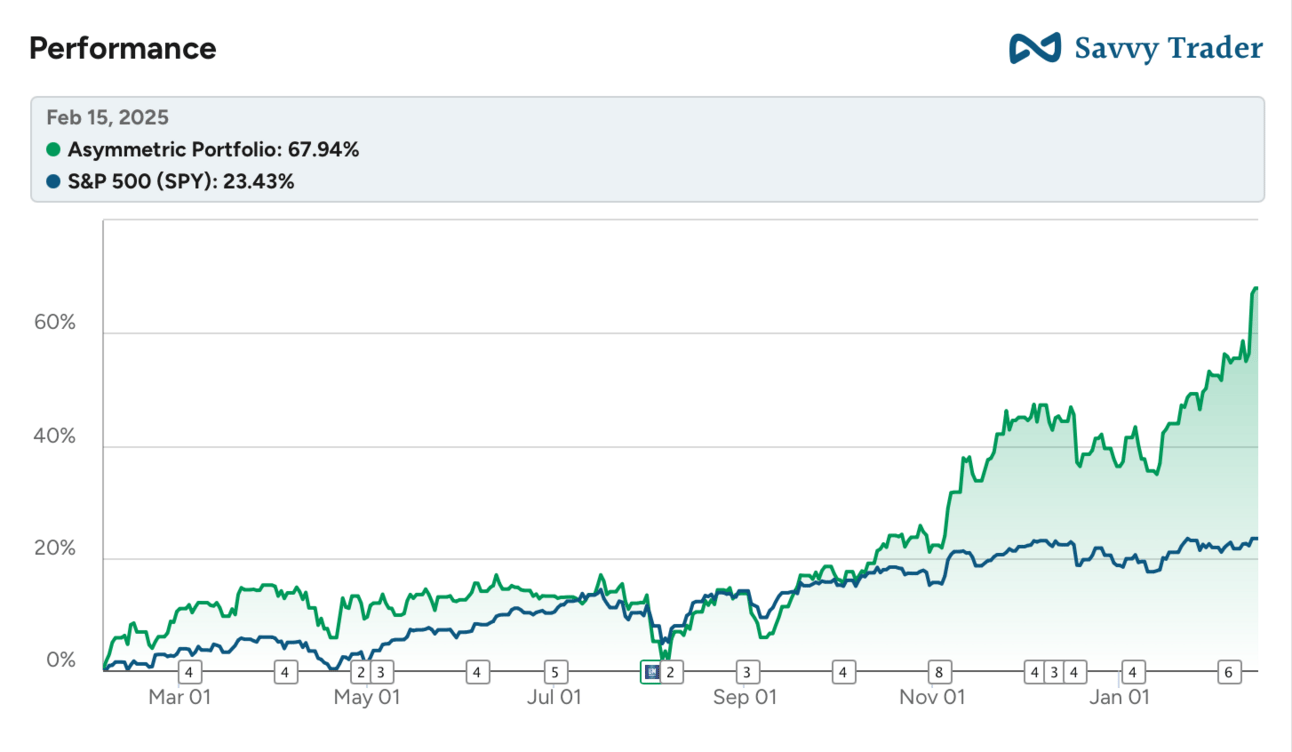

The Asymmetric Portfolio continues its tear in 2025. The jump in Hims & Hers stock, which I’ll get to below, has helped. But this week brought a few 10%+ moves higher after earnings, so the gains have been widespread. I don’t expect this level of outperformance to continue, but I’m also not abandoning the frameworks that got the portfolio here.

The “Special Situation Short” position is also up 10.1% since it was put on, despite partially being a hedge against a falling market overall.

What stocks am I adding to my market-beating portfolio each month? You can sign up for premium here to find out, get 2x the Asymmetric Investing content, and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

How do I make all of the charts in Asymmetric Investing? Simple. With Finchat. You can get started with FinChat Pro free for 2 weeks below. After that, you’ll get 15% off for being an Asymmetric Investing subscriber. I can’t say enough how much easier it’s made my research. Check it out 👇

In Case You Missed It

Here’s some of the content I put out this week.

New Autonomy Leaders: Lyft and Uber are now in the driver’s seat in autonomy.

Robinhood and MGM Resorts Update: Robinhood’s incredible run continues and MGM keeps buying back stock.

Crocs, Airbnb, and Coinbase Update: Crocs and Airbnb impress while Coinbase lays the foundation for a massive future.

Hims & Hers Stock Is On Fire. Is It a Meme?

Hims & Hers has been in the Asymmetric Universe since May 24, 2024, when this Spotlight article was published. I thought the company had 10x potential over the next decade, disrupting how we think about getting medicine in an internet world.

What I didn’t expect was for shares to be up 258.2% in just under 9 months and 142.1% this year alone.

Has the stock become a meme? Is buying now crazy? Or is the rocket ship just taking off?

Hims & Hers Growth Is Out of This World

Since 2018, Hims & Hers has grown revenue at a 95% compound annual growth rate and expects to grow revenue 90% this quarter. There aren’t many companies growing that fast and improving profitability at the same time.

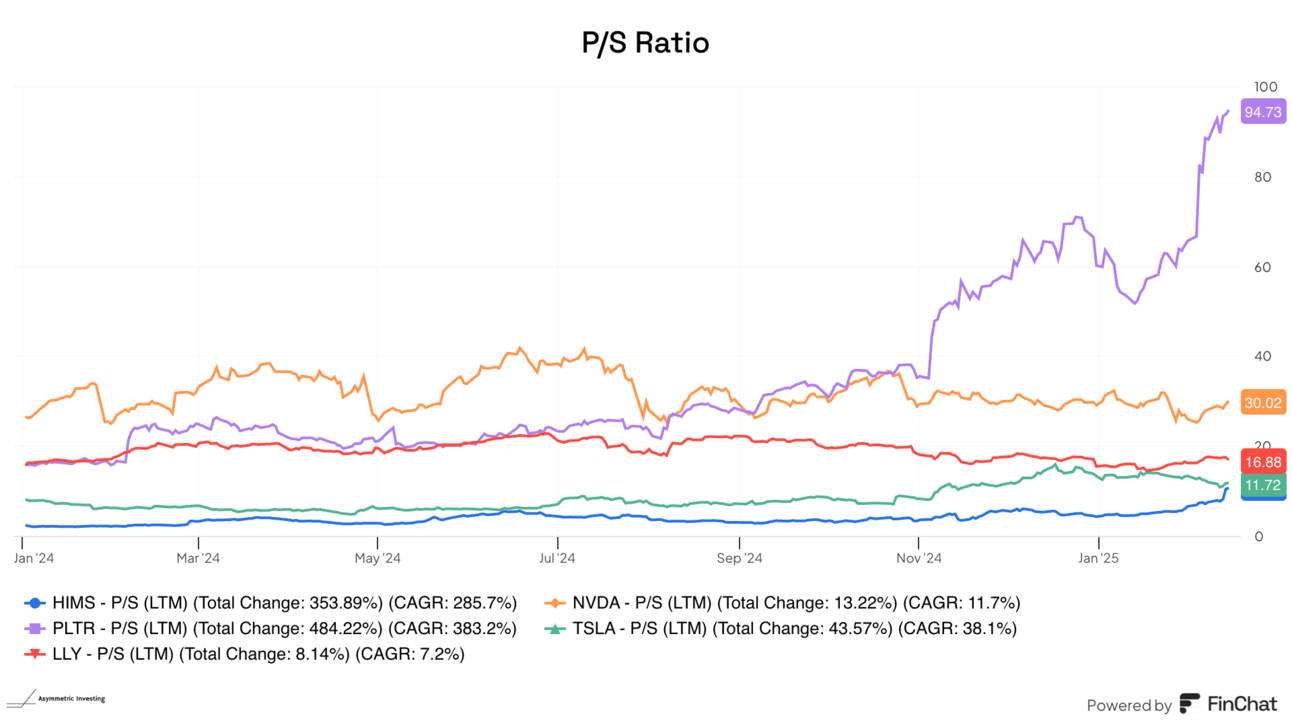

Hims & Hers Stock Isn’t Cheap, But It’s Not Expensive Either

You would think a stock that’s up as much as Hims & Hers would be expensive. But I could make the argument the stock is cheap given the growth rate.

You can see below that Hims & Hers’ price-to-sales ratio is lower than Palantir, NVIDIA, Tesla, and Eli Lilly!

I like P/S in this case because it doesn’t include profitability metrics, which are often low when companies are growing rapidly. But it’s easy to see how Hims & Hers would have better margins than Tesla and Eli Lilly long-term and potentially higher than Palantir and NVIDIA depending on how the market plays out.

The stock’s not cheap, but compared to other hot growth stocks, it’s nowhere near bubble territory.

Hims & Hers Is a Short Favorite

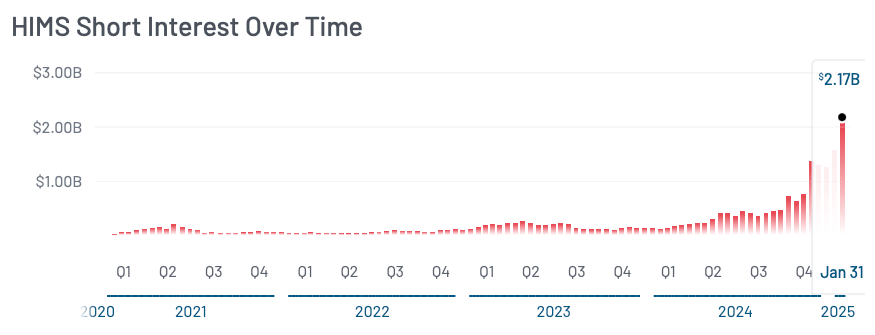

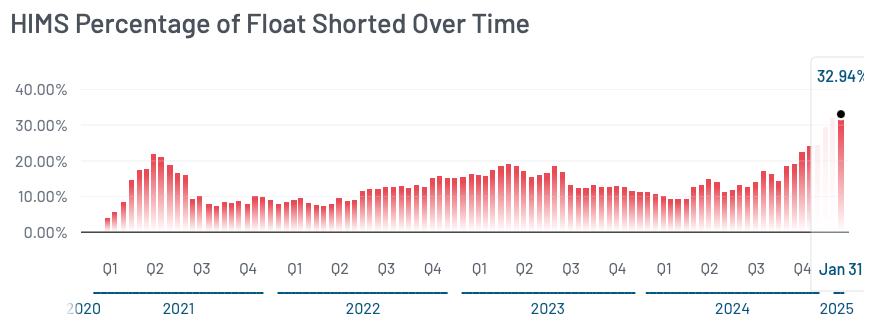

I don’t usually pay attention to short interest in stocks, but this one is unusual.

Not only is the short interest at an all-time high, it’s growing as the stock goes up. That’s unusual.

The percentage of the stock sold short is a whopping 32.94%.

Are the shorts right or does a short squeeze come next?

We don’t know, but the stock may surge higher if shorts aren’t right about GLP-1s.

Hims & Hers & GLP-1s

Why is Hims & Hers so unloved by some investors? It comes down to GLP-1s.

In summer 2024 the company announced it was selling compounded semaglutide GLP-1s, which is the hottest weight loss drug in the world today. But compounding the treatment is only allowed while branded versions are in shortage. And those shortages are coming to an end.

Since then, Hims & Hers has said it will continue to sell GLP-1s through generics, branded versions, or compounded treatments for as long as possible. However, investors think the end of some GLP-1 sales will crush the stock.

It’s a good theory and lots of really smart people believe it. But it hasn’t come to pass.

I’ll take a simpler thesis into the stock and simply say I think Hims & Hers is the kind of customer centric demand generator that will be a winner in the medical market 5, 10, or even 20+ years from now. That simple thinking will keep me in the stock and I bought more in early February. If shares pull back on GLP-1 news, I’ll buy more.

Is this a meme stock? Not yet.

Is it overvalued? It doesn’t appear to be.

Could shares fall 50-80% in the next 6 months? Of course. But they could also go up 100% in the next month if earnings are good and there’s positive GLP-1 news that keeps growth near 90%.

I’ll continue to take the long-term view of Hims & Hers rather than focusing on the volatility brought on by GLP-1s. If the stock drops, I’ll buy more. If it pops I’ll be happy with the gains.

Keep it simple.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your own research before acquiring stocks.