How has the Asymmetric Portfolio more than tripled the market’s performance? Find out with deep dives into the stock I own and find out what I’m buying before I buy each month. It’s the best value in investing.

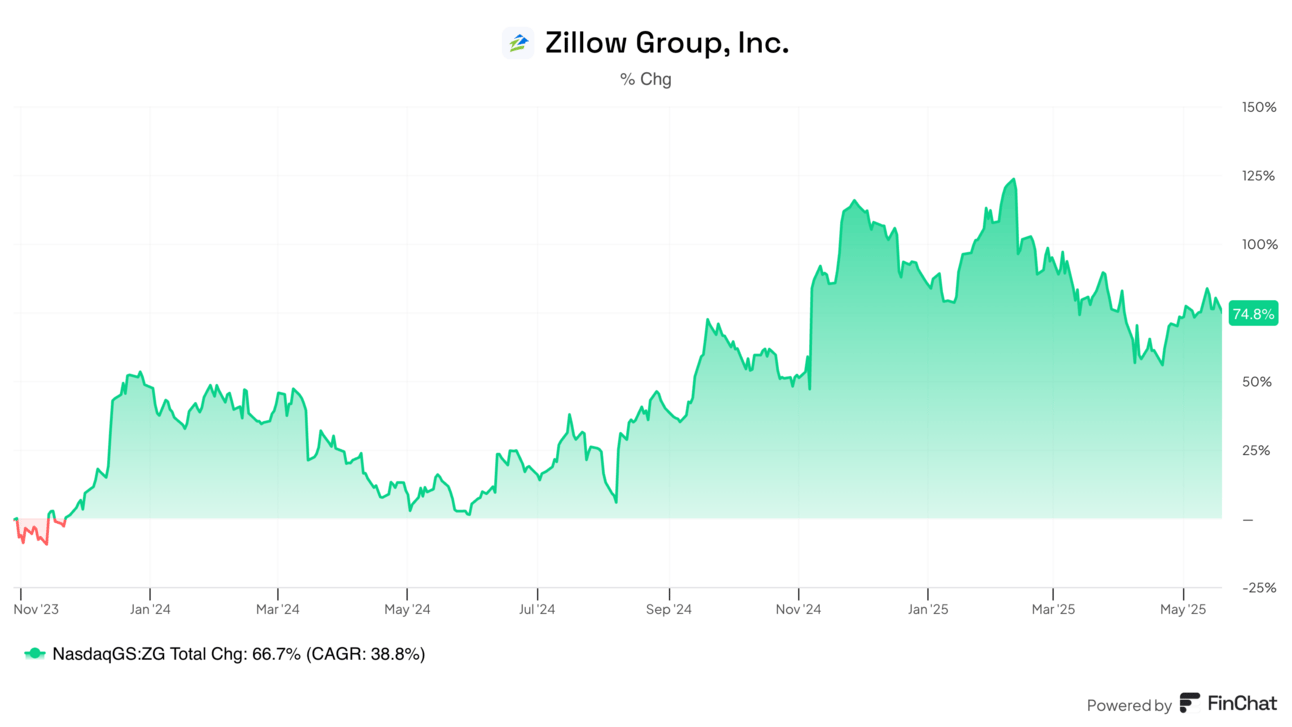

Slowly but surely, Zillow $Z ( ▲ 4.18% ) has become one of the companies building a 10x business in the Asymmetric Portfolio. The “Super App” strategy to become the go-to place for housing searchers (for sale and rentals) is working, and competitors are capitulating.

CoStar is reconsidering its investment in Homes.com, real estate agent groups are signing on to Zillow’s listing transparency efforts after trying to cut Zillow out by privately listing homes, and Redfin is leaning on Zillow to provide rental listings.

Supply and demand are aggregating to Zillow, and that’s what we want to see.

The Housing Super App

In any Zillow earnings report, we want to see three things:

Growing share of “for sale” revenue

Growth in mortgages

Growth in rentals

We got all three in Q1 2025.

For Sale

Residential revenue overall is held back by a slow housing market that may be here for a while. But the trends are moving in the right direction.

We also get small tidbits about Zillow outgrowing the market, which are showing that share is up and the take rate is increasing.

For Sale revenue grew 8% year over year to $458 million in Q1, above the residential real estate industry’s year-over-year total transaction value growth of 3% as reported by NAR and 6% according to industry data tracked and estimated by Zillow. On a trailing 12-month basis, For Sale revenue per total transaction value at the end of Q1 was 10.2 basis points, compared with 9.7 basis points for the same period in 2024.

I wouldn’t call these blowout numbers, but unless we get a low interest rate environment again, small wins will do.

In mortgages, you can see more success in attracting buyers to a more holistic solution. Zillow has said that most buyers start by looking for a mortgage, so if the company can win that business, it’ll be big for the rest of the Super App strategy because they may choose moving services, insurance, and more.

For sale isn’t going to be a massive growth business, but we are seeing Zillow do better than competitors, and that’s enough for now.

Rentals

What’s been incredibly impressive is rentals. Revenue was up 33% to $129 million, and management expects more growth ahead.

This is an image from the shareholder letter, and on the bottom is multi-family properties on Zillow. This is aggregating supply at its finest and has a lot to do with the Redfin deal. Zillow can now sell to property owners and provide distribution on Redfin’s Rent.com and Apartmentguide.com. This is in addition to a similar deal with Realtor.com.

Redfin added an impressive 14,000 listings in 2024, but has added 10,000 in four months of 2025. It certainly looks like the rentals business will continue to be a boon for the business.

Zillow’s Achilles Heel

Strategically, I love where Zillow sits. The company is winning in the markets that matter most, and in time, it looks like demand is choosing Zillow more than its competitors.

But the company’s stock-based compensation is a drag on the stock. This is a look at the company’s share repurchases and the anemic impact it has on shares outstanding.

Zillow is one of those tech companies that generates cash, but isn’t making an operating profit. That needs to change if this is going to be a 10x stock. Stock-based compensation is down, but it’s not falling fast.

This is the one overhang I see for the company becoming one of the best stocks over the next 20 years. It’s diluting shares so quickly that it can’t return cash to shareholders or have enough dry powder to buy competitors.

That said, I’m not selling because I like the opportunity ahead more than my quibbles with stock-based compensation.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.