There are a few big days coming up on Asymmetric Investing over the next few days:

Later Today (late): I’m sending out my newest spotlight article to premium subscribers. This is how I initiate coverage on any stock and put it in the Asymmetric Universe of stocks I buy from each month.

Monday: My monthly buys will go out before the market opens. I’m selling some big winners this month and reallocating to emerging opportunities, so this will be much more involved than the usual monthly update.

If you want access to the Asymmetric Portfolio, the new spotlight, and the portfolio changes on Monday, sign up for premium below.

I’ve been thinking a lot about selling lately.

When do you sell a stock? When do you look for better opportunities?

These aren’t easy questions to answer, and in general, I “default to not selling” and don’t try to time the market in Asymmetric Investing. I’m in for the long haul.

But that doesn’t mean I never sell. More on that in a moment.

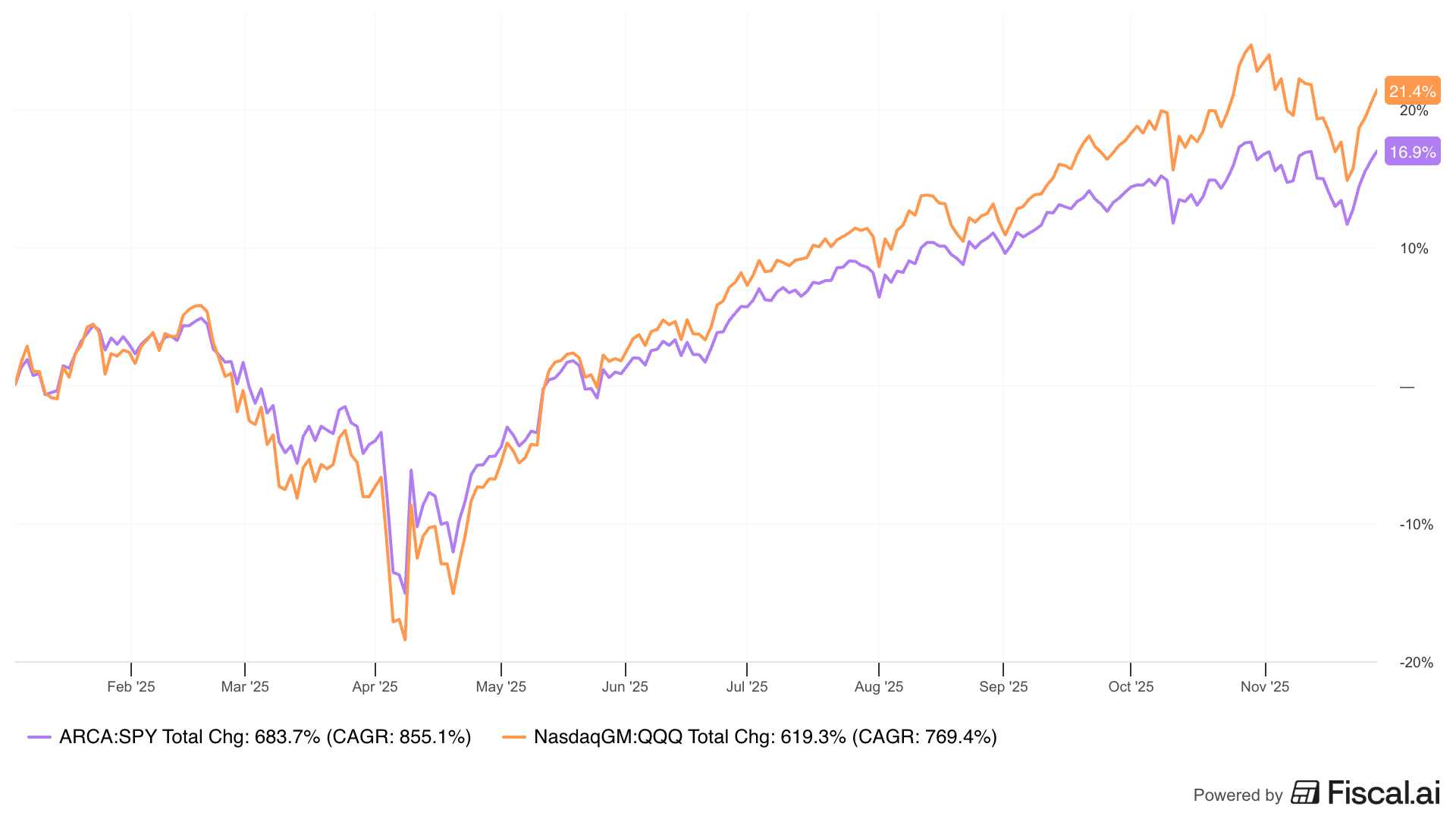

On the market, selling wasn’t popular this week; it was the buyers who won the day. After weeks of declines, the bulls pushed the market to within shouting distance of all-time highs.

s

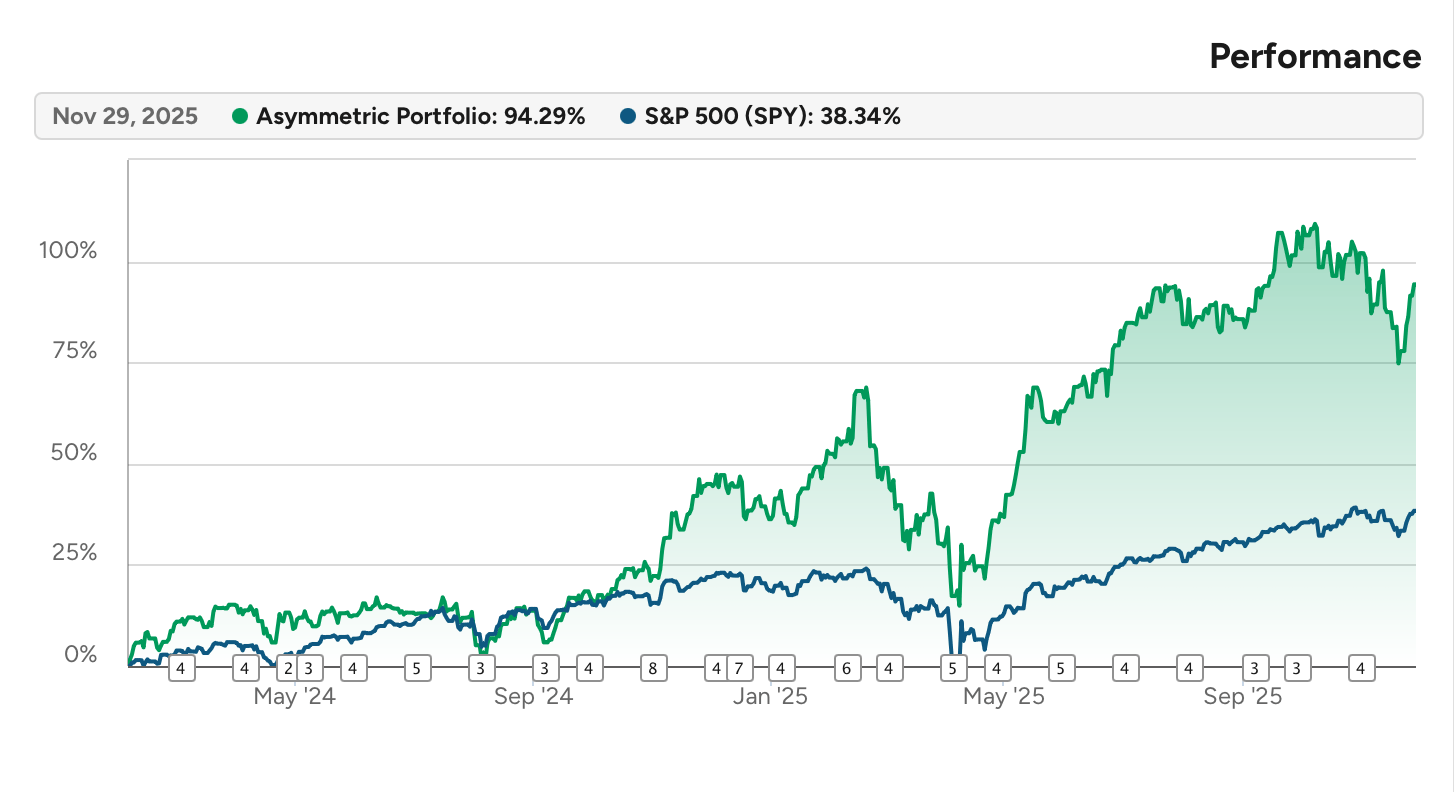

The Asymmetric Portfolio was certainly a beneficiary of the market’s great week. The portfolio jumped more than 10% this week alone.

In Case You Missed It

Here’s some of the content I put out this week.

Why I’m Selling (Some) Robinhood: I explained why I’m selling some Robinhood stock early this week.

The Real Reason NVIDIA Stock Is Down: It’s all about the companies buying NVIDIA’s chips.

The “One Stock” Portfolio: What stock would you buy if you could only buy one?

When Do You Sell Stocks?

One of the reasons I default to “never” selling stocks is that we never know when a stock will move higher or what will drive the move.

I try to find companies that can compound revenue and earnings over a long period of time because that long-term view is our advantage over the market. But that doesn’t mean the ride will be a straight line higher.

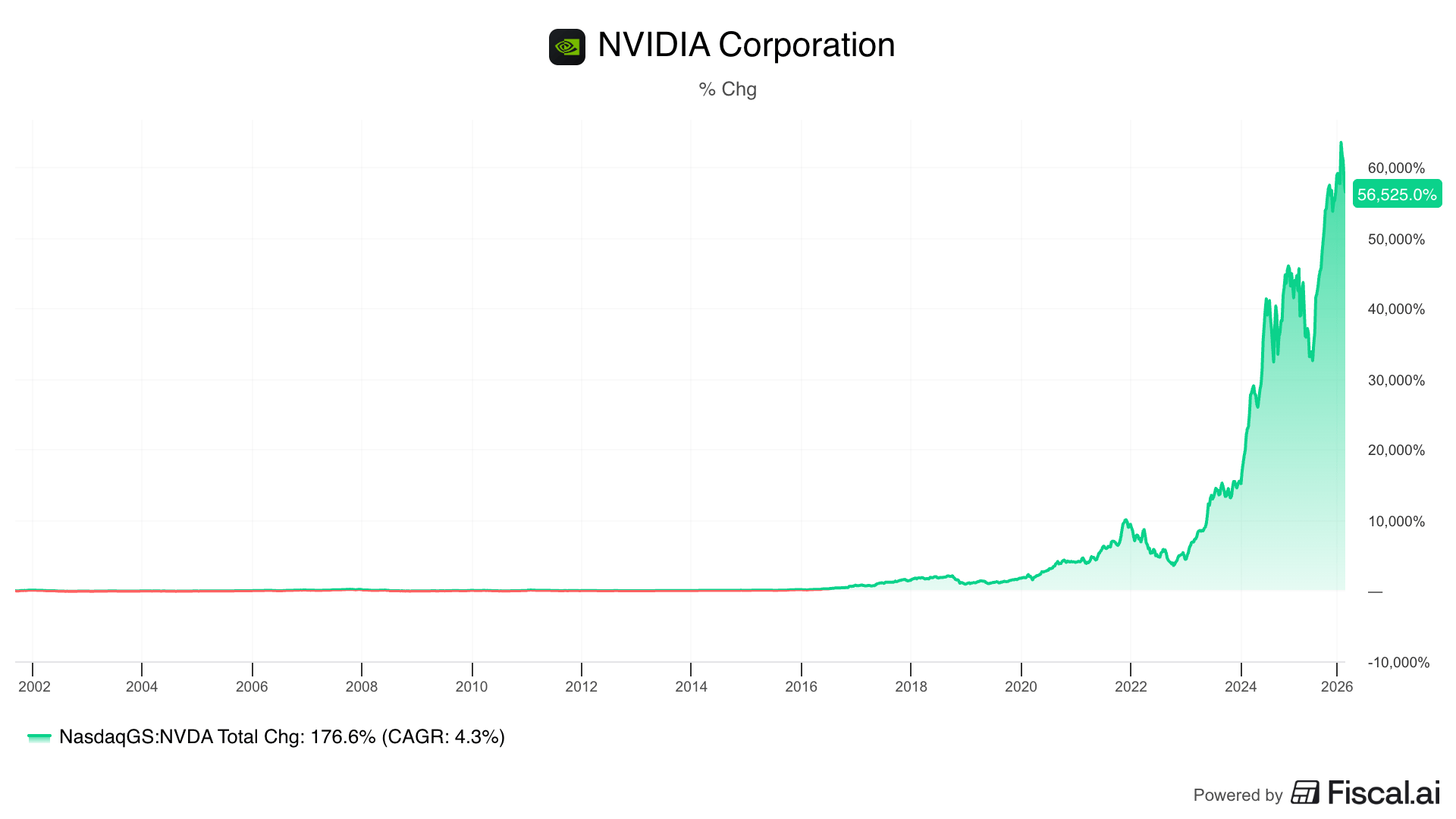

Take NVIDIA as an example. The stock has been an incredible performer over the past two decades.

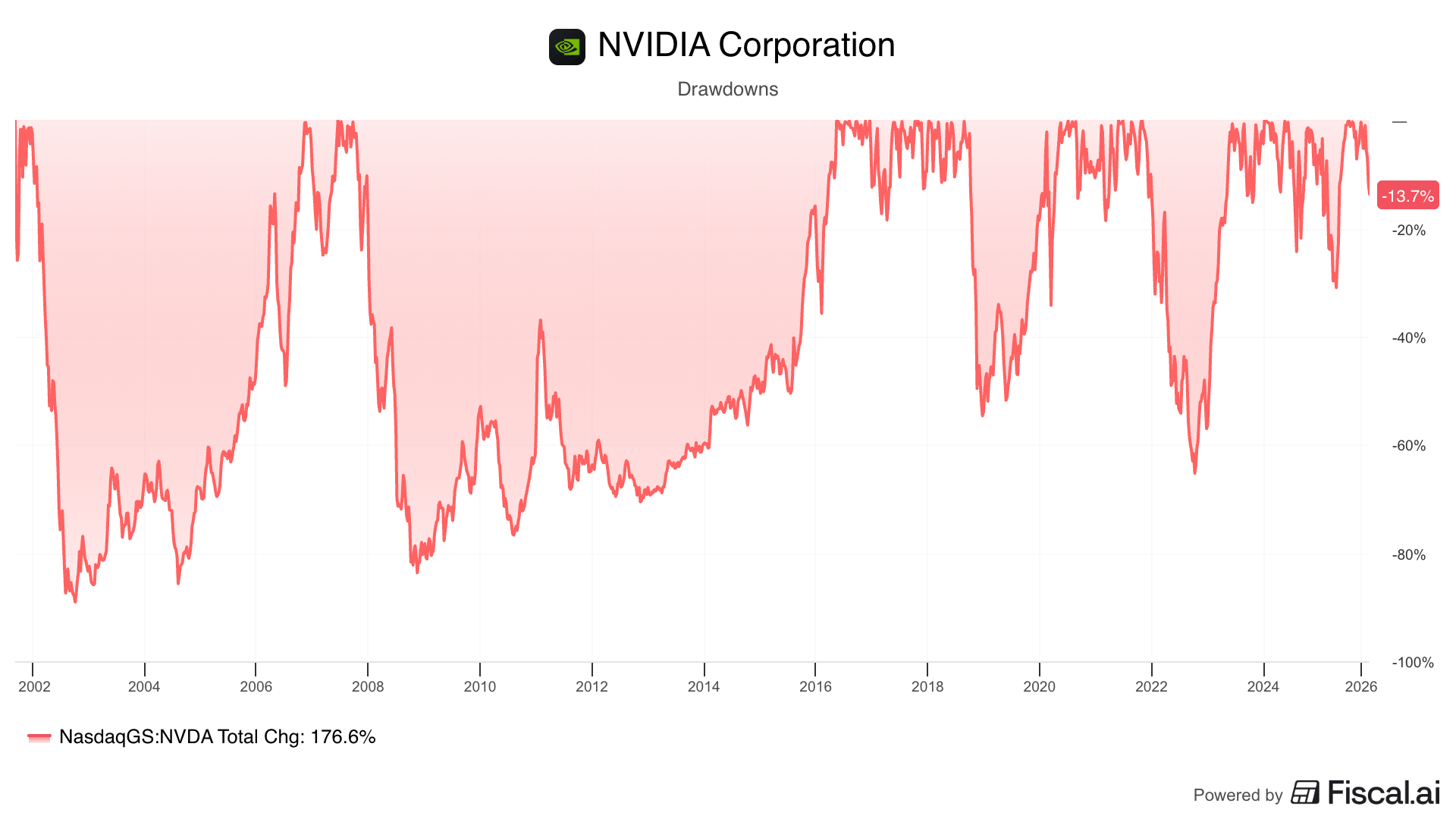

But to realize those gains, you would have had to ride out drops of over 80% multiple times.

How does selling play a role, even when we own phenomenal long-term stocks?

Something Has Changed

If the thesis on a stock I own has changed, it might be time to sell.

I did this with previous Asymmetric Investing stocks like Dropbox, Peloton, GM, and Sony. They didn’t become the companies I thought they could be.

GM is a great example of the thesis changing entirely. I thought GM, the automaker, was a great value, and the upside was Cruise, the autonomous driving business. GM shut down Cruise, so I was out!

Following companies isn’t always about diving into the financials each quarter. It’s about understanding how management is doing the basic blocking and tackling of running the business. If they’re not headed in the direction you think they should be, selling should be on the table.

Concentration Risk

I’m building the Asymmetric Portfolio as a…portfolio.

If I only had one stock, or even if I had 5 stocks, it wouldn’t be much of a portfolio.

Over time, high-performing stocks can grow to be an outsized portion of a portfolio. And it may not be appropriate to have 15%, 20%, or 30% of your net worth in one stock.

I don’t want to sell only because of concentration risk, but if it combines with other risks, this can tip me to sell a stock.

Growing Risk In Places We Didn’t Bargain For

Sometimes, a stock becomes a risk we didn’t want to take.

If you bought NVIDIA in 2015, did you realize you were getting in on the AI trade?

Maybe it’s a stock like Coinbase, which can be a disruptive force in finance, but has risen because Bitcoin is up.

Sometimes stocks become risky in ways we don’t accept and want to have in our portfolios.

I’m thinking this way about Robinhood right now. It’s a company that’s grown with the help of cryptocurrencies, prediction markets, and short-term options, which weren’t part of my original thesis.

Valuation Has Become a Big Risk

I consistently say the three main reasons stocks go up are revenue growth, multiple expansion, and multiple expansion.

Revenue can grow indefinitely.

Margins can rise for years, but also have a natural peak.

Multiples can move a stock higher the most quickly, but can also be a big part of a stock’s downfall.

In general, I want to have multiple expansion at my back, not as a headwind.

Especially if the market itself looks a little frothy, like today.

These aren’t hard and fast rules, and selling is something I struggle with more than any part of investing.

My biggest mistakes have been selling (Chipotle in 2009, Apple in 2010, Microsoft in 2016), and I don’t want to repeat those mistakes. But that doesn’t mean selling doesn’t make sense sometimes, especially if I’m locking in 5x profits on a stock.

Sometimes, taking a win is OK, even if more winning is ahead.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.