It’s hard to disentangle a technology from the financial representation of that technology to the public. We are seeing that today with crypto, which has given blockchain technology an extremely bad rap because of some high-profile frauds and scams.

But frauds and scams don’t mean the blockchain technology crypto was built on is useless or that leading technology companies are frauds. I am old enough to remember the mid to late 1990s on the internet when frauds and scams ran rampant and putting your credit card number online seemed insane.

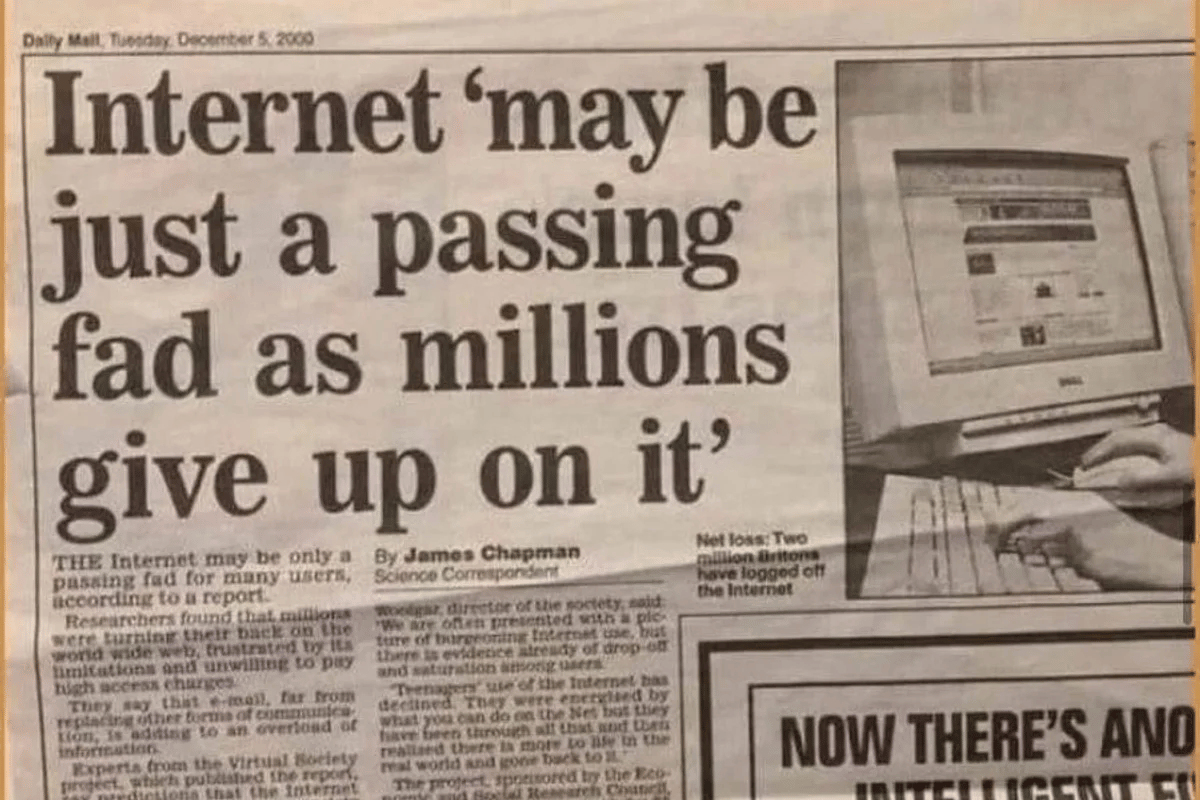

As late as December 5, 2000, people thought the internet may be a fad.

But fraud wasn’t the only use for the internet and real businesses, like Amazon, were being built. A $1,000 investment on Amazon the day the headline above was written would be worth $107,370 today. Maybe this internet thing has legs?

Visa’s Surprise & The Blockchain Grows Up?

The shock to me over the last few months is that companies are getting more and more interested in the blockchain as Congress and the SEC flail around to try and kill it (reminiscent of the internet?).

On September 5, 2023, Visa announced it would allow for USDC stablecoin settlement on the Solana blockchain. Merchant acquirers (the payment company merchants actually interact with) Worldpay and Nuvei were initial partners, but if it’s successful this could be a global settlement medium for companies.

Unlike traditional banks, the blockchain enables nearly instant settlement of transactions, which for merchants means money in the bank (wallet) immediately, not a few days later. If you’ve ever run a small business, you know this is a BIG DEAL!

This may just be the tip of the iceberg of blockchain usage. Visa is using the blockchain to settle transactions, but the disruptive possibilities are only now being revealed and Visa isn’t the only one interested.

The Blockchain is Coming

In the last month, a few companies you may have heard of have begun rolling out blockchain use cases.

Visa’s adoption of USDC settlement

Mercado Pago is allowing customer to accept USDC

Shopify integrated Solana Pay in August

Grab and Circle are piloting a Web3 wallet within the super-app

These are just a few examples of blockchain usage by companies and a lot of work taking place hasn’t seen the light of day yet. What’s worth noting is that big companies with lots of financial transaction volume are paying a lot of attention to the blockchain. Not crypto, the blockchain.

The Blockchain Is Not Crypto

Crypto may be down bad, but that doesn’t change the underlying technology of the blockchain or its use cases.

On the blockchain, developers can build contracts that immediately move stablecoins to where they need to go and even convert them to the correct currencies. The use cases are almost unlimited.

If Visa, Mercado Libre, Shopify, and Grab are interested in how the blockchain can benefit their businesses — and not just as a grift — it’s time to pay attention to it.

Premium members know that Coinbase is already the top-performing stock in the Asymmetric Portfolio. And Coinbase is building the tools companies like Blackrock, Shopify, and Circle are using to build real businesses on the blockchain.

It sure looks like the “number go up” phase of crypto is over and I welcome the companies building real innovation on the blockchain. Coinbase is at the top of the list.

Incredibly, Visa seemed to give the blockchain a ringing endorsement. I didn’t have that on my 2023 BINGO card.

If you want to get Asymmetric Investing spotlight articles and know every stock trade I make in the Asymmetric Portfolio BEFORE I make it sign up below.

Disclaimer: Travis Hoium owns shares of Coinbase. Asymmetric Investing provides analysis and DOES NOT provide individual financial advice. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.