The stock market is weird.

You can do a great analysis. Be correct about your thesis. And sometimes, the stock doesn’t react for months or even years.

Eventually, fundamentals win, but short-term emotions and speculation drive the market.

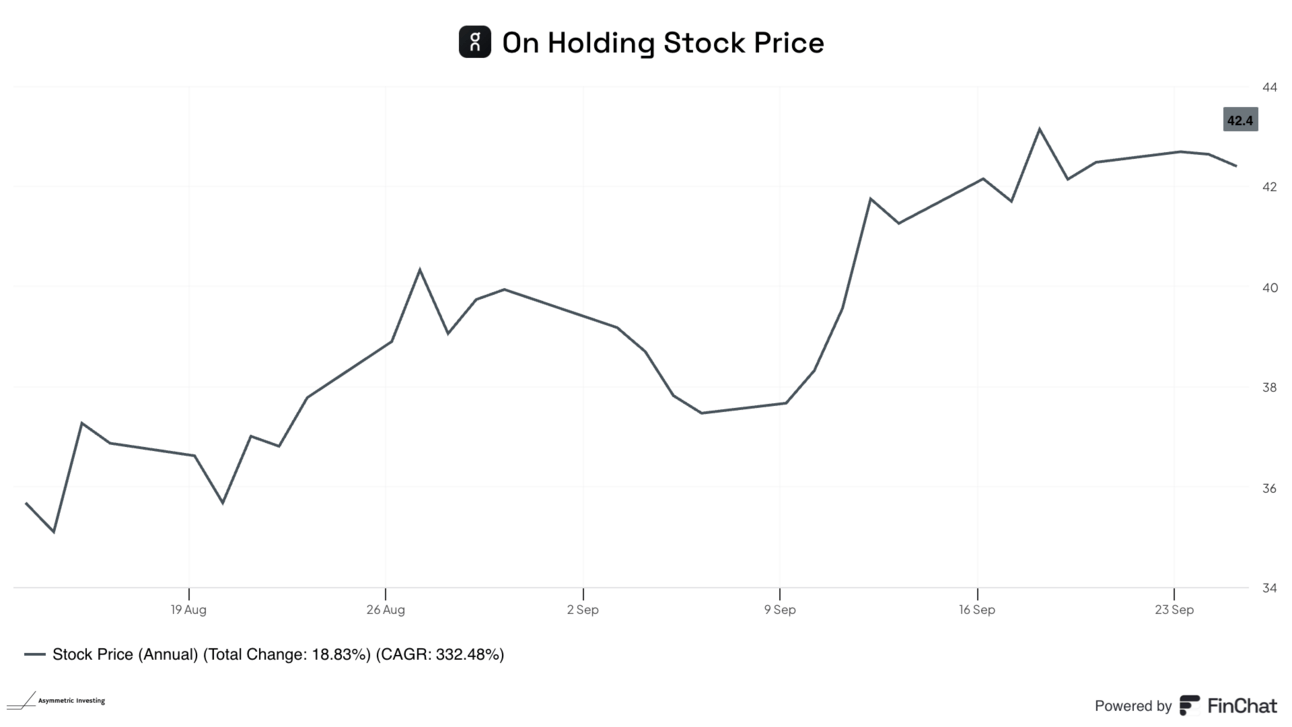

I’m seeing this dynamic play out in On Holding. The company hasn’t released so much as a press release since earnings came out on August 13, 2024, and yet the stock is up 22.1% in that time. The market’s sentiment changed, but why?

The Same Story

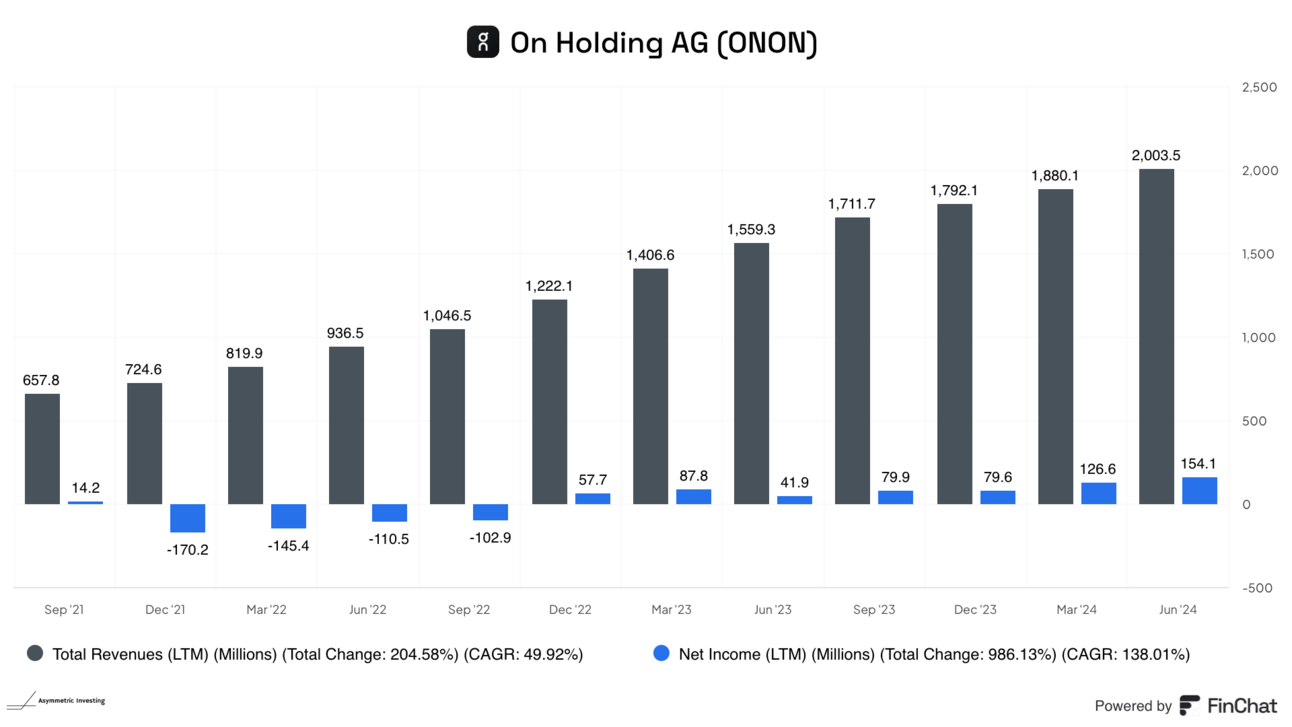

Nothing about On Holding has changed in the past month.

Nothing has changed in the past year.

The company just keeps delivering steady growth quarter after quarter.

Why is the stock up?

I could spin a tale to tell you why shares are moving. Maybe it was Nike’s missteps that caused investors to “rotate” to higher-growth names in athletic gear and fashion.

Maybe it was the Fed’s rate cuts that…something, something…investors bought high-growth stocks again?

The reality is this volatility is the price we pay for market-beating returns. We don’t know when the market will react to the fundamental business performance. All we can do is analyze the past performance and business opportunities ahead of us.

In the case of On, management has said the company will grow at nearly 30% per year over the next three years, and they’ve delivered on that.

Eventually, the market will price great assets accordingly. However, the short-term performance may differ wildly from the potential you or I see in a business.

The Market’s Turn Can Be Just As Swift

On is a positive story right now, but the opposite is true for some stocks in the Asymmetric Portfolio.