The Asymmetric Investing Portfolio | May 2023 Additions

This is the first allocation of $500 into a personal portfolio of stocks that have 10x potential over the next decade. I’ll make the allocation to what I call the “Asymmetric Universe” of stocks. Today, that universe is three stocks that I’ve written about, but in time, the universe will grow.

Not all stocks covered will receive an investment, and allocations may be made to the same stock multiple times. Here are the rules of allocation.

Invest $500 in total new capital each month

Pick among any stock* in the Asymmetric Universe

*Stocks can be bought more than once.

Hold stocks “forever”

Any funds received from sales/dividends will be redeployed

The Universe of Asymmetric Stocks

Spotify: Audio streaming company with over 500 million active users worldwide.

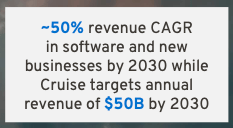

GM (Cruise): One world’s largest automakers projects Cruise’s autonomous driving fleet could reach $50 billion in annual revenue in 2030.

Peloton: Streaming fitness company with nearly 4 million paying subscribers.

This Month’s Allocation

Buy $200 of Spotify

Spotify continues to grow its user base at an impressive clip and seems to be taking market share from larger tech rivals (Apple, in particular). It’ll take time for recent changes (cost structure and tech stack) to impact financial results, but Spotify is at cash flow breakeven today, and it has the opportunity to be a financial juggernaut in audio over the next decade.

Buy $200 for GM

GM raised guidance in the same week that Tesla reported disappointing results. Eventually, the market will realize that GM is not the frail automaker so many Tesla bulls think it is. And this little nugget from GM’s earnings deck made me confident that my back-of-the-envelope model for Cruise may be attainable.

Buy $100 of Peloton

After reading the spotlight on Peloton, a friend of mine said that most analyses of Peloton are “just lazy.” Dig into the numbers and you see that’s right. The media and investors may think Peloton is a shell of itself since mid-pandemic peaks, but subscribers who actually pay Peloton hard-earned money each month continue to flock to the platform. And competitors are getting weaker by the day. Digital fitness may be a winner-take-all market, and Peloton continues to position itself to win the market.

Follow the Asymmetric Investing Portfolio

I’ll use Commonstock to follow the performance of the Asymmetric Investing portfolio. This site is tied to my personal Asymmetric Investing brokerage account and will update positions and gains/losses.

Follow along to see how this portfolio performs.

Note: I had planned to launch my premium service on May 1, but technical challenges have delayed that launch. More on that as soon as possible.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium does have a long position in GM, Spotify, and Peloton. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.