This article references the Matterport Spotlight from November 25, 2023.

Wait…you’re not a premium subscriber and didn’t get the Matterport research? Sign up now to get the research that brought subscribers Matterport (up 85%), Coinbase (up 245%), and Spotify (up 101%) in just the last year.

Today, Matterport has become the first buyout of an Asymmetric Universe stock and I want to give investors some quick thoughts on the news.

First of all, the buyout price is shocking. Shares of Matterport closed at $1.74 on Friday and the buyout is for $5.50 per share ($2.75 in cash and $2.75 in CoStar stock).

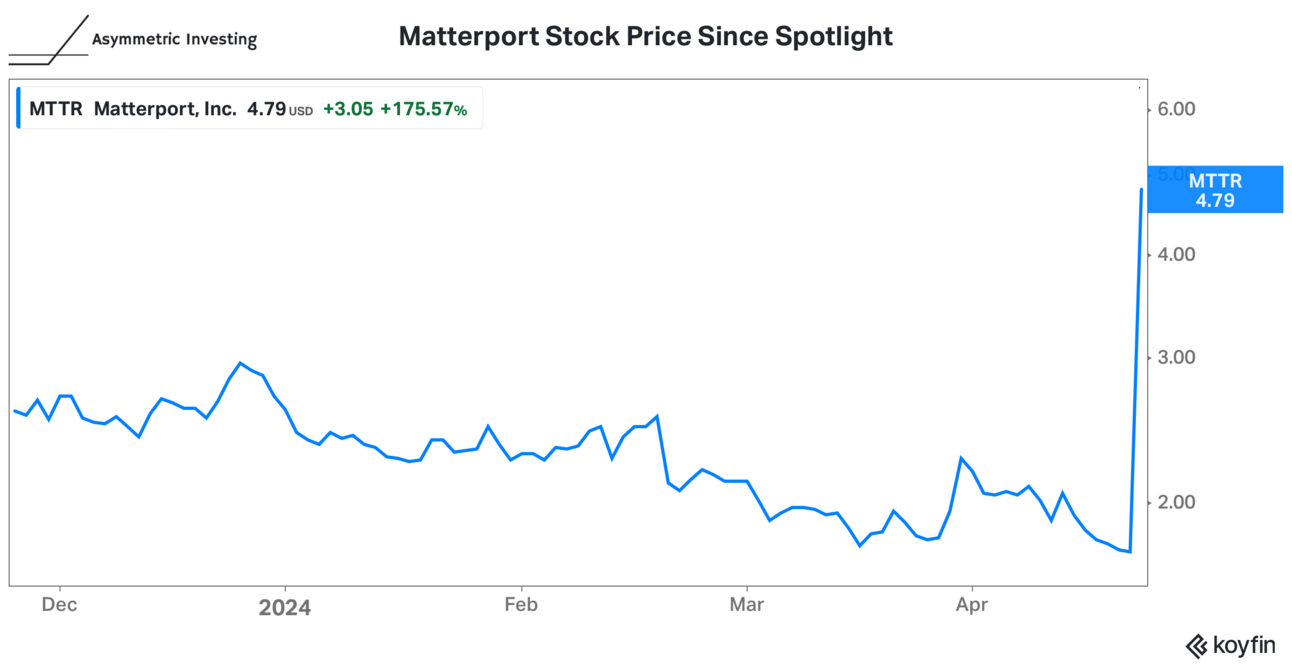

I’ve never seen a buyout at a 216% premium or a price chart that looks like this.

Matterport Buyout Details

Here’s what Matterport shareholders will get in the buyout:

$2.75 per share in cash

$2.75 per share in CoStar stock

The transaction is subject to a 10% symmetrical collar based on a CoStar Group share price of $86.02 as the midpoint.

The transaction is expected to close this year and 15% of shares outstanding are already committed to voting for the deal.

I don’t see any major regulatory roadblocks to the deal closing.

Asymmetric Outcomes

This buyout was a great confirmation of the asymmetric potential for Matterport. The company had $400 million in cash and a market cap of only about $600 million before today, which I thought gave tremendous upside and limited downside, especially given recent momentum in the business.

That worked out to plan today with a huge buyout deal. I’m sad to not participate in the company’s turnaround, but at this price, I can’t complain.

Congratulations to shareholders!

Congratulations to Asymmetric Premium Subscribers!

It’s days like this that make all the hard work worth it!

More Thoughts on Matterport’s Buyout

If you want to see my thoughts on YouTube, they are here.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.