We are through the heart of earnings season and all three of the Asymmetric Universe stocks have reported calendar first quarter 2023 results. For the most part, trends look good, but you really have to be a long-term investor to see why the trends are positive.

Below is what I’m looking for long-term and how these companies performed against those strategic goals.

Spotify

What I’m looking for

Growing subscriber base

Growing ad revenue $

Operating costs growing more slowly than revenue

What we got

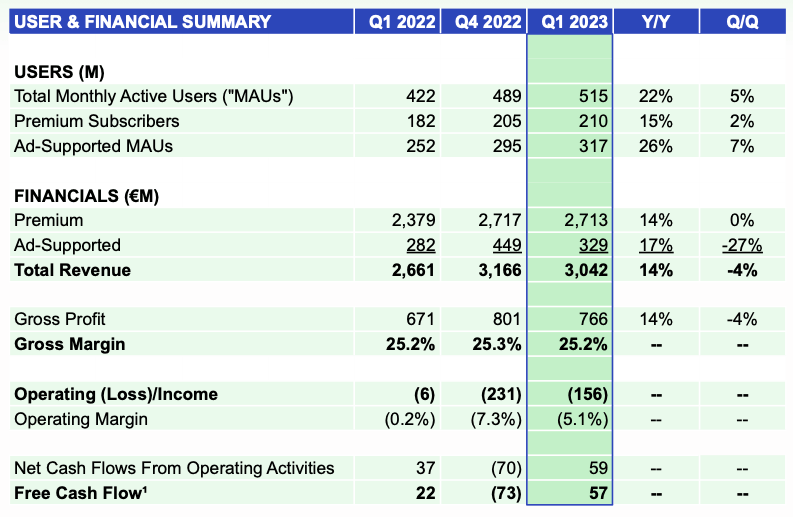

The shocking number in this earnings report was user growth. I don’t think anyone expected 26 million new users on the platform in just the last three months. Most of those new users are ad-supported, but that’s great for the long-term business. These users are top of the funnel AND they create a bigger base of users for advertisers to reach.

Speaking of advertising, ad revenue was up 17% from a year ago to $329 million. I would like that to be higher, but when big, established ad companies are reporting declines or low single-digit growth, I guess this wasn’t that bad. Spotify has also opened its ad platform in more countries just this week, so there’s more opportunity for growth.

Operating expenses also appear to be moving in the right direction. Opex was $1.03 billion in the fourth quarter of 2022 and $922 million in Q1 2023. That’s why you see the operating loss declining and Spotify moving from negative to positive free cash flow.

I would say this quarter was a step in the right direction, especially on the user side, but we need to see more from ads. It’ll take time to build the advertising business and if Spotify can do it the potential for an asymmetric return still remains.