Sometimes called “reasoning from first principles,” the idea is to break down complicated problems into basic elements and then reassemble them from the ground up. It’s one of the best ways to learn to think for yourself, unlock your creative potential, and move from linear to non-linear results.

As investors, we tend to be influenced heavily by survivorship bias. This worked in the past, therefore it’ll work again in the future.

All too often, that thesis is wrong because we’re looking at results, not first principles.

I’m seeing this happen again in the market today. Tesla was a big winner, so Rivian, Lucid, and ChargePoint will be too! NVIDIA was an asymmetric stock so obviously, C3 AI or Palantir are going to 🚀.

In reality, there will likely never be another Tesla or another NVIDIA.

That doesn’t mean we can’t learn from the success of past multi-baggers. Of course, we can and the process I use looks something like this:

Pick a company that had tremendous success.

Show why they had that success.

Understand what we can learn from their success and what might be repeatable in new or adjacent markets in the future.

This is where we get frameworks for investing.

Add these learnings and “frameworks” to my investing toolkit.

In the interest of “showing my work”, here are three first principle frameworks that make their way into the Asymmetric Portfolio.

The Internet Leads to “Winner-Take-All” Markets

Why were Microsoft, Google, Facebook, Netflix, and Amazon multibaggers for investors? Because the nature of the internet leads to large “winner-take-all” markets.

“All” in this case is all of the profits. It doesn’t necessarily mean that competitors don’t exist.

Business has always tended to winner-take-all dynamics, it’s just that the markets companies were addressing were often limited in scale by geography. There were one, maybe two, newspapers in each city, there was often one dominant grocery store in an area, and media was even very local in nature. But scaling that local success on a national or global scale was often difficult or impossible.

The internet eliminated most of the constraints on regional businesses and broke many of their business models in the process.

This led to the massive tech companies we know today and the fundamental dynamics behind their performance are covered in these two articles.

The first principle I keep going back to is that winner-take-all markets will continue to be prevalent on the internet.

One core thesis in Asymmetric Investing is that the next phase of winner-take-all businesses will be more niche. The market for these niche businesses won’t be as big as Facebook, Google, or Microsoft, but these can still be extremely profitable, differentiated businesses with big competitive moats. Examples in the Asymmetric Universe are:

They may not all succeed, but the companies that do build a winner-take-all business could drive asymmetric returns like their tech giant brethren did over the last decade.

What’s The Point of a Car, Anyway?

Let’s break this question down into factual components.

Why do we own vehicles? At the core, to get from Point A to Point B.

The average vehicle is used less than 5% of the time.

Vehicles are the second most expensive asset people own (behind housing).

Autonomous vehicles are here, they’re expanding service areas, and they’re becoming more and more cost-effective as they scale.

Add these factors together and there’s something disruptive here, but it’s easy to get lost in what it is without going back to first principles:

People want to get from Point A to Point B and autonomy will make that easier and more cost effective.

From a business model standpoint, the market could play out in one of two ways.

Scenario 1: As autonomy becomes more prevalent, it might be something we pay for in addition to the vehicle. This is the Tesla model of selling you a vehicle and then adding on high-margin autonomy software (up to $15,000). On a fundamental basis, an autonomous vehicle will inherently be more expensive than a non-autonomous vehicle when hardware and software are included but this scenario doesn’t improve utilization. In this model, autonomy makes driving easier AND more expensive!

I’m skeptical this is the path forward!

Scenario 2: Autonomy allows transportation itself to become a service.

If vehicles can drive themselves and operate up to 24 hours per day, wouldn’t it make more sense that an autonomous vehicle can just pick you up anytime, anywhere for a fee? Instead of owning a car and driving it less than 5% of the time, just share the vehicle and accomplish the same task! Vehicle utilization could increase significantly and costs should be lower on a per mile basis.

Maybe transportation as a service doesn’t replace 100% of car ownership in the foreseeable future, but what if it caused families to rethink a second or third car? What if it made it easier to forego car ownership in urban areas? What’s the impact of my 6-year-old growing up in a world with autonomous vehicles driving around? Will the next generation see transportation as a service from a young age and not have the obsession with owning vehicles that I grew up with?

The market has already proven transportation as a service has value and is a big market. Uber, Lyft, DoorDash, Instacart, etc. are all examples of transportation as a service and they generate hundreds of billions of dollars per year in combined revenue. They are just captive to the drivers that provide their service. Autonomy solves that supply problem and could make the experience much better and cheaper.

Going back to first principles, it makes sense that autonomous vehicles will become more prevalent, lower cost, and ultimately a viable alternative to owning a vehicle.

Cruise is building an autonomous fleet that will both transport people and goods like groceries and restaurant deliveries. There’s a reason Cruise was one of the first Asymmetric Investing Spotlights. If we go back to first principles, it makes a lot of sense for Cruise to be the driver of the future, replacing car ownership altogether.

Demand > Supply

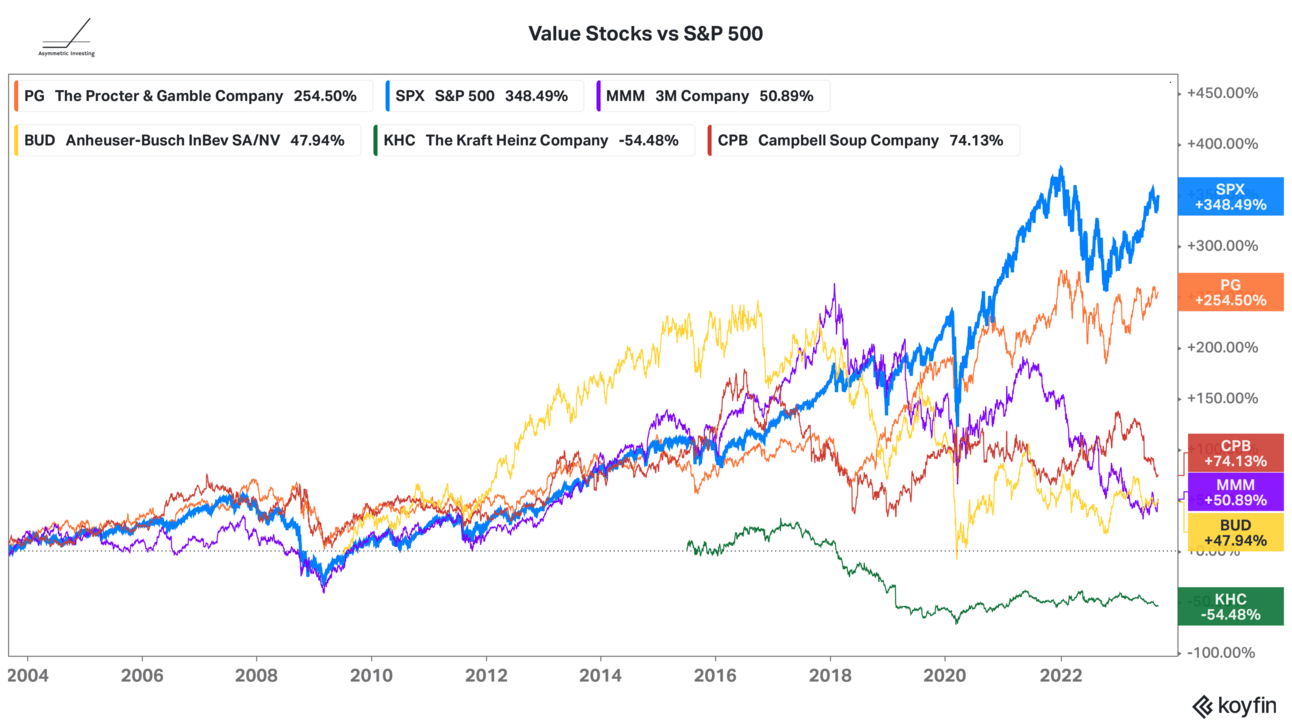

Big brand, value stocks have underperformed the market by a wide margin over the last 20 years. But why?

One of the reasons value investing has struggled is the erosion of supply power. Companies like P&G, 3M, Budweiser, Kraft Heinz, Campbell, Kellog, and other brand giants used to dominate store shelves at grocery stores, big box retailers, and every small retail shop, pushing their weight around to get premium shelf space and even push competitors out.

Were they powerful because people wanted them or because they were the only choice?

Whether you’re looking at beer, deodorant, or socks, the answer is clear. People wanted more choice, they just weren’t getting it.

Today, the power dynamic has shifted and you can find smaller brands taking up shelf space at retailers. But that’s in response to the internet where shelf space is infinite and big brands have little power. Amazon, Facebook, Instagram, and Google were more than happy to help small product companies grow by serving up niche ads to fill your very specific needs to the detriment of big brands.

On the internet, demand started exerting control.

As a result, we want to own companies that control (or direct) demand. Think of this as the companies we choose to go back to over and over again.

These are companies that customers seek out. And that’s much more important today than owning shelf space or manufacturing capacity.

If you want access to all Asymmetric Investing research you can upgrade at the link below. Your first month is free!

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.