When I started investing in the 1990s, there were metrics you could use as investors that would generally lead to solid results if you knew how to use them. Return on invested capital (ROIC), price to earnings, and price to book were metrics you could count on to tell you something meaningful about what you were paying for a business.

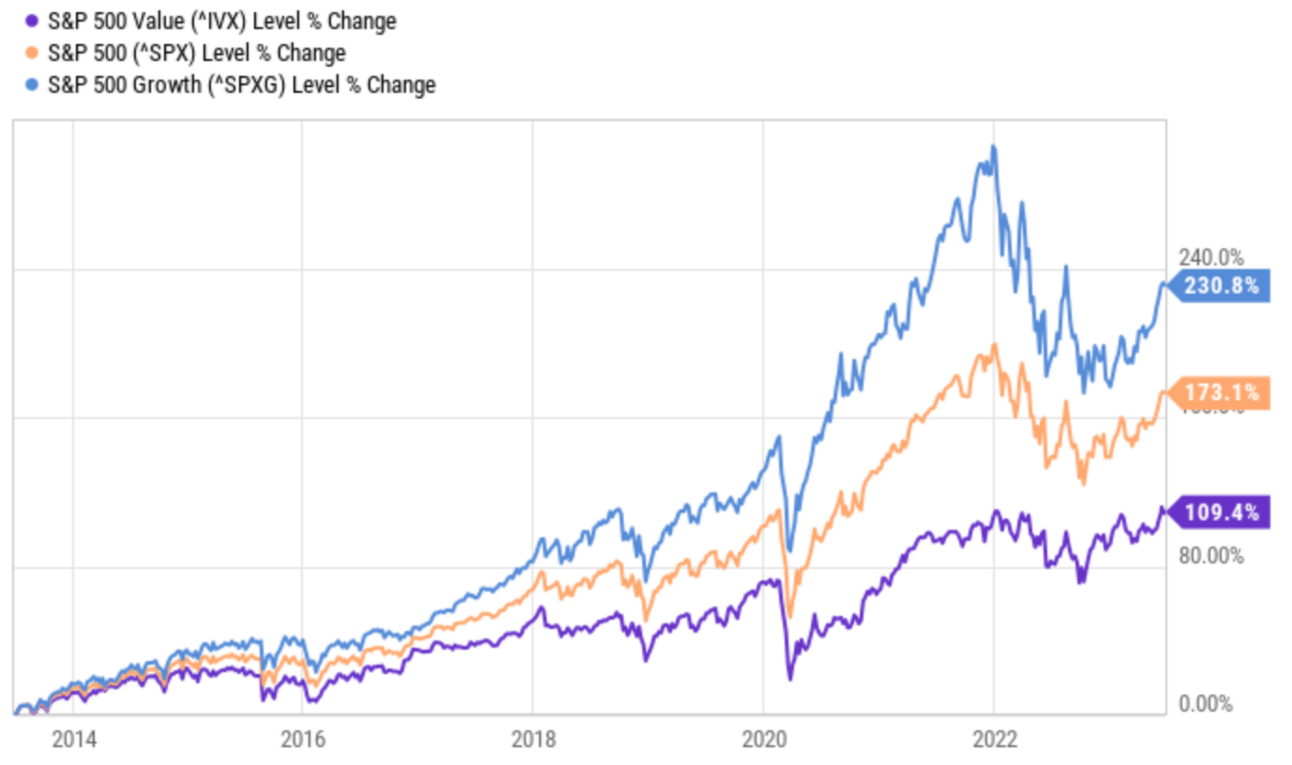

But the past 20 years have blown up value investing as we know it. You can see below that the S&P 500 Value Index, which carries S&P 500 stocks that are “values” based on price-to-earning, price-to-book, and price-to-sales ratios, has underperformed the S&P 500 overall and been destroyed by the S&P 500 Growth Index. The question is: Why?

The Story Of A Value Trap

For decades, Budweiser, Miller Lite, and Coors — BIG BEER — were the staples of every bar and restaurant in the U.S. It was easy to say they won because they had brand power, but the trap for investors was that the numbers didn’t tell the whole story. Big beer’s power didn’t come from branding or making superior products, it came from distribution.

In the early days of the microbrew craze, I had a friend who worked for a beer distributor tell me that he would walk into a bar and if he saw a new microbrew tap he would give the owner a choice. Take the microbrew out or Bud Light would pull their stock.

From a volume and profit margin perspective, Bud Light was doing around 20x the revenue and profit of a microbrew for most bars, so the decision was easy. And this worked for a very long time.

Eventually, bars started being built specifically to sell microbrews and tap houses became common across the country. And they started attracting customers away from the traditional bar. Of course, the bar that was coerced to keep microbrews off the taps took notice.

Slowly and then suddenly, the Bud Light distributor’s threat held less weight. Not only did they have less power over what competition was served in bars, many bar didn’t give a damn if Big Beer pulled their product.

Over the course of a decade, the Bud Light distributor has gone from a position of immense power to a position of weakness in the market. Power went from distribution to customer demands.

Go to your local grocery store and you’ll see a similar dynamic in the ketchup, mustard, and salsa aisles to name a few. Distribution power has been replaced by customer demands and it’s showing in the margins, profits, and stock prices of former giants.

Value Does Not Mean Safety

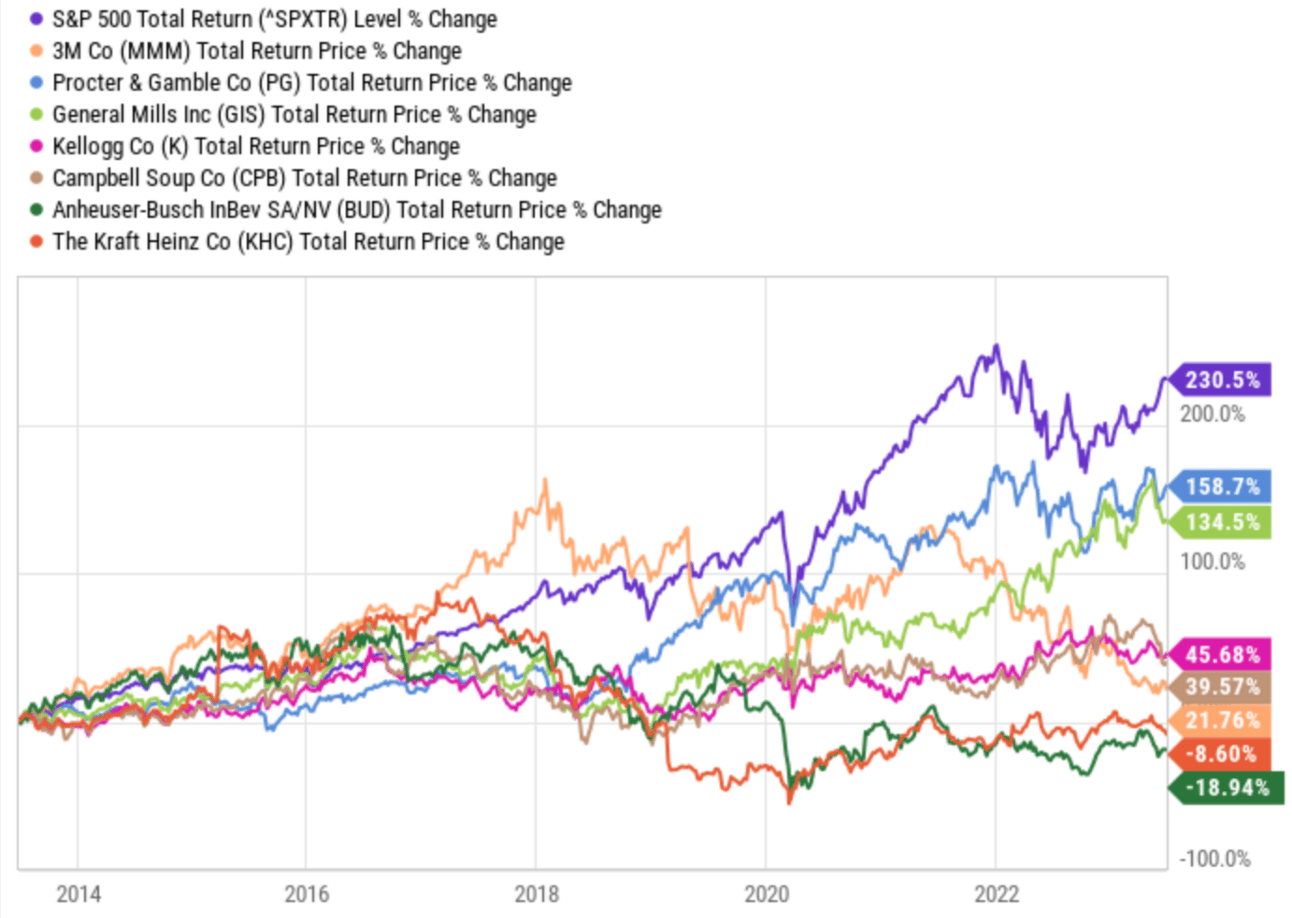

I used beer as my primary example, but the trend extends to consumer goods companies like General Mills, 3M, P&G, Kellogg, Campbell Soup, Kraft Heinz, Colgate-Palmolive, and Clorox. THEY ALL UNDERPERFORMED THE MARKET OVER THE LAST DECADE!

The world changed over the past decade. Brands can build relationships directly with consumers with targeted ads on Facebook or Google, online stores on Amazon or Shopify make building a business easier than ever, and even retailers have become open to the idea of working with startup brands.

These value stocks that seemed safe weren’t run poorly, they had macro headwinds and the wrong business model for the times. And that mattered more than elite execution.

Business Models Matter

In the Asymmetric Spotlight articles, I spend a majority of time covering the strategy and business model a company is building and and how that company’s business model could lead to outsized returns in the market. This beer story is an example of why I put more focus on the business model than a stock’s valuation.

This isn’t to say that I don’t look at valuation, because I do. GM has a P/E ratio of 6 and Dropbox is trading for 14 times earnings, just to name two stocks in the Asymmetric Portfolio. But I think getting the business model analysis right will be the most important factor in finding market-beating returns over the next few decades.

To access my stock analysis, portfolio, and trades before I make them sign up for a premium membership below. Right now, you can get your first month free.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.